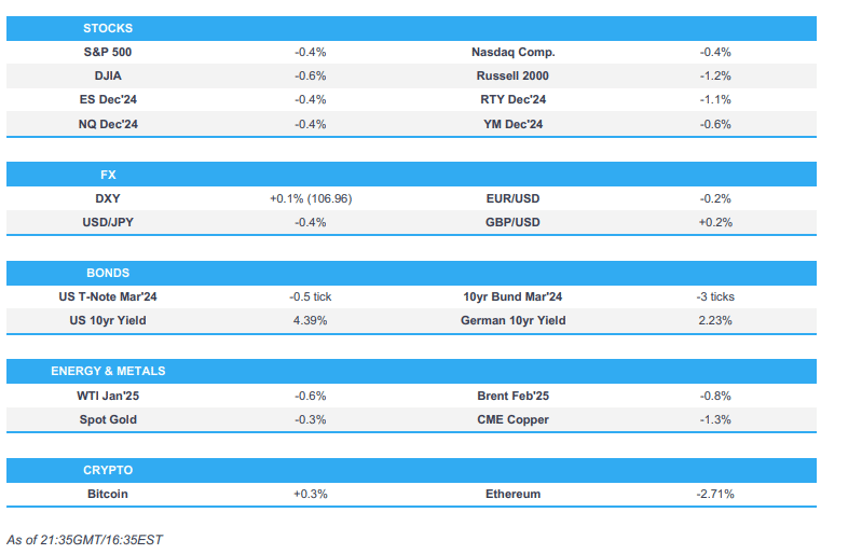

- US stocks saw risk off with underperformance in the Russell and Dow vs S&P and Nasdaq. Sectors were predominantly lower, led by losses in Industrials, Energy and Financials.

- USD saw marginal gains on Tuesday, although barely flinched to US retail sales data as participants await the FOMC rate decision, updated SEP’s and Chair Powell's presser on Wednesday.

- T-notes pare earlier downside on US data ahead of the FOMC.

- Oil prices were lower on Tuesday and seemingly weighed on by the initial broader risk-off sentiment.

- Looking ahead Highlights include New Zealand Current Account, Japanese Trade Balance, Australian AGB Auction.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks saw risk off with underperformance in the Russell and Dow vs S&P and Nasdaq. Sectors were predominantly lower, led by losses in Industrials, Energy and Financials while Consumer Discretionary, Consumer Staples and Healthcare were the relative outperformers.

- SPX -0.39% at 6,051, NDX -0.43% at 22,001, DJI -0.61% at 43,450, RUT -1.18% at 2,334.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US Congressional leaders have struck a bipartisan deal to push the Government funding deadline to March 14 and deliver more than USD 100bln in emergency disaster aid, via Politico.

DATA RECAP

- US Retail Sales MM (Nov) 0.7% vs. Exp. 0.5% (Prev. 0.4%, Rev. 0.5%); Ex-Autos 0.2% vs. Exp. 0.4% (Prev. 0.1%, Rev. 0.2%)

- US Retail Control (Nov) 0.4% vs. Exp. 0.4% (Prev. -0.1%)

- US Industrial Production MM (Nov) -0.1% vs. Exp. 0.3% (Prev. -0.3%, Rev. -0.4%)

- Canadian Core CPI MM SA (Nov) 0.1% (Prev. 0.3%); CPI MM SA (Nov) 0.1% (Prev. 0.3%)

- BoC Core Measures Average (Nov): 2.43% (prev. 2.43%, rev. 2.50%)

FX

- USD saw marginal gains on Tuesday, although barely flinched to US retail sales data as participants await the FOMC rate decision, updated SEP’s and Chair Powell's presser on Wednesday.

- Safe-haven FX, JPY and CHF, were two of the best performers against the Greenback as they benefited from the broader risk-off sentiment, as opposed to anything currency-related.

- AUD, CAD, and NZD, all saw losses and were hit by the downbeat risk tone. Newsflow was sparse for the Antipodeans, while Canadian CPI was slightly cooler Y/Y, but Median and Trim came in hot M/M; the average of the BoC eyed measures ticked down to 2.43% from a revised up 2.50%.

- EUR was weaker, albeit not to the extent of the above currencies after mixed German data. Ifo figures were mixed, with the Business Climate and Expectations components printing below expectations whilst the Current conditions improved a touch.

FIXED INCOME

- T-notes pare earlier downside on US data ahead of the FOMC.

- US sold USD 13bln 20yr Bond; High Yield: 4.686% (prev. 4.68%, six-auction average 4.398%). WI: 4.671%.. Tail: 1.5bps (prev. 3.0bps, six-auction avg. 0.6bps). Bid-to-Cover: 2.50x (prev. 2.34x, six-auction avg. 2.57x). Dealers: 17.9% (prev. 22.6%, six-auction avg. 13.3%). Directs: 20.1% (prev. 7.9%, six-auction avg. 15.3%). Indirects: 62% (prev. 69.5%, six-auction avg. 71.4%).

COMMODITIES

- Oil prices were lower on Tuesday and seemingly weighed on by the initial broader risk-off sentiment.

GEOPOLITICAL

MIDDLE EAST

- "The IDF has approved plans for major strikes in Yemen, and is prepared to act pending government approval", via Open Source Intel citing N12 News

- Gaza ceasefire deal is expected to be signed in coming days; Israeli PM Netanyahu is on his way to Cairo for Gaza ceasefire talks, via Reuters citing sources

OTHER

ASIA-PAC

NOTABLE HEADLINES

- Honda Motor (7267 JT/HMC) and Nissan (7201 JT/NSANY) to begin merger talks amid EV competition, according to Nikkei. Honda and Nissan are considering operating under a holding company, and soon will sign a memorandum of understanding. Their respective stakes in the new entity, as well as other details, will be decided later. "They also look to eventually bring Mitsubishi Motors, in which Nissan is the top shareholder with a 24% stake, under the holding company. This would create one of the world's largest auto groups, with combined sales among the three Japanese players topping 8 million vehicles."

- Honda Motor (7267 JT/HMC) reiterates exploring various possibilities with Nissan (7201 JT/NSANY) and Honda notes reported content not released by Co.

EU/UK

NOTABLE HEADLINES

DATA RECAP

- UK Avg Wk Earnings 3M YY (Oct) 5.2% vs. Exp. 4.6% (Prev. 4.3%, Rev. 4.4%); Ex-Bonus) (Oct) 5.2% vs. Exp. 5.0% (Prev. 4.8%, Rev. 4.9%)

- UK ILO Unemployment Rate (Oct) 4.3% vs. Exp. 4.3% (Prev. 4.3%);

- Employment Change (Oct) 173k vs. Exp. 2k (Prev. 219k)

- UK HMRC Payrolls Change (Nov) -35k (Prev. -5k, Rev. 24k)

- German Ifo Business Climate New (Dec) 84.7 vs. Exp. 85.6 (Prev. 85.7); Ifo Current Conditions New (Dec) 85.1 vs. Exp. 84.0 (Prev. 84.3); Ifo Expectations New (Dec) 84.4 vs. Exp. 87.5 (Prev. 87.2)

- German ZEW Current Conditions (Dec) -93.1 vs. Exp. -93.0 (Prev. -91.4); ZEW Economic Sentiment (Dec) 15.7 vs. Exp. 6.5 (Prev. 7.4); ZEW says economic outlook is improving; experts still expect further interest rate cuts for the coming year; experts assess the recent rise in inflation as a temporary phenomenon

- EU ZEW Survey Expectations (Dec) 17 (Prev. 12.5)

LATAM

- Brazil's Lower House Speaker Lira says tax reform and part of the fiscal package will be voted on today, the other two proposals from the spending cut package will be voted on tomorrow, via Estadao