Subscribe on our website www.gmgresearch.com

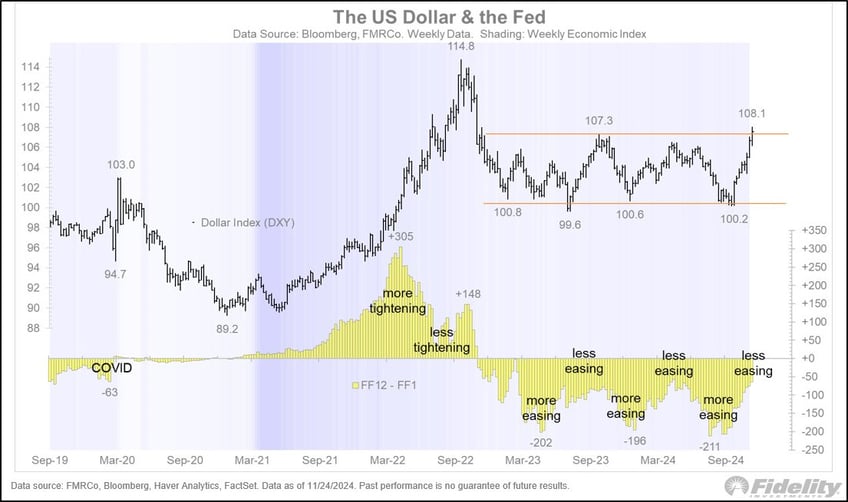

Dollar is strong. Commodities holding up.

Equal weighted S&P is making new highs (bullish broadening).

Macro: Most “investors” on Wall Street are brainless with a bottom-up mindset (CFA) which can lead to a lot of confusion when macro forces take over the narrative.

Recent Bitcoin and data-center names that are gaining attention are APLD, WULF & IREN.

Email us

% of S&P 500 above the 50ma shows we are NOT overbought

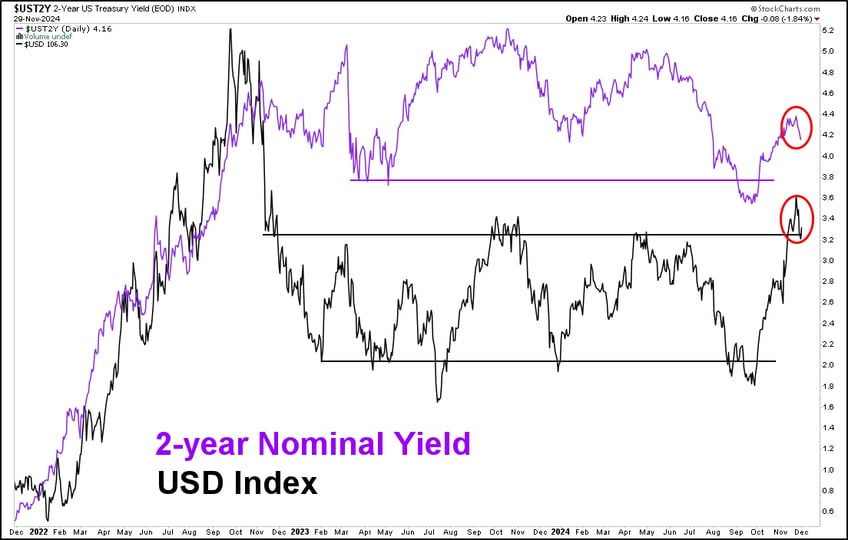

Macro data was extremely weak in late Nov causing rates to come down a bit.

Same data, different display.

On Sept 30th we brought OPRA to your attention. Up around 32% since

Applied Digital: Nov 18th we wrote in our research that NVDA bought 3% of this company. Up nearly 45% since.

WULF: Druckenmiller raised his initial position by 40.88% to 2.9M shares in Q3.

IREN: Keep an eye out on this.

We are seeing serious desperation with ETH holders.

Never forget that people are seriously addicted to coffee.

Again, Johnson Controls will lead the liquid cooling segment of data-centers.

Japanese 10Y rates hit a fresh new high. Something to watch.

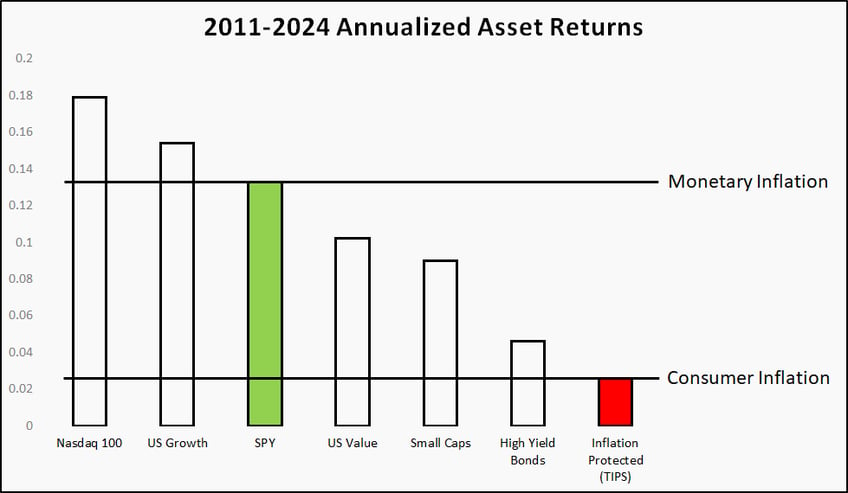

Very hard to beat the monetary inflation benchmark. Bitcoin crushes.

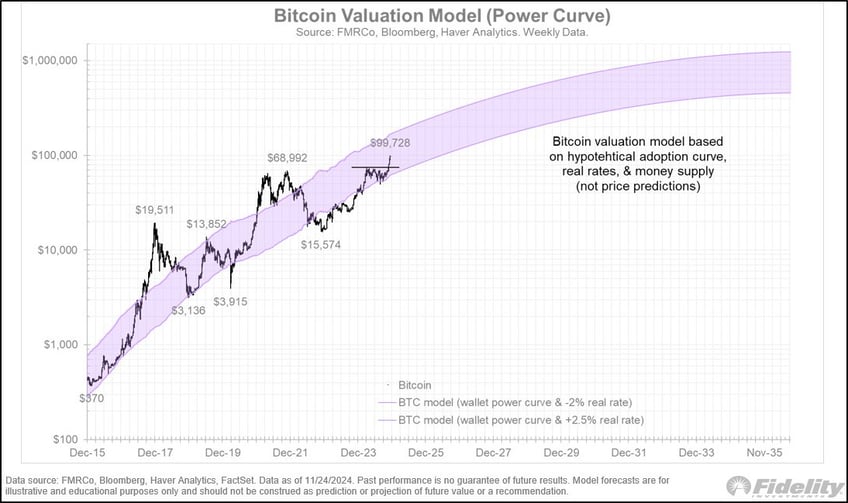

Fidelity’s Bitcoin Valuation Model. Going higher.

Return always wants its risk payment.

NOT INVESTMENT ADVICE. Only for entertainment.