Putting the Recent Crypto Carnage Into Perspective

This week ended badly for everything, with the DJIA losing %1 on the day, 1.7% on the S&P500 and 2.55% for the Nasdaq, Zerohedge called it “Kamala Karnage,

“and boy was it an epic flush: everything – like literally everything – and certainly anything with a high beta or even a trace of momentum, imploded with a sheer violence that made Aug 5 look like amateur hour.”

Bitcoin, touched as low as $52.7K – a week ago it was flirting with $60K -prompting the usual no-coiners to gloat that Bitcoin was “imploding”, seemingly implying that everything else wasn’t tanking as well.

When August 5th Black Monday hit, the alert sent out to my Bitcoin Capitalist Letter readers said

My view is that this entire selloff in crypto is 100% a macro induced liquidity crisis and globally contagious margin call.

It has very little (nothing?) to do with Bitcoin, it has everything to do with a few chickens coming home to roost and a mad scramble for solvency.

Pretty well everything is down hard and the reason cryptos are down harder is because, as we all know, there are no circuit breakers or “plunge-protection teams” for Bitcoin or anything else in the space, and it all trades 24x7x365.

That’s why it tends to overshoot to both the upside and down.

Contrast this summer softness in Bitcoin with 2021-2022 crypto winter, which was 100% subject to the internals of the digital assets economy itself: Terra/Luna, 3AC, Celsius, and of course, the FTX debacle brought a well deserved purge to the space and the (some of) the most egregious offenders are where they belong: in prison.

Many look at the unrestrained volatility of Bitcoin and gloat, arguing that it makes it untenable as a store of value. (I wonder who was around during the Weimar hyperinflation who, looking at the volatility of gold compared to the rapidly disintegrating Reichmark said the same thing: “Too Volatile to function as a store of value”. That’s right, nobody remembers them).

You’ll often see charts from Weimar Germany of gold priced in the paper mark going parabolic.

— Dylan LeClair 🟠 (@DylanLeClair_) May 23, 2021

What that chart doesn’t show is the sharp drawdowns & volatility that occurred during the hyper-inflationary period. Speculating using leverage got wiped out multiple times.$BTC 1/2 pic.twitter.com/tZhpP1KMS1

Something I’ve said since 2013 – when Mt. Gox imploded and everybody was calling it “The Death of Bitcoin”. This is what a free market looks like, no circuit breakers, no plunge protection team and even contrast to some of the cryptos, like Ethereum, no “do overs” in the form of hard forking your way out of a jam.

Because BTC is getting clobbered along with everything else, this is reminding me more of the COVID panic of 2020 more than it resembles the onset of the crypto winter, in 2021 (I think I launched The Bitcoin Capitalist Letter right at the top of that cycle, as luck would have it).

People point at the volatility as proof that Bitcoin is not a safe haven and it’s not a hedge – one prominent newsletter writer I’ve known for a long time constantly berates me that Bitcoin doesn’t move opposite to the dollar, as one should expect it to if it’s some sort of hedge against inflation or debasement.

Others say that “Bitcoin is basically Tesla” or that it simply moves with, and trades like just another high flying tech stock or the Nasdaq as a whole.

They’re not entirely wrong about Bitcoin’s correlation with high tech, but they’re not seeing the entire picture either.

Our current era is driven almost entirely by technological advancement, that idea isn’t controversial to most people – however they do fail to grasp the ramifications of the feedback loops technology creates and the accelerating pace of change that comes with it.

This is why the tech sector is moving faster and outperforming everything else and it’s why Bitcoin is outperforming the tech sector. My mantra, as laid out in The Crypto Capitalist Manifesto, is:

Bitcoin isn’t a trade. It’s a monetary regime change.

In Ferdinand Lips’ “Gold Wars” (cited in “Sound Money Makes for Short Wars“), he talks about how the global move to a gold standard happened without governments (or globalists) decreeing that it should be so, owing to gold’s superiority as a monetary metal:

By 1900, approximately fifty countries were on a gold standard. including all industrialized nations. The interesting fact is that the modern gold standard was not planned at an international conference, nor was it invented by some genius. It came by itself, naturally and based on experience. The United Kingdom went on a gold standard against the intention of its government. Only much later did laws turn an operative gold standard into an officially sanctioned gold standard.

This is exactly what’s happening today with Bitcoin, only the people who have been so wrong about it for so long are digging in even harder now, despite it becoming more obvious by the day that this is the direction things are going (I can imagine some future history teacher stumping her class with “You’ll never guess which nation state was the first one to adopt Bitcoin as legal tender, I’ll even give you a hint: It wasn’t any of the former US Republics”).

What’s so disorientating about it happening now is because where in the past, when the incentives impelled market actors toward a gold standard, it took place over decades or even centuries. For most people, in any given lifetime, the current monetary regime of the day was something that had been in place already the day they were born, and it probably wasn’t going to change over their own lifetime.

Those exceptional occasions when it did are where history books come from. Panics, wars, hyperinflations throughout the ages were once-in-a-lifetime or generational events. Today you’re seeing it unfold in your twitter feed.

Now, because of the technology curve and acceleration in the rate of change, they happen all the time, with increasing frequency and magnitude.

Most of the ridiculous bullshit people believe today

— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) June 18, 2024

… and nearly all the policy blunders that are so catastrophically stupid as to appear to be intentional conspiracy

- are pure and simple Future Shock.

Go back and read the entire series.

Then you’ll get what’s actually… pic.twitter.com/9xGmhtnJJk

People like Peter Schiff (and my anonymized newsletter writer colleague) delight in seizing on any one-day squiggles where Bitcoin goes down and gold goes up as proof positive that “the Bitcoin trade” is over, and they trot out all the usual eulogies (“Tulips, backed by nothing”, “ponzi”, “NSA psyop“, et al).

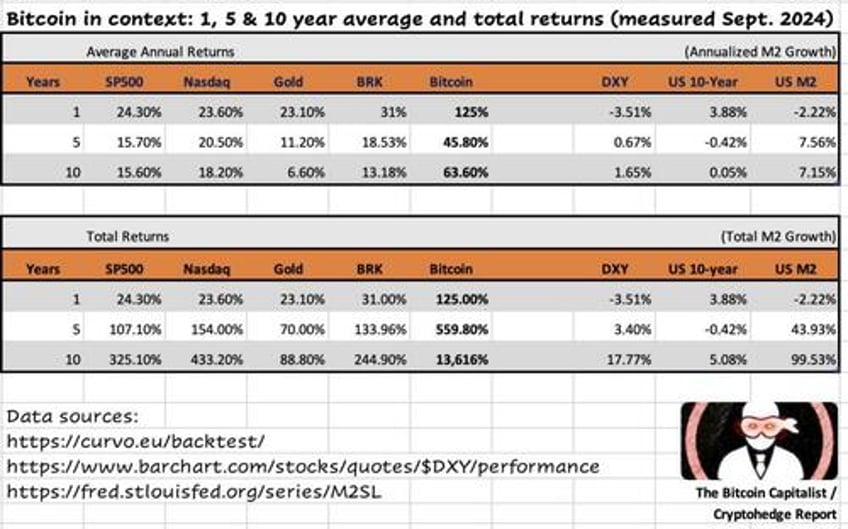

It takes an act of concerted motivated reasoning to blot out the cognitive dissonance that just looking at the factual record of Bitcoin’s performance must induce in the skeptics:

I included Berkshire Hathaway here because it’s run by Cantillionaires that hate Bitcoin and frequently lauded as tried-and-true capital allocation machine (despite its outperformance over the S&P being in a secular downtrend).

Also interesting to note that gold is barely keeping up with the expansion of M2 over a 10-year timeframe, and none of the Bitcoin-loathing goldbugs trash talking BTC on Twitter ever responds when I point out that gold still hasn’t surpassed it’s inflation-adjusted high from 1980.

Bonds are dead capital walking, “Return-free risk”, as they say. A cornerstone of my thesis is an eventual bond exodus that sees even a fraction move into Bitcoin (1% to 3% would put BTC somewhere in the high-6 or low-7 digits).

Bitcoin simply is the highest performing asset in absolute terms of all time.

At the end of the day, I’d be worried in the short term if there was something specific to the Bitcoin or crypto markets driving this pullback (like Tether finally being revealed to be a fraud, which we covered in latest letter) – but so far that’s still just speculation and it hasn’t become an issue.

The Bitcoin ETFs have not been dumping though the weakness. Many said they would, that the spot ETFs would make it easier to dump positions at the first sign of trouble.

“Despite price volatility, ETF holders have shown resilience, with no major outflows since March. But overall inflow rates have slowed considerably post-launch” — via Ecoinometrics

But as we’ve been saying over the last few issues, so far this cycle, it’s been all institutional – meaning, for most of the bull run this year (remember, Bitcoin is still up 22% YTD and 106% over the past year) so while institutions may prefer to garner their exposure via ETFs, they tend to take a longer term outlook and not to make sudden moves.

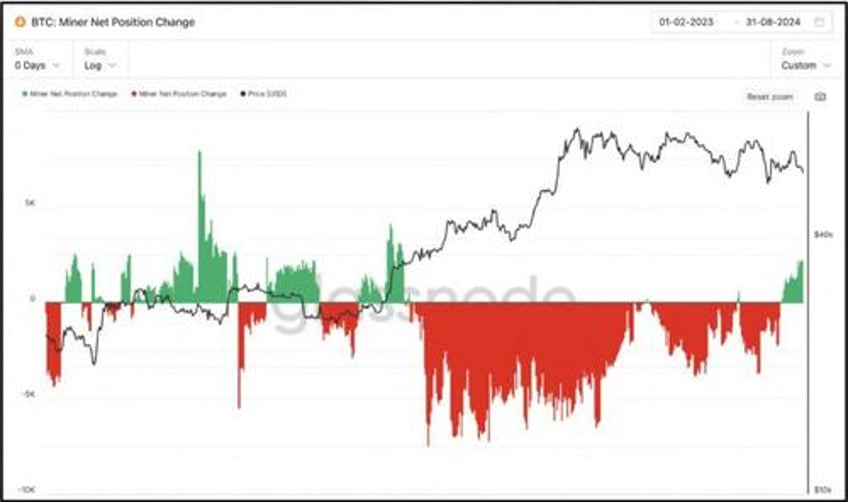

I’ve noticed that miners have been accumulating meaningfully for the first time in this year:

And finally, we’re pretty well in line with previous halving cycle years with the notable exception that Bitcoin put in fresh, all-time highs before the halving event in April, which is something that didn’t happen in previous cycles until several months afterwards.

In my mind, the major parabolic “up-only” move for Bitcoin is still ahead, perhaps dead ahead with the remainder of the cryptos to follow thereafter (except maybe Ethereum 😉

The global rate hike cycle is over, the central banks are trapped between dilemmas of their own making, policy makers are openly espousing capital controls, wealth taxes, if not outright communism – it’s really hard to see a scenario where Bitcoin doesn’t continue to attract more capital and take its place as the ultimate safe haven asset in this modern-day Fourth Turning.

* * *

Sign up to the Bombthrower Mailing list today and get a free copy of the aforementioned Crypto Capitalist Manifesto – I’ll also send you my forthcoming e-book The CBDC Survival Guide when it drops this fall.

Follow me on Twitter here, or Nostr: npub1elwpzsul8d9k4tgxqdjuzxp0wa94ysr4zu9xeudrcxe2h3sazqkq5mehan