Here's the FindLeadingStocks.com Morning Report 10/16/23

Good Morning Team,

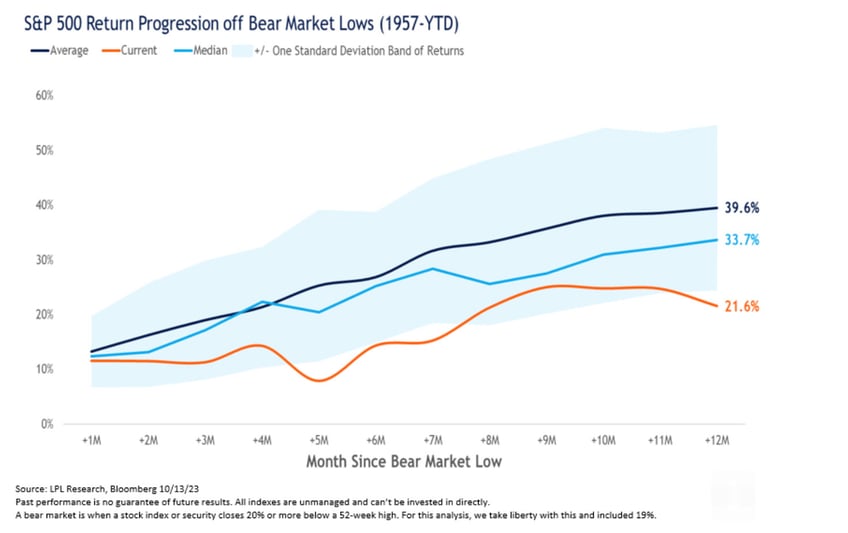

1. One Year Anniversary - The bull market bottomed one year ago on October 13, 2022. Since then, this has been one of the weakest rallies off a bottom that we have seen.

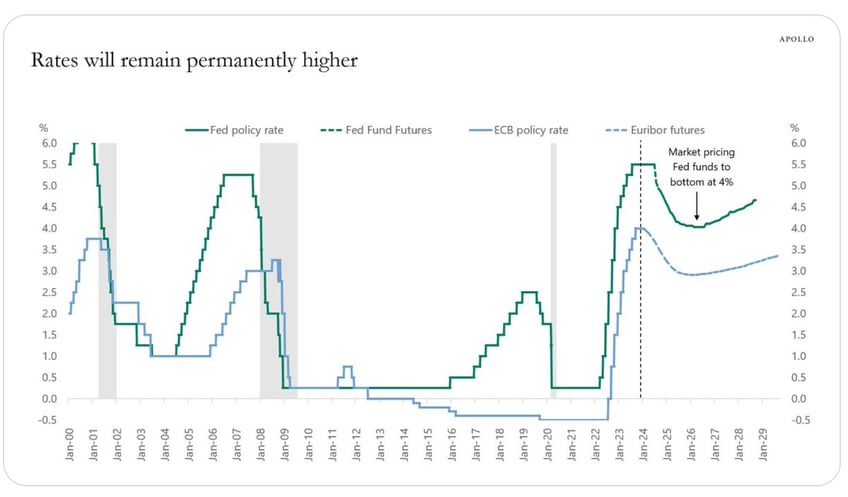

2. Higher Rates For Longer - Some people hope that once inflation hits 2% the Fed will slash rates and it will go back to/near zero - or at least the era of free money will return. The market believes higher rates are here to stay for the foreseeable future.

3. Busy Week Of Economic Data & Fed Speakers

Monday: NY Empire State Manufacturing Index (Oct), FOMC Member Harker Speaks, Federal Budget Balance (Sep)

Tuesday: Retail Sales, FOCM members Bowmen, Barkin, & Williams Speak, NAHB Housing Market Index,API Weekly Crude Oil Stock, Industrial Production, Redbook (YoY)

Wednesday: MBA Mortgage Applications, Building Permits, Housing Starts, Crude OIl Inventories & Imports, Fed Bowman, Harker, Cook, Williams, & Waller Speak, Beige Book

Thursday: Jobless Claims, Existing Home Sales, US Leading Index, Philly Fed Business Conditions, Fed Speakers: Powell, Harker, Logan, Goolsbee, Bostic, Jefferson, and Fed Vice Chair Barr Speak, Natural Gas Storage, Fed's Balance Sheet

Friday: FOMC Harker, Mester speak, US Baker Hughes Oil Rig Count, CFTC Speculative Net Positions Released

4. Busy Week Of Earnings.... There are more stocks reporting this week. Here are some that I will be watching.

Monday: BEFORE THE OPEN SCHW

Tuesday: BEFORE THE OPEN: BAC, LMT, GS, JNJ, PLD, ERIC, BK, ACI,- AFTER THE CLOSE - UAL, IBKR, JBHT, HWC

Wednesday: BEFORE THE OPEN: ASML, PG, MS, ABT, USB, NDAQ, ELV, MTB, ALLY, TRV, CFG, WGO, STT, AFTER WED'S CLOSE: TSLA, NFLX, LRCX, LVS, AA, DFS, EFX, SLG, STLD,

Thursday: BEFORE THE OPEN: T, TSM, AAL, BX, NOK, KEY, FCX, UNP, FITB, POOL, IRDM, AFTER THE CLOSE: ISRG, WAL, CSX, OZK, KNX, MCB,

Friday: BEFORE THE OPEN: AXP, SLB, ALV, CMA, HBAN, RF, IPG, WRLD, AND SXT AFTER THE CLOSE NOTHING.

5. Most Important Thing I'm Watching: How Will The Market React To Everything Mentioned Above Plus The Ongoing Situation In The Middle East.

Remember, from the weekend report, defense is key because the major indices are below their respective 50 DMA lines.

That means the bears have, once again, regained the upper hand.

Have a great day,

Adam Sarhan

FindLeadingStocks.com