Oil futures settled at their lowest level in over six weeks on Tuesday, with U.S. prices extending losses into a fourth straight session, as worries about a slowdown in demand fed broad weakness among commodities.

"Oil bears appear to be getting in early ahead of the seasonal decline for oil prices," Han Tan, chief market analyst at Exinity, told MarketWatch.

Over the past five years, crude prices have averaged monthly declines from August through November, he said.

Oil benchmarks have been "dragged lower by renewed concerns over Chinese demand, given the absence of further economic support out of Beijing," said Tan.

But all eyes are back on the tactical leg next as inventory data is due...

API

Crude: -3.9M

Cushing: -1.6M

Gasoline: -2.8M

Distillates: -1.5M

Crude stocks fell for the fourth straight week as API reports inventory-draws across all segments...

Source: Bloomberg

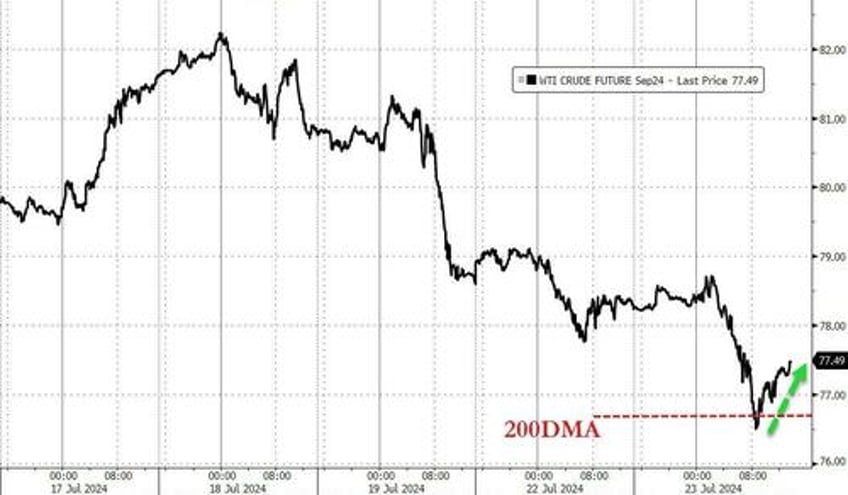

WTI is extending its bounce off technical support (200DMA) after API reported the draws...

Both Brent and WTI oil futures settled Wednesday at their lowest since June 7, with WTI prices down a fourth session in a row.

In a note, Carsten Fritsch, commodity analyst at Commerzbank, said headwinds for oil are likely to come from the "generally negative market sentiment towards cyclical commodities, which is also reflected in the fall in the price of base metals."