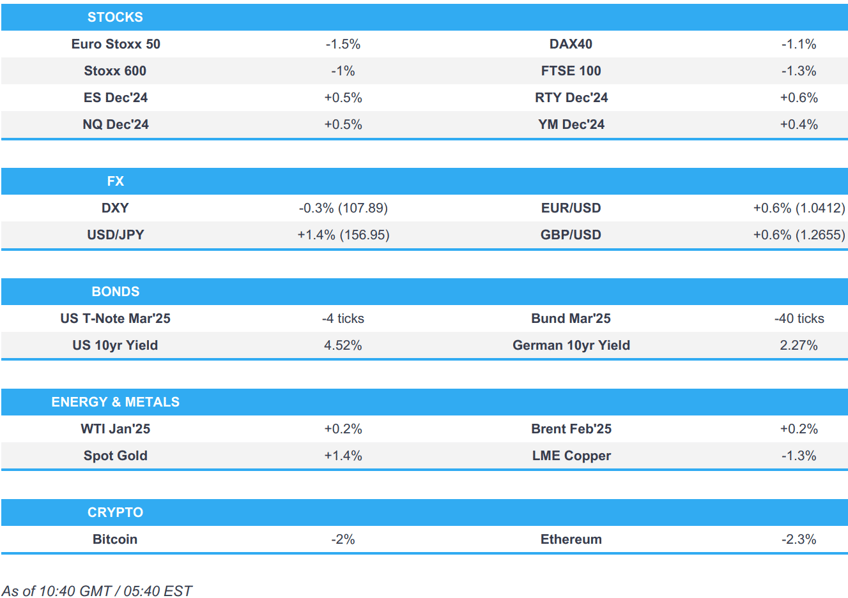

- European stocks tumble post-FOMC, MU -15% pre-market weighing on chip peers in Europe; US futures attempting to recoup yesterday’s losses.

- USD gives back some of yesterday's post-FOMC gains, JPY hit after BoJ Governor Ueda’s press conference.

- US yield curve steepens, JGBs outperform post-Ueda, Gilts lag pre-BoE.

- Crude lifts incrementally off Wednesday's lows, XAU fares better as the USD pauses for breath.

- Looking ahead, US Jobless Claims, Philly Fed Index, NZ Trade Balance, Japanese CPI, BoE, CNB, Banxico Policy Announcements, Earnings from Accenture, Cintas, Conagra Brands, Nike, FedEx, BlackBerry.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

BOJ MEETING

BOJ STATEMENT:

- BoJ maintained its rate at 0.25% as expected, with an 8-1 vote; Board Member Tamura dissented, advocating for a 25bps hike to 0.50%. The central bank said inflation expectations were heightening moderately, and inflation was likely to reach a level generally consistent with the BoJ's price target in the second half of the three-year projection period through fiscal 2026.

- However, uncertainty regarding Japan's economic and price outlook remains high, the central bank said. BoJ highlighted the need to scrutinise FX and market movements, along with their impact on Japan's economy and prices.

- BoJ said the impact of FX volatility on inflation could be greater than in the past due to changes in corporate wage and price-setting behaviour. Meanwhile, Japan's economy was recovering moderately despite some weaknesses, with private consumption increasing.

- Little action was seen outside of Japanese assets; USD/JPY and JGB futures saw upside, Nikkei trimmed some earlier losses.

UEDA PRESS CONFERENCE

- For the next rate hike need "one more notch" to decide on tightening. Want to see next year's wage negotiation momentum.

- Hard to say if the January outlook report and various info are sufficient as "one more notch".

- If they decide not to hike, will consider whether this decision is a safe one. A risk of falling behind the curve while waiting. Will consider the risks, if they were to decide to skip rate hike.

- Need more data on the wage outlook; needs a little bit more information on wage trends.

- Will need considerable time to see the full picture of wage hikes and Trump policies. Need to gauge the situation for quite a while.

- Large picture on wage trends will become clearer in March and April. Will have to combine other data to make rate decisions until then.

- In totality, Ueda's remarks have a dovish and cautious skew with Ueda expressing a desire for "one more notch" to decide on tightening. Overall, the presser has increased the odds of rates being left unchanged at the January 24th meeting with focus on the March 19th gathering as details on Spring wage negotiations will have begun filtering through by then.

EUROPEAN TRADE

EQUITIES

- European bourses began the session entirely in the red and have generally traversed worst levels throughout the morning, as traders react to the hawkish cut at the Fed which sparked considerable pressure in US stocks, in the prior trading day.

- European sectors are entirely in the red, with sentiment hit following the hawkish Fed decision. Optimised Personal Care fares better than peers, with Autos taking second spot. Technology is by far the clear underperformer today, with sentiment across chip-makers hit after Micron’s (-15.5% pre-market) guidance disappointed.

- US equity futures are modestly in positive territory, as the complex attempts to recoup some of the losses seen in the prior session after the hawkish cut delivered by the Fed, sent the S&P 500 tumbling by around 3%.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is currently giving back some of yesterday's FOMC-induced gains which saw DXY take out the 22nd Nov 2024 high (108.09), topping out at 108.25. DXY has since returned to a 107 handle. As the dust settles on the Fed decision, around 2bps of loosening is priced for the Fed's January decision with the next 25bps cut not priced until July, whilst around 36bps of cuts is priced by end-2025.

- EUR macro drivers are on the light side and as such impetus for EUR/USD is being mostly driven by the USD leg of the equation. EUR/USD is back on a 1.04 handle after slumping to a 1.0343 low in the aftermath of the FOMC. As for NY OpEx, there are a slew of notable clips due to roll off (details below).

- JPY is by the far the underperformer across the G10 FX complex. USD/JPY was already driven higher following the hawkish Fed announcement, reaching a 154.86 peak. This extended to 155.44 following the BoJ's decision to keep rates unchanged. Thereafter at Governor Ueda's press conference, despite some initial firming of the JPY (as Ueda flagged the need to look at financial and FX markets), JPY then sharply depreciated as Ueda struck a cautious tone on future rate hikes. (details in the BoJ section above).

- GBP near the top of the G10 leaderboard in the run-up to today's BoE policy announcement which is expected to see the MPC hold rates at 4.75% via an 8-1 vote split on account of stubborn services inflation, elevated wage growth and a potential upcoming boost to growth from recent fiscal measures.

- Antipodeans are both firmer vs. the USD in today's session but very much down on the week after being dealt a hammer blow by yesterday's FOMC policy decision. AUD/USD made a fresh YTD low overnight at 0.6200 to hit its lowest level since October 2022. NZD/USD also hit a fresh YTD low overnight at 0.5609 to trade at its lowest level since October 2022. Softness in NZD was also exacerbated by soft GDP metrics overnight.

- EUR/SEK fell from 11.50 to an 11.4872 session low. SEK appreciation was in response to outside bets for 50bps unwinding (though, recent global hawkish action had already done this), phrasing around a "more tentative approach" to policy easing going forward and the elevated CPIF forecast for 2025.

- Following the Norges Bank announcement to keep rates unchanged (as expected), there was some modest two-way reaction seen in EUR/NOK. Initially, the NOK came under pressure on the explicit nod to March before paring given MPR adjustments; as the dust settles, EUR/NOK is back towards pre-release levels of 11.7680.

- PBoC set USD/CNY mid-point at 7.1911 vs exp. 7.3165 (prev. 7.1880)

- BCB announces spot Dollar auction for December 19th; to offer up to USD 3bln.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs continue to falter post-FOMC and now at a 108-26+ trough, just below Wednesday’s 108-27 base and at a contract low. Ahead, we look to the US quarterly PCE and GDP before Friday’s monthly metric ahead of blackout lifting and Fed speak potentially resuming. Amidst this, the 2yr, 5yr, 7yr announcement before a TIPS auction. The US yield curve is steepening and markedly so with the 10yr at a 4.53% peak, its highest since May when 4.69% printed, while the short-end is under pressure and the 2yr is pulling back from a 4.36% peak.

- JGBs caught a bid following BoJ Governor Ueda's press conference, in which he largely held a dovish tone and remained cautious on future hikes, noting he is waiting for "one more notch" on the wage data front. Currently higher by around 21 ticks, after rising to a 142.51 peak earlier.

- Bunds were pressured, in-fitting with USTs as outlined above. Specifics for the bloc have been light, with focus thus far and ahead firmly on external drivers. Bunds down to a 133.79 trough overnight, for reference 132.00 is the contract low from November, but have since bounced back above 134.00 to a 134.23 peak taking impetus from JGBs.

- Gilts gapped lower by 69 ticks before moving below the 92.00 handle to a 91.87 base, which is another contract low. The BoE is set to announce is policy decision today, where it is widely expected to keep rates unchanged, so focus will lie on any potential forward guidance.

- Click for a detailed summary

COMMODITIES

- WTI and Brent are essentially flat; the complex came under post-FOMC, but has since attempted to recoup some of the losses as the Dollar strength fades a touch. Brent Feb 2025 currently at the today's peak at USD 73.55/bbl.

- Gold is firmer, lifted off USD 2584/oz post-Fed lows as the USD comes off highs and the risk tone in Europe sours. In terms of resistance levels the 21-DMA resides at USD 2650/oz before the 50-DMA at USD 2670/oz.

- Base metals are in the red, alongside the slump in sentiment and the relatively strong Dollar; albeit, the USD strength has unwound a touch in the European morning. 3M LME copper has traversed the bottom end of the day’s USD 8,906.50-961.50/oz range thus far.

- Sinopec Energy Outlook said China’s petroleum consumption is expected to peak in 2027 at up to 800mln metric tons, according to Reuters.

- Indonesia is considering deep cuts to Nickel mining, according to Bloomberg; looking at reducing Nickel ore allowed to be mined in 2025 to 150mln tonnes

- Click for a detailed summary

NOTABLE DATA RECAP

- German GfK Consumer Sentiment (Jan) -21.3 vs. Exp. -22.5 (Prev. -23.3, Rev. -23.1)

- EU Current Account SA, EUR (Oct) 26.0B (Prev. 37.0B).

NOTABLE EUROPEAN HEADLINES

- Riksbank Rate 2.50% vs. Exp. 2.50% (Prev. 2.75%); if the outlook for inflation/activity remains unchanged, the rate could be cut again during H1-2025 (reiteration). Click for details.. Riksbank's Thedeen says they are somewhere near the neutral rate, this justifies going forward a little more carefully. If the situation is unclear, will wait with rate changes.

- Norwegian Key Policy Rate 4.50% (exp. 4.50%, prev. 4.50%); "the policy rate will most likely be reduced in March 2025". Click for details.

- ECB's Simkus says "best to keep consistent pace toward neutral; economic environment to determine terminal rate; downward direction monetary policy is clear; 1.75% is below the neutral rate. Inflation risks are balanced for the next year."

NOTABLE US HEADLINES

- Morgan Stanley now expects the Fed to deliver two 25 bps rate cuts in 2025 (prev. forecast of three 25 bps cuts) following the December FOMC meeting, according to Reuters.

- US President-elect Trump said he's totally against stopgap bill, Fox News reported. President-elect Trump and Vance called for a temporary funding bill without "Democrat giveaways" combined with an increase in the debt ceiling; Congress should debate the debt limit now.

- Micron Technology Inc (MU) - Q1 2025 (USD): Adj. EPS 1.79 (exp. 1.77), Adj. Revenue 8.71bln (exp. 8.71bln). Adjusted gross margin 39.5% (exp. 39.5%). Adjusted operating income 2.39bln (exp. 2.34bln). Adjusted operating income margin 27.5% (exp. 27%). Cash flow from operations 3.24bln (exp. 4.1bln). Guidance: Sees return to growth in H2 of FY. Q2 adj. revenue 7.7-8.1bln (exp. 8.99bln). Q2 adj. gross margin 37.5-39.5% (exp. 41.3%). Q2 adj. EPS 1.33-1.53 (exp. 1.92). Fiscal Q2 bit shipment outlook weaker than expected. Prioritizing investments to ramp 1β & 1γ tech nodes. Commentary: The PC refresh cycle is unfolding more gradually. Sees sale of projects to China-headquartered customers to be concentrated in high-end customer portfolios for the remainder of 2025. Shares fell 15% after-market.

- Micron (MU) executive said see conditions for margin expansion occurring after Q3, and added they saw some moderation in purchases of data centre SSDs after several quarters of rapid growth.

- Apple (AAPL) said Meta (META) has made 15 requests for potentially far-reaching access to Apple's technology, and it raises concerns about users' privacy and security as it made more requests than other firms, according to Reuters.

- Apple (AAPL) is reportedly in talks with Tencent (700 HK) and ByteDance to integrate their AI features into iPhones sold in China, according to Reuters sources.

- Indonesian President Prabowo has reportedly approved Apple's (AAPL) USD 1bln investment plan, via Bloomberg citing sources.

- Teamsters launch the largest strike against Amazon (AMZN) in US history; workers to strike nationwide on Thursday, according to Reuters.

- Russian President Putin says he has not spoken to US President-elect Trump in four years but is ready to talk to him.

GEOPOLITICS

MIDDLE EAST

- "Israel-Hamas hostage deal not imminent", according to Al Jazeera citing Jerusalem Post.

- "IDF: Sirens sound in several areas of central Israel, including Tel Aviv", according to Sky News Arabia.

- Senior Israeli official said IDF attacked in Sana'a (Yemen), according to Axios' Ravid.

- Yemeni Houthi spokesperson posted "An important statement for the Yemeni armed forces in the coming hours.", via X.

- "Arab media reported attacks in the area of the Yemeni capital Sana'a, the port of al-Hodeidah in the west of the country, and an oil facility in the Ras al-Issa area", according to Kann News.

- "An adviser to the Houthis' information ministry in Yemen: 'The Israeli attacks will not go unanswered. We will attack facilities related to electricity and oil reservoirs deep inside the occupation entity'", via Kan's Kais on X.

OTHER

- Ukrainian drone attack on Russia's Rostov region starts fire at Novoshakhtinsk oil refinery, according to the regional governor.

- Swedish Police say they went on board the Yi Peng 3 vessel today at the invitation of Chinese authorities

CRYPTO

- Bitcoin is on the backfoot after slumping in the aftermath of the FOMC decision; currently sits around 101.7k.

APAC TRADE

- APAC stocks traded with losses across the board amid the fallout from the hawkish Fed, as sentiment from Wall Street reverberated to the region.

- ASX 200 was pressured by its IT and gold sectors following the post-Fed tech downside and the slide in the yellow metal.

- Nikkei 225 pared some losses following the BoJ's decision to maintain rates, but choppy trade was seen thereafter ahead of Governor Ueda's presser.

- Hang Seng and Shanghai Comp were both lower as China conformed to the broader post-Fed risk tone, with Fed Chair Powell also suggesting that some Fed members had taken a very preliminary step and incorporated conditional effects of coming policies in their projections - i.e. potential Trump tariffs.

NOTABLE ASIA-PAC HEADLINES

- BoJ's comprehensive review of past monetary easing steps highlighted it was deemed appropriate for the bank to continue conducting monetary policy with the aim of achieving the price stability target of 2% in a sustainable and stable manner. The bank stated that no specific measures should be excluded at this point when considering the future conduct of monetary policy. Regarding the effectiveness of monetary easing, it was noted that the quantitative degree of its effects remains uncertain compared with conventional monetary policy measures. While monetary easing influenced inflation expectations to some degree, it was not sufficiently effective in anchoring inflation at 2%. In terms of its impact on interest rates and the economy, long-term interest rates were reduced by approximately 1ppt since 2016. Large-scale monetary easing contributed to GDP growth by an estimated 1.3% to 1.8%, while its effect on CPI was between 0.5 and 0.7ppts. Note, the policy review was initiated by Ueda when he took office in April 2023.

- Honda (7267 JT) and Nissan (7201 JT) talks to start as early as next week, according to Nikkei.

- HKMA cut its base rate by 25bps to 4.75%, as expected in lockstep with the Fed.

- South Korean Finance Minister said market-stabilising measures will be taken if volatility is deemed excessive; will prepare FX stability and liquidity measures in 2025 policy plan, according to Reuters.

- South Korean financial regulator said it has asked banks to flexibly adjust FX transactions and loan maturity for firms, according to Reuters.

- South Korea's National Pension Service (NPS) and BOK to extend and expand their FX swap agreement, according to Reuters.

- Indonesia's central bank said it is committed to stabilising the IDR in case of any excessive volatility, according to Reuters.

- Westpac now forecasts the RBNZ to cut the cash rate to 3.25% by May 2025 following the NZ GDP data.

DATA RECAP

- New Zealand GDP Prod Based QQ, SA (Q3) -1.0% vs. Exp. -0.2% (Prev. -0.2%, Rev. -1.1%)

- New Zealand GDP Exp Based QQ, SA (Q3) -0.8% vs. Exp. -0.4% (Rev. -0.8%)

- New Zealand GDP Prod Based YY, SA (Q3) -1.5% vs. Exp. -0.4% (Prev. -0.5%)

- New Zealand GDP Prod Based, Ann Avg (Q3) 0.1% vs. Exp. -0.1% (Prev. -0.2%, Rev. 0.6%)

- New Zealand ANZ Business Outlook (Dec) 62.3% (Prev. 64.9%)

- New Zealand ANZ Own Activity (Dec) 50.3% (Prev. 48.0%)