Bitcoin’s price may have seen its drawdown bottom as the German government has now run out of Bitcoin to sell, and technical indicators point to the potential beginning of a reaccumulation phase according to CoinTelegraph.

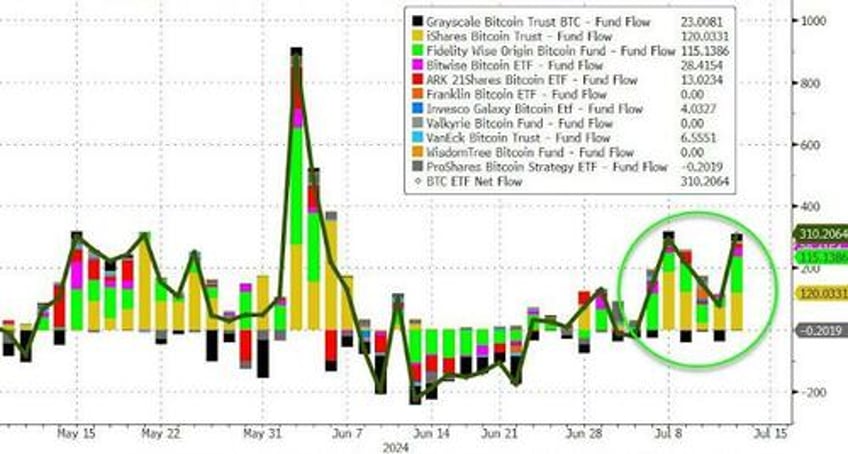

The German government’s wallet is down to just 0 Bitcoin, only three weeks after it started selling. As a result, the additional $222 million worth of selling pressure has pulled BTC’s price below $60,000 over the past week, but signs of a potential bottom are emerging following a flood of bitcoin ETF buying:

Anyway, back to Germany's bitcoin liquidation: in its latest transfers on July 12, the German wallet sent 800 BTC to Kraken exchange, 500 BTC to wallet “bc1q” and another 1,000 BTC to wallet “="139p” before liquidating its last remaining 3,094 bitcoin.

According to Arkham Intel, "the German Government now has $1 of Bitcoin... The German Government sent their entire balance of 49,860 BTC ($2.90B) to exchanges and market makers in the past 3 weeks."

BREAKING: The German Government is now out of Bitcoin.

— Arkham (@ArkhamIntel) July 12, 2024

The German Government just sent 3846.05 BTC ($223.81M) to Flow Traders and 139Po (likely institutional deposit/OTC service).

The German Government has 0 BTC ($0.00M) remaining. pic.twitter.com/R2vfylR1b2

The wallet started selling Bitcoin in the middle of June after it held nearly 50,000 BTC since February 2024. The funds are believed to have been seized from the pirate movie website operator Movie2k.

The end of the German government’s Bitcoin selling could help Bitcoin find its local price bottom. For instance, technical analysis using the Wyckoff method points to a potential price bottom and a recovery above the $60,000 psychological mark:

BREAKING: The German Government is now out of Bitcoin.

— Arkham (@ArkhamIntel) July 12, 2024

The German Government just sent 3846.05 BTC ($223.81M) to Flow Traders and 139Po (likely institutional deposit/OTC service).

The German Government has 0 BTC ($0.00M) remaining. pic.twitter.com/R2vfylR1b2

Other indicators are also pointing to a local price bottom, including the Coinbase Premium:

Indicators: Coinbase Premium showing bottom. ☝️#Coinbase @coinbase #Bitcoin https://t.co/vHLURZj75W pic.twitter.com/yB5RwcJ5ny

— MartyParty (@martypartymusic) July 11, 2024

The Coinbase premium measures the price differences between Bitcoin on Coinbase, largely used by United States investors and Binance. The premium signals US demand for Bitcoin compared to the rest of the world. Still, Bitcoin’s price needs to hold above the $56,750 mark to stop further bearish momentum.