Personal consumption represents over two-thirds of economic activity.

Therefore, consumers’ ability to spend, i.e., income, is vital to the economy.

Taking it one more step, RealInvestmentAdvice.com's team notes that confidence in the security of our jobs and wages drives the marginal consumption behaviors of most citizens.

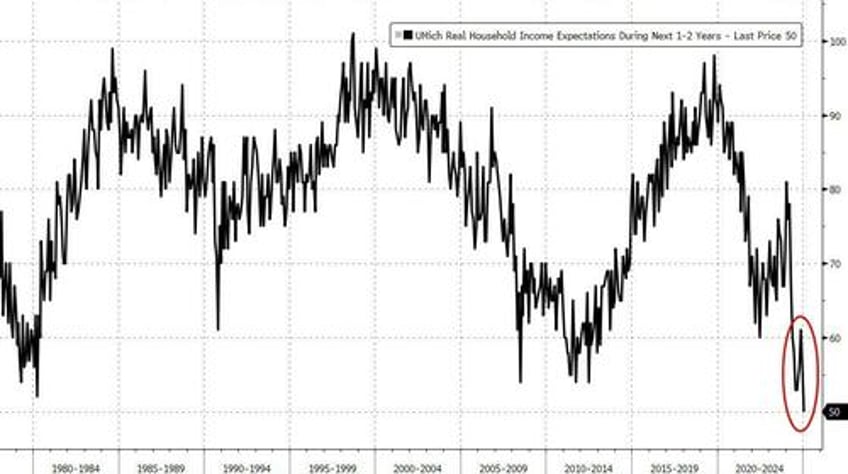

With that, we share a chart that should worry the Fed.

The chart below shows that the University of Michigan survey of real household income expectations is plummeting.

Moreover, the index is at its lowest since record began...

There is a robust correlation between the unemployment rate and economic activity.

This relationship is logical.

When consumers are confident in their job security and the ability of wages to keep up or exceed inflation, they are more willing to spend.

Conversely, if they fear the possibility of a layoff or a wage that doesn’t keep up with inflation, they tend to save.

While labor market data is generally good, there are signs the labor market is at a standstill. Continuing jobless claims are steadily rising and at their highest level in over three years. The JOLTS hires rate is at ten-year lows. While the number of layoffs remains low, employers aren’t hiring either.

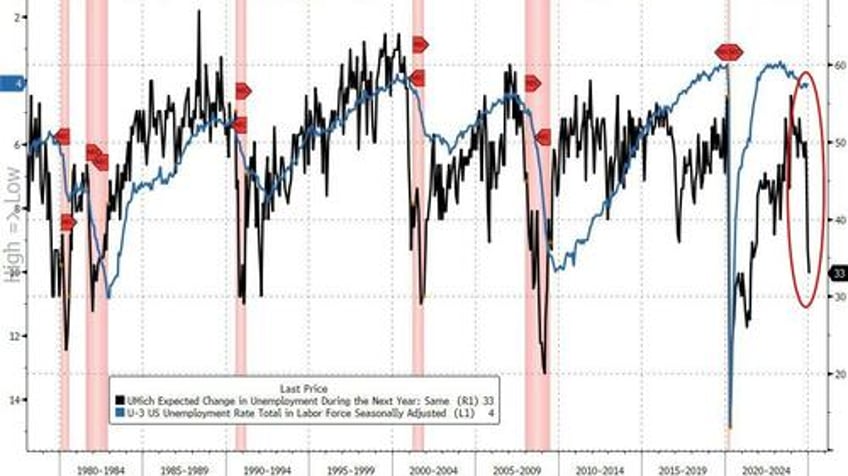

If the chart above wasn’t concerning enough, the following chart should wake a few up in The Eccles Building...

It shows employment expectations are also plummeting. Similar changes in expectations have led to a higher unemployment rate previously.

Accordingly, the broad labor market data may seem good, but these two charts and other data should give the Fed pause that consumers may start to spend less and save more.

h/t: RealInvestmentAdvice.com and @TheBondFreak