- APAC stocks were mostly higher but with gains capped at month-end and as participants digested earnings and tariff threats.

- US President Trump said he will put a 25% tariff on Canada and Mexico because of fentanyl, and stated that China is going to end up paying a tariff as well.

- US President Trump posted on Truth Social that the US will require commitment from BRICS countries to neither create a new BRICS currency nor back any other currency to replace the mighty US Dollar or they will face 100% tariffs.

- Mega-cap after-market US earnings saw Apple, Intel, and Visa rise by 3.0%, 3.7%, and 1.2% respectively.

- ECB may drop its "restrictive" label on the rate stance as soon as March, according to Bloomberg citing sources. The sources noted that with another 25bps rate cut highly likely then.

- Looking ahead, highlights include German Retail Sales, Unemployment & CPI, French CPI, Spanish Retail Sales, US PCE, Employment Costs, Canadian GDP (Q4), ECB SCE, German Credit Rating, Comments from Fed's Bowman, Earnings from Novartis, Exxon, AbbVie, Chevron, Colgate-Palmolive, LyondellBasell & Phillips 66.

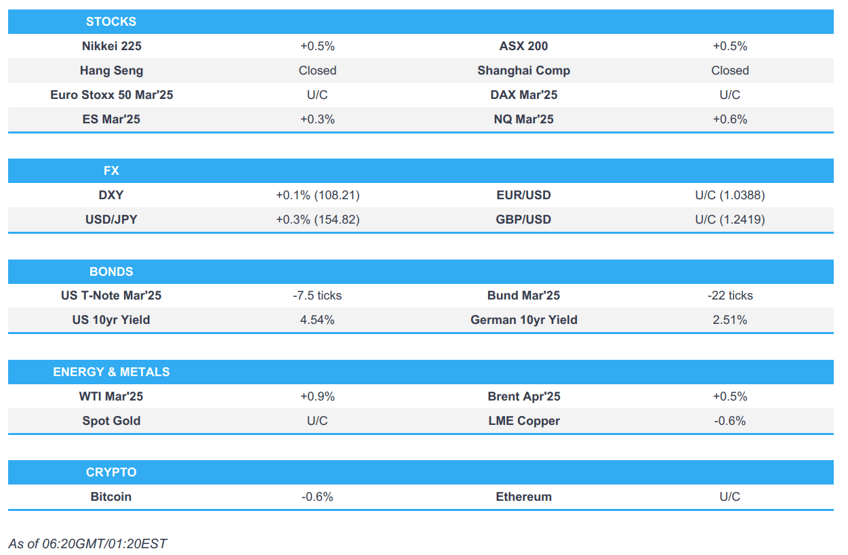

SNAPSHOT

- Holiday: Chinese Spring Festival (Jan 28 - Feb 4 2025)

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks closed in the green albeit well off their best levels amid a broad-based macro reaction to tariff talk from US President Trump whereby he said he is to announce 25% tariffs on Canada and Mexico because of fentanyl, while he added they will probably decide on Thursday night whether to impose tariffs on oil on Canada and Mexico. This pressured the major indices and lifted the dollar, while treasuries were sold and oil rose to session highs. Following the initial remarks, President Trump commented that China is also going to end up paying a tariff as well.

- SPX +0.53% at 6,071, NDX +0.45% at 21,508, DJIA +0.38% at 44,882, RUT +1.07% at 2,307.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President Trump said he will put a 25% tariff on Canada and Mexico because of fentanyl, according to Bloomberg. Trump also commented they will probably decide on Thursday night whether to impose tariffs on oil on Canada and Mexico, while he added that they have all the lumber they need and stated that China is going to end up paying a tariff as well.

- US President Trump posted on Truth Social that the US will require commitment from BRICS countries to neither create a new BRICS currency nor back any other currency to replace the mighty US Dollar or they will face 100% tariffs.

EARNINGS

- Apple Inc (AAPL) Q1 2025 (USD): EPS 2.40 (exp. 2.35), Revenue 124.3bln (exp. 124.12bln); shares rose 3% after-market.

- Intel Corp (INTC) Q4 2024 (USD): Adj. EPS 0.13 (exp. 0.12), Revenue 14.26bln (exp. 13.81bln); shares rose 3.7% after-market.

- Visa Inc (V) Q1 2025 (USD): Adj. EPS 2.75 (exp. 2.66), Revenue 9.50bln (exp. 9.34bln); shares rose 1.2% after-market.

APAC TRADE

EQUITIES

- APAC stocks were mostly higher but with gains capped at month-end and as participants digested earnings and tariff threats.

- ASX 200 printed a fresh all-time high with the index led by strength in gold miners and tech although the defensive sectors lagged.

- Nikkei 225 remained afloat albeit with momentum restricted by a choppy currency and a slew of earnings.

- KOSPI underperformed on return from the holiday closure with tech names pressured as SK Hynix got its first opportunity to react to the DeepSeek debacle and Samsung Electronics was also negative despite better-than-expected earnings for Q4 as it provided a pessimistic view for the current quarter.

- US equity futures edged higher overnight following the initial indecisive reaction to Apple's earnings as the iPhone maker beat on its top and bottom lines but missed on iPhone and products revenue, as well as posted a double-digit decline in Greater China revenue.

- European equity futures indicate a flat cash open with Euro Stoxx 50 futures U/C after the cash market gained 1% on Thursday.

FX

- DXY remained afloat after getting a late boost yesterday from President Trump who warned that he will place a 25% tariff on Canada and Mexico because of fentanyl and will probably decide on Thursday night whether to impose tariffs on oil for Canada and Mexico. This pressured the greenback's major counterparts and heavily weighed on MXN and CAD, while Trump also later commented on Truth Social that the US will require BRICS countries to neither create a new BRICS currency nor back any other currency to replace the dollar or they will face 100% tariffs.

- EUR/USD traded little changed after fading its post-ECB advances, while source reports noted policymakers expect to cut rates again in March but anticipate a deeper debate for April and the ECB may drop its "restrictive" label on the rate stance in March.

- GBP/USD lacked direction after its recent choppy performance within the 1.2400 handle amid light UK-specific catalysts.

- USD/JPY saw two-way price action after mixed data releases but rebounded off lows as support held at the 154.00 level.

- Antipodeans nursed some of the losses seen following Trump's tariff remarks amid light catalysts and the absence of relevant tier-1 data.

FIXED INCOME

- 10yr UST futures continued its gradual retreat from yesterday's peak following a drop in jobless claims and a surge in consumer spending, while yields were mildly higher in the aftermath of US President Trump's latest tariff threats.

- Bund futures partially reversed some of the prior day's firm gains after failing to sustain a brief return to 132.00 territory but with price action quiet ahead of a slew of German data including Retail Sales, Unemployment & CPI figures.

- 10yr JGB futures were ultimately pressured following mixed data releases from Japan including Tokyo CPI which showed a firmer-than-expected headline reading, while the Core and Core-Core figures matched estimates with a slight acceleration from the prior month.

COMMODITIES

- Crude futures were higher after prices were underpinned late in the US session owing to Trump's tariff remarks in which he plans to impose 25% tariffs on Canada and Mexico, while he said he would likely decide on Thursday night whether to include oil in the tariffs.

- Spot gold plateaued overnight after steadily advancing yesterday to just shy of the USD 2,800/oz level.

- Copper futures traded sideways amid the somewhat mixed risk appetite and tariff threat overhang.

CRYPTO

- Bitcoin slightly pulled back overnight in a choppy fashion but with the downside cushioned by support around the USD 104k level.

- Elliott Management Corp warned that the Trump administration's embrace of crypto is helping fuel a speculative mania that could cause havoc when prices collapse, according to FT.

NOTABLE ASIA-PAC HEADLINES

- US is probing whether DeepSeek sourced NVIDIA (NVDA) chips through Singapore, with the White House and FBI investigating the use of Singapore intermediaries by DeepSeek, according to Bloomberg. It was also reported that US Congressional offices are being warned not to use DeepSeek, according to Axios.

DATA RECAP

- Tokyo CPI YY (Jan) 3.4% vs. Exp. 3.1% (Prev. 3.0%)

- Tokyo CPI Ex. Fresh Food YY (Jan) 2.5% vs. Exp. 2.5% (Prev. 2.4%)

- Tokyo CPI Ex. Fresh Food & Energy YY (Jan) 1.9% vs. Exp. 1.9% (Prev. 1.8%)

- Japanese Industrial Production MM (Dec P) 0.3% vs. Exp. 0.3% (Prev. -2.2%)

- Japanese Industrial Production YY (Dec P) -1.1% vs. Exp. -2.2% (Prev. -2.7%)

- Japanese Retail Sales MM (Dec) -0.7% vs. Exp. -0.1% (Prev. 1.8%, Rev. 1.9%)

- Japanese Retail Sales YY (Dec) 3.7% vs. Exp. 3.2% (Prev. 2.8%)

GEOPOLITICS

MIDDLE EAST

- Hamas armed wing announced the killing of its military leader Mohammed Deif and the killing of its deputy commander Marwan Issa, according to a statement.

- Lebanese media Al Mayadeen posted on X that Israeli warplanes struck several areas on Lebanon's eastern border with Syria which it stated marked another set of blatant violations of the ceasefire agreement.

- US military said it killed a senior operative of Al-Qaeda affiliate terror group Hurras Al-Din in northwest Syria.

RUSSIA-UKRAINE

- US President Trump said he had been in contact with Russia and will facilitate the transfer of remains of the deceased to Russia in reference to the recent plane and helicopter collision.

EU/UK

NOTABLE HEADLINES

- ECB may drop its "restrictive" label on the rate stance as soon as March, according to Bloomberg citing sources. The sources noted that with another 25bps rate cut highly likely then, bringing the deposit rate to 2.5%, such a level may not fully deserve that label anymore, while a change in that terminology in the ECB’s statement is therefore something officials will weigh when they next discuss monetary policy.

DATA RECAP

- UK Lloyds Business Barometer (Jan) 37 (Prev. 39)