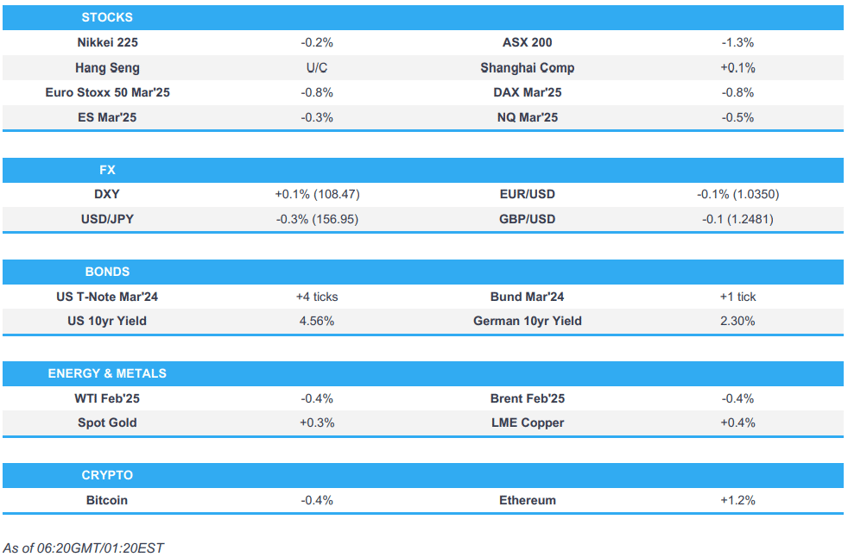

- APAC stocks eventually traded mixed following a mostly lower open as markets digested a slew of central bank decisions whilst still feeling some of the hangover from the Fed.

- US equity futures gradually trickled lower after reports the US House of Representatives defeated the bill to temporarily fund the federal government and avert agency shutdowns beginning on Saturday.

- USD/JPY was choppy overnight as traders reacted to the BoJ presser and then hot Japanese CPI and currency jawboning by officials.

- EUR came under fleeting pressure on remarks from President-elect Trump that the EU needs to make up its deficit to the US, otherwise it is "tariffs all the way".

- PBoC maintained 1yr LPR at 3.10% and 5yr LPR at 3.60% as expected; Banxico cut its rate by 25bps as expected.

- European equity futures are indicative of a lower open with the Euro Stoxx 50 future -1.0% after cash closed -1.6% on Thursday.

- Looking ahead, highlights include UK Retail Sales, US PCE, Canadian Retail Sales, Quad Witching, Fed's Daly, Hammack

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

LOOKING AHEAD

- Highlights include UK Retail Sales, US PCE, Canadian Retail Sales, Quad Witching, Fed's Daly & Hammack.

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks were choppy, with SPX and Dow flat after the mega losses seen on Wednesday, while Russell and Nasdaq were sold.

- Sectors were mixed with Utilities, Financials and Tech outperforming, while Real Estate, Materials and Energy lagged.

- SPX -0.09% at 5,867, NDX -0.47% at 21,111, DJIA +0.04% at 42,342, RUT -0.45% at 2,221

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President-elect Trump says "I told the European Union that they must make up their tremendous deficit with the United States by the large scale purchase of our oil and gas. Otherwise, it is TARIFFS all the way!!!"

- US House of Representatives defeated a bill to temporarily fund the federal government and avert agency shutdowns beginning on Saturday; Next steps unclear in avoiding government shutdown following House defeat of spending bill, according to Reuters.

- US President-Elect Trump said House Speaker Johnson and the House have come to a very good deal for the American people; urges Republicans and Dems to vote yes. Trump earlier said he would support abolishing the debt ceiling entirely.

- US President-elect Trump says "Congress must get rid of, or extend out to, perhaps, 2029, the ridiculous Debt Ceiling. Without this, we should never make a deal. Remember, the pressure is on whoever is President."

- Canadian PM Trudeau is to shuffle his cabinet on Friday; the New Canadian Finance Minister said Trudeau has the full support of the cabinet to stay on.

- FedEx Corp (FDX) Q2 2025 (USD): EPS 4.05 (exp. 4.06), Revenue 22.0bln (exp. 22.1bln); FY EPS view 19-20 (exp. 19.75, prev. 20-21); FY25 capital outlook USD 5.2bln. FedEx (FDX) announced its intent to separate FedEx freight, creating two industry-leading public companies. +8.5% in after-market trade

- Nike Inc (NKE) Q2 2025 (USD): EPS 0.78 (exp. 0.63), Revenue 12.4bln (exp. 12.11bln). Gross margin: 43.6% (prev. 44.6% y/y, exp. 43.1%). CFO said Co. expects Q3 revenue to be down low double digits; said Co. expects Q3 margins to be down about 300-350bps. -0.5% in after-market trade

APAC TRADE

EQUITIES

- APAC stocks eventually traded mixed following a mostly lower open after the lead from Wall Street as markets digest a slew of central bank decisions whilst still feeling the hangover from the Fed.

- ASX 200 was pressured by heavyweight financial, materials, and healthcare sectors, whilst Utilities and IT bucked the trend and posted mild gains.

- Nikkei 225 was briefly supported by the recent JPY weakness, although later faltered as JPY eventually strengthened following hotter-than-expected CPI and currency jawboning by Japanese officials.

- Hang Seng and Shanghai Comp both opened lower and trimmed losses to later trade, with Chinese markets unfazed as the PBoC maintained its LPRs.

- US equity futures initially traded horizontally across the board as markets took a breather following the FOMC-induced slump, although futures gradually trickled lower after reports US House of Representatives defeated the bill to temporarily fund the federal government and avert agency shutdowns beginning on Saturday, with the next steps unclear in avoiding government shutdown following House defeat of spending bill.

- European equity futures indicative of a lower open with the Euro Stoxx 50 future -0.7% after cash closed -1.6%.

FX

- DXY saw flat trade within a narrow 108.39-48 range after the index on Thursday briefly topped the 11th November 2022 peak (108.44) to a 108.48 high, with clean air then seen until near 111.00 from earlier in November 2022.

- EUR/USD moved horizontally amid a lack of drivers, with the pair largely driven by the USD. EUR/USD resides in a 1.0347-1.0369 range vs Thursday's 1.0346-1.0422 parameter.

- However, in recent trade EUR has come under pressure from remarks via US President-elect Trump that the EU must make up the deficit to the US via oil/gas purchases, otherwise it is tariffs.

- GBP/USD held a downward bias following the dovish BoE, with Cable giving up 1.2500 status ahead of Retail Sales data. GBP/USD was in a 1.2476-1.2508 range overnight with the next level to the downside the 22nd Nov low (1.2484). Meanwhile, EUR/GBP rose above 0.8300.

- USD/JPY was initially higher amid some JPY weakness as APAC players reacted to comments from BoJ Governor Ueda at the BoJ presser, but the pair later pulled back following hotter-than-expected CPI and currency jawboning by Japanese officials, who expressed concerns over recent JPY moves.

- Antipodeans were both softer amid the risk tone whilst the Kiwi overlooked a narrower trade deficit and a rise in exports.

- PBoC set USD/CNY mid-point at 7.1901 vs exp. 7.3086 (prev. 7.1911)

FIXED INCOME

- 10yr UST futures consolidated after T-notes steepened on Thursday in a continuation of the Fed reaction and as US President-elect Trump called for the abolishment of the debt limit.

- Bund futures were initially firmer in tandem with US and Japanese counterparts, with the 10yr German debt future briefly reclaiming a 134 handle after seeing some resistance at the level as European players departed on Thursday. The contract later gave up the modest gains to trade flat intraday.

- 10yr JGB futures outperformed as APAC players reacted to BoJ Governor Ueda's press conference remarks, in which he noted the BoJ will need "considerable time" to see the full picture on wage hikes and Trump policies, adding that the "large picture on wage trends will become clearer in March and April".

- US Treasury sold USD 22bln in 5yr TIPS: b/c 2.10x. High Yield: 2.121% (prev. 1.67%, six auction average 1.99%). Tail: 5.6bps (prev. 1.5bps, six auction average -0.9bps); 5yr TIPS was trading at c. 2.065% at 13:00 EST. Bid-to-Cover: 2.10x (prev. 2.40x, six auction average 2.50x). Dealer: 25.42% (prev. 7.9%, six auction average 5.55%). Direct: 23.15% (prev. 17.30%, six auction average 16.73%). Indirect: 51.43% (prev. 74.8%, six auction average 77.7%).

- Australia sold AUD 700mln 2028 AGB: b/c 3.93x (prev. 3.54x), average yield 3.9785% (prev. 3.5038%)

COMMODITIES

- Crude futures were subdued following a choppy session on Thursday which ultimately saw a lower settlement after a Bloomberg report noted that G7 is looking at measures to firm up the price cap on Russian oil and lowering the price threshold from the current USD 60/bbl to around USD 40/bbl.

- Spot gold saw flat for most of the session before tilting higher despite a lack of catalysts, with the yellow metal hovering just under USD 2,600/oz.

- Copper futures were consolidating after the post-Fed slump which saw 3M LME copper slide under USD 9,000/t to a low of 8,866/tm with fewer project Fed rate cuts not boding well for demand.

- Syria's largest refinery stopped operating as Iran oil flow ceases, FT reported.

- Russian President Putin authorises foreigners to credit Roubles for payment for Russian gas to the supplier's account not only in Gazprombank, but also in other banks by 1st April, via a Decree.

CRYPTO

- Bitcoin consolidated after tumbling sub-100k with prices hitting lows just under 95k before finding some composure.

NOTABLE ASIA-PAC HEADLINES

- PBoC maintained 1yr LPR at 3.10% and 5yr LPR at 3.60% as expected.

- Japan Finance Minister Kato said no comment on FX levels; recently seeing one-sided, sharp moves; will take appropriate action against excessive moves; concerned about recent FX moves, including those driven by speculators, according to Reuters Kato added that it is important for currencies to move in a stable manner reflecting fundamentals.

- Japan's top currency diplomat Mimura said gravely concerned about forex moves, and will take appropriate action against excessive forex moves, alarmed including over speculative moves, according to Reuters.

- South Korea to relax FX regulations to improve liquidity conditions, according to the finance ministry.

DATA RECAP

- Japanese CPI, Core Nationwide YY (Nov) 2.7% vs. Exp. 2.6% (Prev. 2.3%)

- Japanese CPI, Overall Nationwide (Nov) 2.9% (Prev. 2.3%)

- Japanese CPI Index Ex-Fresh Food (Nov) 109.2 (Prev. 108.8)

- South Korea PPI Growth YY (Nov) 1.4% (Prev. 1.0%, Rev. 1.0%)

- South Korea PPI Growth MM (Nov) 0.1% (Prev. -0.1%, Rev. -0.1%)

- New Zealand Annual Trade Balance (Nov) -8.25B (Prev. -8.96B, Rev. -9.07B)

- New Zealand Trade Balance (Nov) -437.0M (Prev. -1544.0M, Rev. -1658M)

- New Zealand Imports (Nov) 6.92B (Prev. 7.31B, Rev. 7.27B)

- New Zealand Exports (Nov) 6.48B (Prev. 5.77B, Rev. 5.61B)

- Australian Private Sector Credit (Nov) 0.5% (Prev. 0.6%)

- Australian Housing Credit (Nov) 0.5% (Prev. 0.5%)

GEOPOLITICS

MIDDLE EAST

- "Israel's Channel 14 on security officials: Israel is preparing for a new attack against the Houthis in Yemen", according to Sky News Arabia.

- Israeli official said that there is progress in the negotiations on the hostage deal taking place in Doha, but there are still issues of contention and gaps that need to be closed, via Axios' Ravid.

- "Israel's Channel 13 on officials: optimism remains high that a deal with Hamas is imminent.", according to Sky News Arabia.

RUSSIA-UKRAINE

- "7 strong explosions are heard in the Ukrainian capital Kiev", according to Sky News Arabia; Ukraine air defence repelling an attack on Kyiv, according to official cited by Reuters.

- Russia fired a series of Kinjal hypersonic missiles on the capital Kiev, according to Sky News Arabia.

EU/UK

NOTABLE HEADLINES

- French PM Bayrou said they will present a new cabinet before December 25th, according to Reuters.

- UK Chancellor Reeves is posed to visit China in January to revive high-level economic and financial talks, according to Reuters sources.

LATAM

- Mexican Interest Rate (Dec) 10.0% vs. Exp. 10.0% (Prev. 10.25%); Vote was unanimous.

- Brazil called an FX credit line auction of up to USD 4bln on December 20th, according to Bloomberg.

- Brazil's Lower House approved the main text of the fiscal package bill that limits minimum wage increases to 2.5% above inflation.