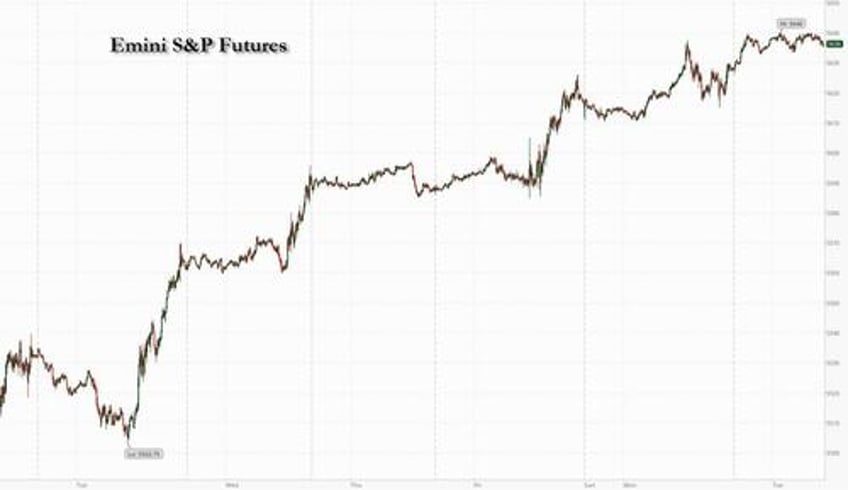

There is apparently nothing that can stop this relentless tech momentum juggernaut: after the S&P 500 hit another record high on Monday, US equity futures rose again on Tuesday on pace for a fresh all time high as investors awaited fresh dovish hints from Powell on when the Fed's first cut would come (and follows Nikileaks Timiraos' weekend report in the WSJ that September easing is largely assured). As of 8:00am S&P futures were up 0.2%, hitting their 36th record high of the year, with Nasdaq futures rising 0.4% as AI/semi stocks continued their endless meltup. Treasury yields rose 2bps while traders held on to bets for two rate cuts this year. That outlook helped fuel expectations for higher longer-term yields and a steeper curve, even as two-year notes continued to exceed their 10-year counterparts. However, for the curve to materially steepen, the US economy needs to deteriorate decisively enough to push the Fed to lower borrowing costs, Bloomberg argues. The USD is modestly higher while commodities are once again selling off with precious the primary area of safety. Fedspeak is today’s macro focus; Powell speaks at 10am EST.

In premarket trading, all the usual suspects were again up: NVDA +1.25%; MU +1%; INTC +3.6% on the continued AI Chip rally despite Goldman's head of equity research openly unleashing a firestorm of criticism on the "AI bubble"; BAC is up +1% on an upgrade while BP slides 4% as it warned of weaker refining margins/write-downs. Here are some notable premarket movers:

- Helen of Troy (HELE) falls 28% after the consumer products company cut its adjusted earnings per share guidance for the full year.

- Helios Technologies (HLIO) falls 11% as CEO Josef Matosevic was placed on paid leave following allegations of a potential violation of the manufacturer’s code of conduct.

- Indivior (INDV) drops 36% after the drugmaker cut its net revenue guidance for the full year.

- Intel (INTC) rises 3% and is set to extend gains to a fifth consecutive session.

- Nikola (NKLA) rises 5% as shares are set to extend gains to a fifth consecutive session.

- Tempus AI (TEM), a medical data firm that went public in June, gains 3% as Morgan Stanley, JPMorgan and Stifel initiate coverage with bullish ratings.

Investors will be closely watching for any hints from the Fed chair about how soon the Fed will be in a position to cut interest rates. A long-awaited pivot to easier policy would provide investors sitting on a record $6 trillion of money-market with an incentive to buy bonds and other assets; validation for a rate cut would come from Thursday's CPI if it prints at or below expectations. Markets are pricing the chance of two rate cuts this year, with a roughly 70% chance of the first in September, according to swaps data compiled by Bloomberg. Powell is also likely to face questions over US plans to force Wall Street lenders to set aside significantly more capital. Reuters reported that regulators are considering a change to its calculations that could save the country’s eight largest banks combined billions of dollars.

“Until they see the Fed truly cutting, there is a level of show-me,” said Anders Persson, chief investment officer at Nuveen. “There’s some skepticism about getting off the cash or money market investments that pay 5% and many retail investors are sitting on and enjoying.”

“With the recent signs of softer growth and labor market, markets will closely watch if Powell gives any hints on the timing of rate cuts,” said Carol Kong, a strategist at Commonwealth Bank of Australia in Sydney. “Market pricing for a September cut can increase and the US dollar can fall further if Powell’s comments are perceived as dovish.”

European stocks reversed Monday gains and dropped 0.4% but were off the lows, as wariness grew over French government spending following the left’s resurgence in the weekend election. France’s CAC 40 underperforms regional peers with a 0.5% fall. Among individual movers, BP fell more than 3% after saying it will take a hit of as much as $2 billion from impairments in second-quarter results. Dassault Systemes SE fell after cutting its full-year earnings forecast. Here are some other notable premarket movers:

- Prysmian rises as much as 4.6% after the cable manufacturer was upgraded to buy at Jefferies, with a Street-high price target. Citi also opened a 30-day positive catalyst watch on the shares

- BMW rises as the German carmaker gets upgraded to buy by HSBC, which says it doesn’t see a calamitous 2Q for the autos sector, though the downgrade cycle continues

- Exclusive Networks gains as much as 8.5% to €23.65 after an investor group backed by Clayton Dubilier & Rice and Permira made a non-binding offer to take the firm private at €24 a share

- Hunting rises as much as 8.4% in London, reaching its highest intraday level since October 2019, after after the oil-field services provider forecast Ebitda for the full year of about $134m-$138m

- Capita shares rise as much as 25% after the UK-based professional services company agreed to sell its standalone software business, Capita One, to Orchard Information Systems Limited

- Addtech jumps as much as 4.3% and to a record high, after ABG Sundal Collier upgraded its view on the Swedish tech group to buy from hold ahead of the firm’s earnings on July 12

- Indivior sinks as much as 44%, the most since November 2020, after the drugmaker cut its net revenue guidance for the full year, in part due to performance of its opioid addiction treatment

- BP drops in London trading after it warned of “significantly lower” refining margins and predicted a writedown on the value of a plant in Germany of $1 billion to $2 billion

- PageGroup shares plunge as much as 15%, hitting their lowest level since October 2022, after the recruitment company warned warned activity levels softened during the second quarter

- Verallia shares plunge as much as 15% to the lowest level since December 2022 after the glass-packaging company cut its annual earnings guidance due to a delayed demand recovery

- Dassault Systemes falls as much as 6.2% to the lowest since 2023 after the French software maker cut full-year guidance, citing delays in large deals and cautious customer decision making

- Mercedes-Benz shares fall as much as 3.6% after analysts at Bank of America downgrade the German automaker to underperform from neutral on earnings concerns

Earlier, Asian stocks rebounded as tech shares in Japan tracked their US peers higher. Chinese equities were volatile moving closer to an upcoming key political meeting. The MSCI Asia Pacific Index rose as much as 0.7% on Tuesday, boosted by Japanese names including Sony Group, Hitachi and Tokyo Electron. The Nikkei 225 hit a new record high as the prospects of lower US interest rates helped prop up semiconductor-related stocks. Benchmarks in Australia, Singapore and Indonesia also advanced. Mainland Chinese and Hong Kong shares gained, paring losses from the morning, as investors try to gauge Beijing’s policy direction at next week’s Third Plenum. Fiscal stimulus announced so far has failed to arrest concerns over China’s ailing property market and sluggish macro picture.

In rates, treasuries dip, pushing US 10-year yields up 2bps to 4.30% as investors await Federal Reserve Chair Jerome Powell’s testimony to Congress for further clues on the central bank’s interest-rate outlook. Treasury 10-year yields cheaper by around 2bp on the day with bunds and gilts lagging by additional 2bp and 3bp in the sector; US 2s10s, 5s30s spreads are steeper by 1.5bp and 1bp on the day. European bonds underperform Treasuries, with bunds snapping two days of gains. French bonds lead a sell off in European government debt. US session also includes 3-year note sale, first of this week’s cycle, which also includes 10- and 30-year auctions.

In FX, the Bloomberg Dollar Spot Index also gains 0.1%. The index has dropped 0.7% this month to its lowest since mid-June after successive data prints suggested the US economy is softening. Moves across G-10 FX have been muted with the euro and pound little changed. Yen trades around 161 per dollar.

Oil prices decline, with WTI falling 0.6% to near $81.85 a barrel. Spot gold rises $4 to around $2,363/oz.

Bitcoin gains 2% and climbs back over $57.5k, while Ethereum sits comfortably above USD 3k.

Looking to the day ahead now, and the main highlight will be Fed Chair Powell’s testimony to the Senate Banking Committee. We’ll also hear from the Fed’s Barr and Bowman, and the ECB’s Cipollone. Data releases include the NFIB’s small business optimism index for June from the US. Finally in the political sphere, the NATO leaders summit will get underway in Washington DC.

Market Snapshot

- S&P 500 futures up 0.2% to 5,637.25

- STOXX Europe 600 down 0.1% to 515.76

- MXAP up 0.6% to 185.09

- MXAPJ up 0.4% to 578.45

- Nikkei up 2.0% to 41,580.17

- Topix up 1.0% to 2,895.55

- Hang Seng Index little changed at 17,523.23

- Shanghai Composite up 1.3% to 2,959.37

- Sensex up 0.5% to 80,327.58

- Australia S&P/ASX 200 up 0.9% to 7,829.71

- Kospi up 0.3% to 2,867.38

- German 10Y yield +1.8 bps at 2.56%

- Euro little changed at $1.0818

- Brent Futures down 0.6% to $85.23/bbl

- Brent Futures down 0.6% to $85.23/bbl

- Gold spot down 0.0% to $2,358.81

- US Dollar Index little changed at 105.08

Top Overnight News

- The White House once hoped the NATO summit that opens Tuesday would showcase President Biden’s leadership of the trans-Atlantic alliance and his differences with Donald Trump. Instead it has become a pivotal test of his fitness for a second term. A solid performance during the three-day gathering of NATO leaders could help shore up his candidacy, reminding voters of his support for the 75-year-old military partnership that his predecessor regularly attacked. Another stumble like his debate against Trump last month could only intensify calls for the 81-year-old commander in chief to exit from the presidential race. WSJ

- Australia, backed by allies including the US, UK and Japan, has accused a Chinese state-backed cyber hacking group of targeting the country’s government and private sector networks. FT

- Temasek’s holdings of Chinese assets fell below its investments in the Americas for the first time in at least a decade. BBG

- France’s political gridlock means its fiscal deficit is an issue for here and now. The yield premium investors demand to hold French bonds over their German peers is still above 60 bps even after markets’ relief at the election result. BBG

- Saudi Aramco is betting the internal combustion engine will be around for a “very, very long time” as the world’s largest oil company spots a business opportunity from the rise of the electric car. The state-owned oil group, which made $500bn in revenues last year mainly from producing and selling crude, last month took a €740mn, 10 per cent stake in Horse Powertrain, a company dedicated to building fuel-based engines. FT

- Hopes of a cease-fire in Gaza ebbed on Monday after Prime Minister Benjamin Netanyahu of Israel and Hamas both issued statements that narrowed the chances of reaching a compromise about the territory’s future. NYT

- Joe Biden won support from Alexandria Ocasio-Cortez and other Democratic progressives who previously criticized him, as the mood seemed to shift against calls on him to step aside. He allowed his physician to share health details to quell concerns. BBG

- Jerome Powell may strike a more dovish tone after unemployment crept ahead of Fed projections. It’s his last scheduled address to lawmakers before the election — he’ll probably have to defend the higher-for-longer policy stance and the Fed’s claim to be independent. BBG

- The Fed is considering a change to capital rules for global systemically important banks that may save the firms billions of dollars. RTRS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed as the region only partially sustained the positive mood seen in the US where the S&P 500 and Nasdaq 100 extended on record highs, but with upside limited amid a lack of major catalysts ahead of upcoming risk events. ASX 200 traded higher as tech, telecoms and real estate stocks benefitted from slightly softer yields. Nikkei 225 extended on its all-time highs with the advances led by electronic and tech-related stocks. Hang Seng and Shanghai Comp. were subdued as the former continued its recent downward momentum to its lowest in more than two months, while sentiment in the mainland was clouded amid lingering trade frictions and ongoing debt-related concerns.

Top Asian News

- China's exports of auto products to Belt and Road partner countries for January-May rose 13.3% Y/Y to USD 51.32bln, according to Global Times.

- BoJ is releasing briefing material from its meeting with bond market participants; received various views from participants in the survey incl. the idea to reduce monthly buying to JPY 2-3tln or have it at around JPY 4tln

European bourses, Stoxx 600 (-0.1%) are mostly lower, having initially opened entirely in the red; the FTSE 100 managed to climb into the green, whilst peers such as the DAX 40 and CAC 40 continued to trundle lower, the latter pair currently reside near lows. European sectors are mixed, and with the breadth of the market to the upside fairly narrow. Basic Resources is near the top of the pile, paring recent losses and with the metals complex also benefitting from a late pick up in sentiment in China. US Equity Futures (ES +0.2%, NQ +0.3%, RTY +0.3%) are entirely in the green, building on the gains seen in the prior session, which saw the S&P 500 and Nasdaq notch record highs. Today, markets will await Fed Chair Powell’s testimony, though he is unlikely to deviate too far away from comments he made at the Sintra conference last week.

Top European News

- ECB's Panetta says the ECB can gradually reduce rates in line with the actual and expected inflation rate which will complete the disinflationary process underway. But ECB should be ready to respond quickly and to any shocks in one direction or the other. Previous rate hikes will continue to dampen demand, output and inflation for months to come. Concern about high service sector prices in understandable, but it is normal that they fall with a lag compared to goods prices. Wage growth can also be expected to ease. Italian GDP probably grew by about 0.3% Q/Q in Q2.

- Barclays said UK June Consumer Spending fell 0.6% Y/Y which was the first decline since February 2021.

- German economy minister says not satisfied with German economic situation

FX

- DXY is chopping and changing around the 105 mark as markets await comments from Fed Chair Powell. Upside for DXY sees Friday's peak at 105.16 and downside sees yesterday low at 104.80.

- EUR/USD is flat vs. the USD and tucked within yesterday's 1.0803-1.0845 parameters. French political risk remains, however, given the current paralysis of the situation, greater guidance for the EUR/USD pair may be provided by upcoming comments from Fed Chair Powell.

- Cable is back towards the 1.28 handle after venturing as high as 1.2846 yesterday following hawkish comments from BoE's Haskel. ING suggests that greater guidance on the core thoughts of the MPC may be garnered from Pill's speech tomorrow.

- JPY is trivially softer vs. the USD as USD/JPY eyes 161. USD/JPY had been as high as 161.13 overnight before moving back onto a 160 handle in quiet trade. If the upside trend resumes, Friday's 161.39 peak would be the next target.

- Antipodeans are mixed vs. the USD. AUD was unfazed by weak Consumer Sentiment and mixed Business Surveys from Australia. AUD/USD is below yesterday's 0.6761 peak; highest since Jan 3rd. NZD/USD is holding onto a 0.61 handle after slipping from yesterday's 0.6153 peak.

- PBoC set USD/CNY mid-point at 7.1310 vs exp. 7.2676 (prev. 7.1286).

Fixed Income

- USTs are softer by only a handful of ticks as markets await Fed Chair Powell's testimony. Treasuries are currently sitting in a narrow 110-13 to 110-18 band, with support residing at 110-10, 110-04 and 109-17+.

- JGBs were unreactive to overnight Bloomberg reports about the format of the BoJ bond participants meeting. Thereafter, the release of details from the first session sparked some modest pressure in JGBs, seemingly on the initial line of one view being to reduce buying to JPY 2-3tln/month markedly below the exp. 5tln (current 6tln).

- Bunds are holding just above the 131.00 mark in a 131.01-31 band, and unreactive to commentary from ECB's Panetta. A breach of the 131.00 handle brings into view support at 130.74 and 130.44.

- Gilts are lower by around 25 ticks, and dipped below the 98.00 mark in a 97.92-98.11 parameters which are entirely within Monday's 97.73-98.27 range.

Commodities

- Another subdued session for the crude complex in what has been a quiet session thus far ahead of Fed Chair Powell's testimony. Crude prices rose in tandem with Chinese markets in early European hours before that strength faded. Brent Sept currently holding around USD 85.25/bbl.

- Precious metals are firmer across the board following yesterday's weakness, but price action is modest in the absence of pertinent drivers. Spot gold is caged to a USD 2,355.81-2,368.72/oz range.

- Mixed trade across base metals with an early European rally seen in copper in lockstep with sharp gains in the Chinese markets despite a lack of catalysts. That being said, the complex is awaiting the next driver, possibly via Fed Chair Powell later this afternoon.

- Port of Houston announced that all terminals will remain closed on Tuesday.

- Marathon's (MPC) Galveston Bay, Texas refinery (535k BPD) reported emissions and that the recent hurricane caused a power loss and multiple units to shut down, while it brought the plant to a safe state waiting for power before resuming operations. However, it was later reported that the refinery was preparing multiple units for a restart, according to Reuters sources.

- Shell (SHEL LN) said it will start the process of redeploying personnel to Perdido and Whale assets beginning on Tuesday.

- NHC said further weakening is forecast for Beryl which was expected to become a tropical depression overnight and a post-tropical cyclone on Tuesday, while NHC later confirmed that Beryl had become a tropical depression.

- Citi says physical gold demand eases, but should rebound into year-end; the bank writes that physical gold demand likely softened in Q2 vs Q1, though off a very strong base

Geopolitics: Middle East

- Syrian state news agency claims Israel launched an air attack today targeting a possibly Iran-linked site around Baniyas, Syria, causing some material losses", according to Times of Israel's Berman.

- Violent explosions were reported amid Israeli raids in the city of Latakia, north-western Syria, according to Al Arabiya. It was also reported that Israel launched an air attack targeting the vicinity of Baniyas, according to Syrian state news

- Palestinian media reported that Israeli shelling on a UNRWA school in the new camp in Nuseirat caused casualties.

- US Assistant Secretary of State for Near Eastern Affairs Barbara A. Leaf is on travel July 8th-14th to the United Arab Emirates, Qatar, Egypt, Jordan, Israel, the West Bank, and Italy.

Geopolitics: Other

- US President Biden said Russian missile strikes on Kyiv that damaged a children's hospital are a horrific reminder of Russia’s brutality, while he added the US will announce together with allies new measures to strengthen Ukraine’s air defences, according to Reuters.

- Ukrainian drone attack caused a fire at an oil depot and power substation in Russia's Volgograd region, according to the regional governor. It was separately reported that a power plant in Russia's Rostov region caught on fire after Ukraine launched tens of drones.

- China Qingdao Maritime Safety Administration issued a navigation warning for military exercises to be conducted in some waters of the Yellow Sea from 08:00 local time on July 9th to 08:00 on July 13th with entry prohibited.

- Elite North Korean military trainees were reportedly visiting Russia amid deepening ties.

US Event Calendar

- 06:00: June SMALL BUSINESS OPTIMISM 91.5, est. 90.2, prior 90.5

Central Bank Speakers

- 09:15: Fed’s Barr Speaks on Financial Inclusion

- 10:00: Fed’s Powell Testifies to Senate Banking

- 13:30: Fed’s Bowman Speaks on Promoting Inclusive Financial System

DB's Jim Reid concludes the overnight wrap

I'm off to Cape Town later today for my first ever work trip there. It snowed there on the outskirts over the weekend so I think I picked the wrong time to go. The last time I went was 20 years ago to watch England play cricket and an ambulance had to meet the plane on the runway on arrival as I was so tired I momentarily fell asleep standing up while waiting for the bathroom. In doing so I fell over and hit a food trolley on the way down and split open my forehead. I got a police and ambulance escort to a local hospital. After getting bandaged up I was sent on my way in time for the test match to start only to then develop a stomach bug that kept me in bed for 2 days. So I missed the first three days of the holiday. Thankfully the cricket was terrible and England got annihilated so I didn't miss much. I'm hoping for a less eventful trip this time around.

You can contrast my lack of resilience 20 years ago with that of the market today as even with the newsflow becoming more negative politically and data wise of late, last night the S&P 500 (+0.10%) edged to its 35th record high this year. For once the equal weight index (+0.18%) slightly outperformed with the small-cap Russell 2000 also doing so in posting a +0.59% gain. In Asia overnight the Nikkei is flying (+2.15%) this morning to a fresh all time high and is now up nearly +24.5% YTD. For Europe there was a bit of weakness yesterday though, with the STOXX 600 (-0.03%) posting a marginal fall, alongside a larger decline for France’s CAC 40 (-0.63%). There were more positive developments on the fixed income front in Europe, as the Franco-German 10yr spread tightened a further -3.0bps after the French election results, just as Euro IG spreads also reached their tightest in over two years.

In terms of the French situation, the results from the second round now leave the situation pretty gridlocked in the National Assembly, with no group close to reaching a majority. The different outlets differ slightly on how they categorise some MPs, but on Bloomberg’s numbers you’ve got the left-wing New Popular Front as the largest party on 178 seats, followed by President Macron’s centrist alliance on 156 seats, and then Marine Le Pen’s National Rally and their allies on 143. But in some ways this has actually been reassuring to markets, at least on the grounds it makes it difficult for any policies to be implemented, with neither the far-left or the far-right able to implement their programme on these numbers.

The -3.0bps tightening in Franco-German 10yr spreads yesterday to 63bps was the tightest it’s been in nearly four weeks (having peaked at 82bps shortly before the first round). But it’s still above the 48bps level from before the snap election announcement, so it’s clear that investors are still pricing in more political risk than they were. Moreover, the CAC 40 (-0.63%) did underperform the other European bourses yesterday, with fresh losses for financials including BNP Paribas (-1.76%) and Société Générale (-1.27%). So a bit of a mixed reaction, although all eyes are now on what sort of government can be formed. France’s current Prime Minister Gabriel Attal offered his resignation on Monday, but this was rejected by President Macron who asked Attal to stay on "for the time being to ensure the country's stability".

Staying on the politics, yesterday saw US President Joe Biden try to prevent any further rebellion against his 2024 election candidacy. He wrote a letter to congressional Democrats, which said that “despite all the speculation in the press and elsewhere, I am firmly committed to staying in this race”. Towards the end of the letter, he also warned that “Any weakening of resolve or lack of clarity about the task ahead only helps Trump and hurts us.” That came alongside a call-in with MSNBC’s Morning Joe, where he challenged his opponents to run against him and challenge at the Democratic convention. Biden is now set to host the NATO leaders’ summit in Washington DC from today, with the convention not taking place until August 19.

When it comes to the US economy, the focus is increasingly on this Thursday’s CPI report for June, and whether that can open the door for a Fed cut as soon as September. Ahead of that, we did get the New York Fed’s Survey of Consumer Expectations, but it painted a mixed picture on inflation expectations in June. On the one hand, 1yr expectations were down to 3.0%, the joint-lowest since October 2020. But on the other, 3yr expectations ticked up to 2.9%.

Looking forward, today's focus will now be on Fed Chair Powell, who’s speaking before the Senate Banking Committee, and then the House Financial Services Committee tomorrow. That’s his usual semiannual testimony before the two committees, and it’ll be interesting to see if he has any commentary on the weaker data of late, including the highest unemployment rate (4.1%) since November 2021. Currently, investors are pricing in two full cuts by the December meeting, above the one cut that the median dot pencilled in back at the June meeting.

With that to look forward to, Treasury yields ticked slightly higher yesterday. The 10yr yield was little changed (+0.1bps) at 4.28%, while the 2yr yield was up +2.4bps to 4.63%. Meanwhile in Europe, there was also a flattening of the curve, but that came alongside a stronger overall performance, with yields on 10yr bunds (-1.6bps), OATs (-4.6bps) and BTPs (-4.6bps) all seeing a clear move lower.

In Asia, outside of the surge in the Nikkei discussed above, the S&P/ASX 200 (+0.77%) and the KOSPI (+0.19%) are also trading higher while Chinese stocks are lagging again with the Hang Seng (-0.44%), the CSI (-0.11%) and the Shanghai Composite (-0.05%) all edging lower. S&P 500 (+0.23%) and NASDAQ 100 (+0.36%) futures are healthily higher for this time of the day.

Early morning data showed that Australia’s NAB Business Confidence rose from a revised reading of -2 to 4 in June, marking its highest level since early 2023 and returning to positive territory. However, Business Conditions fell from 6 to 4.

To the day ahead now, and the main highlight will be Fed Chair Powell’s testimony to the Senate Banking Committee. We’ll also hear from the Fed’s Barr and Bowman, and the ECB’s Cipollone. Data releases include the NFIB’s small business optimism index for June from the US. Finally in the political sphere, the NATO leaders summit will get underway in Washington DC.