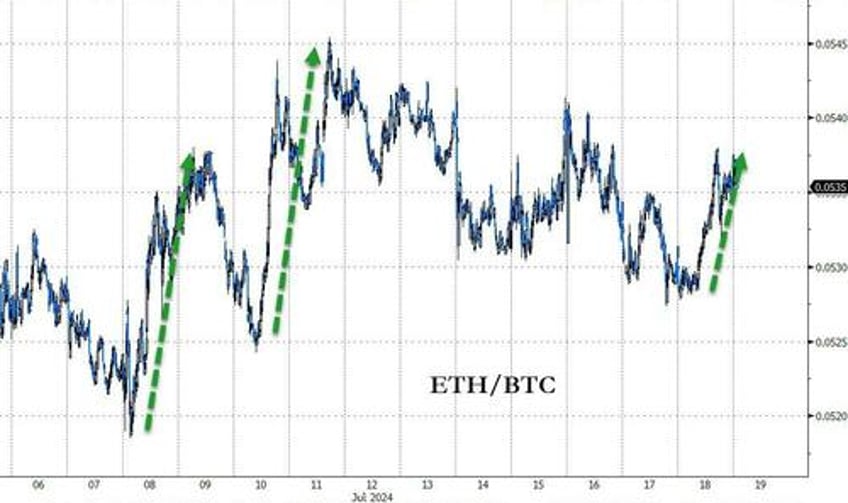

Ether price rallied 12.5% between July 12 and July 15, but strong resistance at $3,500 halted the bullish momentum.

The subsequent correction down to $3,400 on July 18 occurred despite the United States Securities and Exchange Commission (SEC) approving two additional spot Ethereum exchange-traded funds (ETFs).

Despite this positive development, Ether’s derivatives market has shown little excitement.

Analysts predict $5,000 ETH price, but is it realistic?

The SEC reportedly gave preliminary approval to at least three issuers to begin trading spot Ether ETFs on July 23.

A total of eight spot Ether ETFs are awaiting final regulatory approval after amendments to the funds' S-1 filings.

Bitwise Chief Investment Officer Matt Hougan expects Ether’s price to reach $5,000 by the end of 2024, citing its low equivalent inflation rate, lack of significant cost for validators, and 28% supply locked in staking.

Given the total crypto market capitalization gained 43% year-to-date in 2024, it is puzzling why Ether’s investors lack bullishness, despite the spot ETH ETF momentum. Furthermore, volumes on Ethereum decentralized applications (DApps) rose 7% in the last 30 days to $221 billion, according to DappRadar data. In comparison, competitor BNB Chain saw a 25% decline in activity, while Solana experienced a 16% drop in volumes.

Blockchains ranked by 30-day DApps volumes, USD. Source: DappRadar

In terms of DApps deposits, the Ethereum network remains the leader with 17.5 million ETH in total value locked (TVL), equivalent to $59.8 billion, according to DefiLlama data. This metric remained flat from the prior month, while competitors Solana and BNB Chain hold approximately $4.8 billion each. Additionally, activity in Ethereum’s layer 2 ecosystem increased, with the aggregate native TVL rising by 8.5% over the past 30 days to $14 billion, according to L2Beat data. Thus, Ethereum onchain data shows no signs of weakness.

From a macroeconomic perspective, the latest US Producer Price Index was 2.6% above the prior year, slightly above the market consensus of 2.3%. This indicates that the US Federal Reserve (Fed) still has work to do to curb inflation, meaning price pressure will continue to hurt demand for a while. Moreover, China’s disappointing 4.7% yearly gross domestic product growth could spell trouble for global stock markets.

Additionally, the US Department of Labor reported 243,000 initial jobless claims were filed in the week ending July 13, the highest level since August 2023. The signs of a cooling labor market increase the odds of the US Fed cutting interest rates over the next couple of months, according to Goldman Sachs chief economist Jan Hatzius, as reported by Yahoo Finance.

There is no indication that investors are exiting risk markets, which is evident as the S&P 500 index is only 2% below its all-time high from July 16. Meanwhile, Ether’s price needs to gain 43% to surpass the $4,868 mark set in November 2021.

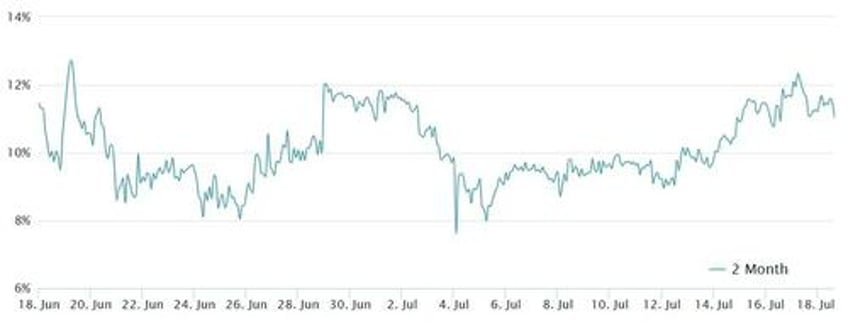

Ether futures do not anticipate an imminent price pump

To assess whether crypto traders are gaining confidence, one should analyze the Ether futures premium. In normal markets, these contracts should trade 5% to 10% higher than regular spot markets to account for their extended settlement period.

Ether 2-month futures contracts premium. Source: Laevitas.ch

The Ether fixed-month contracts annualized premium, or basis rate, currently stands at 11%, indicating moderate optimism. However, this indicator has not sustained levels above 12% for the past month, which is somewhat concerning given the potential inflows from the upcoming spot ETF launch in the US. For comparison, Bitcoin’s basis rate also stands at 11%, indicating there is no excessive bullishness among Ethereum investors.

Ether bulls might argue that the current lack of confidence leaves room for a surprise if the expectation of strong spot ETF net inflows is confirmed.

Still, given that Ether’s price failed to rally despite a bullish scenario for risk-on assets, the ETH derivatives metrics point to investors’ lack of appetite, making a bull run above $4,000 less likely.