By Alex Kimani of OilPrice.com

The AI boom and Big Tech might be hogging all the media limelight right now, but the smart money is quietly piling into energy stocks. Indeed, the energy sector is the most crowded of all 11 U.S. market sectors, with the sector’s favorite benchmark, Energy Select Sector SPDR Fund up 10.7% in the year-to-date compared to a 7.9% return by the Technology Select Sector SPDR Fund and 9.4% gain by the S&P 500.

According to Citi, Energy is now the most crowded U.S. quant factor, noting that once it hits that level, it tends to underperform over the next one to six months.

The stock market is in "one of the longest overbought periods in history. Typically, such an extreme is followed by a churning market over the short to intermediate term rather than a dramatic pullback, which reinforces Canaccord's view to buy weakness if/when it comes," analysts at Canaccord Genuity say.

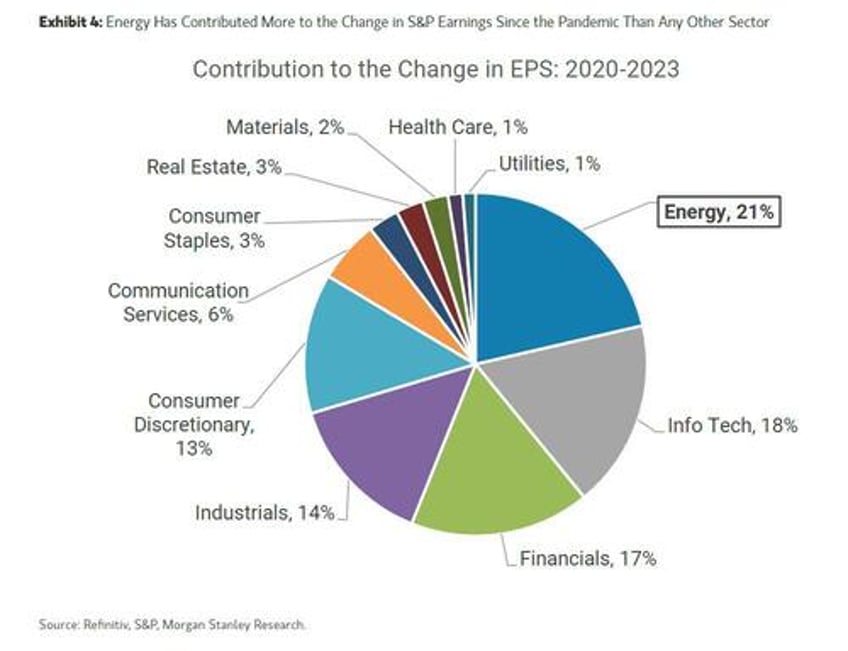

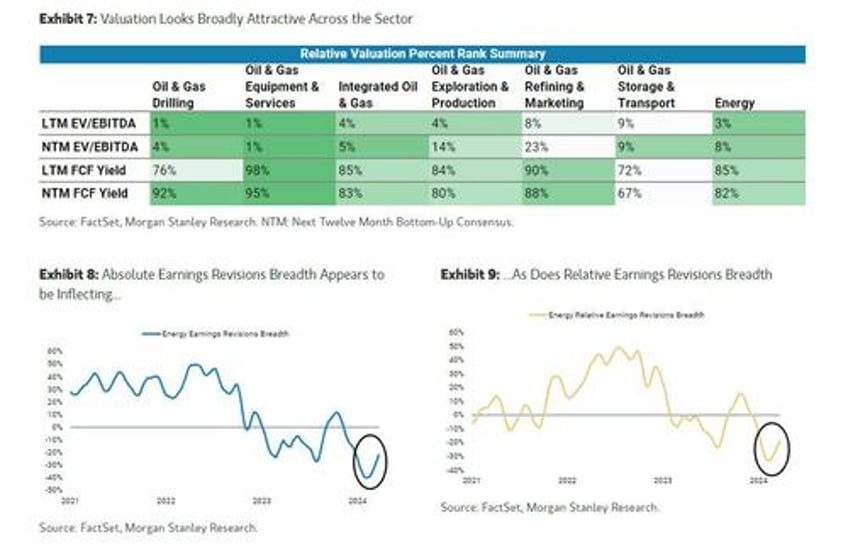

But not everybody is bothered by the energy sector’s huge momentum. Morgan Stanley remains pessimistic about the U.S. stock market overall; however, MS has upgraded energy stocks to overweight from neutral (full report available to zerohedge pro subscribers), noting that energy companies have lagged the performance of oil, and the sector is favorably valued.

“Taking the Fed’s recent messaging into account and assuming it is less concerned about inflation or looser financial conditions, commodity-oriented cyclicals and energy in particular could be due for a catch-up," they said.

Bullish on Energy

Commodity analysts at Standard Chartered have noted that energy markets kicked off the new year with an overly pessimistic view of oil demand, and sees an oil price rally unfolding in the coming months. StanChart estimates that January oil demand clocked in at 100.24 million barrels per day (mb/d), good for a 2.67 mb/d year-over-year increase and 0.25 mb/d higher than StanChart’s latest forecast. StanChart has now revised its earlier 2024 demand growth forecast to 1.69 mb/d from 1.64 mb/d previously. The analysts have also predicted a sustained period of inventory draws in H1-2024, with the cumulative draw coming in at 185 mb compared with a H1-2023 build of 230 mb.

StanChart has predicted that global demand will hit a new all-time high of 103.01 mb/d in May, with June setting a new record at 103.62 mb/d while August demand is expected to be even higher at 104.31 mb/d. StanChart says tightening oil markets will continue to power the oil price rally and has predicted Brent to average $94/bbl in Q2-2024.

Supply growth is likely to remain constrained, with StanChart predicting that U.S. crude supply will not grow significantly higher than November 2023’s all-time high of 13.319 mb/d. Meanwhile, Russia is intent on keeping supply tight in a bid to support higher prices. A few days ago, Moscow ordered oil companies to lower their output in the second quarter so that the country can meet its OPEC+ production target of 9 million barrels per day (bpd). Private sources have told Reuters that Moscow has given specific targets to each oil company, an indication of Moscow’s commitment to keep its OPEC+ pledge. Russian oil and gas condensate production has declined to 10.8 million currently from an annual peak of 11.7 million bpd in 2019 due to production cuts. The fall has come despite Russia experiencing a drilling boom even after concerted efforts by the U.S. and its allies to limit technology transfer. The withdrawal of major Western oil field service companies from Russia left their local subsidiaries to fill their void, and appear to be succeeding so far.

“Only some 15% of the nation’s domestic drilling market depends on technologies from so-called unfriendly nations,” Daria Melnik, vice-president for exploration and production at Rystad Energy, has revealed.

However, production disruptions due to Russia’s war in Ukraine continue. Last week, Russia's Kuibyshev oil refinery halted one of its two primary refining units, effectively taking half of its capacity offline following a Ukraine drone attack. The attack over the weekend, the eighth on Russian refineries in the last three weeks, will knock another 35K bbl/day of Russian refinery capacity out of action, bringing a total of ~400K bbl/day offline on top of normal maintenance.

The full Morgan Stanley report is available to pro subscribers in the usual place