Quotes from Sampath Sharma Nariyanuri, Fintech Research Analyst at S&P Global Market Intelligence

"The bearish funding cycle for fintech startups is likely bottoming out, with deal volumes at startups in later funding stages stabilizing in recent times. The improved investor sentiment for fintechs in public markets has yet to trickle down to private markets, creating some opportunities for venture capitalists (VCs) to deploy capital at relatively attractive valuations and add alpha to returns. While it could still be a tall order for the industry to register growth in funding in the first half of 2024, S&P Global Market Intelligence anticipates that the second half to experience flat to modest growth in funding.

Q4 2023 hedge fund letters, conferences and more

“In 2024, fintechs will face ongoing pressure to strengthen their compliance policies, while maintaining agility and utilizing rapid iteration to learn and improve. VCs will continue to prioritize capital-efficient growth and predictability in revenue. The fintech sector will increasingly leverage artificial intelligence to introduce new products, enhance the end user experience and drive incremental topline growth. A re-evaluation of investment opportunities could lead to a geographical and segment rotation for VCs."

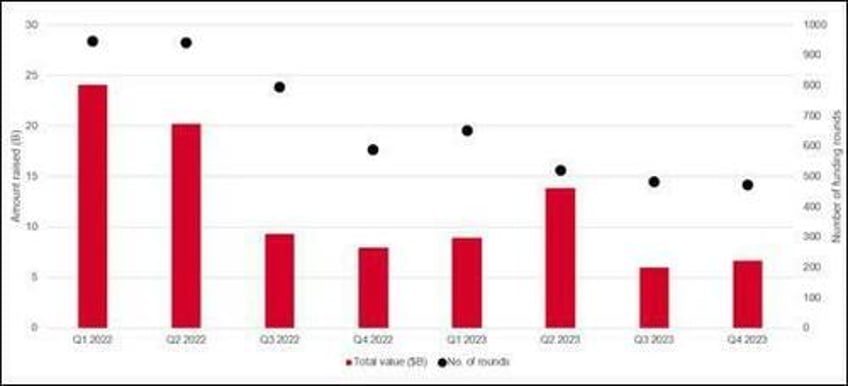

Funding winter may be nearing end as deal count, values stabilizing

Source: S&P Global Market Intelligence 2024

© 2024 S&P Global

Key highlights from the report include:

- Venture capital flows into fintechs dropped 42% year over year (y/y) to $35 billion in 2023, according to S&P Global Market Intelligence data.

- By region, North America and Asia Pacific (APAC) each dropped 27% to register investments of $17 billion and $9 billion, respectively. Funding in Europe, Middle East and Africa (EMEA) and Latin America plunged 62% to $8 billion and 71% to $1 billion, respectively.

- In terms of segment, investment and capital markets suffered the most amid crypto winter, dropping 72% to $4 billion. Payments remained the largest destination for VCs, drawing $14 billion of investment, down 26% y/y, thanks to a trio of big-ticket (about $1 billion) deals.

- The industry saw "insider rounds" as VCs backed leaders in their portfolios to extend their runways, by writing smaller checks, mostly at valuations of previous rounds. As a result, the number of late-stage rounds remained resilient and even grew over 8% in the final quarter of 2023.

- Outlook for 2024

- VCs tend to rotate between segments and geographies. Investment and capital markets, banking technology and digital lending are likely candidates for a rebound, partly due to the low base effects. In terms of geography, Latin America and Europe could be up for a revival.

- Fintechs with recurring revenue models may continue to be prioritized above startups with usage-based fintech revenue streams.

- Fintechs operating in regulatory gray areas will face pressures to shore up compliance policies and build risk management capabilities. VCs may be reluctant to allocate capital to banking-as-a-service vendors connecting banks to end users without greater due diligence.

- Among other favorable funding themes are fintech models expected to gain from the ongoing implementation of FedNow, the planned modernization of European payments and the current migration toward ISO 20022 messaging standard.