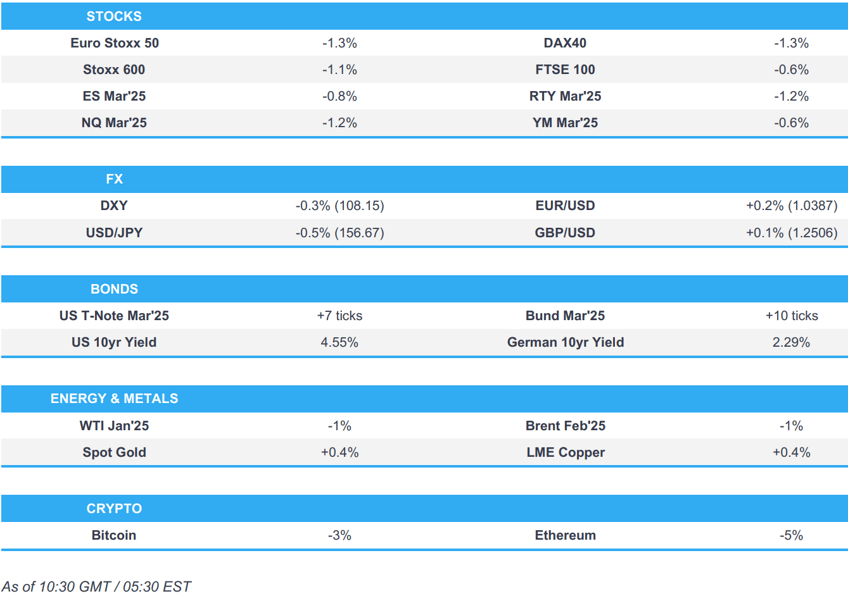

- Stocks continue to slide on Quad Witching.

- USD gives back some of its FOMC-induced gains, JPY gains after the region’s inflation data and overnight jawboning.

- USTs and Bunds are incrementally firmer but ultimately contained into PCE and Fed speak.

- Crude continues to falter while base metals attempt a recovery.

- Looking ahead, US PCE, Canadian Retail Sales, Quad Witching, Fed's Williams, Daly & Hammack.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses began the morning entirely in the red, and continued to proceed lower as the session progressed; as it stands, indices generally reside at worst levels.

- As it stands, all European sectors find themselves in the red; in-fitting with sentiment. Whilst still in the red, Real Estate fares the best vs peers. Banks are by far the clear underperformer, weighed on by Deutsche Bank, which expects a Q4 EUR 300mln hit due to its Polish subsidiary litigation.

- US equity futures are in negative territory and drifting lower as the session progresses, following the glum mood seen in European trade.

- Foxconn (2354 TT) to pause pursuit of Nissan (7201 JT) as Honda (7267 JT) deal talks unfold, via Bloomberg citing sources

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is giving back some of its gains which saw DXY top the 11th November 2022 peak overnight (108.44) to make a 108.48 high. Today will see a slew of Fed speakers on the wires who can help further explain the announcement. Williams, Daly, Hammack are all due on deck with particular interest on the latter given her hawkish dissent at the meeting.

- EUR is edging out slight gains vs. the USD but remains on a 1.03 handle after printing a fresh low for the month earlier @ 1.0344 in the wake of comments from US President-elect Trump cautioning that the EU "must make up their tremendous deficit with the United States by the large scale purchase of our oil and gas. Otherwise, it is TARIFFS all the way!!!". It is worth noting that there is some huge option activity in EUR/USD for today's NY cut, detailed below.

- JPY is attempting to undo some of the damage seen over the past few sessions as a hawkish Fed cut and lack of a hike from the BoJ has driven the pair from a 153.32 base on Wednesday to a multi-month high overnight at 157.92. Some respite has been granted following hotter-than-expected Japanese CPI overnight and currency jawboning by Japanese officials, who expressed concerns over recent JPY moves.

- GBP flat vs. the USD and lagging peers following soft UK retail sales data for November in what has been a generally busy week for UK data as well as yesterday's dovish hold by the BoE. Cable has slipped onto a 1.24 handle for the first time since 22nd November with a current session trough at 1.2476.

- AUD unable to make much headway vs. the broadly softer USD in what has been a bruising week for AUD/USD after the pair made a fresh YTD low yesterday at 0.6200 to hit its lowest level since October 2022. Similar price action for NZD/USD which hit a fresh YTD low yesterday at 0.5609 to trade at its lowest level since October 2022.

- PBoC set USD/CNY mid-point at 7.1901 vs exp. 7.3086 (prev. 7.1911)

- Brazil called an FX credit line auction of up to USD 4bln on December 20th, according to Bloomberg.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are modestly firmer but yet to significantly deviate from the unchanged mark in 108-19+ to 108-26+ parameters. Docket ahead features monthly PCE data before the docket turns to Central Bank speak with Fed’s Williams, Daly & Hammack scheduled; the latter is set to explain her dissent. The yield curve continues to steepen though action is modest and a function of the short-end continuing to pull back from post-Fed highs.

- Bunds are incrementally firmer, but similarly to USTs are yet to deviate lastingly from the unchanged mark but have printed a slightly more expansive 133.81 to 134.10 range. Bunds did come under modest pressure on a much hotter than expected German PPI release; but did since pare alongside peers.

- Gilts opened higher by a single tick before slipping to a 92.18 trough and then paring back to unchanged. Since, action has been very limited and choppy in 92.18-48 parameters. Before the open, Retail Sales came in softer than expected but still posted a recovery from the prior.

- Click for a detailed summary

COMMODITIES

- WTI and Brent are softer, continuing to falter after Thursday’s reports that the G7 could adjust the Russian energy price cap with pressure also stemming from the downbeat risk tone. Brent'Feb 25 currently reside near lows at USD 72.20/bbl.

- Gold is firmer and holding around the USD 2.6k/oz mark in a thin range with catalysts for the metal light and after trading flat overnight. XAU is holding in proximity to the 100-DMA at USD 2606/oz.

- 3M LME Copper is defying the risk tone and holding modestly in the green, though still yet to test USD 9k/handle yet.

- India's finished steel imports from China reach all-time high during April-November, according to Govt data.

- German Parliament has passed its energy law: will accommodate the waiver of internal gas storage levy at intra-EU border points and virtual trading hubs. This entails the gas levy payable to the operator Trading Hub Europe to apply to domestic customers only from Jan 1st 2025.

- Russia's Kremlin says will act to counter the possible new G7 oil sanctions; will act to minimise any consequences and protect Russian companies, measures will backfire on those who take them.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Retail Sales MM (Nov) 0.2% vs. Exp. 0.5% (Prev. -0.7%); "For the first time in three months there was a boost for food store sales, particularly supermarkets"

- UK Retail Sales Ex-Fuel MM (Nov) 0.3% (exp. 0.0%, prev. -0.9%)

- UK Retail Sales YY (Nov) 0.5% vs. Exp. 0.8% (Prev. 2.4%, Rev. 2.0%); Ex-Fuel 0.1% vs. Exp. 0.7% (Prev. 2.0%, Rev. 1.6%)

- UK PSNB Ex Banks GBP (Nov) 11.249B GB vs. Exp. 13.0B GB (Prev. 17.354B GB, Rev. 18.217B GB)

- German Producer Prices MM (Nov) 0.5% vs. Exp. 0.3% (Prev. 0.2%); YY 0.1% vs. Exp. -0.3% (Prev. -1.1%)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves is posed to visit China in January to revive high-level economic and financial talks, according to Reuters sources.

- NIER sees Swedish GDP for 2025 +1.2%. See the Riksbank rate averaging 1.5% in 2025 and 1.5% in 2026

NOTABLE US HEADLINES

- US President-elect Trump says "I told the European Union that they must make up their tremendous deficit with the United States by the large scale purchase of our oil and gas. Otherwise, it is TARIFFS all the way!!!"

- US House of Representatives defeated a bill to temporarily fund the federal government and avert agency shutdowns beginning on Saturday; Next steps unclear in avoiding government shutdown following House defeat of spending bill, according to Reuters.

- US President-Elect Trump said House Speaker Johnson and the House have come to a very good deal for the American people; urges Republicans and Dems to vote yes. Trump earlier said he would support abolishing the debt ceiling entirely.

- US President-elect Trump says "Congress must get rid of, or extend out to, perhaps, 2029, the ridiculous Debt Ceiling. Without this, we should never make a deal. Remember, the pressure is on whoever is President."

- FedEx Corp (FDX) Q2 2025 (USD): EPS 4.05 (exp. 4.06), Revenue 22.0bln (exp. 22.1bln); FY EPS view 19-20 (exp. 19.75, prev. 20-21); FY25 capital outlook USD 5.2bln. FedEx (FDX) announced its intent to separate FedEx freight, creating two industry-leading public companies. +7% in pre-market

- Nike Inc (NKE) Q2 2025 (USD): EPS 0.78 (exp. 0.63), Revenue 12.4bln (exp. 12.11bln). Gross margin: 43.6% (prev. 44.6% y/y, exp. 43.1%). CFO said Co. expects Q3 revenue to be down low double digits; said Co. expects Q3 margins to be down about 300-350bps. -2.5% in pre-market trade

GEOPOLITICS

MIDDLE EAST

- "Israel's Channel 14 on security officials: Israel is preparing for a new attack against the Houthis in Yemen", according to Sky News Arabia.

- "Israel's Channel 13 on officials: optimism remains high that a deal with Hamas is imminent.", according to Sky News Arabia.

RUSSIA-UKRAINE

- "7 strong explosions are heard in the Ukrainian capital Kiev", according to Sky News Arabia; Ukraine air defence repelling an attack on Kyiv, according to official cited by Reuters.

- Russia fired a series of Kinjal hypersonic missiles on the capital Kiev, according to Sky News Arabia.

CRYPTO

- Bitcoin continues to sink post-FOMC, and has dipped below USD 95k; Ethereum briefly dipped under USD 3.2k.

APAC TRADE

- APAC stocks eventually traded mixed following a mostly lower open after the lead from Wall Street as markets digest a slew of central bank decisions whilst still feeling the hangover from the Fed.

- ASX 200 was pressured by heavyweight financial, materials, and healthcare sectors, whilst Utilities and IT bucked the trend and posted mild gains.

- Nikkei 225 was briefly supported by the recent JPY weakness, although later faltered as JPY eventually strengthened following hotter-than-expected CPI and currency jawboning by Japanese officials.

- Hang Seng and Shanghai Comp both opened lower and trimmed losses to later trade, with Chinese markets unfazed as the PBoC maintained its LPRs.

NOTABLE ASIA-PAC HEADLINES

- Japan cuts view on corporate profits for the first time since March 2023; says economy is recovering moderately.

- China intends to cut tax evasion at online platforms, according to Xinhua.

- PBoC maintained 1yr LPR at 3.10% and 5yr LPR at 3.60% as expected.

- Japan Finance Minister Kato said no comment on FX levels; recently seeing one-sided, sharp moves; will take appropriate action against excessive moves; concerned about recent FX moves, including those driven by speculators, according to Reuters Kato added that it is important for currencies to move in a stable manner reflecting fundamentals.

- Japan's top currency diplomat Mimura said gravely concerned about forex moves, and will take appropriate action against excessive forex moves, alarmed including over speculative moves, according to Reuters.

- South Korea to relax FX regulations to improve liquidity conditions, according to the finance ministry.

DATA RECAP

- Japanese CPI, Core Nationwide YY (Nov) 2.7% vs. Exp. 2.6% (Prev. 2.3%)

- Japanese CPI, Overall Nationwide (Nov) 2.9% (Prev. 2.3%)

- Japanese CPI Index Ex-Fresh Food (Nov) 109.2 (Prev. 108.8)

- South Korea PPI Growth YY (Nov) 1.4% (Prev. 1.0%, Rev. 1.0%)

- South Korea PPI Growth MM (Nov) 0.1% (Prev. -0.1%, Rev. -0.1%)

- New Zealand Annual Trade Balance (Nov) -8.25B (Prev. -8.96B, Rev. -9.07B)

- New Zealand Trade Balance (Nov) -437.0M (Prev. -1544.0M, Rev. -1658M)

- New Zealand Imports (Nov) 6.92B (Prev. 7.31B, Rev. 7.27B)

- New Zealand Exports (Nov) 6.48B (Prev. 5.77B, Rev. 5.61B)

- Australian Private Sector Credit (Nov) 0.5% (Prev. 0.6%)

- Australian Housing Credit (Nov) 0.5% (Prev. 0.5%)