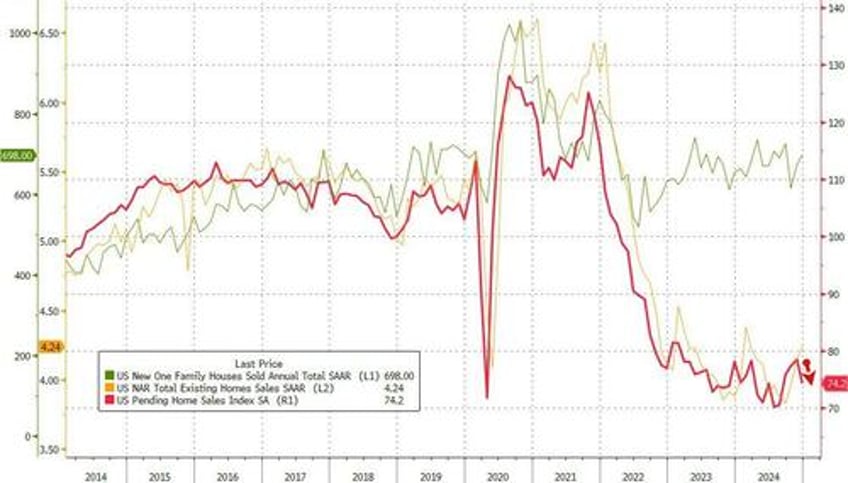

Following unexpected surges in new- and existing-home-sales, pending home sales in the US plunged 5.5% MoM in December (vs 0.0% exp and below all estimates), dragging the total sales down 2.9% YoY (vs +4.2% exp)...

Source: Bloomberg

That was the first MoM decline since July.

This pushed the total pending home sales index back down near record lows...

Source: Bloomberg

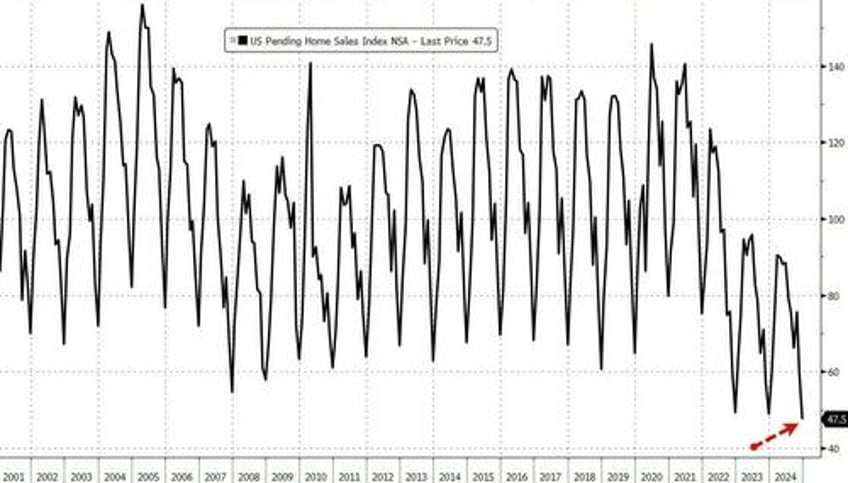

This is the lowest December print since records began (in 2000)...

Source: Bloomberg

It's not the economy, it's affordability, stupid!

“Contract activity fell more sharply in the high-priced regions of the Northeast and West, where elevated mortgage rates have appreciably cut affordability,” Lawrence Yun, NAR’s chief economist, said in a statement.

“It is unclear if heavier-than-usual winter precipitation impacted the timing of purchases.”

In fact, sales fell across all regions:

Northeast fell 8.1% m/m; Nov. fell 1.3%

Midwest fell 4.9% m/m; Nov. rose 0.4%

South fell 2.7% m/m; Nov. rose 3.7%

West fell 10.3% m/m; Nov. rose 0.5%

Last month’s signings figures don’t bode well for the new year after 2024 marked the worst year in the home resale market since 1995 as pending-homes sales tend to be a leading indicator for previously owned homes, as houses typically go under contract a month or two before they’re sold.