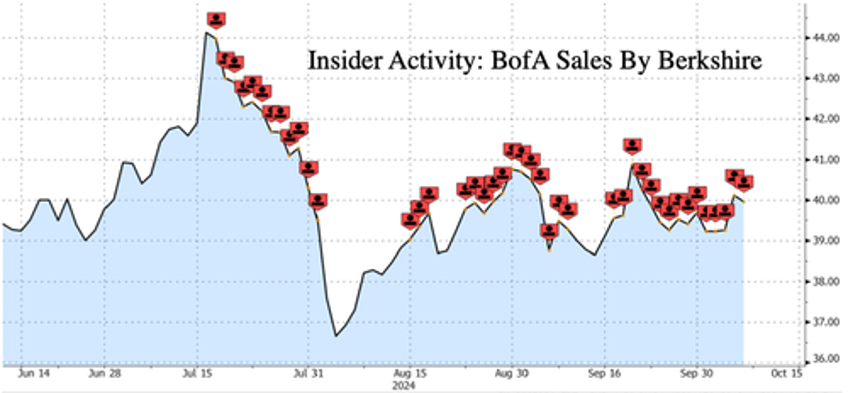

94-year-old Warren Buffett's Berkshire Hathaway has been on a multi-month dump-a-thon of Bank of America shares. The reason for the abrupt selling, which began in mid-July, has yet to be officially disclosed but should be viewed as an ominous sign that the 'Oracle of Omaha' foresees economic trouble ahead.

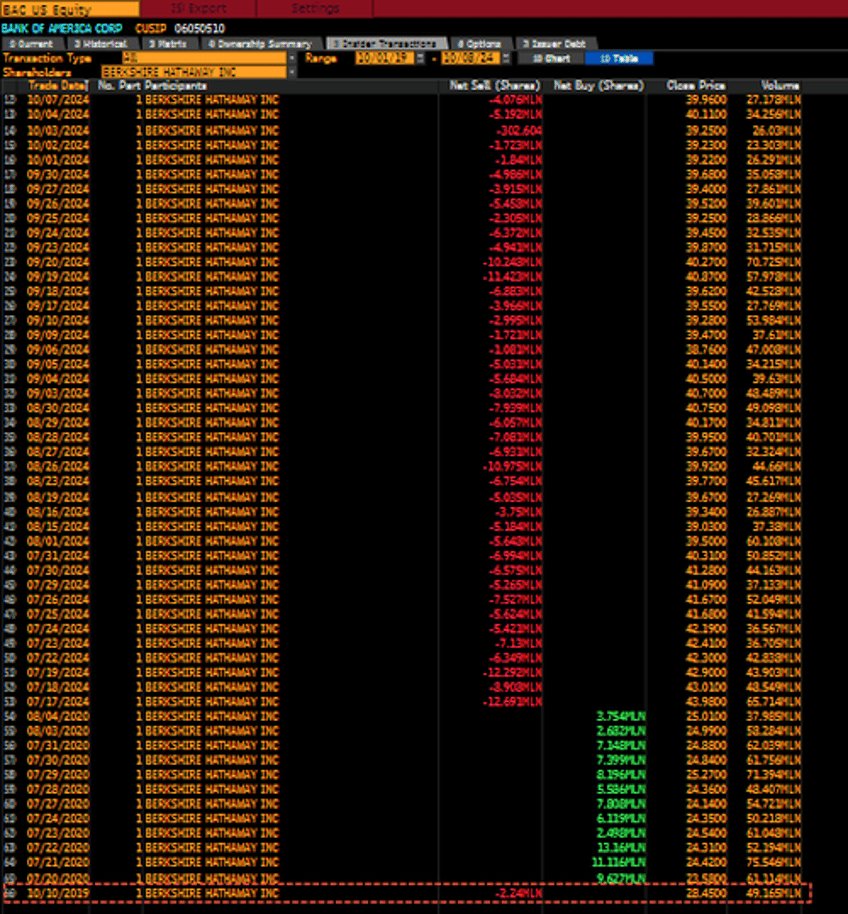

The latest Bloomberg data shows that Berkshire's total proceeds from selling BofA shares have now topped a whopping $10bln.

Traders at Berkshire began paring down the massive investment in mid-July, pressuring the bank's shares ever since. In the last three trading days, Berkshire sold $383mln worth of shares.

The latest selling is the first round of Berkshire selling BofA shares since right before the pandemic.

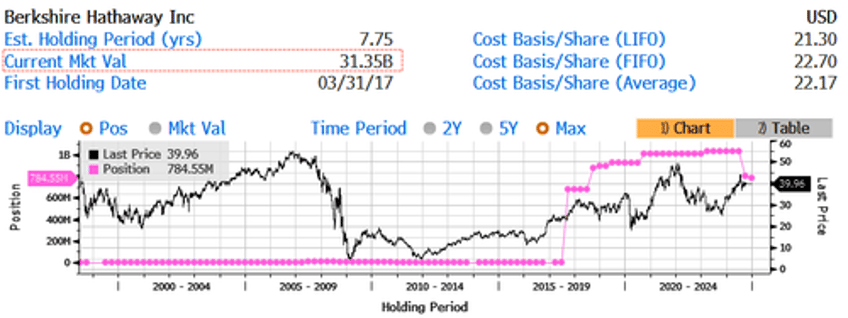

Even with all the selling, Berkshire's BofA position is still massive, totaling $31.35bln.

Berkshire is still the largest shareholder of the bank.

Buffett's stake in BofA has now dwindled to 10.1%, meaning just a bit more selling would drop it below the 10% regulatory threshold. Once that threshold is reached, Berkshire will no longer be required to report additional sales to the SEC.

We offered some theories about possible motives behind Buffett's BofA dumping, including an overvalued market, recession risk, consumer downturn, and the possibility that a US regulatory probe into anti-money laundering surrounding fentanyl cash laundering could expand to major US banks.

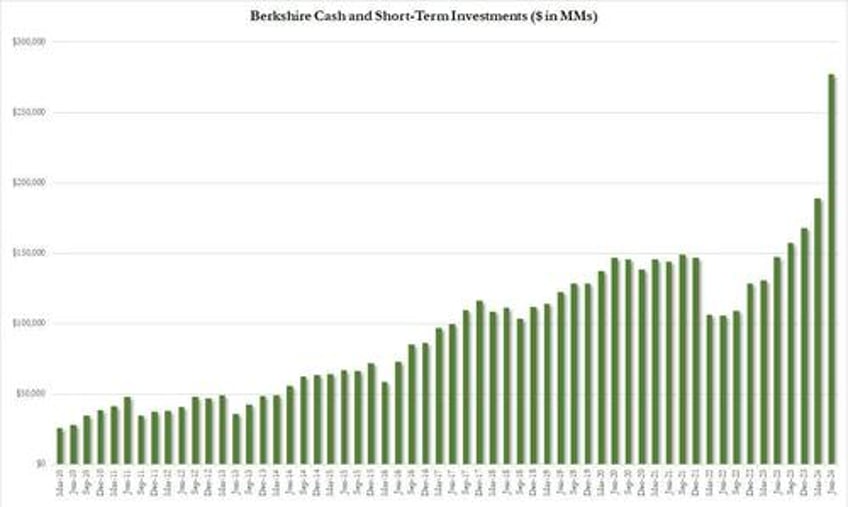

Buffett's cash pile has also soared to record highs.

Hmm.

Buffett also dumped half its Apple shares.

The bottom line is that unlike in October 2008, Buffett led the call to "Buy American"...

... this time, he is selling American at a worrisome pace.