Rising volatility in USD/JPY will make the yen carry trade less attractive. Dollar-yen is now more correlated with US 2-year yields compared to the 10 year, meaning FX volatility is likely to keep rising the closer the Federal Reserve gets to making its first change in rates.

It’s getting precarious for yen carry traders. Twice in recent days has Japan been suspected of intervening to strengthen the yen, with the latest occurring not long after Wednesday’s Fed meeting, where the FOMC pushed back against further rate hikes and tapered quantitative tightening more than expected.

The carry trade depends on rate differentials. Traders borrow the yen, swap it for dollars, i.e. buy USD/JPY, then use the proceeds to buy a US asset, such as T-bills or Treasuries. But that leaves them long USD/JPY and therefore exposed to falls. A big enough move in spot could wipe out the profit from the US versus Japanese rate spread.

That’s why the volatility of the currency matters to carry traders. If it is too high, then the trade becomes too risky. Which is one of the reasons, as Paul Dobson mentions, that the MOF likely prefers to intervene when market liquidity is low.

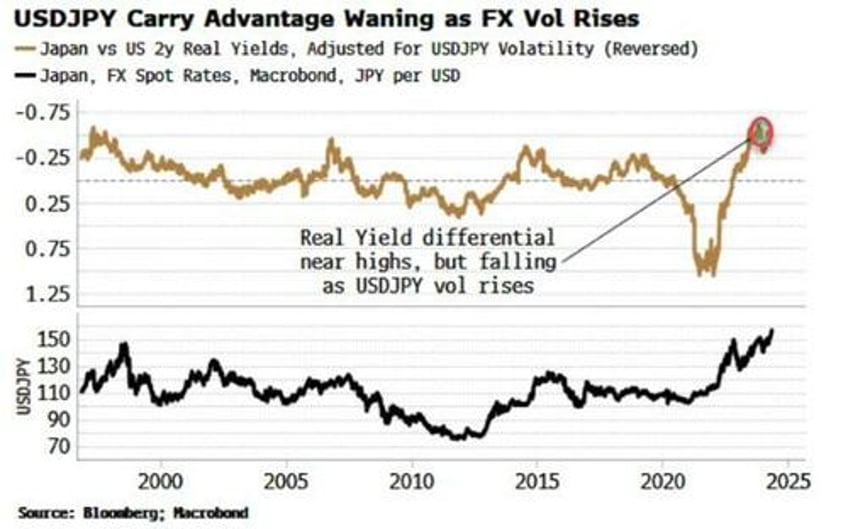

Adjusting the US-Japan real rate differential for USD/JPY volatility shows the measure is still high, but it is beginning to fall. The more vol rises, the more it will keep falling (other things equal).

Aside from the intentional introduction of vol premium from intervention, USD/JPY volatility is likely to pick up more the closer the Fed gets to making its next interest-rate move – which is more likely to be a cut if they shift rates this year.

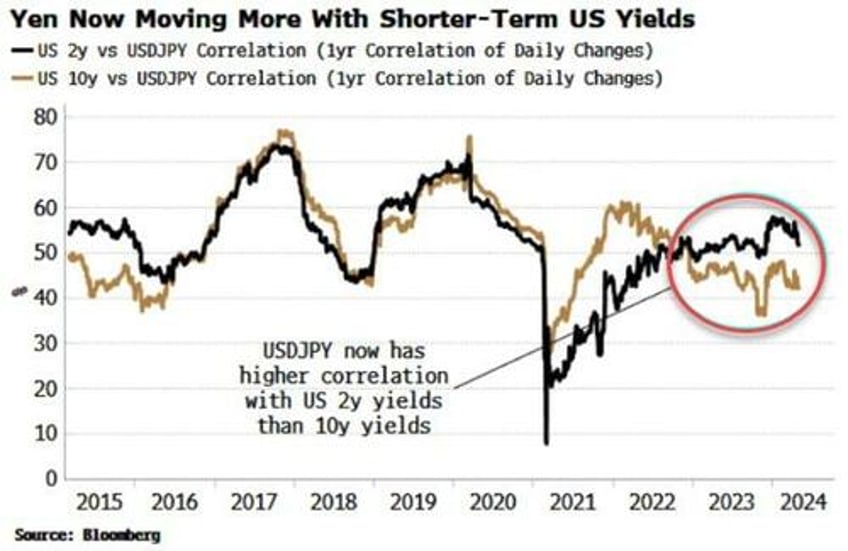

The reason why is that USD/JPY is now more correlated to US 2-year yields than 10-year yields. Since the Fed started hiking in 2022, and the yield curve kept inverting with the 10-year UST’s yield falling versus the 2-year, the latter’s yield has been more correlated to USD/JPY.

Shorter-term yields are likely to get more volatile, which will feed into FX volatility and make the yen-dollar carry trade less attractive.

Still, carry is a moreish drug, and it’s unlikely to be enough to completely derail the trade. The endgame’s not likely to come until the Fed cuts rates – given the US Treasury’s swelling interest bill and the impact on market liquidity, the likelihood they do is increasing, despite rising inflation.