After surging in July, US Industrial Production was expected to rise very modestly (+0.1% MoM) in August. Instead, despite signals from ISM surveys that the industry is in contraction, industrial production rose 0.5% MoM. That surprise pulled orders up 0.25% YoY...

Source: Bloomberg

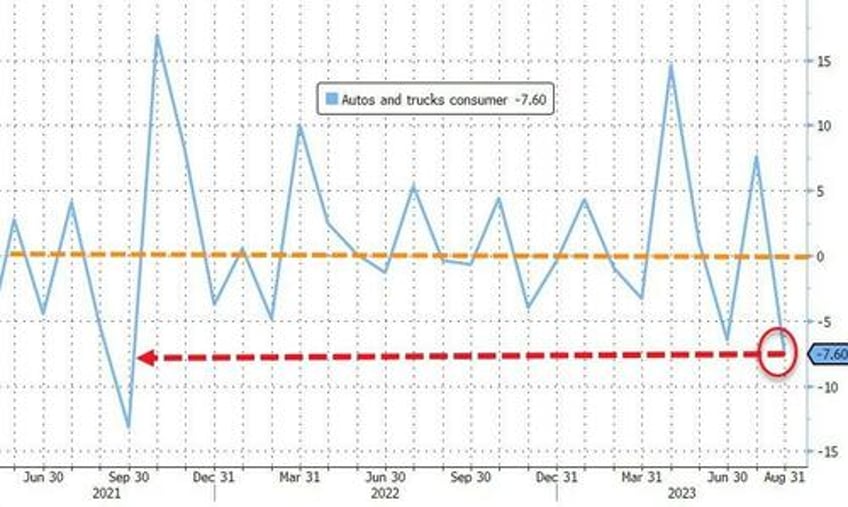

In August, the drop in the output of motor vehicles and parts contributed to declines in the indexes for consumer durables and transit equipment.

Source: Bloomberg

Most of the other major market groups posted increases in August.

The index for consumer nondurables moved up 0.4 percent, and the index for materials advanced 0.7 percent.

Within materials, energy materials rose 1.5 percent, while non-energy materials edged up 0.1 percent.

The production of defense and space equipment jumped 3.5 percent in August and was up over 10 percent from its year-earlier level.

Narrowing in, we see Manufacturing production also rose (+0.1% MoM as expected) but slower than the +0.4% MoM in July. Manufacturing production remains lower YoY for the sixth straight month.

Source: Bloomberg

Finally, we note that ISM Manufacturing ORDERS continue to significantly diverge from Manufacturers PRODUCTION...

Source: Bloomberg

Presumably that explains the 'deflationary impulse' we have seen in goods inflation.