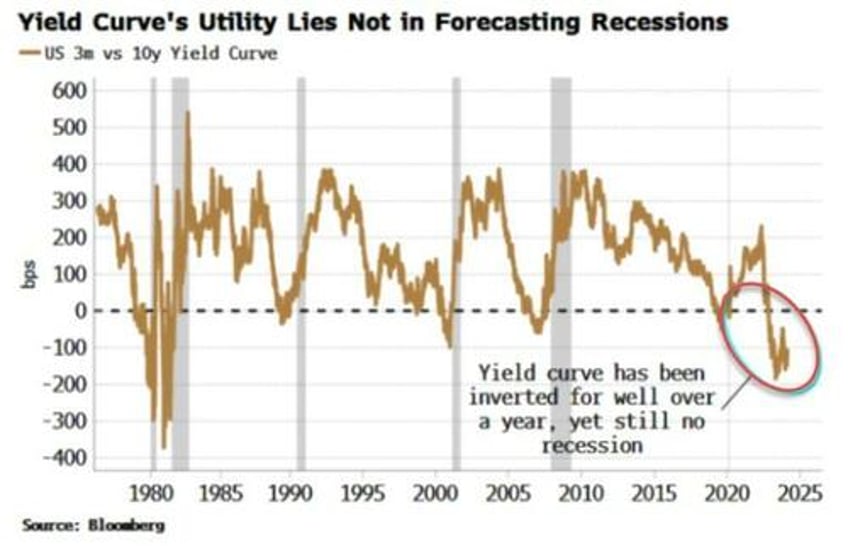

The yield curve has proven a poor (or very early) recession indicator in this cycle. This year, though, it will be far more useful in describing the evolution of liquidity and of funding markets, both critical to highlighting when the stock rally might be about to flounder.

Specifically a bear steepening – longer-term yields rising more than shorter-term ones – will indicate that liquidity and money velocity are in jeopardy from rising government interest payments, and that funding markets are approaching the point where reserves could shift from abundant to scarce abruptly.

Both will imperil risk assets.

Stocks and other risk assets face the perfect storm if longer-term yields continue to outpace their shorter-term counterparts in a bear steepening of the yield curve. An increasingly plausible re-acceleration in inflation makes this outcome more likely.

This year, jettison the yield curve as a recession predictor. With ever more blurring of fiscal and monetary policy, 2024 will be a liquidity battle between government interest payments and funding markets. Rather than anticipating a downturn, the yield curve will have enormous utility as a barometer of liquidity and funding conditions, and thus will act as a leading indicator for when risk assets are about to run into trouble.

A persistent bear steepening of the curve is the worst outcome for markets, as it implies Treasury bills are likely to continue being attractive to money market funds (MMFs), depleting the Federal Reserve’s reverse repo (RRP) facility and thus increasing the likelihood of funding stress.

At the same time, rising yields at the longer end of the curve will inflame the government’s already soaring interest bill, acting as a hoover on monetary velocity. The longer the steepening curve persists, the greater the chance that the economy and stocks – already facing an options-driven risk of a blow-off top – flounder.

Ironically, the issue lies in what was initially a solution to last year’s potential problem: markets facing steep selloffs due to heavy government issuance. The Yellen pivot — the Treasury’s decision to skew issuance toward T-bills — allowed MMFs to sop up the new debt using idle liquidity parked at the RRP, preventing the surfeit of government borrowing from crowding out risk assets.

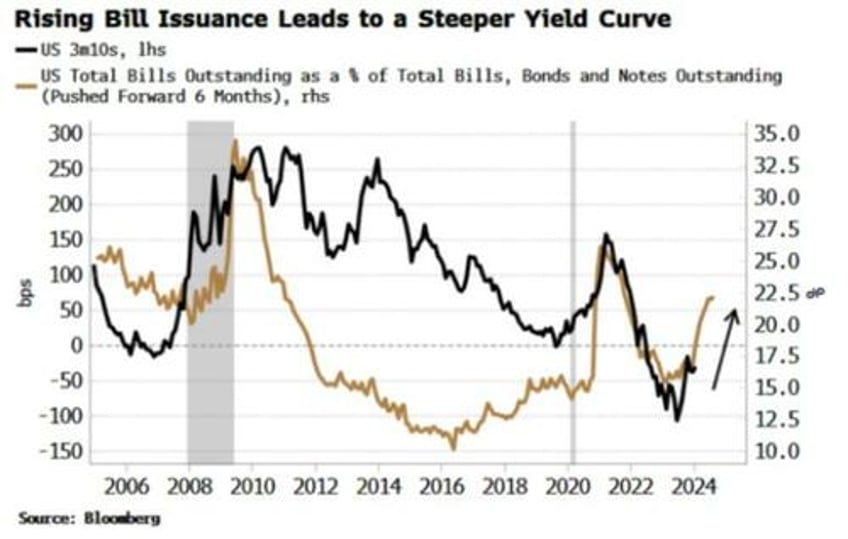

The Yellen pivot is expected to continue for now. That means the yield curve should resume steepening. A rise in bill issuance would typically be expected to lead to a flatter yield curve as yields at the front-end rise, but that’s not what we observe. As can be seen in the chart below, rising bill issuance tends to lead to a steeper curve.

How so? Well, if bill demand is elastic, then rising issuance has little impact on the yield, while the increased short-term supply pulls demand away from longer-term tenors, and the curve steepens.

That outlook neatly tallies with the message from other leading indicators of the yield curve, such as excess liquidity. It’s also what most still currently expect. But what type of steepening we get matters greatly.

The curve has been bear steepening lately, and if inflation comes back on to the scene as I expect it to — and as this week’s CPI data hints it might already be doing — such steepening is likely to persist.

That’s bad news for markets, however. Rising longer-term yields will further swell the government’s already ballooning interest bill.

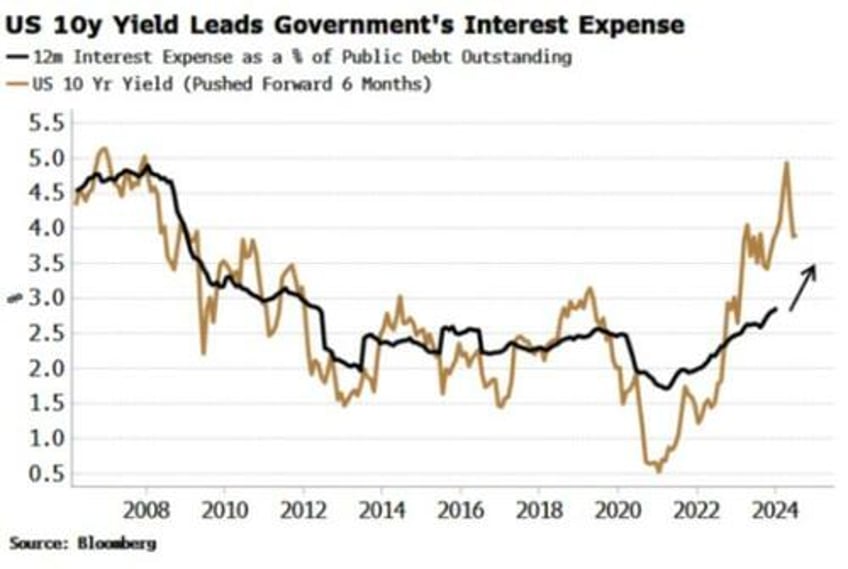

The 10-year yield does an excellent job of leading the US’s interest expense as a proportion of its debt outstanding.

Rising interest payments destabilize liquidity by reducing reserve velocity. Not so fast, you might say, as most interest is paid to the public and thus the proceeds continue to circulate in the economy. But only the household and corporate sectors are likely spend the interest remitted to them — yet they are the smallest holders of Treasuries, accounting for only about 10% of the issuance outstanding.

Financials, the biggest owners, are more likely to reinvest interest paid to them in financial assets. The money to pay the interest, which comes from tax payments or more borrowing, is met with bank deposits. The net result is that the reserves are still in the system, but they are held by savers with a lower propensity to spend, and so their velocity falls.

The relationship in the chart above projects the annual interest expense could be as high as $1.4 trillion (from $980 billion currently) within six months, based on where 10-year yields are.

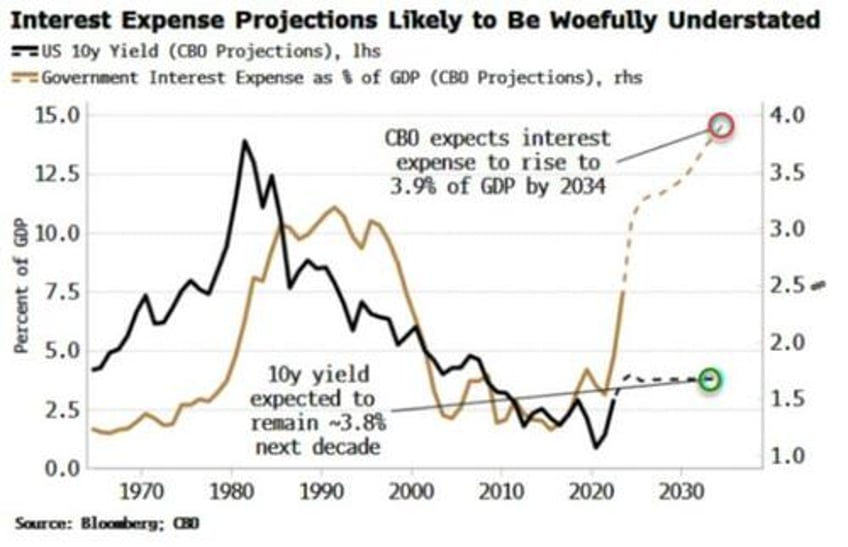

That’s less than the Congressional Budget Office’s latest projections. It sees it at $1 trillion in 2026 and $1.6 trillion in 2034, or 3.9% of GDP. But take these numbers with a clump of salt. Shown in the chart below along with the CBO’s interest projections is its forecast of the 10-year yield over the next decade. Readers can decide for themselves if they think its projections are realistic, and thus the likelihood the interest bill could be much higher than the CBO’s predictions.

That’s already a terrible backdrop for risk assets. And there’s more bad news. The Treasury’s bill issuance is increasing the likelihood of a flare-up in funding markets, by keeping bill yields attractive enough for MMFs to carry on drawing down the RRP.

While this was beneficial for risk assets last year, as quantitative tightening continues and the so-called lowest comfortable level of reserves (LCLOR) is approached, it means we are nearing the “event horizon” in funding markets, where reserves can go from abundant to scarce in a heartbeat.

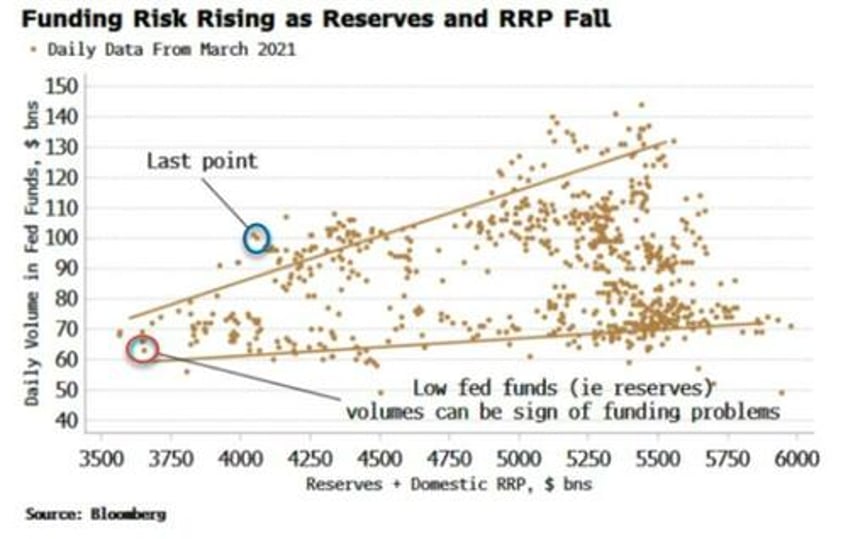

As discussed in a previous column, one prior portent of funding problems has been a sudden drop in fed funds (i.e. reserves) volumes, followed by a rapid rise — like a tsunami wave, drawing back before surging forward and releasing its force.

Reserves have risen lately and are still higher than they were when the Fed began QT in 2022. But the RRP has been falling, taking the sum of reserves and the RRP steadily lower. That typically means lower fed funds volumes and a harbinger of funding stress.

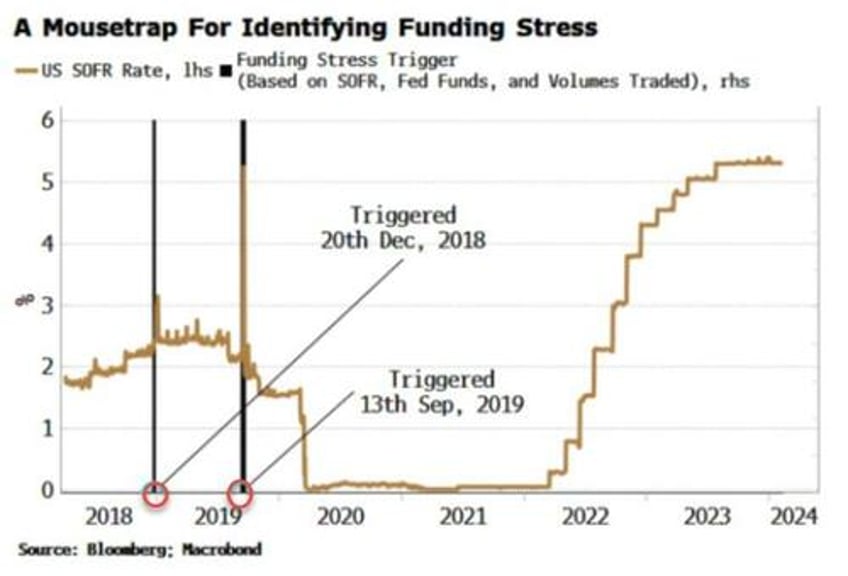

Encapsulating this is the Funding Stress Trigger (explained here), designed to go off ahead of a sharp rise in funding rates that will destabilize risk assets if left unchecked.

This year will thus see a delicate interplay between three things:

by how much higher yields absorb liquidity from the system;

how much liquidity they attract from the RRP; and

when total reserves in the system are about to become scarce.

The time horizons these operate over are different: the effect on liquidity from rising interest payments will happen over a period of weeks and months, while the impact from bill issuance and the RRP can be almost immediate.

Nonetheless, to give a very rough back-of-the-envelope idea, consider what happened after Tuesday’s higher-than-expected CPI print. Ten-year yields are about 12 bps higher since then, and three-month yields about two bps higher, i.e. a bear steepening of ten bps. Using the 10-year yield as a proxy for the interest expense predicts a potential rise of about $30 billion, while the domestic RRP fell about $27 billion on Tuesday.

The steepening thus indicates a weaker liquidity backdrop and a funding market closing in on levels of reserves that could abruptly trigger funding stress, neither of which are supportive of risk assets.

So: park the yield curve as a recession tool, and if you’re long risk assets, pray it doesn’t continue to bear steepen.