A few weeks ago, we reported that Russian crude oil exports are finally starting to show signs of decline.

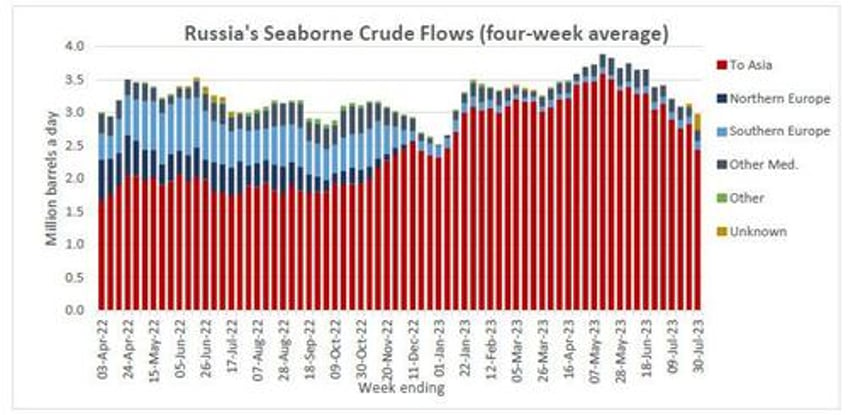

Since then, the slowdown in Russian outbound flows has accelerated substantially, and as Bloomberg's Julian Lee reports, Russian seaborne crude flows in the four weeks to July 30 slid to the lowest since early January, as Moscow continues to cut supply to international markets.

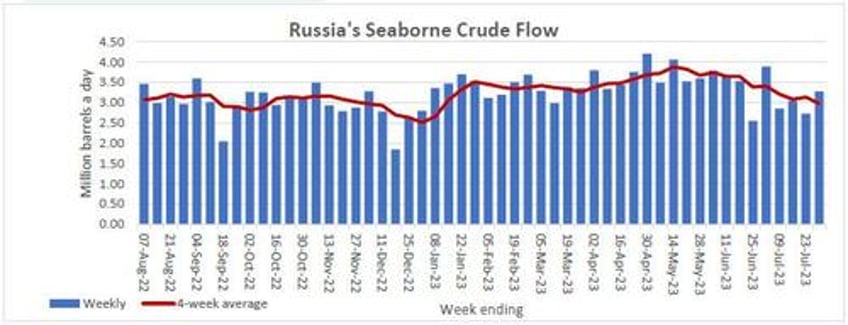

Russia's four-week average crude shipments fell by 154k b/d to 2.98m b/d, down by 905k b/d from their peak in mid-May and 400k b/d below the level seen in February.

... even as the more volatile weekly shipments jumped, rising w/w by 548k b/d to 3.28m b/d, although a lot of the weekly swing is due to seasonality.

As a reminder, February was the baseline month cited when the Russian government announced a 500k b/d output cut that was due to come into effect in March. While the cut was clearly delayed, Russian seaborne flows are now clearly in compliance with Russia's output cut.

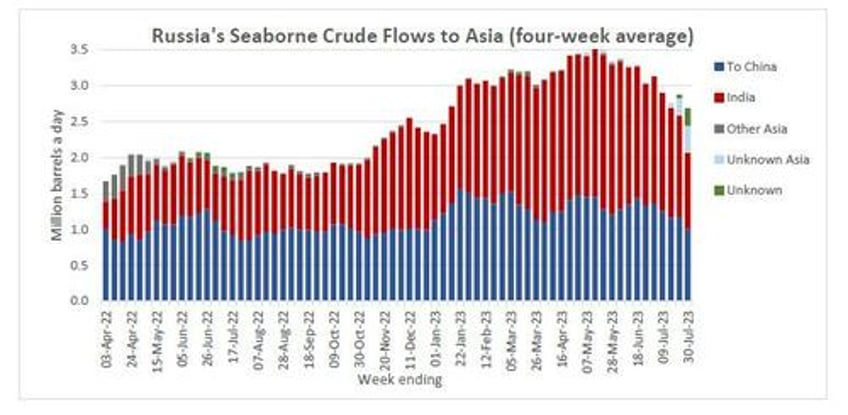

A breakdown of Russian flows by destination shows that Indian supplies have dropped sharply, followed by a more modest decline in China shipment, even as shipments to "unknown" countries in Asia have picked up.

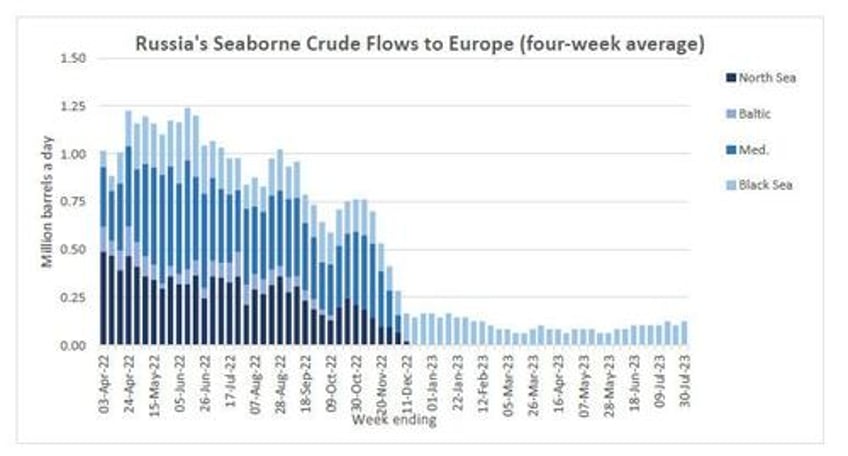

Where there was no pick up, was in Russian flows to Europe...

... and there certainly won't be a pick up any time soon, as the average price for Russia’s Urals crude export blend soared 16.4% m/m to $64.37/bbl in July, the Finance Ministry said in a statement.

That price is far above the G-7 price cap for Russia’s oil, set at $60/bbl (see "In "Victory" For Moscow, Russia Defies Sanctions By Selling Oil Above Western Price Cap" for more). And while the July price of Urals was nearly 18% down y/y from $78.41/bbl in July 2022, it means that virtually all Urals supply is now verboten to western clients, who will be afraid of consequences should they violate the embargo.