- APAC stocks took impetus from the relief rally on Wall St where sentiment was underpinned after a larger-than-expected decline in Initial Jobless Claims soothed some of the recent labour market concerns.

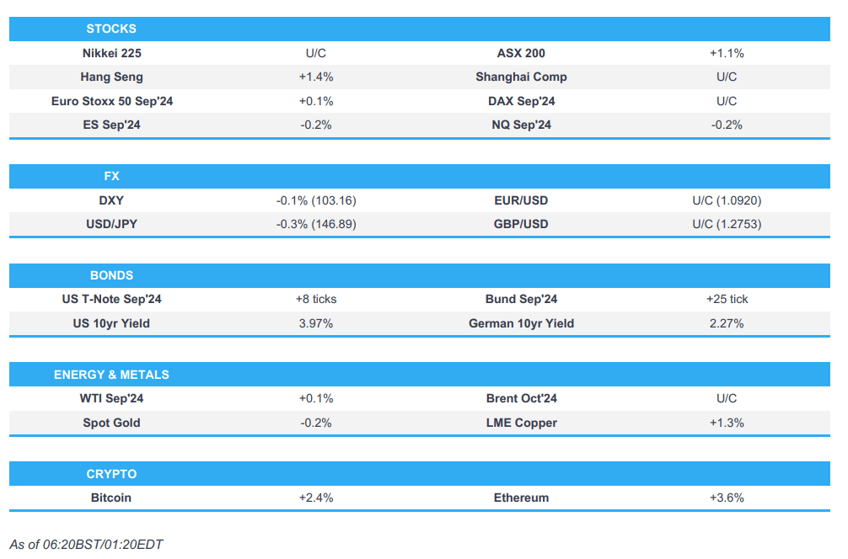

- DXY marginally softened in rangebound trade but remained above 103.00; 10-year UST futures nursed losses and got some mild reprieve after recent bear steepening.

- Crude futures kept afloat amid the positive mood and as participants await Iran and Hezbollah's retaliation.

- European equity futures indicate a firmer open with Euro Stoxx 50 futures up 0.1% after the cash market finished flat on Thursday.

- Looking ahead, highlights include Norwegian CPI, Canadian Jobs, Earnings from Generali.

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks surged and Treasuries bear flattened after Initial Jobless Claims fell by more than expected, helping ease some recent labour market concerns. The equity rally was broad-based as all sectors finished in the green and outperformance was seen in Tech, Communication, Industrials and Health Care with the latter sector buoyed by a stellar report from Eli-Lilly (LLY), resulting in a 9.5% jump in its shares.

- SPX +2.3% at 5,319, NDX +3.1% at 18,414, DJIA +1.8% at 39, 447, RUT +2.4% at 2,084.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Barkin (2024 voter) said what he is hearing from people on the ground in the labour market is that people are cutting back on hiring but not firing, while no hiring and no firing is what they see in the data and from here, it could go either way. Barkin added that for him, the case for lowering rates in July would have been either absolute conviction that the labour market was on the precipice, or if you thought you have inflation under control.

- Fed's Goolsbee (non-voter) said the Fed watches markets but they do not drive policy, while he added they are getting back to more normal conditions in the US economy and the question is if the job market will hold or keep worsening. Furthermore, he said that they need to see more than payrolls and more than one month, as well as noted they need to watch the real economy if they are too tight for too long.

- Fed's Schmid (non-voter) said if inflation continues to come in low, it will be appropriate to adjust policy, as well as noted the current stance of Fed policy is not that restrictive and the Fed is close but still not quite there on reaching 2% inflation goal. Furthermore, Schmid said the path of Fed policy will be determined by data and the strength of the economy, while he would not want to assume any particular path or endpoint for the policy rate.

- US Republican Presidential Nominee Trump said the US is close to depression, very close to a world war, and close to a 1929 crash.

APAC TRADE

EQUITIES

- APAC stocks took impetus from the relief rally on Wall St where sentiment was underpinned after a larger-than-expected decline in Initial Jobless Claims soothed some of the recent labour market concerns.

- ASX 200 gained with outperformance in tech front-running the advances seen across all sectors.

- Nikkei 225 briefly reclaimed the 35,000 status and momentarily turned positive for the week after fully recovering from Monday's turmoil, but later faltered heading into the Japanese long weekend.

- Hang Seng and Shanghai Comp. were positive after encouraging signals from China's inflation data and with notable strength in China's largest chipmaker SMIC after its Q2 results which showed profits dropped sharply but beat expectations and revenue climbed, while it also forecasts double-digit percentage sequential revenue growth for Q3. However, the gains in the mainland were limited after the PBoC's open market operations for this week resulted in the largest net liquidity drain in four months.

- US equity futures traded steadily overnight and remain near yesterday's best levels owing to the jobless claims data.

- European equity futures indicate a firmer open with Euro Stoxx 50 futures up 0.1% after the cash market finished flat on Thursday.

FX

- DXY marginally softened in rangebound trade but remained above 103.00 after benefitting from encouraging initial jobless claims data, while there were several comments from Fed's Barkin, Goolsbee and Schmid which had little sway on the currency.

- EUR/USD traded sideways and lacks direction after recently recovering from a brief dip beneath the 1.0900 handle.

- GBP/USD held on to the prior day's spoils but with further upside capped near the 1.2750 level amid light catalysts.

- USD/JPY lacked conviction amid a quiet calendar for Japan and after having recently returned to above the 147.00 level.

- Antipodeans edged mild gains amid the positive risk tone and after firmer-than-expected Chinese inflation data.

- PBoC set USD/CNY mid-point at 7.1449 vs exp. 7.1690 (prev. 7.1460)

- Mexican Interest Rate (Aug) 10.75% vs. Exp. 11.0% (Prev. 11.0%); 3-2 vote split. Banxico maintained guidance that the Board foresees the inflationary environment may allow for discussing reference rate adjustments and reiterated that the balance of risks for the trajectory of inflation within the forecast horizon remains biased to the upside.

- Peru Central Bank cut its reference rate by 25bps to 5.50% (exp. unchanged at 5.75%), while it stated that future rate changes will be dependent on new information about inflation and its determinants.

FIXED INCOME

- 10-year UST futures nursed losses and got some mild reprieve after recent bear steepening.

- Bund futures rebounded off yesterday's lows after support held at the 134.00 level.

- 10-year JGB futures remained subdued heading into the long weekend in Japan and after this week's volatility.

COMMODITIES

- Crude futures kept afloat amid the positive mood and as participants await Iran and Hezbollah's retaliation.

- Spot gold took a breather after its recent advances and a break above the USD 2,400/oz level.

- Copper futures were underpinned amid the constructive mood and after firmer-than-expected Chinese inflation.

CRYPTO

- Bitcoin mildly eased back overnight after rallying yesterday to briefly above the USD 62,000 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC injected CNY 12.9bln via 7-day reverse repos and drained a net CNY 759.8bln via open market operations this week for its largest weekly cash withdrawal in four months, according to Reuters.

DATA RECAP

- Chinese CPI MM (Jul) 0.5% vs. Exp. 0.3% (Prev. -0.2%)

- Chinese CPI YY (Jul) 0.5% vs. Exp. 0.3% (Prev. 0.2%)

- Chinese PPI YY (Jul) -0.8% vs. Exp. -0.9% (Prev. -0.8%)

GEOPOLITICAL

MIDDLE EAST

- Qatari, Egyptian and US leaders said it is time to conclude a Gaza ceasefire agreement and release hostages and prisoners, while they have worked for months to reach a framework agreement and it is now on the table, with only details of implementation missing. Furthermore, they called on the sides to resume urgent talks on Thursday, August 15th, in Doha or Cairo to bridge all remaining gaps and start implementing an agreement without any delay.

- CNN source said lead mediators will attend the next round of negotiations with the CIA director to lead the US delegation, while the meeting that is being planned is expected to take place but needs the approval of Israel and Hamas, while it was later reported that Israeli PM Netanyahu's office said Israel will send negotiators for August 15th meeting on a Gaza deal and a Hamas official also said that they are ready for ceasefire negotiations to stop the bloodshed, according to source on X

- US senior administration official said President Biden and Defense Secretary Austin reviewed Middle East military deployments, while the official added that there is no expectation that an agreement will be signed by next Thursday and that issues on the table include the sequencing of the exchange. The official added that it is a negotiation and they need some things from the Israelis and the Hamas side, as well as noted that an Iranian escalation would jeopardise hope of getting a ceasefire deal because the focus would shift.

- US Secretary of Defence Austin briefed his Israeli on the nature of the deployment of US forces in the Middle East and stressed the importance of the ceasefire agreement in Gaza, while Austin said the arrival of F-22 jets in the region is part of the efforts to deter, defend Israel and protect US forces.

- US reportedly warned Iran its newly-elected government and economy could suffer a devastating blow if it were to mount a major attack against Israel, according to WSJ.

- Officials believe an Iran assault could be more sudden, larger and longer possibly lasting several days instead of several hours and could also be a coordinated barrage from multiple directions involving Iranian proxies in Iraq, Yemen, Syria and Lebanon, according to Washington Post.

- Syrian Armed Forces Chief of Staff has secretly visited Tehran to strengthen relations with Iran and approved the launch of attacks on Israel from Syrian soil, according to Al Arabiya citing sources.

- US CENTCOM Commander General visited Israel to tighten coordination ahead of a possible attack by Hezbollah and Iran.

- US CENTCOM said the US military destroyed two Houthi cruise missiles targeting ships.

- Rockets were fired at Kiryat Shmona and Manara settlement in northern Israel, while the Israeli army said air defence systems intercepted a rocket fired from the Gaza Strip towards Zikim and Ashkelon south of Israel, according to Al Arabiya.

- Yemeni sources noted US-British raids on Houthi military sites in Ras Issa and Salif areas in Hodeidah, according to Sky News Arabia.

OTHER

- Sevastopol authorities announced a state of air emergency and the shooting down of a Ukrainian anti-ship missile, while it was also reported that a state of emergency was declared after a march attack on Belgorod and Voronezh, according to Al Arabiya.

- IAEA said it's monitoring the situation around Russia's Kursk nuclear plant, according to RIA.

- Source on X reported that residents said there was a huge blast heard in Rylsk, Rostov-On-Don, Russia.

- A fire broke out at a military airfield in Russia's Lipetsk region, according to agencies cited by AFP