Most of the hawkish tilt in yields and rise in Federal Reserve interest rate expectations this year has come in non-US trading hours. A dovish repricing would therefore require (other things equal) a change of trading direction only in overnight hours when volumes are typically lighter.

US yields have risen steadily since their end-of-December lows. Expectations the Fed was going to make over six rate cuts has dwindled down to barely one. The risk-reward now favors a dovish repricing as liquidity conditions are set to worsen as the year goes on. And that is more likely to come from domestic trading rather than from abroad, if recent history is anything to go by.

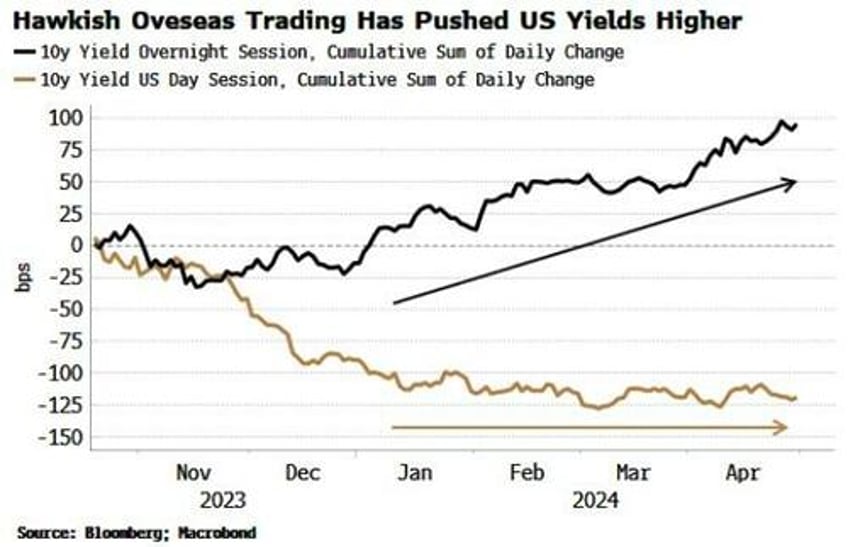

We can get hourly data going back to October for US Treasuries and fed funds futures, and separate it out into a US day session and an overnight session (both contracts trade 22-23 hours a day). The chart below shows the cumulative sum of the daily change in the day session and the overnight session for the 10-year yield. This year, almost all of the rise in 10-year yields has taken place in non-US trading hours.

Making the assumption that it’s predominately US-based volumes driving trading in US hours, US-based traders pushed yields lower from their October peak. But there has been little further movement all of this year. In contrast, predominately overseas trading (and no doubt some US-based algos and insomniac traders) has pushed the 10-year yield higher all this year – driving the 80 bps rise in the 10y in 2024.

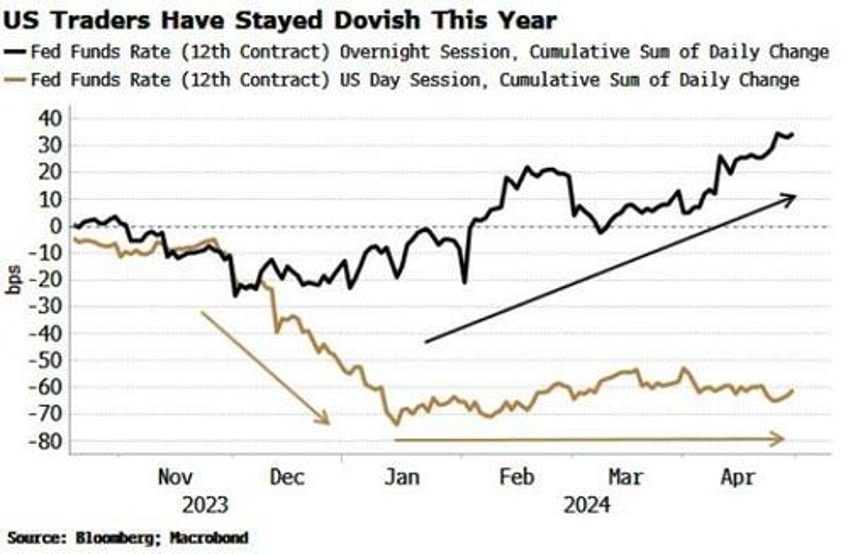

The delineation between US and non-US trading is even more pronounced when looking at Fed rate expectations. The chart below is the same as the one above, but with the twelfth generic fed funds future, which gives an approximation for what’s priced for the Fed in ~12 months’ time.

Here we can see US-based trading drove the proliferation of rate cuts expected at the end of 2023. Since then, US-based traders have not changed their dovish view.

Almost all of the hawkish tilt this year - eradicating most of the cuts expected - came in trading during non-US hours.

It looks like mainly US-based traders took Powell’s pivot in December more seriously than those predominately based abroad. Either way, risk-reward now favors siding with the domestic team for a more dovish rate outcome than is currently priced.