US equity futures and global markets are higher as Russian and US officials met to negotiate an end to the three-year war in Ukraine. As of 8:00am ET, both S&P and Nasdaq futures are 0.4% higher, with Mag7 names all higher ex META (GOOGL +0.5%, AMZN +0.4%, AAPL +0.1%, MSFT +0.3%, META -0.2%, NVDA +1.2% and TSLA +0.8%) and Semis bid up, led by Intel. In Europe, the Stoxx 600 index held near record highs, with defense stocks such as Rheinmetall and Dassault Aviation rallying further on expectations that governments will have to ratchet up military spending. A gauge of emerging-market equities hit a three-month high, while stocks in Asia were mixed, but still closed in the green for a fifth day after President Xi Jinping met with prominent entrepreneurs Monday. Tariff headlines were quiet over the weekend as the market focused on a RU/UKR solution. Bond yields are higher by 1-3 bps and USD looks to break a 5-day losing streak. Commodities are stronger with all 3 complexes bid up and WTI finding support above $70/bbl. Today’s macro releases lack market-moving data as part of a relatively quiet macro week; we have two Fed speakers on deck.

In premarket trading, Nvidia is leading gains among the Magnificent Seven stocks (GOOGL +0.5%, AMZN +0.4%, AAPL +0.1%, MSFT +0.3%, META -0.2%, NVDA +1.2% and TSLA +0.8%). Intel shares extended their recent surge after the Wall Street Journal reported that Taiwan Semiconductor and Broadcom are mulling deals that would break up the US chip giant. Delta Air Lines fell after one of its jets flipped out of control upon landing in Toronto. In Europe, InterContinental Hotels Group Plc dropped after results. Here are some other notable premarket movers:

- Constellation Brands (STZ) rises 8% after Berkshire Hathaway reported a new position in the Corona and Modelo maker.

- Delta Air Lines (DAL) slips about 1% after one of the company’s regional jets flipped out of control after landing in windy, freezing conditions in Toronto on Monday.

- Fluor (FLR) drops 6% after the infrastructure construction company’s annual profit forecast fell short of Wall Street expectations. The company also said Chief Operating Officer Jim Breuer will take over as CEO on May 1.

- GeneDX Holdings (WGS) rises 22% after the genomics testing company issued guidance for 2025.

- H&E Equipment Services (HEES) jumps 16% after announcing that the company received a superior proposal from Herc Holdings. Shares of Herc (HRI) fall 4%.

- Hims & Hers Health (HIMS) declines 1% after Morgan Stanley downgraded the telehealth company, saying it is “time for a breather after a torrid run.”

- Intel (INTC) rises 5% as the Wall Street Journal reports that Taiwan Semiconductor Manufacturing Co. and Broadcom are mulling potential deals that would break the US chipmaking giant in two.

- Solid Biosciences Inc. (SLDB) gains 94% after reporting initial clinical data from next-generation Duchenne Gene Therapy candidate SGT-003.

- Southwest Airlines (LUV) rises 2% after the carrier said it will cut about 1,750 jobs in its leadership ranks to reduce expenses.

As discussed last night, the "romantic phase" of the European defense stock surge is coming to an end, as attention turns to who gets to pay for all those trillions in required defense expenditures. The spending concerns weighed on European bonds, with German 10-year bund yields — the benchmark borrowing rate for the euro area — touching the highest in more than two weeks. As US Treasuries trading resumed, 10-year yields rose about three basis points. The moves came as Saudi Arabia hosted talks between Russia and the US, which could pave the way for President Donald Trump and Russia’s Vladimir Putin to meet. Meanwhile, European governments are mulling new defense funding measures ahead of a March 20-21 summit.

“The prospect of the war in Ukraine coming to an end is very positive,” said Tim Graf, head of EMEA macro strategy at State Street Bank and Trust Co. “Underneath it all is defense spending, which will be good for US defense contractors, but also European industrials and defense contractors.”

Indeed, the mood on equities remains bullish overall, with a Bank of America survey showing global stocks are the most popular asset class with investors. Fund managers’ cash levels have dropped to the lowest since 2010, indicating greater willingness to take on risk.

Attention is now set to refocus on the Federal Reserve’s interest-rate path, with Governor Christopher Waller saying recent economic data supports keeping rates on hold until more progress is seen on inflation. His comments helped the dollar advance against Group-of-10 peers. Fed officials Mary Daly and Michael Barr are due to speak Tuesday, while minutes from the central bank’s latest policy meeting will be released on Wednesday.

European stocks were little changed after reaching a fresh record high on Monday, as investors assessed the outlook for defense spending and the likelihood of ceasefire in Ukraine. Investors will turn their focus to Saudi Arabia, where Russian and US representatives are meeting to negotiate an end to the war in Ukraine. Stoxx 600 was little changed at 555.49 with 366 members down, 209 up, and 25 unchanged. Here are some of the biggest movers on Tuesday:

- Glencore shares rise as much as 1.9% after the stock was upgraded to overweight from equal-weight at Morgan Stanley. Analyst says that concerns over the impact of a potential end to the war in Ukraine on the miner and commodities trader’s earnings power are “exaggerated.”

- Hollywood Bowl shares rise as much as 5.3%, the most in more than a year, after the bowling center operator launched a £10m share buyback, in line with previous years.

- Formycon shares advance as much as 5.7%, paring some of Monday’s record 35% decline, after Hauck & Aufhaeuser analysts say the selloff seems “overdone” and expectations have been reset.

- Valneva shares rise as much as 6.8%, before paring the gain to 2%, after the French vaccines maker forecast substantially lower operating cash burn in 2025.

- BT shares fall as much as 5.7% and are headed for their worst day in six months after Citi cut its rating to sell from buy, saying the telecom operator’s key Openreach arm may face a revenue decline from 2025-2026.

- Capgemini shares decline 8.7% after the French company gave a lower-than-expected revenue growth target for this year, signaling continued tepid IT demand.

- IHG shares slide as much as 4.6% after analysts flagged higher interest expense and capital expenditure guidance could weigh on the hotelier’s earnings expectations.

- Edenred shares fall 7.9%, the most since October, after fourth-quarter results. Analysts point to slowing like-for-like operating growth in the second half of 2024 and a regulatory overhang in multiple markets.

- Serica Energy shares drop 13% as the oil and gas company grapples with new issues impacting the Triton FPSO (floating production storage and offloading unit), which has been taken offline once again and thrown fresh doubt over the firm’s annual production guidance.

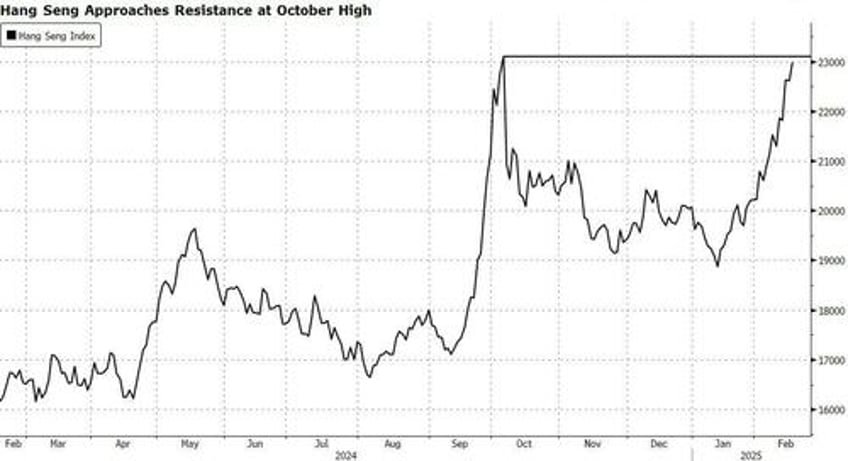

Earlier in the session, Asian stocks were mixed, but are still headed for a fifth day of gains after President Xi Jinping met with prominent entrepreneurs Monday. The MSCI Asia Pacific Index advanced 0.1%, with Hong-Kong listed technology stocks Alibaba, Tencent and Xiaomi among the biggest boosts. Australian shares fell amid the central bank’s decision to cut interest rates by a quarter point, and those in mainland China declined. The meeting with Xi, attended by the likes of Alibaba’s Jack Ma, inspired hopes that the world’s second-largest economy may do more to support its private sector. The Hang Seng Index advanced 1.3%.

“I think it’s more symbolic rather than a structural shift for China tech,” said Billy Leung, an investment strategist at Global X ETFs. The key question is whether this translates into real support measures at the Two Sessions event in March, he added, stating that investors “will need to see follow-through.” Shares traded higher in Korea, Japan and Taiwan.

In FX, the Bloomberg Dollar Spot Index rose as much as 0.3%, arresting a three-day slide that had been gradually losing pace. Waller characterized the economy as solid, with a labor market that is in a “sweet spot.” The Aussie dollar outperforms after the RBA cut interest rates but stressed it won’t ease as aggressively as markets anticipate; the British pound was down 0.2%.

In rates, treasury yields rose across the curve on return from a long holiday weekend. Yields on 10-year Treasuries rose 3bps to 4.51%. Markets are pricing the possibility that the Fed will deliver one 25bps cut by year-end, with a roughly 50-50 chance or another easing. Treasuries also track selling in European government bonds, which take a hit on the growing view that Europe will need to raise defense spending to help Ukraine, likely requiring more bond issuance. German 10-year yields rise 1 bps to 2.50%. Gilts underperform after UK pay growth picked up to its highest level in eight months and employment unexpectedly rose. UK 10-year yields rise 2 bps to 4.55%.

In commodities, oil prices advance, with WTI rising 1.5% to $71.80 a barrel. European natural gas prices fall for a sixth consecutive session to near €47 a megawatt-hour. Spot gold climbs $14 to $2,910/oz after Goldman Sachs Group Inc. analysts raised their year-end gold target to $3,100. Prices for the precious metal are up almost 11% so far this year.

Looking to the day ahead, and US data releases include the Empire State manufacturing survey for February, and the NAHB’s housing market index for February. Eslewhere, there’s UK unemployment for December, the German ZEW survey for February, and Canada’s CPI for January. From central banks, we’ll hear from BoE Governor Bailey, the ECB’s Holzmann and Cipollone, and the Fed’s Daly and Barr. US and Russian delegates meet in Saudi Arabia for talks aimed at ending the war in Ukraine.

Market Snapshot

- S&P 500 futures up 0.3% to 6,149.75

- STOXX Europe 600 little changed at 554.90

- MXAP up 0.3% to 189.81

- MXAPJ up 0.5% to 598.74

- Nikkei up 0.2% to 39,270.40

- Topix up 0.3% to 2,775.51

- Hang Seng Index up 1.6% to 22,976.81

- Shanghai Composite down 0.9% to 3,324.49

- Sensex little changed at 76,020.69

- Australia S&P/ASX 200 down 0.7% to 8,481.01

- Kospi up 0.6% to 2,626.81

- German 10Y yield up 1.7 bps at 2.50%

- Euro down 0.3% to $1.0457

- Brent Futures up 0.7% to $75.77/bbl

- Gold spot up 0.6% to $2,913.32

- US Dollar Index up 0.35% to 106.95

Top Overnight news

- Fed Governor Christopher Waller said recent economic data support keeping rates on hold, but cuts may resume later this year if inflation behaves as it did in 2024. Waller (voter) said tariffs are expected to have a modest and non-persistent impact on prices that the Fed should try to look through when setting policy, while he added the recent CPI reading was disappointing but may be the result of seasonal adjustment issues. Waller also commented that the Fed cannot let uncertainty about policy paralyse action and decisions must be guided by data but added that it is appropriate to keep rates on hold for now and seasonal effects may be distorting data, as well as noted that he sees inflation progress in the past year as excruciatingly slow. BBG

- Top US and Russian officials started meeting in Saudi Arabia to discuss how to end the war in Ukraine, without anyone from Kyiv taking part. France’s Emmanuel Macron spoke separately with Donald Trump and Volodymyr Zelenskiy on aligning with the US on peace talks. BBG

- Bearishness among individual investors—measured by the percentage who expect stock prices to fall over the next six months—reached 47.3% for the week ended Feb. 12, according to the latest survey from the American Association of Individual Investors. That is the highest level since November 2023. WSJ

- Crews responded to a plane crash at the Toronto Pearson airport, while the incident occurred upon landing involving a Delta Airlines plane arriving from Minneapolis although all passengers and crew are accounted for.

- China’s Xi made a strong show of support for the China’s private sector and its tech entrepreneurs at an event Monday as the government marshals all components of the economy to bolster growth and counter rising trade tensions with the US. WSJ

- Singapore will boost payments and tax rebates to households to help with living costs, PM Lawrence Wong said in his first budget — one that comes ahead of elections in November. BBG

- Australia’s RBA cut interest rates by 25bp, as expected, but expressed caution on the potential for additional easing given that the war on inflation hasn’t been completely won. RTRS

- UK pay growth picked up to 5.9% last quarter, its highest level in eight months, and employment unexpectedly rose, indicating a more resilient jobs market than expected. Traders trimmed expectations for BOE cuts to 54 bps from 57 bps yesterday. BBG

- France proposed a “reassurance force” of European troops to be stationed behind a potential armistice line should Russia and Ukraine reach a settlement in their war, although there was pushback to the idea from Germany, Italy, Poland, and Spain. FT

- Four of the EU’s top central bankers urged the bloc’s regulatory arm to simplify the mass of rules that commercial lenders blame for increasingly putting them at an international disadvantage. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded somewhat mixed in the absence of a lead from Wall St owing to the Presidents' Day holiday, while participants in the region braced for central bank updates beginning with the RBA rate decision. ASX 200 traded negative amid underperformance in energy and the top-weighted financials sector, while sentiment failed to benefit from the RBA's widely expected 25bps rate cut as it also signalled caution on further cuts. Nikkei 225 gained but with upside capped after swinging between gains and losses amid firmer yields and a quiet calendar. Hang Seng and Shanghai Comp were varied as the Hong Kong benchmark resumed its recent outperformance with the help of strength in tech and auto names, while the mainland was lacklustre as US-China frictions lingered and after reports noted that the PBoC may further limit its MLF rollover to prevent idle funds.

Top Asian News

- RBA cut the Cash Rate by 25bps to 4.10%, as expected, and said underlying inflation is moderating and the outlook remains uncertain, while it added that sustainably returning inflation to the target is the priority and the board will continue to rely on data and evolving risk assessments to guide decisions. RBA stated the board is more confident that inflation is moving toward the midpoint of the 2–3% target range but noted that upside risks remain and the board remains cautious on prospects for further policy easing. Furthermore, it stated that forecasts suggest that easing monetary policy too soon could stall disinflation and cause inflation to settle above the target midpoint.

- RBA Statement on Monetary Policy stated inflation and GDP have been softer than expected, while the labour market remains strong and domestic financial conditions are restrictive, with rates above neutral. RBA also noted a wide range of estimates for the neutral rate, with some estimates declining and it forecast GDP to grow by 2.0% in June 2025, 2.3% in June 2026, and 2.2% in June 2027, while CPI is forecast at 2.4% in June 2025, 3.2% in June 2026, and 2.7% in June 2027 with the trimmed mean inflation forecast at 2.7% for June 2025, 2026, and 2027. Furthermore, its forecasts assumed a cash rate of 4.0% in June 2025, 3.6% in December 2025, and 3.4% in June 2026.

- RBA Governor Bullock said in the post-meeting press conference that it is clear high rates have worked and cannot declare victory on inflation yet, while the strength of the jobs market has been surprising and further rate cuts implied by the market are not guaranteed. Bullock said cannot get too ahead of ourselves on rates and the rate cut was a difficult decision, as well as stated that they have to be patient and it is really important to get inflation down.

- China's state planner said 'precise' policies are to be implemented to help ease difficulties faced by private companies and the current political, economic, and social environment is conducive to the development of the private economy. NDRC stated that China will further break down barriers to market access and revise the negative list for market access as soon as possible, while it will continue efforts to solve financing difficulties and high costs for private enterprises, as well as plans to speed up preparations for the implementation of the private economy promotion law.

- BoJ Governor Ueda says last summer's volatility was mainly caused by market concern over weak US jobs data, US economic slowdown; says BoJ aware of views that guidance was not clear enough.

European bourses (STOXX 600 U/C) began the session with a modest upward bias, but price action has been choppy since; indices currently display a mixed picture. European sectors are mixed after initially opening with a slight positive bias; the breadth of the market is fairly narrow. Banks take the top spot, mainly driven by UK banks after the region’s latest jobs data saw a slight paring of BoE rate cut bets; Dec'25 -58bps (prev. -62.8bps). US equity futures are modestly firmer, with slight outperformance in the NQ (+0.4%), as the region returns from holiday on account of Presidents’ Day. BofA Fund Manager Survey highlights that investors are bullish and are long stocks, and short "everything else"; cash levels have hit their lowest in 15 years. 89% of respondents said US stocks are overvalued. On positioning: Euro-area longs rose to an eight-month high, UK shorts to a 11-month high. Interestingly, the survey suggests that the trade war is seen as no more than a "tail risk". EU antitrust chief said she is ready to issue decisions on Apple (AAPL) and Meta (META) next month; says EU will not engage in transactions with the US over democracy and Europe's values.

Top European News

- ECB's Holzmann said there's some probability of a March rate cut and decisions in favour of more cuts are getting harder, according to Bloomberg.

- UK Chancellor Reeves will have to raise taxes by an extra GBP 12bln if she wants to boost defence spending to 2.5% of GDP and avoid a fresh round of austerity, according to The Telegraph.

- BoE Governor Bailey says "we are in a period of heightened uncertainty"; disinflation is continuing. Facing weak growth environment in the UK. Hump in inflation due to administered prices. Risks are on two sides, could go either way. "Careful" language was chosen to reflect more uncertainty. Latest UK labour data looks on the quantity not far out of line with what was expected. Latest UK pay growth has risen less than we expected. Yet to see anything in the data that fundamentally changes the view of the BoE's outlook. Bond term premia are being moved by US comments on tariffs. Agree with US Treasury Sec's comments on whishing to see smaller moves in term premia. Yet to see anything in the data (referencing this morning's jobs data) that fundamentally changes the view of the BoE's outlook.

FX

- USD is a little firmer vs peers. Focus for today is on US officials who are currently meeting with Russian counterparts to discuss a path towards ending the Russia-Ukraine conflict. Given the absence of Ukraine and Europe in the discussions, it remains to be seen how much progress can be made. There are few Tier 2 data releases today, with attention also on Fed speak from Daly and Barr. DXY has ventured as high as 107.05 but failed to hold a move above the 107 mark.

- EUR is weaker vs. the USD and to a lesser-extent GBP. Focus in Europe remains on discussions between European leaders over the Russia-Ukraine conflict. The likely need for greater bond issuance to fund additional defence spending commitments has placed upside pressure on yields, however, this has failed to provide support for the EUR since the beginning of the week. ZEW data (which were a little better than expected) had little impact on the Single-Currency; currently within a 1.0453-86 range.

- USD/JPY has regained some composure after the recent declines and but has failed to hold above the 152.00 level with gains potentially capped by the recent stronger-than-expected Japanese economic growth. Comments from BoJ Governor Ueda proved to be non-incremental this morning, noting that the Bank is aware of views that guidance was not clear enough. If USD/JPY is able to reclaim 152, yesterday's peak kicks in at 152.39.

- GBP is softer vs. the USD but to a lesser-degree than peers on account of the latest UK jobs data. The release saw the unemployment rate unexpectedly hold steady at 4.4% (vs. 4.5%), whilst employment change was higher-than-expected and headline earnings growth a touch above expectations. Elsewhere, focus is on the fiscal front with The Telegraph writing that Chancellor Reeves will have to raise taxes by an extra GBP 12bln if she wants to boost defence spending to 2.5% of GDP. Cable ventured as high as 1.2625 post-data before fading gains; currently sits within yesterday's 1.2579-1.2635 range.

- Diverging fortunes for the antipodeans with AUD resilient vs. the broadly firmer USD following a cautious cut from the RBA overnight. RBA Governor Bullock also suggested that further rate cuts implied by market are not guaranteed.

- PBoC set USD/CNY mid-point at 7.1697 vs exp. 7.2538 (prev. 7.1702).

Fixed Income

- USTs are slightly softer. Action which comes as cash plays catch up to yesterday’s action and as such yields are firmer across the curve, steepening and outperforming European peers. Thus far, USTs down to a 109-01 trough which is comfortably clear of Monday’s 108-26 base. Ahead, Fed speak from Barr and Daly; attention also on the Russia-US meeting in Saudi.

- Bunds are on the backfoot, but off worst levels following a pair of well-received outings from Germany and the UK. Downside not to quite the same extent as USTs given the marked European pressure on Monday as leaders met to discuss how to fund additional defence spending. Reports suggest that an emergency meeting will be held on/around 24 February, where markets will be attentive to details on the size of the defence spending. No sustained move to the German ZEW figures which came in firmer than expected across the board, ZEW puts this down to expectations of policy progress after this weekend’s election and assistance from recent ECB easing. Bunds have made their way off the above low and have climbed above 132.00 and look to retest the overnight peak at 132.16.

- Gilts are in the red, in tandem with peers but with specific pressure from a hawkish set of employment/wage data. In the wake of this, market pricing continues to point to the next 25bps move occurring in June but thereafter the timing for a second move has just about been pushed from September to November. BoE's Bailey spoke on the latest jobs data, saying that there is nothing in the latest jobs data which fundamentally changes their view, a remark which came alongside a robust UK auction and has lifted Gilts to retest their 92.78 peak.

- Orders for new 8yr "BTP Plus" bond reach EUR 6bln since start of offer, via Reuters citing bourse data.

- UK sells GBP 1.75bln 4.0% 2063 Gilt: b/c 2.8x (prev. 3.10x), average yield 5.076% (prev. 4.557%), tail 0.3bps (prev. 1.3bps)

- Germany sells EUR 3.54bln vs exp. EUR 4.5bln 2.20% 2027 Schatz: b/c 2.7x (prev. 2.8x), average yield 2.14% (prev. 2.26%), retention 21.33% (prev. 23.68%)

Commodities

- A firm session across crude prices this morning with WTI not experiencing a settlement on Monday amid the US Presidents' Day holiday, whilst Brent Apr settled with gains of 0.48/bbl. Geopolitical updates have been plentiful as US-Russia high-level delegations met in Riyadh to discuss a peace path for Russia-Ukraine. Elsewhere, Lebanon said any remaining Israeli presence on Lebanese soil would be considered an occupation. Brent Apr sits in a USD 75.05-75.89/bbl parameter.

- Softer price action across nat gas with European prices well under EUR 50/MWh from levels above EUR 58/MWh last week. US-Russia talks on a Ukrainian peace deal is likely one of the main sources of this recent pressure.

- Mixed trade across precious metals with mild gains seen in gold despite the firmer Dollar (to which silver is succumbing to), with the yellow metal propped up by uncertainty and geopolitics. Spot gold resides in a current USD 2,892.07-2,915.76/oz range.

- Base metals are mostly lower amid the firmer Dollar and cautious risk tone. Copper futures prodded Monday's lows overnight with demand hampered amid the mixed risk appetite in Asia, coupled with a mostly lower picture in Europe.

- Goldman Sachs has raised its gold price target to USD 3,100/ troy ounce by the end of 2025, driven by central-bank buying and increased ETF inflows.

- "The presence of Kirill Dmitriev among the Russia delegation in Riyadh for the Washington-Moscow talks suggest that oil is going to be on the table.", according to Bloomberg's Blas. "Perhaps in the form of US oil sanction relief, or as a quid pro quo opening Russian oil again for American companies"

- CPC says it continues oil transit via Tengiz-Novorossiysk route.

- Russia's Transneft says reduction of oil pumping volumes from Kazakhstan via CPC are estimated at around 30%. Consequences of the drone strike will take 1.5-2 months to eliminate.

Geopolitics: Middle East

- Israeli Foreign Minister Saar says "we will begin negotiations on the second phase of the hostage deal; we demand a complete demilitarisation of Gaza". Will visit Brussels next week, and Washington "soon"

- Lebanon says any remaining Israeli presence on Lebanese soil would be considered an occupation; Lebanon says it has the right to use all means to ensure Israeli withdrawal from Lebanese land.

- "Iranian government spokesperson: It makes no sense to negotiate when the other side imposes a policy of maximum pressure", according to Al Jazeera

- Israeli security official said they are preparing to receive the bodies of four hostages on Thursday and are working to secure the release of six living hostages on Saturday.

- Sources noted that the Egyptian plan on Gaza includes reconstruction within a period ranging from 3 to 5 years without displacing the population, according to Asharq News.

- US President Trump posted on Truth that US forces conducted a precision airstrike against a member of al-Qaeda in Syria this weekend.

- Iran’s Foreign Minister said they will never negotiate under pressure or threat but if the US negotiates with respect and dignity, the Iranian response will be with the same language.

- Russia is ready to help Tehran in solving problems related to Iran's nuclear program and the start of Russia-US talks will have no impact on Russia-Iran cooperation, according to TASS citing the Kremlin.

Geopolitics: Ukraine

- Russia's Kremlin says cannot give an evaluation of the negotiation with US officials yet as they have only just started. No understanding of a Russian President Putin-US President Trump meeting, today's talks may bring more clarity. Putin has repeatedly said he is ready to speak about peace. "Main thing is to achieve our aims, Of course, we would prefer to achieve our aims peacefully." Asked if Ukraine could join the EU: This is the sovereign right of any country, we are not going to dictate.

- Russia's sovereign wealth fund chief Dmitriev said "we are still at the beginning of the dialogue with America on sanctions", according to Al Arabiya." It must be realized that sanctions have affected Washington more than Moscow." US companies will return to Russia at some point." Projects with America must move forward, including in the Arctic." Trump administration is now ready to understand Russia's concerns". Progress of negotiations with Washington is possible in the next two months", according to Al Arabiya

- Journalist Rahman says "Few concrete results were expected from Paris, it was organised so quickly. Expectations now running high for an additional high-level emergency meeting on/around 24 Feb in Kyiv, hosted by the Ukrainian Govt."

- Russia's sovereign wealth fund chief Dmitriev said in Riyadh that US-Russia talks on ending the Ukraine war are important and US businesses have lost millions due to leaving Russia, while he added that US businesses have lost USD 300bln after leaving Russia and believes US oil majors will at some point return to Russia.

- Russia’s sovereign wealth fund chief Kirill Dmitriev said he has already met with several members of the Trump team in Riyadh on Monday, via CNN; “All I can say is they’re great problem-solvers. And I think President Trump is a great problem-solver,” he said. “I think the promise is: let’s have dialogue, let’s figure out the best solution for our countries, for other countries, for the global community,” he said. “I think it’s very important to build bridges. I think US-Russia relations are very important for the world,” he said.

- Ukrainian President Zelensky said he had a "long" call with French President Macron on security guarantees and achieving peace in Ukraine.

- US President Trump spoke with French President Macron about Ukraine, the European meeting, and Saudi talks between US and Russian officials.

- French President Macron said he spoke with US President Trump and then with Ukrainian President Zelensky, while he added that they will continue discussions about Ukraine in the coming days and work will continue based on the European Commission’s proposals, supporting Ukraine and investing in defence.

- UK PM Starmer said part of his message to European allies is that they’ve all got to step up on capability and on spending and funding, while he added that includes the UK which is why he has made a commitment to spend more, according to FT.

- German Chancellor Scholz rejected UK PM Starmer's call for Europe to step up and deploy troops to Ukraine as part of any peace deal, according to The Telegraph.

- Polish PM Tusk said all participants in the meeting on Ukraine had similar opinions to Poland on key issues and all agreed close cooperation within NATO is needed. Tusk added they realise that transatlantic relations are in a new stage and European partners realise that the time has come for greater European defence capabilities and spending.

- Danish PM said they must ramp up military preparedness and see no signs that the Russians want peace.

- European leaders at the Paris meeting agreed it would be dangerous to conclude a Ukraine ceasefire without a peace agreement at the same time, while they are ready to provide Ukraine with security guarantees depending on the level of US support.

Geopolitics: Other

- Taiwan is considering a multi-billion-dollar weapons purchase from the US which could be between USD 7-10bln and could include coastal defence missiles and HIMARS rockets, while the package would send a message that Taiwan is committed to its defence, according to Reuters sources.

- North Korea’s Foreign Ministry said the US is pursuing an outdated and absurd plan of denuclearisation of the Korean Peninsula, while North Korea will adhere to bolstering its nuclear force, according to KCNA.

US Event Calendar

- 08:30: Feb. Empire Manufacturing, est. -2.0, prior -12.6

- 10:00: Feb. NAHB Housing Market Index, est. 46, prior 47

- 10:20: Fed’s Daly Speaks to American Bankers Association

- 13:00: Fed’s Barr Discusses AI, Financial Stability

- 16:00: Dec. Net Foreign Security Purchases, prior $79b

- 16:00: Dec. Total Net TIC Flows, prior $159.9b

DB's Jim Reid concludes the overnight wrap

I have a certain “circle of life” feeling this morning as for the first time I went to bed before my 9-year daughter Maisie last night. It’s half term and she had friends over for a sleepover. By the time I headed up to bed at 9:30pm they were still awake. Let’s hope it’s a few more years before she comes home from a nightclub around 430am just as I’m getting up to write the EMR.

By the time that inevitable day arrives, the defence architecture of Europe could look a lot different. As I said in my chart of the day yesterday, to paraphrase Lenin (not something I do often), there are days when decades happen. While that might be a slight exaggeration, the potential implications are huge after the events of the last five days where first the US froze out Europe in announcing the start of talks with Russia, and second with the broadside against Europe from US Vice President JD Vance. That all this is occurring within a week of the German general election (this Sunday) means that Europe might start to move down a very different path within weeks to the pre-existing one.

The initial reaction yesterday was to price in more European defence spending with bonds selling off and equities rising, especially in the defense sector. This lifted the STOXX 600 (+0.54%) and the DAX (+1.26%) to fresh all-time highs. Indeed, for the DAX, that now leaves it up +14.5% YTD, marking its strongest start to a year since 2012. At the sectoral level, cyclicals generally did better, whilst the strength among defence companies meant Rheinmetall (+14.03%) was the strongest performer in the DAX, and the second-best performer in the STOXX 600. US markets were closed for the holiday, but by the European close, futures pointed to gains that would’ve been enough to take the S&P 500 to a fresh all-time high. They remain around the same levels in Asia with S&P 500 (+0.21%) and NASDAQ 100 (+0.30%) contracts up.

This discussion of more spending and new issuance helped to drive a fresh bond selloff across Europe. For instance, yields on 10yr bunds (+5.7bps) rose to 2.49%, their highest in over two weeks, whilst yields on 10yr OATs (+3.8bps), BTPs (+2.6bps) and gilts (+2.7bps) all moved higher as well. US markets were closed yesterday, but 10yr treasury futures also lost ground during the European session, with cash bonds reopening +3.2bps this morning so the pattern has been clear across the world. That said, the broader risk-on tone did lead to a fresh tightening in sovereign bond spreads, and the Italian 10yr spread over bunds hit a 3-year low of 106bps.

Earlier in the day, there had been divisions among European countries at the emergency summit in Paris over whether to send troops to Ukraine. For instance, UK PM Keir Starmer said that the UK was "ready and willing to contribute to security guarantees to Ukraine by putting our own troops on the ground if necessary". But Spain’s foreign minister separately said that “Nobody is currently considering sending troops to Ukraine”. In the meantime, Bloomberg reported that the US had asked European countries about what security guarantees they’d be willing to provide to Ukraine, and there’s been extensive talk of something much more substantial. For instance, France’s minister for European affairs said that joint Eurobonds were something that should be considered, whilst Germany’s foreign minister has said on defence that “We will launch a large package that has never been seen in this dimension before”. Peace talks are set to start in Saudi Arabia today between US and Russian representatives. So we'll see if any headlines emerge from that.

All this is coming during a pivotal week for Europe, as the German election is taking place this Sunday. Depending on the results, that could pave the way for some reform of the debt brake that permits for more borrowing. As a reminder, our Germany team’s base case is now that a coalition agreement will include a meaningful increase in defence spending from the 2026 budget onwards, potentially with some glide path toward at least 2.5% by the end of the term. They now expect a new defence fund would be set up with greater urgency and spent more rapidly, implying a positive fiscal impulse.

Asian equity markets are mostly trading higher this morning amid a rally in Chinese technology stocks. Across the region, the Hang Seng (+1.28%) is leading gains and resuming its tech-led rally but with the Shanghai Composite (-0.19%) dipping after a stronger open. Today has seen a meeting between President Xi Jinping and China’s top business leaders in what is seen as a possible end to the years-long crackdown on the private sector with the government working to revive an economy disrupted by a pandemic, regulatory crackdowns, and a real estate crisis.

Elsewhere, the Nikkei (+0.53%) and the KOSPI (+0.57%) are higher but the S&P/ASX 200 (-0.66%) is extending its previous session losses following a hawkish RBA statement and press conference after their 25bps cut this morning.

This was the RBA's first rate cut since 2020, with the bank citing some progress towards bringing down inflation, but warning that further monetary easing still hinged on more downside in inflation. The central bank flagged that it would retain a restrictive policy due to the strength of the jobs market and an uncertain global economic outlook. Following the decision, the Aussie (-0.04%) briefly climbed before paring gains, trading fairly flat at 0.6352 against the dollar while yields on the policy sensitive three-year government bond have increased +5.5bps to trade at 3.93% as we go to print.

To the day ahead now, and US data releases include the Empire State manufacturing survey for February, and the NAHB’s housing market index for February. Otherwise, there’s UK unemployment for December, the German ZEW survey for February, and Canada’s CPI for January. From central banks, we’ll hear from BoE Governor Bailey, the ECB’s Holzmann and Cipollone, and the Fed’s Daly and Barr. US and Russian delegates meet in Saudi Arabia for talks aimed at ending the war in Ukraine.