Contents:

Summary of Citi's Uranium Report1

- Surging Uranium Prices

- Record Highs and Supply Constraints

- Revised Price Forecast

- Six Months of Price Rally

- Overcoming Challenges in Nuclear Energy

- Future Growth in Nuclear Energy

- Supply Risks Loom

- Geopolitical Risks and Speculative Activity

Key Quotes and Rationale

“This year’s climbing prices could be just a beginning for longer and higher”

“The market has changed overnight, and it is hard to go unnoticed”

“Nuclear energy continues to grow globally, with accommodative policies/financing, leading to strong uranium demand over the next few decades”

“Stabilizing role of inventories in the market could vanish”

1- Summary:

Surging Uranium Prices

Authored by GoldFix ZH Edit

Uranium prices (U3O8) have witnessed an exceptional surge, skyrocketing by more than 50% year-to-date. This impressive performance places uranium among the top-performing commodities this year.

In a notable milestone, the spot price of uranium breached the $70 per pound mark in September, drawing attention to its remarkable ascent.

Record Highs and Supply Constraints

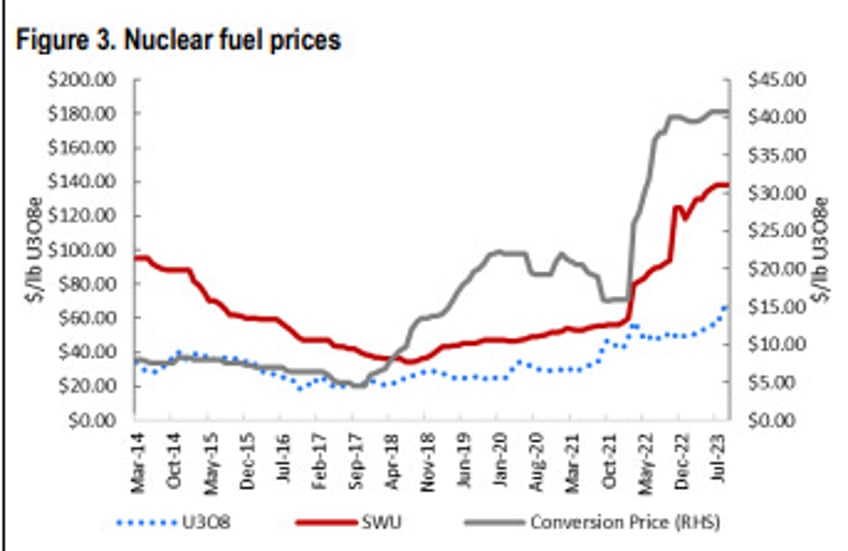

The nuclear fuel market has experienced its own version of record highs, driven by strong demand and constrained global capacity. Conversion prices (UF6) have maintained their upward trajectory, adding to the sector's momentum.

However, challenges loom over the horizon, particularly concerning Canadian mines and ongoing border closures in Niger.

These issues not only jeopardize uranium production levels for 2023 but also cast shadows over the prospects of new mining projects, potentially disrupting the delicate supply-demand equilibrium.

Revised Price Forecast

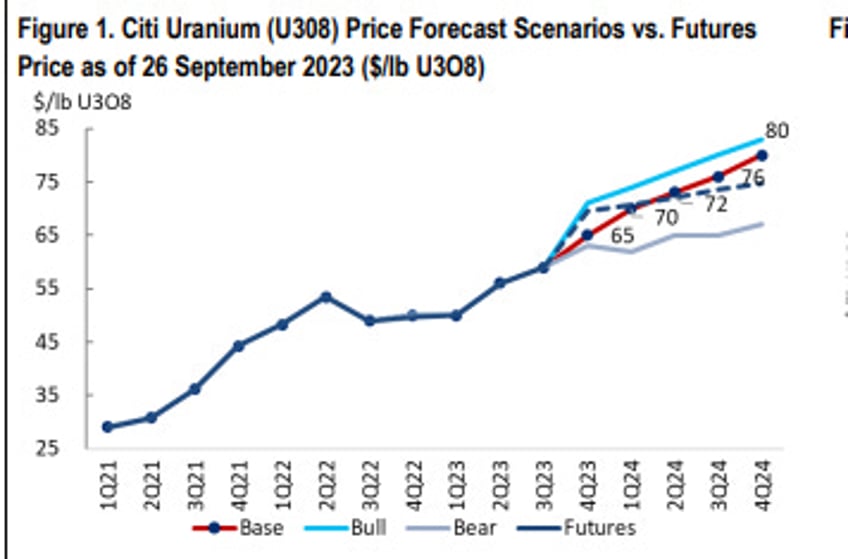

“A comparable historical period that we can think about is 2004-2007 when U3O8 prices hit $148/lb....An average of $75/lb U3O8 should be observed in 2024.”

In response to these pressing supply concerns and the sustained global support for nuclear energy, CITI has revised its price forecasts. Uranium prices appear to be transitioning into a new phase marked by heightened price volatility in a context of limited liquidity. A key driver behind this transformation is the fervent interest from utilities and financial funds seeking exposure to uranium assets.

Six Months of Price Rally

Overcoming Challenges in Nuclear Energy

While the nuclear energy sector continues to grapple with long-standing challenges, such as high overnight capital costs, operational security, extended construction timelines, and labor shortages, promising developments are on the horizon.

Advancements in technology and increased government funding for skilled labor are helping address some of these concerns. Rising borrowing costs and escalating capital expenditures for alternative energy sources are enhancing the global appeal of nuclear energy.

Future Growth in Nuclear Energy

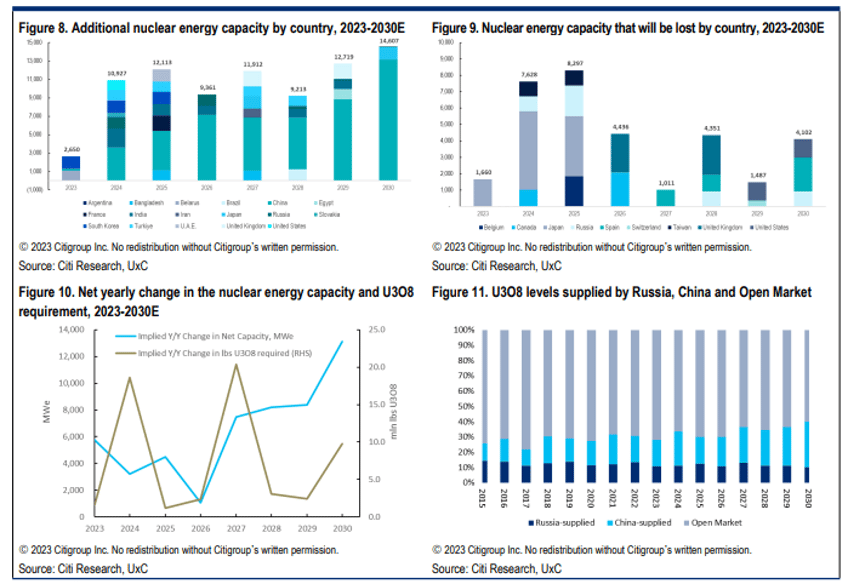

CITI maintains a positive outlook for nuclear energy, projecting a net addition of 50GWe of capacity globally by 2030, with China leading the way.

Continues here ...

Free Posts To Your Mailbox