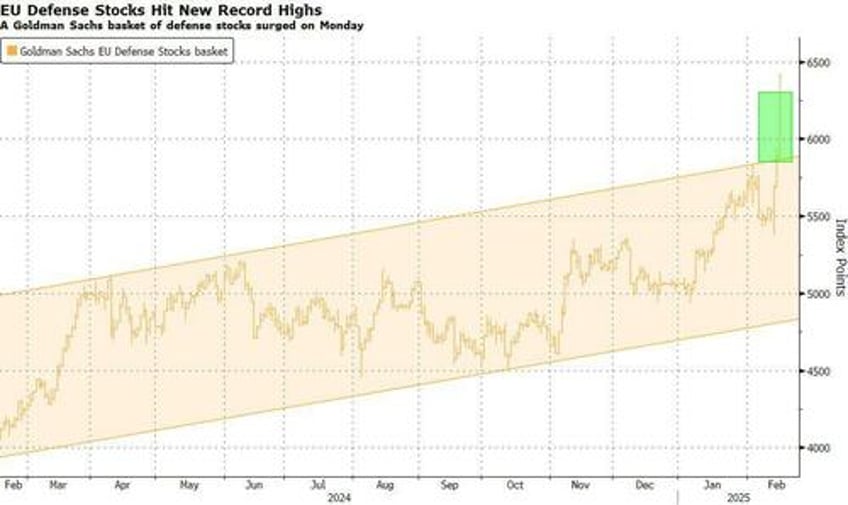

European defense stocks exploded this morning, surging to an all time high and helping also push the broader Euro Stoxx 600 index to a fresh record, after it emerged that Europe will have to fund its own defense after VP JD Vance effectively pulled the US out of NATO on Friday.

There is just one problem with this newfound euphoria: while the market is already reaping the benefits of Europe's rearmament, the question - which we asked last Thursday well before Vance's speech, is just who gets to pay for this surge in defense stocks.... and for Europe's general rearming as the continent is forced to boost its military spending from 2% of GDP to 5% (where it should have been decades ago).

Has the market decided yet how Europe (and likely Japan) get the funding to boost military spending to 5% of GDP?

— zerohedge (@zerohedge) February 13, 2025

We are talking massive debt issuance, just as massive QE here.

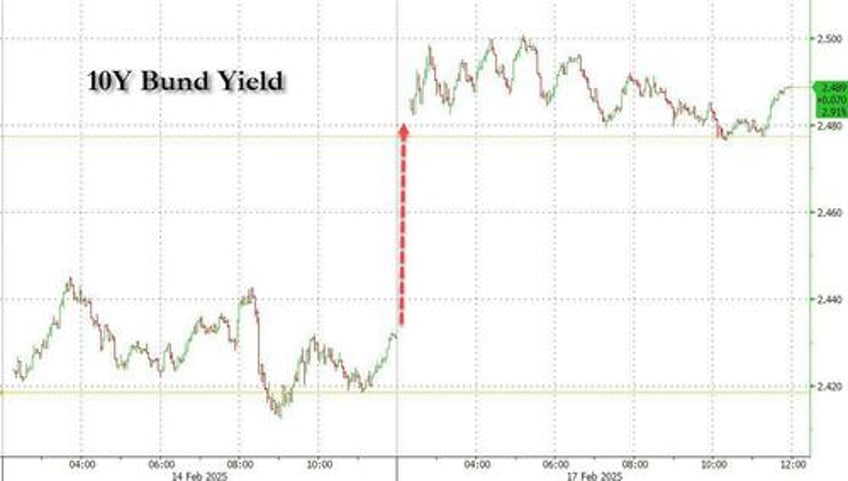

This morning others also asked this ($8) trillion question, and the result was a broad-based selloff in European bonds this morning as a growing number realized that Europe - which already is drowning in excess debt - will have even more debt to drown in.

“The goalposts are shifting, and the EU is realizing they can rely less and less on the US for protecting their borders. In lockstep, we’re going to have to see European countries spend more on defense,” said Aneeka Gupta, head of macro research at Wisdomtree UK Ltd. “That does warrant a bit more caution on bonds.”

As Bloomberg also notes (almost a week after us), the view is finally becoming accepted that debt sales will need to increase as European nations shoulder the cost of a lasting peace deal between Ukraine and Russia. And according to Bloomberg calculations, upgrading defense and protecting Ukraine may cost Europe’s major powers (or not so major as the case may be) an additional $3.1 trillion over 10 years.

Bottom line, lots of numbers being thrown around and nobody willing to pay them. Understandably, as Bloomberg reports separately, discussions are (begrudgingly) gathering pace in the European Union on how to increase defense spending, with joint financing becoming a realistic option for a growing list of leaders.

The topic will likely be raised informally at a meeting French President Emmanuel Macron is hosting in Paris Monday with other leaders including the UK’s Keir Starmer, German Chancellor Olaf Scholz and Italian Prime Minister Giorgia Meloni.

Repeat warnings by top US officials that they’ll move forward with decisions on the future of Ukraine that will alter Europe’s security architecture for years to come - without input from the European capitals - has focused the minds of leaders in Europe, who have indicated a willingness to contemplate bold action to ensure it has a say in its own defense, including the controversial topic of joint bonds. What is remarkable is that it took this long before said minds were "focused."

“In the face of this emergency, I think it is time to take historic decisions,” French Minister for European Affairs Benjamin Haddad said in an interview with Bloomberg. “And indeed, the question of eurobonds, for instance, is one of the mechanisms that we should be talking about.”

And even though we warned last Thursday that a flood of new debt issuance (followed by an even bigger flood of QE to monetize said issuance) is coming, it took days before German, French and Italian bonds all slipped, with 10-year bund yields — the benchmark borrowing rate for the euro area — reaching the highest in more than two weeks (see above) as the "efficient market" finally grasped what was obvious to others for a long, long time.

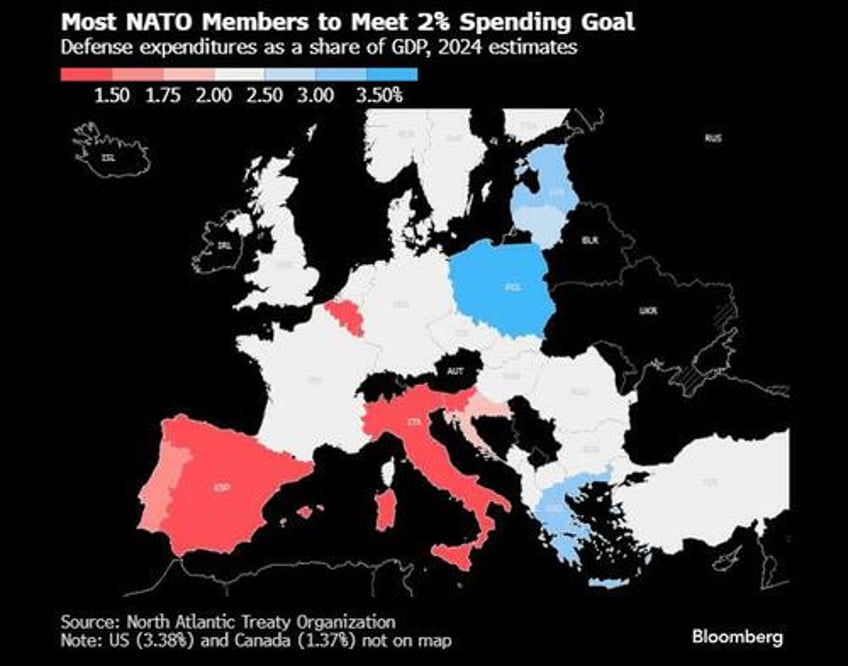

What is the cost? According to NATO planners, the alliance will need to spend as much as 3.7% of GDP on defense, with Bloomberg calculating that the bottom line will be about $3.1 trillion over the next 10 years. Indicatively, just 23 out of the 32 North Atlantic Treaty Organization countries met the 2% spending target as of last year.

Among the funding options being discussed include triggering an escape clause to the EU’s fiscal rules to allow countries to boost funding without running afoul of the bloc’s regulations. European Commission President Ursula von der Leyen proposed activating that mechanism for defense investments last week in a speech at the Munich Security Conference.

The EU’s economy chief, Valdis Dombrovskis, emphasized that the bloc will find ways to support national spending. “We are currently looking in more flexibility as regards European fiscal rules for defense and looking how to apply the escape clause, which we have in our legislation,” he told reporters Monday in Brussels.

Other options available include re-purposing existing funds, including those in the pandemic recovery fund, to use for defense spending. There are also talks of a smaller group of countries moving forward rather than all 27 member states, to avoid lengthy discussions and to have more flexibility in setting up instruments to issue common debt.

German Foreign Minister Annalena Baerbock signaled over the weekend that a significant plan for building strong defenses is in the works, saying “similar to the euro or the corona crisis, there is now a financial package for security in Europe."

“That will come in the near future,” she said, without giving additional details.

Hilariously, Europe - which suddenly finds itself in deep financial trouble after JD Vance slammed its censorship and lack of free speech as the root cause for US withdrawal from funding arrangements - plans to do more of just that. According to Bloomberg, the new spending plans - which will be in the trillions in debt - won’t be unveiled until after the German election on Sunday in order to avoid stirring up controversy before the vote.

That's right: to prevent an outcome that Europe is terrified of, namely an AfD avalanche in next Sunday's German election (full preview here), Europe will not even mention the vast numbers that will be required, and which may even ensure an AfD victory if the voting population knew what was coming! As a reminder, Germany and the Netherlands have traditionally been against joint borrowing; it will be up to them however to fund the bulk of European defense in a world where the US no longer funds NATO.

Deutsche Bank economists estimate that the EU has about €400 billion ($419 billion) of defense funding available through national fiscal space, the bloc’s cohesion funds and from re-purposing money in existing programs, such as the Recovery and Resilience Facility and the European Stability Mechanism.

“If spending needs exceed this, new EU solutions may be required,” the economists wrote in a Monday report.

European Central Bank President Christine Lagarde has also been supportive of increasing the bloc’s fiscal capacity to finance common goods like security, saying last year: “common financing is desirable, whether by way of an increased fiscal capacity or by way of joint debt.”

Lithuanian Defense Minister Dovile Sakaliene said there’s been a big shift in perception among European allies on EU budget rules and joint borrowing after the past four days in Brussels and Munich.

“Regarding joint European instruments, solidarity instruments like we used during pandemics or like we used for the green course — these need to be set up immediately,” Sakaliene said in an interview with Bloomberg TV Monday. “I think everybody or almost everybody is on board.”

Denmark has traditionally maintained a cautious stance toward joint EU debt issuance as it’s advocated fiscal responsibility and preference for individual member states managing their own debts. But during Russia’s war in Ukraine, the Danish government has increasingly opened up for using such measures, and Denmark along with other countries are now pushing to ease the EU budget rules to boost military spending.

“We must increase military support for Ukraine, we must produce more, and we must do it faster,” Danish Prime Minister Mette Frederiksen, who attended the Paris meeting, said in a Monday statement. “I sense a new European determination, a seriousness, and a decisiveness that are needed.”

Actually what is really needed is money, and Europe, a continent that has been on the edge of recession for years, has none, and thanks to its staggering debt to GDP ratio, second only to Japan, it can't even issue debt.

But it will have to, and - as usual - we will be right, because one way or another more QE is coming. The only question is what does the ECB do before it is forced to monetize another several trillion in debt. Its options, according to Goldman strategist Alberto Bacis, are:

- lean against it with higher rates, delivering an ortogonal monetary policy that will enhance the higher rates dynamics…or

- facilitate it, with lower borrowing costs in the front end and ultimately forcing steeper curve?

We'll find out soon enough, although probably not soon enough to keep Zelenskyy in the Kiev presidency.

Meanwhile, those expecting the market's honeymoon to persist, will be disappointed. As Bacis concludes, "markets are trading the emotional part of the risk. We will get to the detailed part in coming sessions but not now. Too soon to trade the details for now but will ultimately get there: we are trading the “will you marry me? Yes” phase: the emotional bit….in coming days post announcement we will get to the “marital agreement” (=the Detailed phase) and things we will get more interesting and less romantic."

Full Goldman note available to pro subs in the usual place.