The Trump administration is likely monitoring sliding scheduled import volumes at the Port of Los Angeles—the largest container port in the Western Hemisphere—amid President Trump's overnight remarks hinting at a potential de-escalation in the trade war with China. The president's comments to ease trade tensions with Beijing come as scheduled import volumes at the LA Port indicate possible inbound trade disruptions on the horizon.

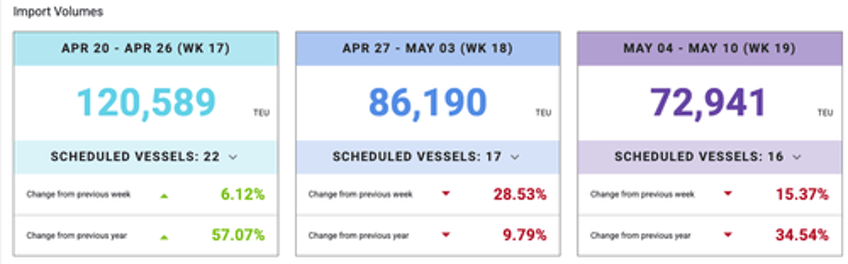

According to Port Optimizer, a tracking system for vessel operators, scheduled import volumes for the LA Port for the week ending May 3 show a 38.53% week-over-week plunge. Year-over-year, the data shows a 9.79% decrease. For the week ending May 10, scheduled import volumes continued to slow, with a year-over-year change down around 35%.

We've closely monitored the fallout from the 145% tariffs on Chinese goods entering the U.S. for weeks, as trade disruptions ripple from China to the U.S. Now, it appears those disruptions are about to reach American West Coast ports.

Let's review what's transpired:

Amazon Cancels Orders, Walmart Pulls Forecast As Tariffs Take Hold

Are China Road Traffic Indicators Set To Collapse As Tariff War Cancels Factory Orders

Chinese Sellers On Amazon Panic After Trump's Tariff Bazooka

Liberation Day Fallout: China's Port Volumes Sink After Trump's Tariff Blitz

Chinese Plastics Factories Face Mass Closure As U.S. Ethane Supply Evaporates

"We are at a tipping point on the West Coast," Ken Adamo, chief of analytics at DAT Freight & Analytics, told CNBC, adding, "Looking at how many truck loads are available versus trucks, we've seen a precipitous drop, over 700,000 loads have evaporated nationally in the past week compared to two weeks prior."

Falling scheduled import volumes at the LA Port coincide with a rise in canceled sailings.

More color from CNBC:

The vessel drop coincides with a rise in canceled sailings from ocean carriers on Pacific routes that include ports of Long Beach, Los Angeles, Oakland, and Seattle, according to an alert from Worldwide Logistics informing clients of blank sailings.

The Gemini alliance between Maersk and Hapag Lloyd has a cancellation rate of 24.39%; followed by the Ocean Alliance, comprising CMA CGM, Cosco Shipping, Evergreen, and OOCL, at 18%; and the Premier Alliance, comprising Ocean Network Express, Hyundai Merchant Marine, and Yang Ming Marine Transport, at 15%. MSC and ZIM currently have a 10% rate of canceled sailings.

Ocean carriers are trying to balance the pullback in orders resulting from the tariffs and the escalation of tensions in the trade war. CNBC recently reported a total of 80 blank, or canceled, sailings out of China as demand plummets and carriers suspend or adjust transpacific services.

Trump's possible de-escalation of the trade war also came after the IMF reported on Tuesday that tariffs had prompted it to slash its global growth forecast.

Probably what compelled the sudden shift from the top.

— Gregory Brew (@gbrew24) April 23, 2025

Another week or two of this, and you get empty shelves in the US. Actual COVID-style physical shortages. https://t.co/5m8v5KEvFK

. . .