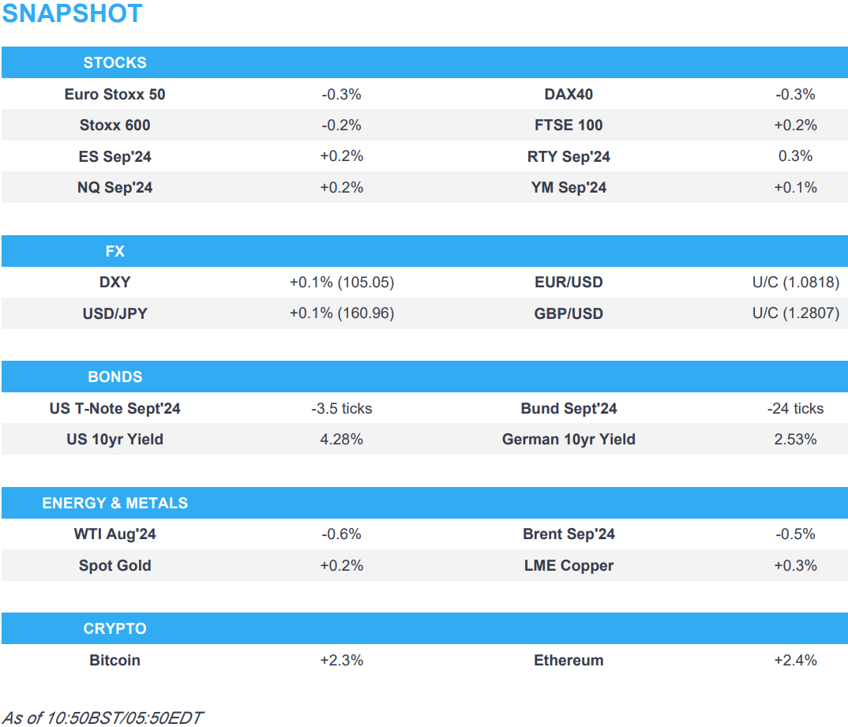

- European equities are mostly lower, US futures are modestly in the green ahead of Fed Chair Powell’s testimony

- Dollar is flat and G10s are uneventful vs the Dollar, though the Kiwi lags

- Bonds are lower, with focus today on Fed Chair Powell and US 3yr supply

- Crude is subdued and near session lows, XAU nurses recent losses

- Looking ahead, NFIB Business Optimism Index, Comments from Fed’s Powell, Barr & Bowman, Supply from the US

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.1%) are mostly lower, having initially opened entirely in the red; the FTSE 100 managed to climb into the green, whilst peers such as the DAX 40 and CAC 40 continued to trundle lower, the latter pair currently reside near lows.

- European sectors are mixed, and with the breadth of the market to the upside fairly narrow. Basic Resources is near the top of the pile, paring recent losses and with the metals complex also benefitting from a late pick up in sentiment in China.

- US Equity Futures (ES +0.2%, NQ +0.3%, RTY +0.3%) are entirely in the green, building on the gains seen in the prior session, which saw the S&P 500 and Nasdaq notch record highs. Today, markets will await Fed Chair Powell’s testimony, though he is unlikely to deviate too far away from comments he made at the Sintra conference last week.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is chopping and changing around the 105 mark as markets await comments from Fed Chair Powell. Upside for DXY sees Friday's peak at 105.16 and downside sees yesterday low at 104.80.

- EUR/USD is flat vs. the USD and tucked within yesterday's 1.0803-1.0845 parameters. French political risk remains, however, given the current paralysis of the situation, greater guidance for the EUR/USD pair may be provided by upcoming comments from Fed Chair Powell.

- Cable is back towards the 1.28 handle after venturing as high as 1.2846 yesterday following hawkish comments from BoE's Haskel. ING suggests that greater guidance on the core thoughts of the MPC may be garnered from Pill's speech tomorrow.

- JPY is trivially softer vs. the USD as USD/JPY eyes 161. USD/JPY had been as high as 161.13 overnight before moving back onto a 160 handle in quiet trade. If the upside trend resumes, Friday's 161.39 peak would be the next target.

- Antipodeans are mixed vs. the USD. AUD was unfazed by weak Consumer Sentiment and mixed Business Surveys from Australia. AUD/USD is below yesterday's 0.6761 peak; highest since Jan 3rd. NZD/USD is holding onto a 0.61 handle after slipping from yesterday's 0.6153 peak.

- PBoC set USD/CNY mid-point at 7.1310 vs exp. 7.2676 (prev. 7.1286).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are softer by only a handful of ticks as markets await Fed Chair Powell's testimony. Treasuries are currently sitting in a narrow 110-13 to 110-18 band, with support residing at 110-10, 110-04 and 109-17+.

- JGBs were unreactive to overnight Bloomberg reports about the format of the BoJ bond participants meeting. Thereafter, the release of details from the first session sparked some modest pressure in JGBs, seemingly on the initial line of one view being to reduce buying to JPY 2-3tln/month markedly below the exp. 5tln (current 6tln).

- Bunds are holding just above the 131.00 mark in a 131.01-31 band, and unreactive to commentary from ECB's Panetta. A breach of the 131.00 handle brings into view support at 130.74 and 130.44.

- Gilts are lower by around 25 ticks, and dipped below the 98.00 mark in a 97.92-98.11 parameters which are entirely within Monday's 97.73-98.27 range.

- Click for a detailed summary

COMMODITIES

- Another subdued session for the crude complex in what has been a quiet session thus far ahead of Fed Chair Powell's testimony. Crude prices rose in tandem with Chinese markets in early European hours before that strength faded. Brent Sept currently holding around USD 85.25/bbl.

- Precious metals are firmer across the board following yesterday's weakness, but price action is modest in the absence of pertinent drivers. Spot gold is caged to a USD 2,355.81-2,368.72/oz range.

- Mixed trade across base metals with an early European rally seen in copper in lockstep with sharp gains in the Chinese markets despite a lack of catalysts. That being said, the complex is awaiting the next driver, possibly via Fed Chair Powell later this afternoon.

- Port of Houston announced that all terminals will remain closed on Tuesday.

- Marathon's (MPC) Galveston Bay, Texas refinery (535k BPD) reported emissions and that the recent hurricane caused a power loss and multiple units to shut down, while it brought the plant to a safe state waiting for power before resuming operations. However, it was later reported that the refinery was preparing multiple units for a restart, according to Reuters sources.

- Shell (SHEL LN) said it will start the process of redeploying personnel to Perdido and Whale assets beginning on Tuesday.

- NHC said further weakening is forecast for Beryl which was expected to become a tropical depression overnight and a post-tropical cyclone on Tuesday, while NHC later confirmed that Beryl had become a tropical depression.

- Citi says physical gold demand eases, but should rebound into year-end; the bank writes that physical gold demand likely softened in Q2 vs Q1, though off a very strong base

- Click for a detailed summary

NOTABLE DATA RECAP

- UK BRC Retail Sales YY (Jun) -0.5% (Prev. 0.4%); Total Sales YY -0.2% (Prev. 0.7%)

- Hungarian Core CPI YY (Jun) 4.1% vs. Exp. 4.0% (Prev. 4.0%); CPI YY (Jun) 3.7% vs. Exp. 4.0% (Prev. 4.0%)

NOTABLE EUROPEAN HEADLINES

- ECB's Panetta says the ECB can gradually reduce rates in line with the actual and expected inflation rate which will complete the disinflationary process underway. But ECB should be ready to respond quickly and to any shocks in one direction or the other. Previous rate hikes will continue to dampen demand, output and inflation for months to come. Concern about high service sector prices in understandable, but it is normal that they fall with a lag compared to goods prices. Wage growth can also be expected to ease. Italian GDP probably grew by about 0.3% Q/Q in Q2.

- Barclays said UK June Consumer Spending fell 0.6% Y/Y which was the first decline since February 2021.

- German economy minister says not satisfied with German economic situation

NOTABLE US HEADLINES

- US House Democrats to meet behind closed doors amid debate over Biden's path forward, according to ABC News; taking place at 09:00 ET/ 14:00 BST.

- TSMC (TSM) may revise its 2024 sales growth projection in US dollar terms at its upcoming investors conference, according to industry sources cited by the Digitimes. The adjustment is expected in response to substantial orders secured from major clients, the report added.

GEOPOLITICS

MIDDLE EAST

- "Syrian state news agency claims Israel launched an air attack today targeting a possibly Iran-linked site around Baniyas, Syria, causing some material losses", according to Times of Israel's Berman.

- Violent explosions were reported amid Israeli raids in the city of Latakia, north-western Syria, according to Al Arabiya. It was also reported that Israel launched an air attack targeting the vicinity of Baniyas, according to Syrian state news

- Palestinian media reported that Israeli shelling on a UNRWA school in the new camp in Nuseirat caused casualties.

- US Assistant Secretary of State for Near Eastern Affairs Barbara A. Leaf is on travel July 8th-14th to the United Arab Emirates, Qatar, Egypt, Jordan, Israel, the West Bank, and Italy.

OTHER

- US President Biden said Russian missile strikes on Kyiv that damaged a children's hospital are a horrific reminder of Russia’s brutality, while he added the US will announce together with allies new measures to strengthen Ukraine’s air defences, according to Reuters.

- Ukrainian drone attack caused a fire at an oil depot and power substation in Russia's Volgograd region, according to the regional governor. It was separately reported that a power plant in Russia's Rostov region caught on fire after Ukraine launched tens of drones.

- China Qingdao Maritime Safety Administration issued a navigation warning for military exercises to be conducted in some waters of the Yellow Sea from 08:00 local time on July 9th to 08:00 on July 13th with entry prohibited.

- Elite North Korean military trainees were reportedly visiting Russia amid deepening ties.

CRYPTO

- Bitcoin continues to gain and climbs above USD 57.5k, whilst Ethereum sits comfortably above USD 3k.

APAC TRADE

- APAC stocks were mixed as the region only partially sustained the positive mood seen in the US where the S&P 500 and Nasdaq 100 extended on record highs, but with upside limited amid a lack of major catalysts ahead of upcoming risk events.

- ASX 200 traded higher as tech, telecoms and real estate stocks benefitted from slightly softer yields.

- Nikkei 225 extended on its all-time highs with the advances led by electronic and tech-related stocks.

- Hang Seng and Shanghai Comp. were subdued as the former continued its recent downward momentum to its lowest in more than two months, while sentiment in the mainland was clouded amid lingering trade frictions and ongoing debt-related concerns.

NOTABLE ASIA-PAC HEADLINES

- China's exports of auto products to Belt and Road partner countries for January-May rose 13.3% Y/Y to USD 51.32bln, according to Global Times.

- BoJ is releasing briefing material from its meeting with bond market participants; received various views from participants in the survey incl. the idea to reduce monthly buying to JPY 2-3tln or have it at around JPY 4tln. Click for full details.

- Acer (2353 TT) June (TWD): Revenue 28.19bln (prev. 21.13bln M/M); making 12 months of consecutive Y/Y growth and highest in 24 months

DATA RECAP

- Australian NAB Business Confidence (Jun) 4.0 (Prev. -3.0); Conditions 4.0 (Prev. 6.0)

- Australian Consumer Confidence Index (Jul) 82.7 (Prev. 83.6); Consumer Sentiment MM -1.1% (Prev. 1.7%)