We've come a long way since Covid, when disgruntled Goldman Sachs junior bankers made the infamous PowerPoint presentation that forced banks on the street to at least pretend and posture like they cared about their lower-rung employees' mental health.

Not even a half decade later, and looks like we might be back at square one.

Now, mounting stress on Wall Street's junior bankers is evident when looking at staffers, the deputy managers who assign tasks to trainees. These staffers, not to be confused with general employees, are responsible for distributing work to underlings when investment bankers or clients need something done.

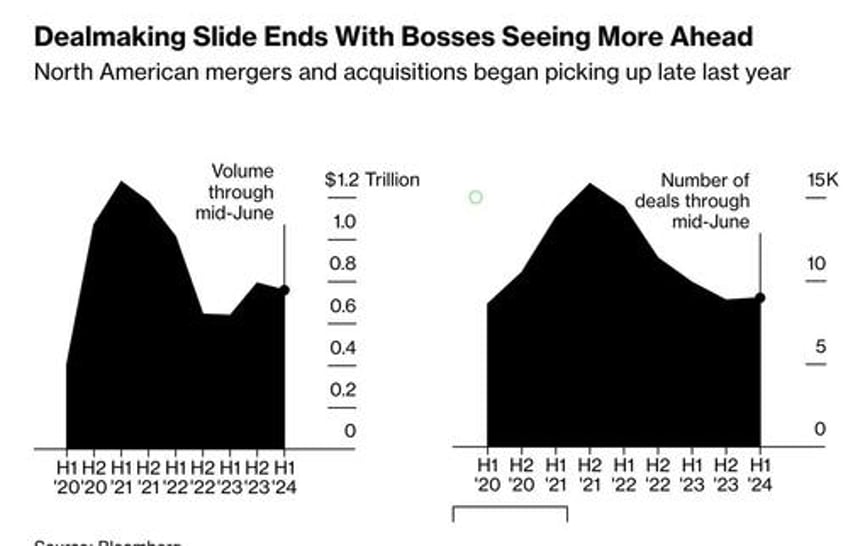

With banks recovering from a slump and operating with reduced staff, the task is becoming more challenging, putting pressure on both trainees and staffers, according to Bloomberg.

Also known as: work.

The report said that at JPMorgan Chase & Co. and UBS Group AG, junior bankers are inflating their reported weekly hours to avoid losing their remaining free time. Conversely, at Bank of America Corp., some trainees are understating hours to stay below 100-hour limits, avoiding potential HR issues - some of which were likely put in place in response to 2021's junior banker temper tantrum.

When junior bankers are scarce, staffers must inform bosses, which can be nerve-wracking, as a Citigroup Inc. staffer recently experienced.

After one staffer emailed a managing director about being too busy, they became physically ill and cried. The response, “I am so disappointed in you,” led to her resignation, the report noted.

Interviews with current and former junior bankers reveal that 100-hour work weeks are resurging as banks pursue a modest deal flow. Employees, speaking anonymously, note that workloads are testing promises to protect trainee health.

The death of Bank of America associate Leo Lukenas from a heart attack sparked online outcry about excessive demands. Despite the bank's public-facing commitment to junior bankers' well-being, heavy workloads persist, Bloomberg revealed.

Now, in an HR workaround, junior bankers, under pressure, inflate or understate hours to manage expectations. Dealmaking desks are starting to see results, but trainees have little leverage to improve conditions.

Despite safeguards, long hours remain. One junior banker ignored chest pain to meet deadlines, fearing backlash. An Overheard on Wall Street survey found junior bankers average 80-hour weeks and score poorly on health metrics.

Perks like Peloton bikes gather dust, and the banking culture hasn't evolved to meet junior bankers' needs, according to Columbia Business School professor Stephan Meier.

The intense environment pushes some to private equity or money management for better work-life balance. Hamilton Lin of Wall Street Training & Advisory likens banking to "selling your soul," but sees it as a worthwhile trade.

As we noted in 2021 and will note again now, grueling work for junior bankers is a tradeoff that is almost as old as Wall Street itself.

"Junior bankers trade a grueling workload for pay that’s higher than the average American salary and a shot at eventually earning multi-million dollar compensation packages as a managing director," CNBC notes.