- APAC stocks traded cautiously after the two-way price action stateside and as participants await US CPI data.

- BoJ's Nakagawa said that the central bank is likely to adjust the degree of monetary easing if the economy and prices move in line with its projection.

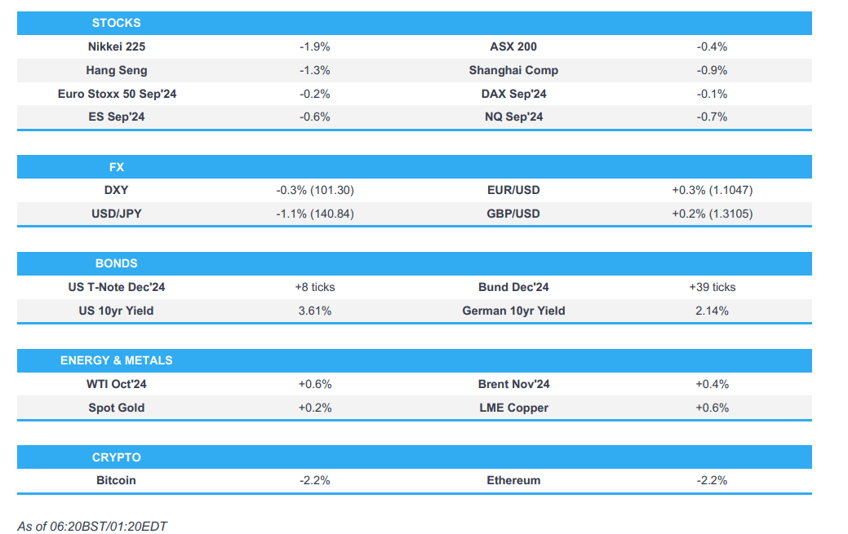

- European equity futures are indicative of a subdued open with the Euro Stoxx 50 future -0.2% after the cash market closed lower by 0.7% on Tuesday.

- USD is broadly softer vs. peers, JPY outperforms due to haven flows and BoJ commentary; USD/JPY below 141.

- Looking ahead, highlights include UK GDP Estimate & Services, US CPI, Supply from UK, Germany & US.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

EQUITIES

- US stocks were mixed after rebounding from the initial financial-induced losses that were triggered by downbeat updates from Ally Financial (ALLY)(-17.6%) and JPMorgan (JPM)(-5.2%) just after the cash open which resulted in a clear flight-to-quality. Nonetheless, the major indices then gradually recovered from their lows despite the absence of any obvious catalysts although there was a slightly more encouraging update from Bank of America (BAC), while market focus turned to upcoming key events including the US Presidential Election Debate overnight and Wednesday's US CPI data release.

- SPX +0.45% at 5,496, NDX +0.90% at 18,829, DJIA -0.23% at 40,737, RUT Flat at 2,097.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Bowman said concerns for stress tests include volatility and transparency.

- WSJ's Nick Timiraos said economists who produce detailed inflation forecasts expect the August CPI to have been relatively mild, as was July. Furthermore, he noted the median of these forecasts has the core CPI up 0.21%, which would hold the 12-month rate at 3.2%, while headline CPI is seen decelerating to 2.5%.

PRESIDENTIAL DEBATE

- US Vice President Harris said she supports small businesses and will offer a tax cut for these businesses, while she added that Trump left them with the worst unemployment rate, an economic recession and the worst attack on democracy since the Civil War. Harris stated that Trump got them into economic wars and that he thanked the Chinese President but is attacking him today. Furthermore, she said Trump favours campaigning on issues instead of solving them and that 81mln Americans fired Trump which is hard for him to realise.

- Former President Trump reiterated that millions of migrants are pouring into the country illegally and "taking our jobs before our eyes", while he added the economy is terrible economy because of inflation which is devastating to the middle American class. Trump also commented that the Biden administration only gained "bounce back" jobs, as well as stated that Harris doesn't have an economic plan and copied Biden's plan.

APAC TRADE

EQUITIES

- APAC stocks traded cautiously after the two-way price action stateside and as participants await US CPI data.

- ASX 200 trickled lower as weakness in tech and financials overshadowed the gains in commodity-related stocks.

- Nikkei 225 was pressured amid currency strength and after BoJ's Nakagawa kept the door open for further hikes.

- Hang Seng and Shanghai Comp conformed to the downbeat mood with the former dragged beneath the 17,000 level amid heavy losses in energy stocks, while there was very little to spur a turnaround.

- US equity futures (ES -0.5%) were lacklustre with markets bracing for the incoming key US inflation data.

- European equity futures are indicative of a subdued open with the Euro Stoxx 50 future -0.2% after the cash market closed lower by 0.7% on Tuesday.

FX

- DXY softened amid the Presidential Debate although the move was predominantly influenced by strength in its major counterparts especially the yen after comments from BoJ's Nakagawa, while the attention now turns to the looming US CPI data.

- EUR/USD mildly edged higher but remains firmly beneath the 1.1100 handle ahead of a widely anticipated ECB rate cut.

- GBP/USD eked slight gains and breached the 1.3100 level with UK monthly GDP estimates and output data due later.

- USD/JPY continued on the prior day's retreat which had initially been spurred by haven flows, while selling was further exacerbated on a break beneath the 142.00 level following comments from BoJ's Nakagawa that the central bank is likely to adjust the degree of monetary easing if the economy and prices move in line with its projection.

- Antipodeans traded rangebound amid a lack of tier-1 releases and cautious risk appetite.

- PBoC set USD/CNY mid-point at 7.1182 vs exp. 7.1198 (prev. 7.1136).

FIXED INCOME

- 10yr UST futures extended on gains after yesterday's bull steepening and a strong 3yr auction although further upside was limited heading into the key US inflation data and a 10yr offering.

- Bund futures reclaimed the 135.00 level to the upside to print their best levels in over a month but with trade quiet overnight amid a lack of pertinent drivers and with Bund supply scheduled later.

- 10yr JGB futures tracked the advances in global counterparts despite the comments from BoJ's Nakagawa who suggested they will keep raising rates if inflation is on track.

COMMODITIES

- Crude futures partially nursed some of the prior day's losses after slipping to multi-year lows with mild support following bullish private sector inventory data which showed a surprise draw in headline crude stockpiles.

- US Private Inventory Data (bbls): Crude -2.8mln (exp. +1.0mln), Distillate +0.2mln (exp. +0.3mln), Gasoline -0.5mln (exp. -0.1mln), Cushing -2.6mln.

- EIA STEO sees 2024 world oil demand of 103.1mln BPD (prev. 102.9mln BPD M/M) and sees 2025 demand of 104.6mln BPD (prev. 104.5mln BPD).

- US Port of New Orleans said terminal operations are to be shut as storm Francine approaches Louisiana and service is to resume on September 12th following damage assessments.

- NHC said Francine is moving towards the Louisiana coast, with a life-threatening storm surge and hurricane-force winds expected to begin in Louisiana on Wednesday, but noted Francine is expected to weaken quickly after it moves inland.

- Russia's Lukoil is set to resume oil supplies via the Druzhba pipeline to Slovakia and Hungary in October after Hungary's MOL said it had struck deals to transport crude through Belarus and Ukraine via the pipeline, according to sources.

- Spot gold eked mild gains after recently bouncing off support at the USD 2500/oz level

- Copper futures traded higher albeit with gains capped alongside the cautious risk tone.

CRYPTO

- Bitcoin was pressured overnight and retreated beneath the USD 57,000 level.

NOTABLE ASIA-PAC HEADLINES

- BoJ Board Member Nakagawa said one-sided yen falls subsided somewhat but rising import prices could affect consumer inflation with a lag and stated that prolonged inflation overseas could put upward pressure on Japan's import prices. Nakagawa said even after the July rate hike, real interest rates remain deeply negative and accommodative monetary conditions are maintained. Furthermore, she said if long-term rates spike, the BoJ could review its taper plan at its policy meeting as needed and that the BoJ is likely to adjust the degree of monetary easing if the economy and prices move in line with its projection.

- RBA's Hunter said the labour market is still tight relative to full employment and has moved towards better balance since late 2022, while she added that the easing in the labour market similar to past mild downturns. Hunter also stated that Australia's economy is moving through a turning point and that turning points are innately challenging and tough.

GEOPOLITICS

MIDDLE EAST

- Israeli army radio said the Israeli army attacked Hezbollah positions in southern Lebanon during the night and destroyed about 25 rocket launchers, according to Sky News Arabia.

- US Defence Secretary Austin spoke with his Israeli counterpart Gallant to express grave concern for the IDF’s responsibility for the "unprovoked and unjustified death" of an American in the West Bank, while he urged Gallant to reexamine the IDF’s rules of engagement while operating in the West Bank.

- Local Iraqi sources noted that a US forces site was targeted near Baghdad Airport, according to Sky News Arabia.

OTHER

- Ukraine Foreign Ministry spokesman said Kyiv will consider its options and could even cut ties with Tehran if Russia uses Iranian missiles in the Ukraine war.

- US issued fresh Iran and Russia-related sanctions which target Iranian air and Russian vessels, according to the Treasury Department website.

- US President Biden said they are working that out now when asked about potentially lifting the Ukraine long-range weapons ban, according to Reuters.

- A cargo train derailed in Russia's Belgorod region due to outside 'interference', according to Russian agencies.