US Industrial Production fell 0.1% MoM in January, dragging it down to unchanged YoY

Source: Bloomberg

As cold weather crushed mining but juice utilities...

In January, mining output fell 2.3 percent amid a weather-related pullback in oil and gas extraction and a drop in coal production.

The output of utilities jumped 6.0 percent as electric and natural gas utilities output increased 4.7 and 13.9 percent, respectively.

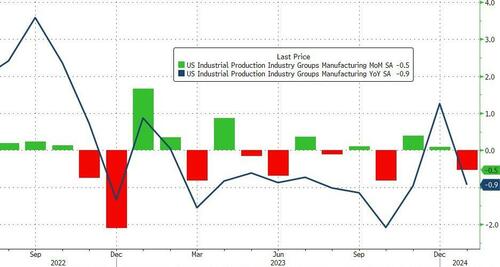

Manufacturing output fell 0.5% in January, dragging it down 0.9% YoY...

Source: Bloomberg

The index for durable manufacturing edged up 0.1 percent, while the index for nondurable manufacturing fell 1.1 percent. The index for other manufacturing (publishing and logging) moved down 0.2 percent.

Among durables, the largest gains were recorded in electrical equipment, appliances, and components as well as in aerospace and miscellaneous transportation equipment. Computer and electronic products also moved up in January, in part based on the continued strength in semiconductor production. Nonmetallic mineral products and primary metals recorded declines of around 1 percent.

Declines were widespread among nondurables, with notable weather-related decreases in the indexes of petroleum and coal products, chemicals, and plastics and rubber products.

Capacity utilization for manufacturing decreased to 76.6% in January, a rate that is 1.6ppts below its long-run average, and its lowest since Sept 2021.

Source: Bloomberg

The operating rate for mining decreased 2.3 percentage points to 92.2 percent, a rate that is 5.7 percentage points above its long-run average. The operating rate for utilities moved up 4.0 percentage points to 74.2 percent, well below its long-run average of 84.4 percent.

All of which is odd, because the 'soft' data said everything was awesome again?

None of which is a great sign for Q1 GDP...