- Tariffs in focus amid reports that Trump could implement copper tariffs in weeks, elsewhere reports that Canada could find some reprieve

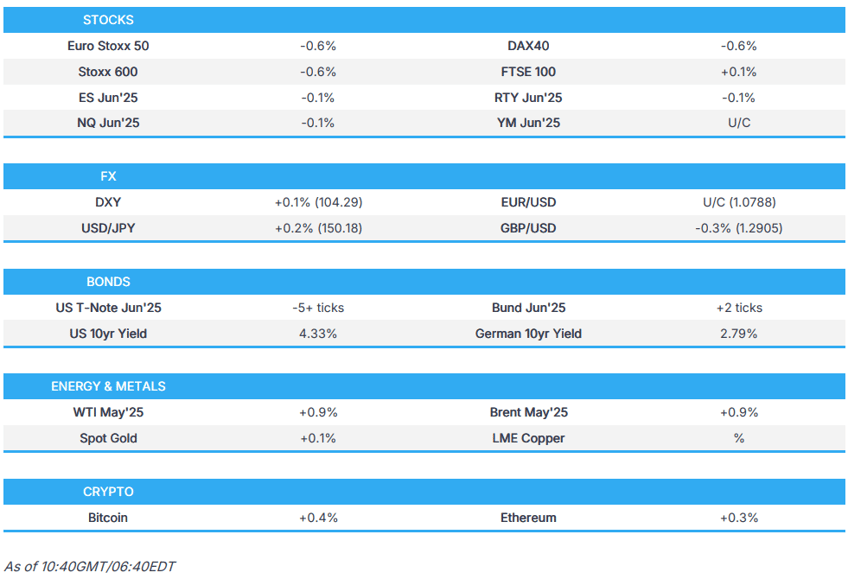

- European bourses opened firmer but have since slumped, US futures are in the red but only modestly so

- GBP lags after UK CPI, EUR/USD attempts to reclaim 1.08, USD/JPY rebounded overnight but is off highs

- Gilts gapped higher on data and extended but have retreated to opening levels into the Spring Statement, USTs softer while Bunds are firmer but only modestly so

- Crude continues to inch higher with a handful of factors underpinning, TTF slips as talks continue, Copper soared on tariff updates but has since pulled back

- Looking ahead, highlights include US Durable Goods, BoC Minutes, UK Spring Statement, Speakers include Fed’s Musalem, Kashkari & ECB’s Cipollone, Supply from the US

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US President Trump may implement copper tariffs within weeks, according to Bloomberg. It was separately reported that Trump may impose escalating tariff levels but Canada could be on the lower end, according to the Toronto Star citing sources.

- Mexico's Economy Minister Ebrard is to visit Washington for trade talks today.

EUROPEAN TRADE

EQUITIES

- Despite a steady and firmer open European bourses now find themselves mostly in the red, Stoxx 600 -0.6%. Selling pressure picked up after the cash open with no obvious catalyst for the price action at the time.

- Sectors began mixed but now have a negative bias with Health Care, Chemicals and Autos bottom of the pile; the latter seemingly hit on remarks from Trump about Europeans "freeloading", reports of copper tariffs and pressure in Porsche SE on an Volkswagen impairment.

- Stateside, futures are in the red but only modestly so with the start to the day a broadly contained one. Modest action occurring alongside that seen in European bourses, but to a much lesser extent with the range for the ES (-0.1%) only around 20 points thus far.

- In specifics, China energy efficiency rules could hit NVIDIA (-0.7%); Apple (+0.1%) is expected to adopt TSM's (-1.0%) 2nm tech; Qualcomm (-0.1%) initiates antitrust campaign against ARM (-0.3%); Google (+0.3%) partners with Hon Hai on cloud; GameStop (+12.5%) approves BTC buying.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is currently flat but with modestly diverging fortunes against peers, greenback softer vs. cyclicals and firmer vs. havens despite the pullback in European stocks seen since the cash open. Comfortably above 104.00 but at the lower-end of a 104.18-38 band.

- EUR attempting to get back above the 1.08 mark and while it has tested the figure it is yet to convincingly breach it. Upside which comes despite the rhetoric from Trump and with incremental drivers light since the Ifo.

- Cable the G10 laggard after cooler-than-expected inflation data this morning and ahead of the Spring Statement which commences from 12:30GMT. Cable back above 1.29 but only modestly so after slipping as low as 1.2887 early doors.

- USD/JPY rebounded overnight from the prior day's trough and reclaimed the 150.00 handle with tailwinds amid the constructive APAC risk tone and following the softer Services PPI data from Japan; got to a 150.63 peak but has since pulled back towards the mentioned figure.

- AUD was hit on soft domestic inflation data overnight which saw a 0.6279 low in AUD/USD print but it has since recovered back above the mark and to a high some 30 pips above.

- PBoC set USD/CNY mid-point at 7.1754 vs exp. 7.2559 (Prev. 7.1788).

- Riksbank Minutes (March): Thedeen says "...we have some scope to see through upturns in inflation if we judge that they are temporary".

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Gilts gapped higher by 33 ticks at the open after an almost entirely cooler-than-expected inflation series. A series which has sparked a modest dovish move in BoE pricing, though the overall narrative hasn’t shifted.

- Got to as high as 91.58 though this proved short lived as we approach the Spring Statement from 12:30GMT where Reeves is expected to try and raise/save GBP 17bln, to plug the fiscal hole she finds herself in and then to provide headroom of just under the GBP 9.9bln she had in October; full preview available.

- Bunds modestly firmer after picking up early doors on the above. Thereafter, hit a 128.36 session high which is a tick above Tuesday's best. Specifics light into supply which was strong but sparked no reaction in the benchmark. Leaving it marginally in the green around 128.20.

- USTs in the red but only modestly so with action relatively steady in the European morning as we await updates to numerous catalysts in addition to Fed speak, data and supply with 70bln of 5yr Notes due and following the 2yr tap on Tuesday which was strong when compared to recent averages though not quite as well received as the outing in February.

- Click for a detailed summary

COMMODITIES

- Crude continues to inch higher and is at highs of USD 69.54/bbl and USD 73.57/bbl respectively for WTI and Brent but remains within Tuesday's parameters. Upside driven by the private inventory report, absence of sanctions removal on oil tankers and Yemeni forces targeting the USS Truman.

- Dutch TTF in the red with Ukraine-Russia geopols in focus and the most recent language from the Kremlin being that talks are continuing with the US and they are satisfied with the dialogue. There have been reports of drone strikes on/from both sides, with the Kremlin continuing to state that they will only comply with the Black Sea truce once specific sanctions are lifted.

- Gold indecisive and flat on the session, around the mid-point of a USD 3013-3032/oz band. Copper was bid overnight after futures hit a record high in Tuesday's session which followed through into 3M LME and lifted it above the USD 10k mark on latest tariff reports; since, the metal has pulled back and is in the red as we await further updates.

- Goldman Sachs maintains its 3-, 6- and 12-month copper price forecasts at USD 9,600, USD 10,000 and USD 10,700, respectively.

- US Private Energy Inventories (bbls): Crude -4.6mln (exp -2.6mln), Distillate -1.3mln (exp. -2.2mln), Gasoline -3.3mln (exp. -2.2mln), Cushing -0.6mln.

- TotalEnergies (TTE FP) CEO says he would not be surprised if two of the Nord Stream gas pipelines came back.

- Reliance has paused purchases of Venezuelan crude following US President Trump's 25% tariff, according to Bloomberg.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK CPI YY (Feb) 2.8% vs. Exp. 2.9% (Prev. 3.0%); Core CPI YY (Feb) 3.5% vs. Exp. 3.6% (Prev. 3.7%); Services YY (Feb) 5.0% vs. Exp. 4.9% (Prev. 5.0%)

- French Consumer Confidence (Mar) 92.0 vs. Exp. 94.0 (Prev. 93.0)

NOTABLE EUROPEAN HEADLINES

- ECB's Villeroy says in the short-term, US President Trump's "lose-lose" strategy is harming the US as the Fed's downgrade of its forecast show. A 25pp increase in US tariffs in Q2 would have a limited impact on European inflation, but could reduce EZ GDP by 0.3pp in a year

NOTABLE US HEADLINES

- Fed's Goolsbee (2025 voter) said it may take longer than anticipated for the next cut to come because of economic uncertainty and ‘wait and see’ is the correct approach when facing uncertainty, according to FT. Goolsbee also commented that market angst over inflation would be a red flag and believes borrowing costs will be a fair bit lower in 12–18 months, while he noted that if investor expectations begin to converge with those of American households, the Fed would need to act.

GEOPOLITICS

MIDDLE EAST

- Two Israeli raids were reported on the northeastern areas of Gaza City, according to Al Jazeera.

- Houthi military spokesman said they targeted Israeli military sites in the Jaffa area with a number of drones and targeted US aircraft carrier Harry Truman.

RUSSIA-UKRAINE

- Russia's Foreign Minister Lavrov said the Black Sea deal is aimed at Russia making legitimate profit in fair competition and ensuring food safety in Africa and elsewhere. Lavrov also commented that Russia and the US are discussing other things than Ukraine in their talks, according to TASS.

- Russian drone attacks caused major destruction in the central Ukrainian city of Kryvyi Rih, according to the local military administration. It was also reported that emergency power cuts were implemented in Ukraine's Mykolaiv port following reported drone attacks, according to the mayor.

- Russia's Kremlin says the order on moratorium on energy strikes is still in force and Russia are compliant; are continuing contacts with the US, satisfied with the dialogue. Black sea initiative will be activated after a number of conditions are met.

CRYPTO

- Firmer on the session with specifics thus far a touch light aside from the GameStop related updates. Bitcoin is at the upper-end of a USD 87.09-88.30k band.

APAC TRADE

- APAC stocks traded with a mostly positive bias after the somewhat mixed performance stateside where the focus centred on tariffs, data and geopolitics including reports that Ukraine and Russia agreed with the US on a maritime ceasefire.

- ASX 200 was led higher by gains in the mining, resources and financial sectors in the aftermath of the recent budget announcement, while participants also digested softer-than-expected monthly inflation from Australia.

- Nikkei 225 reclaimed the 38,000 level with upside supported by a weaker currency and after slightly softer Services PPI data.

- Hang Seng and Shanghai Comp eked slight gains but with upside capped amid ongoing tariff uncertainty with a Chinese delegation to meet with the US Commerce Secretary and the USTR today to negotiate over tariffs in which they will also discuss fentanyl and trade barriers among other issues, while a PBoC adviser warned at the Boao Forum that changes in the global environment will be challenging for China and China must boost domestic demand, especially consumption.

NOTABLE ASIA-PAC HEADLINES

- PBoC adviser said at the Boao Forum that changes in the global environment will be challenging for China and China must boost domestic demand, especially consumption, while it added that there is still very big macro policy space for supporting China's economy and reform measures alongside recent policy steps are needed to support consumption.

- BoJ Governor Ueda said cost-push factors are likely to gradually dissipate but also noted that underlying inflation is likely to gradually converge towards the 2% target even when the temporary boost from food inflation disappears. Ueda said the BoJ will make a judgment call by looking at various indicators to determine whether underlying inflation has hit the target and underlying inflation is close to but has yet to move into the narrow band defined as sufficient achievement of the 2% price target. Furthermore, Ueda said the BoJ remains vigilant to the possibility that underlying inflation may accelerate faster than projected and expects to keep raising interest rates if the economy and prices move in line with forecasts in the quarterly outlook report but later commented that if price risks overshoot expectations, they will take stronger steps to adjust the degree of monetary support.

- BoJ's Koeda says the Bank's mandate is to contribute to a healthy economy, various indicators show Japan's underlying inflation moving towards a sustainable achievement of BoJ's 2%.

DATA RECAP

- Japanese Services PPI (Feb) 3.00% (Prev. 3.10%)

- Australian Weighted CPI YY (Feb) 2.4% vs. Exp. 2.5% (Prev. 2.5%)

- Australian CPI Annual Trimmed Mean YY (Feb) 2.70% (Prev. 2.80%)