- APAC stocks traded mixed as a tech rally in China offset the weak handover from Wall St where the Nasdaq led the declines once again.

- US Commerce Secretary Lutnick said they will investigate the possible imposition of tariffs to rebuild the US copper industry.

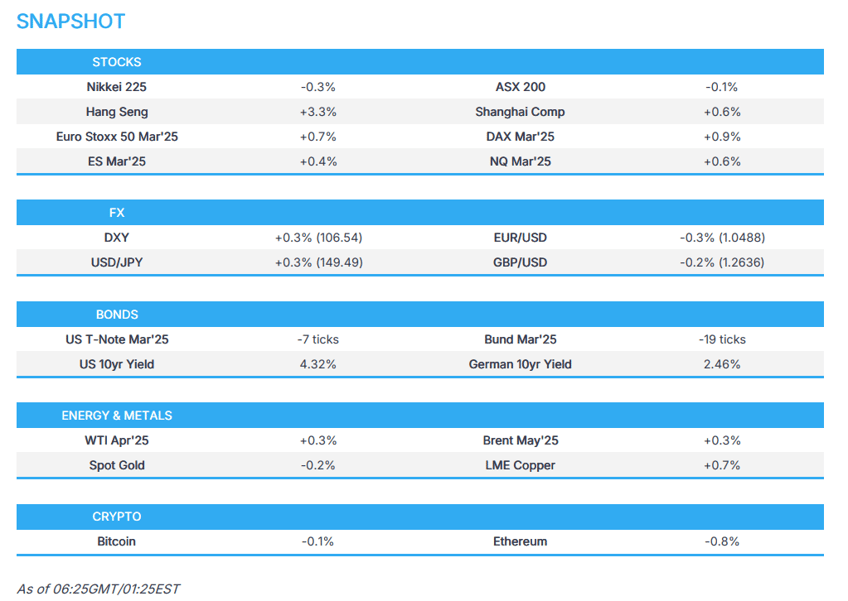

- European equity futures indicate a positive cash market open with Euro Stoxx 50 future up 0.7% after the cash market closed with losses of 0.1% on Tuesday.

- DXY is attempting to claw back yesterday's losses, EUR/USD has slipped back onto a 1.04 handle, AUD unfazed by in-line CPI.

- Looking ahead, highlights include German GfK Consumer Sentiment, US New Homes Sales, ECB's Lagarde & Cipollone, BoE’s Dhingra, Fed’s Barkin & Bostic, French President Macron, Supply from Germany & the US.

- Earnings from NVIDIA, Snowflake, Salesforce, Lowe's, NRG Energy, Advance Auto Parts, AB Inbev, Stellantis, Munich Re, Fresenius, Covestro & Deutsche Telekom.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks closed mostly lower with the declines led by the Nasdaq again amid underperformance in telecommunications and tech heading into Nvidia's earnings, while the energy sector was among the worst hit as oil prices fell and risk appetite was also sapped by disappointing US Consumer Confidence data which fell to beneath the most pessimistic of analysts' expectations.

- SPX -0.47% at 5,995, NDX -1.24% at 21,087, DJIA +0.37% at 43,621, RUT -0.38% at 2,170.

- Click here for a detailed summary.

TARIFFS/TRADE

- US Commerce Secretary Lutnick said they will investigate the possible imposition of tariffs to rebuild the US copper industry and there will be no exemptions or exceptions, as well as stated it is time for copper to come home. Furthermore, Trump trade adviser Navarro said like it has in steel and aluminium markets, China is using industrial overcapacity and dumping to gain control of the world's copper market, while a White House official said President Trump will recognise the copper sector as a national security issue and the Commerce Department will investigate under Section 232 with the investigation to look at raw mined copper, concentrates, refined copper, copper alloy, scrap copper and derivative products.

- US President Trump confirmed he requested the Secretary of Commerce and USTR to study copper imports and end unfair trade putting Americans out of work, while he added tariffs will help build back the American copper industry.

- USTR announced a proposal for new port fees targeting Chinese shipping companies and vessels.

NOTABLE HEADLINES

- Fed's Barr (Vice Chair Supervision) said monetary policy is 'inextricably' tied to stability and now is the time to look at risks to financial stability.

- Fed's Barkin (2027 voter) said uncertainty argues for caution in the last stages of the inflation fight and policy should remain modestly restrictive until there is more confidence inflation will return to target. Barkin said expect upcoming PCE will show a further decline and that the Fed has made a lot of progress, while he will take a wait-and-forecast approach about how coming policy changes impact the economy. Furthermore, Barkin said business and consumer confidence matter a lot and that so far, small business confidence has been up, which might be good for hiring.

- US President Trump said will begin a program to sell 'Trump gold cards' for USD 5mln for foreigners who want to come to the US and create jobs with the sale of gold cards to start in about two weeks.

- White House Press Secretary said US President Trump is looking at the House and Senate budget proposals.

- US House passed the Republican budget blueprint for advancing the Trump agenda after reversing course on cancelling the vote and sent the measure to the Senate.

APAC TRADE

EQUITIES

- APAC stocks traded mixed as a tech rally in China offset the weak handover from Wall St where the Nasdaq led the declines once again and risk appetite was sapped by weak consumer confidence data.

- ASX 200 was led lower by weakness in mining, materials and consumer staples as participants digested disappointing Construction Work data which feeds into Australia's GDP and with supermarket operator Woolworths pressured post-earnings.

- Nikkei 225 fell beneath the 38,000 level for the first time this year with the index underperforming following recent currency strength although was off worst levels as the yen then pared some of its recent advances.

- Hang Seng and Shanghai Comp gained with Hong Kong leading the advances amid tech strength and recent earnings, while Hong Kong continued to record a higher deficit for this year in the Budget and will increase the scale of bond issuances.

- US equity futures (ES +0.4%, NQ +0.6%) nursed losses after suffering from weakness in tech and communications ahead of Nvidia earnings.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 future up 0.7% after the cash market closed with losses of 0.1% on Tuesday.

FX

- DXY recovered some of the prior day's losses that were triggered by weak Consumer Confidence data which printed below analysts' forecasts range, while recent Fed commentary provided little to shift the dial and PCE data on Friday remains a key focus.

- EUR/USD gave back some of its recent spoils and failed to sustain the 1.0500 handle as the dollar regained composure, while there were comments from ECB's Stournaras that the ECB should keep cutting to 2% which he believes is likely the terminal rate.

- GBP/USD retreated from yesterday's peak but retained a comfortable footing above the 1.2600 level with the pullback contained amid a lack of major fresh pertinent drivers and this week's quiet data calendar for the UK.

- USD/JPY rebounded after briefly slipping beneath the 149.00 handle due to the risk-off mood and softer yields stateside.

- Antipodeans marginally weakened amid the mixed risk appetite in Asia-Pac and following Australian data in which monthly CPI matched estimates and Construction Work Done disappointed.

- PBoC set USD/CNY mid-point at 7.1732 vs exp. 7.2526 (prev. 7.1726).

FIXED INCOME

- 10yr UST futures mildly pulled back after yesterday's one-way upward price action which was facilitated by the disappointing US data and an overall strong 5yr auction.

- Bund futures took a breather after its choppy advances to above the 132.00 level and ahead of today's supply.

- 10yr JGB futures tracked the recent advances in global peers with the upside also helped by the underperformance in Japanese stocks, although 10yr JGBs have since come off their intraday highs and reverted to beneath the 140.00 level.

COMMODITIES

- Crude futures were contained after tumbling yesterday as soft consumer confidence data added fears to the demand side of the equation, while the latest private sector inventory data was mixed with a surprise draw in headline crude and an unexpected build in gasoline stockpiles.

- US Private Inventory Data: Crude -0.6mln (exp. +2.6mln), Distillate -1.1mln (exp. -1.5mln), Gasoline +0.5mln (exp. -0.9mln), Cushing +1.2mln.

- Spot gold resumed its gradual rebound from yesterday's trough with the precious metal back above the USD 2,900/oz level.

- Copper futures were underpinned following a power surge in Chile which affected all of state miner Codelco's mines and prompted a state of emergency declaration, while prices were further boosted on reports that the Trump administration will investigate the possible imposition of tariffs to rebuild the US copper industry.

- Chile's state-owned copper miner Codelco said a power outage has affected all of its mines and Chile declared a state of emergency and curfew from 22:00 to 06:00 local time for regions affected by the blackout, while Chile's national electricity coordinator later announced about a quarter of the electrical demand has been restored to the grid and a full recovery could happen by morning.

CRYPTO

- Bitcoin lacked direction and fluctuated around the USD 89,000 level following the recent crypto drop.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi urged to maintain stability across and calmly address domestic and international challenges.

- Hong Kong Financial Secretary delivered the Budget address and noted Hong Kong continues to record a higher budget deficit this year and will increase the scale of bond issuance, while the government aims to reduce accumulated expenditure by 7% in the fiscal year 2027-2028. Hong Kong's government announced a reduction in salaries tax payable by 100% capped at HKD 1,500 and the HKMA is to launch a new CNY 100bln facility for renminbi trade financing liquidity support for banks.

DATA RECAP

- Australian Weighted CPI YY (Jan) 2.50% vs. Exp. 2.50% (Prev. 2.50%)

- Australian Annual Trimmed Mean CPI YY (Jan) 2.80% (Prev. 2.70%)

- Australian Construction Work Done (Q4) 0.5% vs. Exp. 1.0% (Prev. 1.6%)

GEOPOLITICS

MIDDLE EAST

- Israeli air force targeted military bases of the former Syrian army and destroyed "weapons means" in Damascus, while Israel's Defence Minister said they will not allow a repeat of the experience of southern Lebanon in southern Syria and will not allow the stationing of Syrian forces in the buffer zone.

- A senior Israeli official told Axios that the crisis in the hostage deal over the release of Palestinian prisoners is "on the verge of being resolved", while the official said that this was a "completely unnecessary crisis" created by Netanyahu's decision. It was separately reported that sources familiar with the negotiations told the Jerusalem Post there is a crisis regarding the release of the four Israeli hostages' bodies but estimate the issue resolvable, while Hamas later said it agreed during a Cairo visit on a solution to end the delay of the release of Palestinian prisoners.

- Hamas appointed new commanders and is regrouping its military forces for a potential return to fighting with Israel in Gaza as mediators work to salvage the ceasefire that expires this weekend, according to WSJ.

- US Secretary of State Rubio and Saudi Arabia's Defence Minister discussed ways to promote peace and stability in Syria, while they also discussed ways to promote peace and stability in Lebanon, Gaza, and across the region

RUSSIA-UKRAINE

- Kyiv has agreed terms with Washington on the minerals deal that Ukrainian officials hope will improve relations with the Trump administration and pave the way for a long-term US security commitment, according to FT.

- Ukrainian President Zelensky intends to visit the US on Friday on a resources deal, while Ukraine's cabinet is expected to recommend the US critical minerals deal to be signed on Wednesday, according to Bloomberg.

- Ukraine's business community said they expect Ukrainian President Zelensky to take the deal US President Trump is offering to end the conflict, according to FBN's Gasparino citing sources but added that the situation is fluid.

- US President Trump said Ukrainian President Zelensky would like to sign a minerals deal with him, while Trump stated that they have pretty much negotiated their deal on rare earths and would like to get access to Russian rare earths.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer said an increase in defence spending is an opportunity to rebuild Britain's industrial base and investment will maximise British jobs and growth. Starmer said he spoke to French President Macron and will host a number of leaders for a meeting on Sunday.

- BRC warned 160k part-time retail jobs are at risk of being axed over the next 3 years due to higher employer taxes announced in the Budget and regulatory changes.

- ECB's Stournaras said it's too early to discuss pausing cuts and the ECB should keep cutting rates to 2%, while he added it is definitely still restrictive and the terminal rate is likely to be 2%.