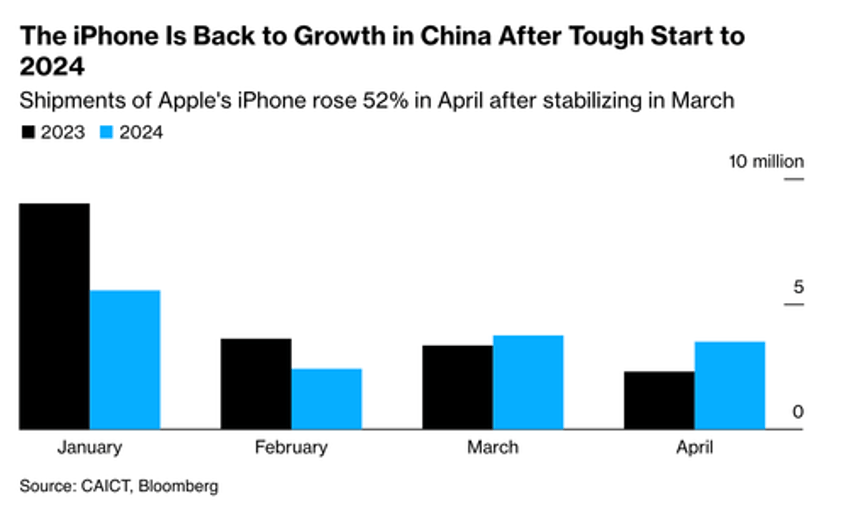

Apple's sliding iPhone market share in China, pressured by competition from Huawei, may finally be stabilizing. New shipment data from the world's largest handset market indicates that iPhones staged a 52% rebound in April, supported by aggressive price cuts to boost demand after a challenging start to the year.

Bloomberg was the first to report new figures from the China Academy of Information and Communications Technology showing that smartphone shipments in April surged to 22.668 million units, a 25.5% year-on-year increase. According to Bloomberg calculations, 3.5 million units came from foreign brands, with the majority of that accounting for iPhones.

For the period January to April, the shipment volume of smartphones topped 86.441 million units, a 10.3% year-on-year increase.

The rebound in iPhone shipments is a significant relief for Apple following sliding sales due to Huawei's new Mate 60 Pro, companies and government agencies banning Apple devices, and a wave of patriotic buying of made-in-China smartphones as the tech war between the US and China worsens.

In the first few months of the year:

- Jefferies Finds iPhone Sales In China Plunged Last Week

- Strike Two: Apple Hit With Another Downgrade On iPhone Demand Worries

- Apple Tumbles on Barclays Downgrade Over Cooling iPhone Demand

- Gloom, Doom: Apple's iPhone Sales In China Plunge 24%

- iPhone Sales In China Tumble 19% In Worst Quarter Since 2020

Followed by discounts...

- Apple Offers Ultra-Rare iPhone 15 Discount In China Amid Sliding Demand Fears

- Apple Cuts iPhone 15 Prices In China By 20% As Demand Wanes

With an improving outlook:

Not as bad as once feared...

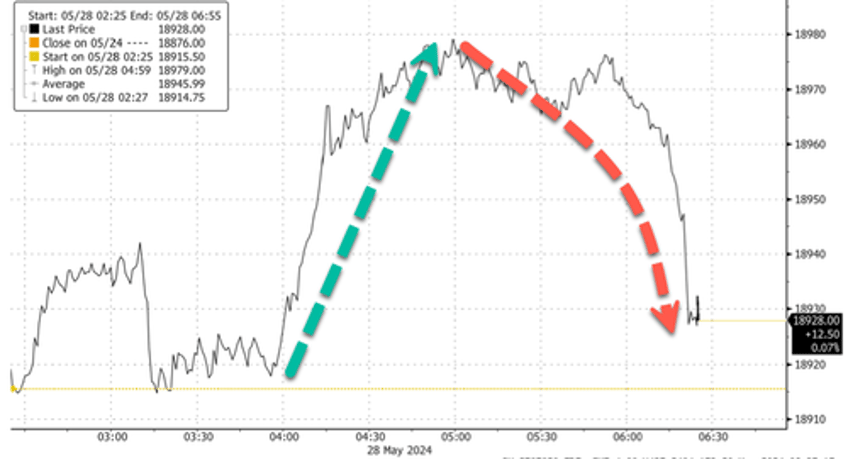

In markets, the iPhone shipment headline hit around 0400 ET.

It sparked a 26bps rise in Nasdaq futures. Those gains have since mostly been wiped around 0630 ET.

Apple's shares were up 2% in premarket trading.

Bloomberg Intelligence analysts say the decline in iPhone shipments in China could be coming to an end.

"The iPhone's shrinking China market share could stabilize soon, as our latest survey shows Apple's comeback as Chinese consumers' favorite smartphone brand after being displaced by Huawei," analysts Steven Tseng and Sean Chen wrote.

The analysts said, "We believe the reversal in user interest could be due to the premiumization trend in China, amplified by consumer fatigue after long waiting times for Huawei's premium models."