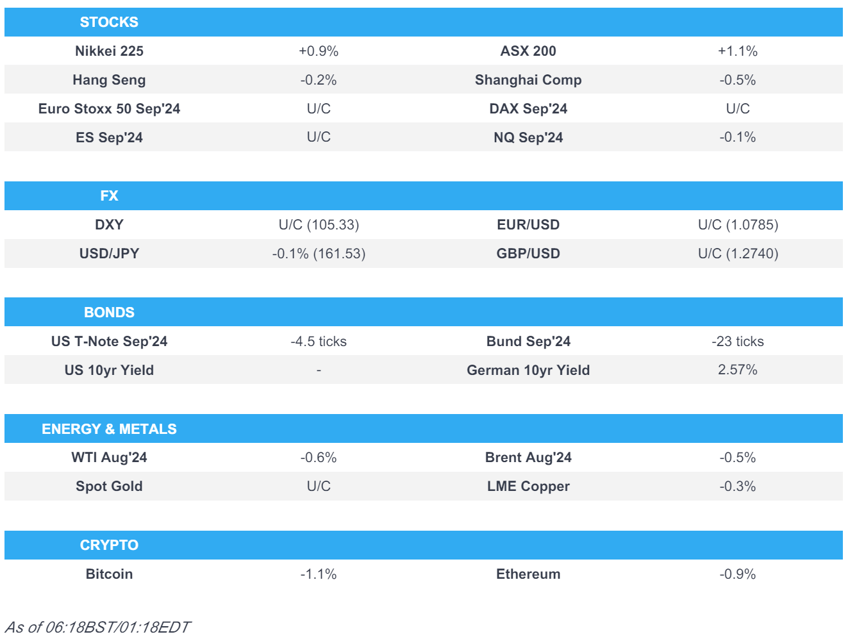

- APAC stocks traded mostly higher as the region followed suit to the gains on Wall Street where the S&P 500 and the Nasdaq notched fresh record closes once again heading into US Independence Day.

- Fed Minutes stated that most saw the current policy stance as restrictive and several participants said if inflation were to persist at an elevated level or rise further, the Fed Funds Rate might need to be raised, while a number of participants said that policy should stand ready to respond to unexpected economic weakness.

- DXY lacked direction after recently softening amid a slew of weak data, USD/JPY slightly eased back from near its 38-year peak. GBP/USD was steady overnight as the UK heads to the polls.

- The final YouGov poll for the UK General Election put Labour on 39% vs Conservatives on 22%. The final FT poll tracker put Labour on 39.7% vs Conservatives on 20.5%.

- European equity futures indicate a quiet open with Euro Stoxx 50 future flat after the cash market closed higher by 1.2% on Wednesday.

- Looking ahead, highlights include German Industrial Orders, Swiss CPI, UK General Election (exit poll 22:00BST), BoE DMP, Comments from ECB's Lane & Cipollone, and Supply from Spain & France.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks finished mostly positive in a shortened trading session ahead of Independence Day with the dollar and yields pressured as markets digested a slew of soft data releases including disappointing ISM Services PMI data. As such, the S&P 500 and Nasdaq continued their recent momentum and notched record closes once again although the Dow lagged and finished relatively flat, while the latest FOMC Minutes released after the close noted that most participants saw the current policy stance as restrictive and several participants said if inflation were to persist at an elevated level or rise further, the Fed Funds Rate might need to be raised.

- SPX +0.51% at 5,537, NDX +0.87% at 20,187, DJI -0.06% at 39,308, RUT +0.14% at 2,037.

- Click here for a detailed summary.

FOMC MINUTES

- Fed Minutes stated that most saw the current policy stance as restrictive and several participants said if inflation were to persist at an elevated level or rise further, the Fed Funds Rate might need to be raised, while a number of participants said that policy should stand ready to respond to unexpected economic weakness. Minutes noted that a vast majority assessed that US economic growth appeared to be gradually cooling and participants remarked that demand and supply in the labour market had continued to come into better balance. Participants also saw 'modest further progress' toward the committee's 2% inflation objective in recent months and May's CPI reading was seen by participants as providing additional evidence of progress toward the inflation goal. Furthermore, participants observed that longer-term inflation expectations had remained well anchored and viewed this anchoring as underpinning the disinflation process, while participants affirmed that additional favourable data were required to give them greater confidence that inflation was moving sustainably toward 2%.

- WSJ's Timiraos posted on X that while there isn't an obvious signal about the policy path in the FOMC minutes, the discussion about inflation and labour market developments provides little to suggest fear of overheating or policy being too loose.

NOTABLE HEADLINES

- Fed's Goolsbee (non-voter) said getting inflation back to 2% will take time and there is still a lot of data to be had on the economy, while he warned against prolonged high interest rates.

- US President Biden reportedly asserted during a staff call that no one is pushing him out, according to AP.

- Minnesota Governor Walz said they had a good conversation with US President Biden and that Biden is fit for office, while Maryland Governor Moore said Democratic Governors announced they will support Biden in the election.

- House Democrats reportedly considered a demand that US President Biden withdraw from the race in which dozens of House Democratic lawmakers considered signing a letter calling for Biden to withdraw, according to Bloomberg.

APAC TRADE

EQUITIES

- APAC stocks traded mostly higher as the region followed suit to the gains on Wall Street where the S&P 500 and the Nasdaq notched fresh record closes once again, heading into the Independence Day celebrations as yields and the dollar softened on weak data.

- ASX 200 outperformed as commodity-related sectors led the upside and with notable strength in Santos shares after a report that Saudi Aramco and ADNOC are considering bids for the Co.

- Nikkei 225 was underpinned at the open and later caught a second wind to edge closer to the 41,000 level.

- Hang Seng and Shanghai Comp. lagged in which the Hong Kong benchmark traded indecisively on both sides of the 18,000 level amid light pertinent catalysts, while the mainland index continued its gradual pullback from the psychological 3,000 level.

- US equity futures traded sideways with US cash markets closed today for the Fourth of July holiday.

- European equity futures indicate a quiet open with Euro Stoxx 50 futures flat after the cash market closed higher by 1.2% on Wednesday.

FX

- DXY lacked direction after recently softening amid a slew of weak data, while the FOMC Minutes revealed little new about the Fed's policy path as most participants saw current policy as restrictive but several kept the door open to a future hike if inflation persisted.

- EUR/USD traded little changed after failing to sustain a brief return to above the 1.0800 level.

- GBP/USD was steady overnight with price action stuck near 1.2750 as the UK heads to the polls.

- USD/JPY slightly eased back from near its 38-year peak although retained a firm grip on the 161.00 handle.

- Antipodeans remained afloat amid the mostly positive mood but with gains capped by a quiet calendar.

- PBoC set USD/CNY mid-point at 7.1305 vs exp. 7.2656 (prev. 7.1312).

FIXED INCOME

- 10-year UST futures faded some of the prior day's data-induced advances with cash Treasury trade shut for the 4th of July.

- Bund futures were lacklustre after Wednesday's rebound was stalled by resistance around the 131.00 level.

- 10-year JGB futures gave back some of its recent spoils with headwinds seen after mixed results at the 30-year JGB auction.

COMMODITIES

- Crude futures trickled lower overnight after climbing yesterday on a weaker dollar and bullish inventories.

- Spot gold marginally extended on recent upward momentum above the USD 2350/oz level.

- Copper futures took a breather following this week's advances amid the constructive risk tone.

CRYPTO

- Bitcoin was pressured and briefly slumped beneath the USD 59,000 level before nursing some of the losses.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi said in a message to new European Council President Costa that China is willing to enhance mutual understanding with the EU and urges the stable development of China-EU relations, according to CCTV.

DATA RECAP

- Australian Trade Balance (AUD)(May) 5.77B vs Exp. 6.30B (Prev. 6.55B)

- Australian Exports MM (May) 2.8% (Prev. -2.5%)

- Australian Imports MM (May) 3.9% (Prev. -7.2%)

GEOPOLITICAL

MIDDLE EAST

- Hamas said it exchanged some ideas with mediators to end the war in Gaza. Furthermore, Hamas said its leader Haniyeh conducted a call with Qatari and Egyptian mediators around ideas to reach a deal to end the war in Gaza and communicated with Turkish officials about the latest developments, while Hamas said it dealt with the content of ongoing talks with a positive spirit, according to Reuters.

OTHER

- China's Coast Guard said it warned and drove away Japanese vessels at the Diaoyu Islands on July 2nd-4th, while it called on Japan to immediately stop all 'illegal activities' in the area, according to Reuters.

- Venezuelan delegate said the first virtual meeting with the US government ended, while a White House spokesperson said the US discussed a range of issues with Venezuelan negotiators including urging competitive and inclusive elections in Venezuela on July 28th.

EU/UK

NOTABLE HEADLINES

- The final YouGov poll for the UK General Election put Labour at 39% vs Conservatives at 22%.YouGov calculates their latest poll will give 431 seats to Labour, 102 to the Conservatives, 72 to the Lib Dems, 18 to the SNP, 3 to Reform UK, 3 to Plaid Cymru, and 2 to the Greens.

- The final FT poll tracker put Labour at 39.7% vs Conservatives at 20.5%.

- UK PM Sunak is expected to stay on as the leader of the Conservative party if he loses the election to ensure an orderly transition, according to The Times.

- ECB's Stournaras said two more rate cuts this year seems reasonable and recent data strengthens the case for more cuts a little but rates will still be restrictive, even after two more cuts.