- APAC stocks eventually traded mixed with sentiment somewhat cautious following the negative lead from Wall Street.

- US assets traded sideways overnight as the focus turns to the FOMC announcement and Chair Powell's press conference.

- Bitcoin saw hefty losses overnight as prices retreated to under USD 104,000 despite a lack of newsflow.

- Honda Motor (7267 JT/HMC) and Nissan (7201 JT/NSANY) to begin merger talks amid EV competition, according to Nikkei.

- European equity futures are indicative of a flat/subdued open with the Euro Stoxx 50 future -0.1% after cash closed -0.1% on Tuesday.

- Looking ahead, highlights include UK CPI, EZ CPI (Final), US Building Permits, FOMC Announcement and Chair Powell's Press Conference, ECB’s Lane, Earnings from General Mills, Jabil, Micron, and Lennar.

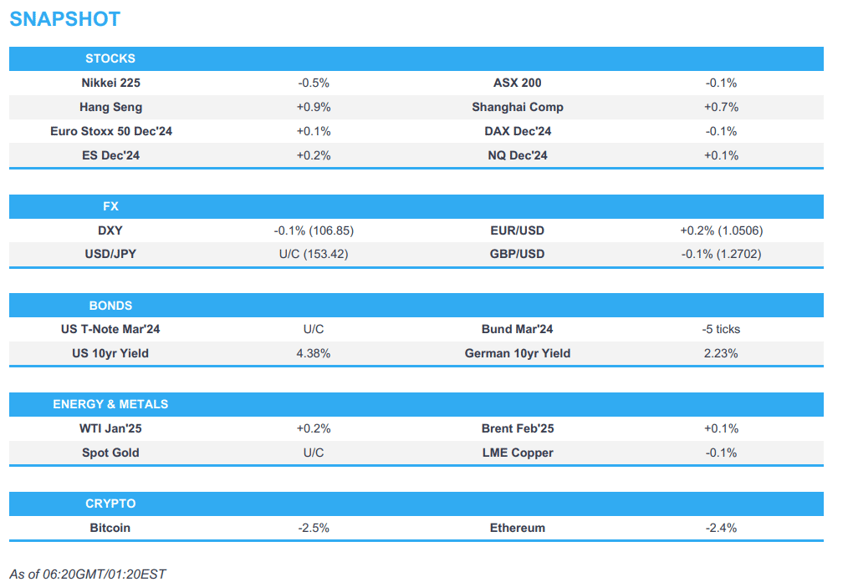

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks experienced risk aversion on Tuesday with underperformance in the Russell and Dow vs S&P and Nasdaq.

- Sectors were predominantly lower, led by losses in Industrials, Energy and Financials while Consumer Discretionary, Consumer Staples and Healthcare were the relative outperformers.

- SPX -0.39% at 6,051, NDX -0.43% at 22,001, DJI -0.61% at 43,450, RUT -1.18% at 2,334.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US DoJ antitrust head Jonathan Kanter to step down on Friday, according to Reuters.

- Mastercard (MA) announced a USD 12bln buyback and raised its quarterly dividend to USD 0.76/shr (prev. 0.66).

DATA RECAP

- Atlanta Fed GDPnow (Q4): 3.1% (prev. 3.3%).

APAC TRADE

EQUITIES

- APAC stocks eventually traded mixed after the earlier upward bias somewhat abated, with sentiment cautious following the negative lead from Wall Street with eyes turning to the FOMC announcement and Chair Powell's presser.

- ASX 200 is currently flat as the upside in Real Estate, Tech, and Healthcare offset losses in Financials.

- Nikkei 225 was subdued but with ranges narrow in the run-up to Thursday's BoJ as expectations lean towards a hold. Meanwhile, Nissan shares surged 22% amid several source reports suggesting a potential merger with Honda, whose shares fell 3%.

- Hang Seng and Shanghai Comp saw positive trade with Chinese markets outperforming despite quiet newsflow but sentiment buoyed ahead of the PBoC's LPR setting on Friday.

- US equity futures held a mild positive bias after Tuesday's risk aversion, with traders cautious ahead of the Fed announcement, which is widely expected to see the lowering of the Federal Funds Rate target by 25bps to 4.25-4.50%.

- European equity futures are indicative of a flat/subdued open with the Euro Stoxx 50 future +0.1% after cash closed -0.1% on Tuesday.

FX

- DXY was flat in a narrow 106.88-106.96 range ahead of the FOMC announcement and press conference, with price action likely to be cautious heading into the event.

- EUR/USD printed on either side of 1.05 and well within yesterday's 1.0477-1.0534 range awaiting the next catalyst.

- GBP/USD drifted marginally lower and briefly dipped under 1.2700 in the run-up to UK inflation data, with the overnight range between 1.2696-1.2720.

- USD/JPY saw choppy trade in a 153.40-78 APAC range as participants await the fallout from the FOMC before gearing up for the BoJ.

- Antipodeans were subdued with both pairs hitting fresh YTD lows amid the broader cautious sentiment, weakness in base metals, and potential headwinds as Australia expects its budget deficit to increase in 2025/26.

- PBoC set USD/CNY mid-point at 7.1880 vs exp. 7.2838 (prev. 7.1891)

FIXED INCOME

- 10yr UST futures traded sideways after the prior day's choppy price action which ultimately resulted in the March 10yr settling only a tick higher, with eyes turning to the FOMC. Tuesday's 20yr bond auction was ultimately weaker than averages but not as weak as the prior.

- Bund futures were treading water under 135.00 in a 134.70-79 APAC range awaiting the next catalyst.

- 10yr JGB futures were choppy but bucked the trend as expectations for the BoJ's upcoming meeting increasingly lean towards a hold instead of a hike.

- US sold USD 13bln 20yr Bond; High Yield: 4.686% (prev. 4.68%, six-auction average 4.398%). WI: 4.671%.. Tail: 1.5bps (prev. 3.0bps, six-auction avg. 0.6bps). Bid-to-Cover: 2.50x (prev. 2.34x, six-auction avg. 2.57x). Dealers: 17.9% (prev. 22.6%, six-auction avg. 13.3%). Directs: 20.1% (prev. 7.9%, six-auction avg. 15.3%). Indirects: 62% (prev. 69.5%, six-auction avg. 71.4%).

COMMODITIES

- Crude futures held an upward bias despite a lack of macro newsflow or geopolitics, but with prices underpinned by a larger-than-expected draw in Private Inventories, with traders looking ahead for confirmation from the DoEs ahead of the main risk event

- Spot gold was flat on either side of USD 2,650/oz as participants kept their powder dry ahead of the FOMC and Fed Chair Powell's press conference.

- Copper futures eventually slipped amid the cautious risk tone with 3M LME copper relinquishing its USD 9,000/t status.

- Private inventory data (bbls): Crude -4.7mln (exp. -1.6mln), Distillate +0.7mln (exp. +0.7mln), Gasoline +2.4mln (exp. +2.1mln), Cushing +0.8mln (prev. -1.5mln).

- Qatar set Feb Al-Shaheen crude term price at USD 1.05/bbl (vs USD 0.73/bbl in Jan) above Dubai quotes.

CRYPTO

- Bitcoin saw hefty losses overnight as prices retreated to under USD 104,000 despite a lack of newsflow.

NOTABLE ASIA-PAC HEADLINES

- Australia sees 2024/25 budget deficit at AUD 26.9bln (vs AUD 28.3bln projected in May); 2025/26 expected at AUD 46.9bln and 2026/27 at AUD 38.4bln.

- Honda Motor (7267 JT/HMC) and Nissan (7201 JT/NSANY) to begin merger talks amid EV competition, according to Nikkei. Honda and Nissan are considering operating under a holding company and soon will sign a memorandum of understanding. Their respective stakes in the new entity, as well as other details, will be decided later. "They also look to eventually bring Mitsubishi Motors, in which Nissan is the top shareholder with a 24% stake, under the holding company. This would create one of the world's largest auto groups, with combined sales among the three Japanese players topping 8 million vehicles." Bloomberg, Reuters, and the FT subsequently released similar reports.

- South Korean Finance Minister Choi said will utilise all available resources to manage the economy as stably as possible, according to Reuters.

- Indian Stock Exchanges to reportedly talk about keeping the market open on Saturday, Feb. 1, 2025, during the Union Budget, according to CNBC-TV18 citing sources.

DATA RECAP

- New Zealand Westpac Consumer Confidence (Q4): 97.5 (prev. 90.8)

- New Zealand Current Account- Annual (Q3) -26.994B vs. Exp. -26.918B (Prev. -27.762B)

- New Zealand Current Account/GDP (Q3) -6.4% vs. Exp. -6.5% (Prev. -6.7%)

- New Zealand Current Account - Qtrly (Q3) -10.581B vs. Exp. -10.399B (Prev. -4.826B)

- Japanese Trade Balance Total Yen (Nov) -117.6B vs. Exp. -688.9B (Prev. -461.2B, Rev. -462.1B)

- Japanese Imports YY (Nov) -3.8% vs. Exp. 1.0% (Prev. 0.4%)

- Japanese Exports YY (Nov) 3.8% vs. Exp. 2.8% (Prev. 3.1%)

GEOPOLITICS

MIDDLE EAST

- "The IDF has approved plans for major strikes in Yemen and is prepared to act pending government approval", via Open Source Intel citing N12 News

- Gaza ceasefire deal is expected to be signed in coming days; Israeli PM Netanyahu is on his way to Cairo for Gaza ceasefire talks, via Reuters citing sources.

- Big gaps remain between Israel and Hamas and a Gaza hostage and ceasefire deal isn't imminent, via Axios citing Israeli officials.

- A Saudi official told Axios that no "breakthrough” has been achieved between Saudi Arabia and Israel regarding the “normalization” of relations.

OTHER

- US President-elect Trump's incoming Ukraine envoy Keith Kellogg plans a fact-finding trip to Kyiv and other European capitals in early January; Kellogg is not planning to visit Moscow during his first overseas trip, via Reuters citing sources.

LATAM

- Brazil's Lower House Speaker Lira said tax reform and part of the fiscal package will be voted on Tuesday, and the other two proposals from the spending cut package will be voted on Wednesday, via Estadao