- US President Trump signed proclamations to reimpose a 25% tariff on steel and aluminium imports and declared there are no exceptions or exemptions, effective March 12th.

- US President Trump said they are looking at tariffs on cars, pharmaceuticals and chips and will hold meetings over the next four weeks, while they will do reciprocal tariffs over the next two days; Trump also commented that tariffs on metals could go higher and he does not mind if other countries retaliate.

- US President Trump is expected to sign executive orders on Tuesday at 15:00EST/20:00GMT.

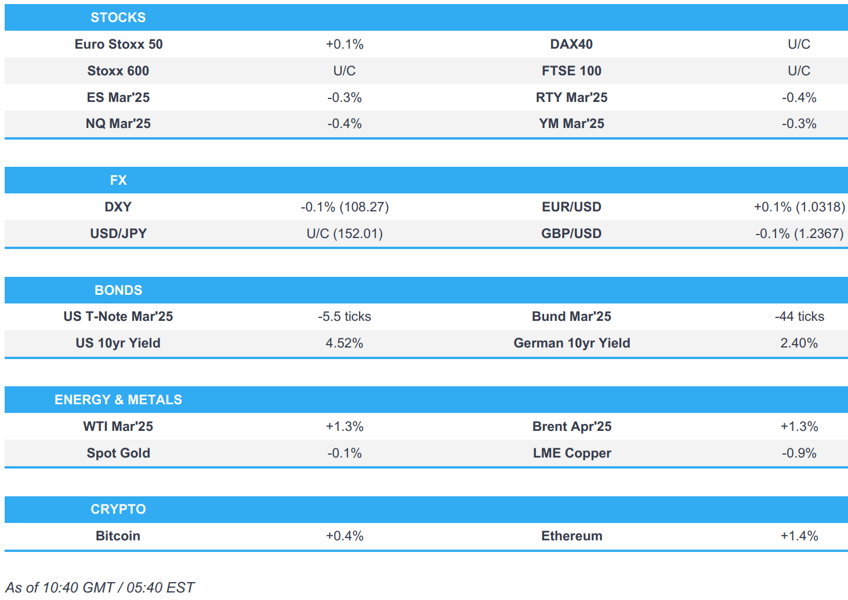

- European stocks are indecisive as markets digest the latest tariffs; US futures are modestly lower.

- DXY is a little lower but with price action contained as markets brace for more trade turmoil.

- Bonds reel as Trump hits steel, BoE's Bailey and Fed's Powell are set to speak; crude gains whilst metals take a hit.

- Looking ahead, highlights include EIA STEO, Speakers including ECB's Schnabel, BoE’s Bailey, Fed’s Powell, Hammack, Williams & Bowman, Supply from the US. Earnings from Shopify, Coca-Cola, Humana, Supermicro, Upstart, DoorDash, Gilead Sciences, Lyft.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS

- US President Trump signed proclamations to reimpose a 25% tariff on steel and aluminium imports and declared there are no exceptions or exemptions, effective March 12th. Trump said they are looking at tariffs on cars, pharmaceuticals and chips and will hold meetings over the next four weeks, while they will do reciprocal tariffs over the next two days. Trump also commented that tariffs on metals could go higher and he does not mind if other countries retaliate. Furthermore, it was also reported that President Trump is expected to sign executive orders on Tuesday at 15:00EST/20:00GMT.

- Canada's Industry Minister said US tariffs on steel and aluminium are "totally unjustified", while he is consulting with international partners on US steel and aluminium tariffs, as well as noted that the response will be "clear and calibrated".

- Australian PM Albanese said he had a great conversation with US President Trump and they committed to working constructively to advance Australian and American interests, while he noted that President Trump agreed to consider an exemption for Australia on steel tariffs.

- Hong Kong said US tariffs are inconsistent with WTO rules and it will file a complaint on US tariffs to the WTO, while it noted the US has completely ignored the city's status as a separate customs territory from China.

- EU Trade Ministers set to hold video conference on Wednesday after Trump confirms steel and aluminium tariffs. EU Commission President von der Leyen says unjustified tariffs on the EU will not go unanswered; they will trigger firm and proportionate countermeasures.

- EU Trade Commissioner Sefcovic says they are looking into the possibility of stronger trade ties with Gulf-nations.

- South Korean acting President says they are to prepare support for firms hit by US tariffs; to discuss response measures with Japan and the EU.

- Canadian PM Trudeau says "our response will be firm and clear and we will stand up for Canadian workers", in relation to the new Trump tariffs.

- "Britain is not expected to join the EU in retaliating against the US after Donald Trump announced plans to hit steel imports with 25% tariffs", according to Times' Swinford. "The EU said it will 'react to protect the interests' of businesses, workers and consumers". "But senior govt sources said that retaliatory tariffs would have little impact and would ultimately serve to provoke Trump further". "Starmer, Reynolds and Lammy have all been very clear that Britain is philosophically opposed to tariffs of any kind".

- Click for a Newsquawk analysis on tariff developments.

EUROPEAN TRADE

EQUITIES

- European bourses (Stoxx 600 U/C) are mixed and trading on either side of the unchanged mark, continuing the indecisive mood in APAC trade overnight, as markets digest Trump signing a reimposition of 25% tariffs on steel and aluminium. Markets are also awaiting updates over the next few days re. tariffs on cars/pharmaceuticals/chips. In recent trade, some downside has picked up a touch.

- European sectors are mixed and with the breadth of the market very narrow. Media takes the top spot, joined closely by Energy; the latter is buoyed by strength in underlying oil prices. Consumer Products was initially the outperformer, lifted by post-earning strength in Kering (+2.2%) – but the upside has since mostly pared.

- US equity futures are modestly lower across the board, ES -0.3%, giving back some of the upside seen in the prior session; the RTY (-0.4%) modestly underperforms. Fed Chair Powell and a slew of other Fed speakers are due throughout the day. US President Trump is set to sign executive orders.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

EARNINGS SUMMARY

- Kering (KER FP) +2.6%: Q4 Sales -12% (in-line with expectations). Seeing an improvement in China.

- BP (BP/ LN) -0.1%: Q4 miss, announces buyback, strategy reset on 26th Feb.

- UniCredit (UCG IM) -2.9%: Q4 beats; sources suggest Delfin is looking to cut its stake in the Co.

FX

- DXY is a little lower as markets digest the latest bout of tariff updates. Trump's tariff regime remains the main focus throughout trade thus far after the President signed proclamations to reimpose a 25% tariff on steel and aluminium imports and declared there are no exceptions or exemptions, effective March 12th. Furthermore, Trump said they are looking at tariffs on cars, pharmaceuticals and chips and will hold meetings over the next four weeks, while they will do reciprocal tariffs over the next two days. US President Trump is expected to sign executive orders on Tuesday at 15:00EST/20:00GMT. A slew of Fed speakers are due to today, with Chair Powell also scheduled for 10:00EST/15:00GMT.

- EUR is trivially firmer vs. the USD after a session of shallow losses yesterday. In the early stages of the Trump Presidency, markets were relieved that no immediate action was taken against the US. However, the recent imposition of steel tariffs by the US has brought this to an end. Actions have subsequently triggered a response from the bloc with European Commission President von der Leyen stating that unjustified tariffs on the EU will not go unanswered. ECB thought-leader Schnabel due to speak at 17:00GMT. EUR/USD is holding above the 1.03 mark and within Monday's 1.0282-1.0336 range.

- JPY saw some fleeting support vs. the USD in early European trade following as markets digested the latest ramp-up in global trade tensions. Fresh macro drivers for Japan were lacking overnight with the nation away for holiday. USD/JPY is currently tucked within Monday's 151.17-15253.

- GBP is trivially higher vs. the USD after three sessions of losses in the wake of last week's "dovish" cut from the BoE. 50bps dissenter Mann has been on the wires overnight and throughout the morning justifying her decision to go back a larger rate reduction. Mann noted that her decision was made on the basis that she is an activist policy maker and wished to "cut through the noise" by taking bold action. Governor Bailey is due to speak at 12:15GMT. Cable has been as high as 1.2377 but is yet to threaten the 1.24 mark.

- Antipodeans are both a touch higher vs. the USD. Focus for AUD has been on the recent imposition of steel tariffs by the US. Australian PM Albanese said President Trump agreed to consider an exemption for Australia on steel tariffs. Trump later declared no exceptions or exemptions.

- PBoC set USD/CNY mid-point at 7.1716 vs exp. 7.3067 (prev. 7.1707).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A slightly constrained start to the session on account of a Japanese holiday and as such there was no overnight cash UST trade. Nonetheless, the bias is bearish as participants digest and assess the inflation implications of Trump’s latest measures and commitments to respond from Canada and the EU. Action which has weighed on USTs to a 109-01+ trough, a tick below Monday’s base but just above the 109-01 low from Friday. Trump is set to sign an executive order at 15:00 EST, with commentary via Fed Chair Powell also due at that time.

- Bunds have moved in tandem with peers. EU Commission President von der Leyen said they will trigger firm and proportionate countermeasures while Trade Commissioner Sefcovic remarked that closer ties with Gulf nations are being looked at; remarks which have had little impact on the complex. Bunds down to a 133.04 base, have seemingly found a slight floor just above the 133.00 mark. ECB Schnabel is due later.

- Gilts are in-fitting with the above. Not quite as pressured as Bunds but not far behind, some modest recent respite has come from reporting around the 2035 Gilt syndication which just before books closed had reportedly attracted orders in excess of GBP 130bln. Prior to these reports, a length text release dropped from BoE dissenter Mann (voted for 50bps cut, decision was 25bps). A speech which sparked a modest hawkish move as the release made clear that Mann continues to favour and wants to maintain “policy rate discipline and restrictiveness”.

- Netherlands sells EUR 2bln vs exp. EUR 1.5-2.0bln 2.75% 2047 DSL: average yield 2.773% (prev. 0.403%)

- Orders for Italy's new 15yr BTP bond exceeds EUR 83bln, spread set at +7bps over BTP maturing in 2039, via Reuters citing leads.

- UK to sell GBP 13bln of 4.5% 2035 Gilt via syndication (a record), according to a bookrunner; orders in excess of GBP 140bln.

- Germany sells EUR 3.777bln vs exp. EUR 5bln 2.40% 2030 Bobl: b/c 2.0x (prev. 2.52x), avg. yield 2.17% (prev. 2.42%) & retention 24.60% (prev. 24.14%).

- Click for a detailed summary

COMMODITIES

- Firmer trade across the crude complex this morning amid Middle Eastern geopolitical updates and in the aftermath of tariff escalations after US President Trump signed proclamations to reimpose a 25% tariff on steel and aluminium imports and declared there are no exceptions or exemptions, effective March 12th. Brent sits in a USD 75.90-76.74/bbl parameter at the time of writing.

- Mixed/mostly lower trade across precious metals with silver and palladium hampered by the implications of US levies, but spot gold trading flat. Silver has both monetary and industrial uses, with around half of its demand coming from industrial applications (electronics, solar panels, etc.). Gold is cushioned by haven properties, with the yellow metal pulling back after printing a fresh high overnight at USD 2,942.78/oz.

- Base metals are lower across the board amid the implication on demand from the aforementioned tariffs. 3M LME copper sits towards the bottom end of a USD 9,364.00-9,452.55/t range at the time of writing.

- Russia's First Deputy Energy Minister believes sanctions won't hinder oil trade with India and said more time is needed to assess the impact of the latest sanctions, while the official added that Russia has the technology to develop energy resources and will continue to meet market demand for energy.

- Russian Deputy PM Novak says will looking to proposals regarding possibility of gasoline export ban.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK BRC Retail Sales Like-For-Like YY (Jan) 2.5% (Prev. 3.1%)

- UK BRC Total Sales YY (Jan) 2.6% (Prev. 3.2%)

- Norwegian GDP Growth Mainland (Q4) -0.4% vs. Exp. 0.2% (Prev. 0.5%)

NOTABLE EUROPEAN HEADLINES

- BoE's Mann said UK inflation is less of a threat as corporate pricing power weakens and pricing is coming very close to 2% target-consistent levels in the year ahead, while she added that demand conditions are weaker than before and that she had changed my mind on that, according to FT.

- BoE's Mann says as an activist policy maker, she opted for 50bps cut in February to 1) ‘cut through the noise’, 2) anchor expectations through the inflation hump, and 3) acknowledge structural impediments and macroeconomic volatility in longer term. On the Bank Rate: "I note that respondents in our Market Participants’ Survey have been consistent in putting this longer-run average at about 3-3½ percent. I’m more likely at the higher end of that range." "I expect that Bank Rate will average well above the nominal equilibrium rate implied by the estimates set out in the August 2018 Inflation Report". "it seemed to me that the two quarter-point cuts last year had not appreciably loosened financial conditions.". "Indeed, the projections in the February Monetary Policy Report were conditioned on a path for Bank Rate that is above four percent for the entirety of the forecast horizon which, given my assessment of the UK outlook, was not consistent with achieving the 2% target sustainably.". On being the activist policymaker, "The activist policymaker needs to maintain policy rate discipline and restrictiveness even after this immediate decision. This ensures that, as we move through the inflation hump, expectations remain anchored both in the near and longer term.".

- BoE's Mann says "my active rate policy does not mean cut, cut, cut". "A 50bps cut now, 50 next time would not be a full reading of what I have said". Looking to see that wage settlements will be moderate and that firms pricing power is moderate. Not expecting additional second-round effects.

- Barclays said UK January consumer spending rose 1.9% Y/Y which is the largest rise since March 2024 and Consumer Sentiment was at +21% which is the lowest since the series began in April 2024.

- European Commission President von der Leyen says the EU aim to mobilise EUR 200bln in AI investments in Europe

NOTABLE US HEADLINES

- US judge temporarily blocked the Trump administration’s cuts to universities and medical centres' research funding.

- US Speaker Johnson intends to begin presenting outlines of his budget reconciliation package today, he believes he’s “very close” to a final budget resolution, according to Punchbowl.

GEOPOLITICS

MIDDLE EAST

- US President Trump said if all Gaza hostages aren't returned by noon on Saturday, he would say cancel the ceasefire and let all hell break out, while he added that Israel can override it and thinks Jordan will take refugees. Trump also said the US could withhold aid to Jordan and Egypt if they don’t take refugees, while he might talk to Israeli PM Netanyahu about the Saturday deadline.

- Al-Qassam Brigades Tulkarm said their fighters, accompanied by the Al-Quds Brigades and the Al-Aqsa Martyrs Brigades, targeted an Israeli force in the vicinity of Tulkarm camp, according to Al Jazeera.

- US President Trump said Iran is very concerned and very frightened because their defence is pretty much gone and now would love to make a deal with the US, according to an interview with Fox News cited by Iran International.

- Egyptian sources say that "Trump's threat to cut off aid to Egypt would mean that the peace treaty between Israel and Egypt "would have no meaning," and that the tension in relations between the United States and Egypt was the greatest in three decade".

- Israeli "security cabinet is now convening at the Prime Minister's Office in Jerusalem to discuss Israel's response to Hamas's postponement of the release of hostages", via Times of Israel.

RUSSIA-UKRAINE

- Russian Deputy Foreign Minister meets the US envoy, according to RIA.

- "A Gulfstream jet registered to a company controlled by Steve Witkoff, United States Special Envoy to the Middle East, is moments away from landing in Moscow...It is unclear if Witkoff himself is on board", according to HuffPost's Ali.

- Ukraine's Energy Minister said Russia launched an air attack on Ukraine's gas infrastructure overnight and in the morning, while emergency power restrictions were imposed to minimise possible consequences.

- Russia's aviation watchdog suspended flights at four airports to ensure safety after officials reported drone attacks.

- Industrial facility in Russia's Saratov region was on fire after a Ukrainian drone attack, according to the regional governor, while Russia's Shot Telegram news channel reported explosions were heard in the area of the oil refinery in Saratov.

- US President Trump said he will speak with Ukrainian President Zelensky this week and special envoy Kellogg is going to Ukraine soon. It was also reported that the Trump administration will push European allies to purchase more US weapons for Ukraine, while weapons approved by the Biden administration are still flowing to Ukraine, according to Reuters citing sources and the US Special Ukraine Envoy.

OTHER

- North Korea said a US nuclear submarine has arrived at a South Korean port, escalating security tensions, according to KCNA. Furthermore, North Korea said Washington's sending of a nuclear submarine to Seoul is a serious threat.

CRYPTO

- Bitcoin is a little firmer and sits just above USD 98k; Ethereum posts gains to a larger degree and back above USD 2.7k.

APAC TRADE

- APAC stocks were ultimately mixed after the tech-led gains on Wall St and as participants digested US President Trump's 25% tariffs on steel and aluminium which take effect from March 12th, while Japanese markets were closed for a holiday.

- ASX 200 closed flat with gold stocks underpinned after the precious metal extended on its record highs, while the tech sector took impetus from the strength seen in its US counterpart.

- Hang Seng and Shanghai Comp were subdued following US President Trump's latest tariff actions, while he reiterated they will do reciprocal tariffs in the next two days and is also looking at tariffs on cars, pharmaceuticals and chips with meetings to take place over the next four weeks. Furthermore, Hong Kong criticised the US tariffs and will file a complaint on US tariffs to the WTO, as well as claimed that the US has completely ignored the city's status as a separate customs territory from China.

NOTABLE ASIA-PAC HEADLINES

- US President Trump said he had spoken to Chinese President Xi since his inauguration but didn't provide further details.

DATA RECAP

- Australian Consumer Confidence (Feb) 92.2 (Prev. 92.1); Sentiment (Feb) 0.1% (Prev. -0.7%)

- Australian NAB Business Confidence (Jan) 4.0 (Prev. -2.0); Conditions (Jan) 3.0 (Prev. 6.0)