Apple shares are marginally lower in premarket trading in New York following a report that first-quarter iPhone sales in China had been the worst since early Covid. This comes ahead of an earnings report from the world's most valuable company next week and other souring reports from independent research firms tracking the slide in iPhone sales in China.

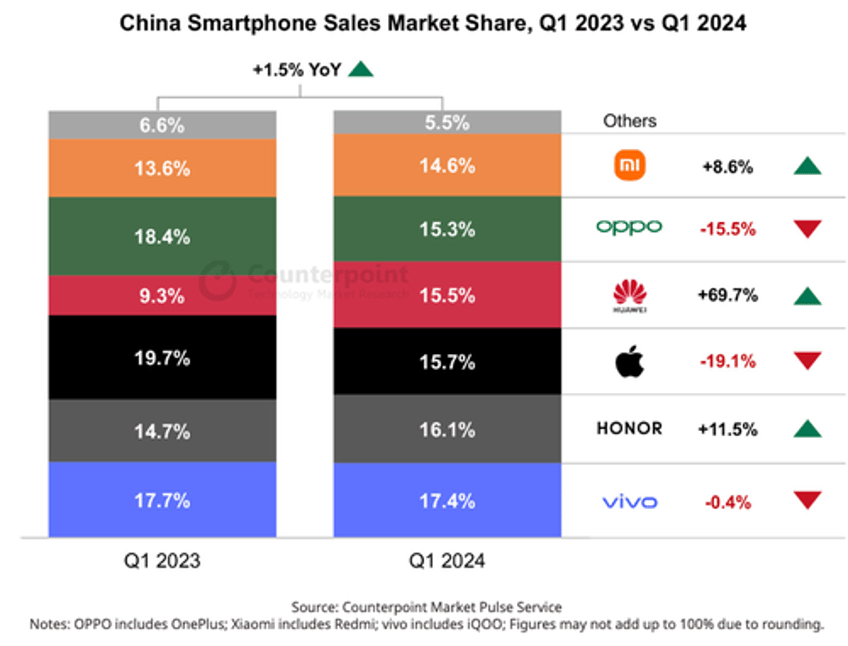

Counterpoint reports that overall, China, the world's largest handset market, recorded growth upwards of 1.5% year-over-year in the first quarter, marking the second consecutive quarter of positive year-over-year growth. Huawei is a rising star and the best performer of all major brands, growing 69.7% year-over-year, mainly because of the release of its 5G-capable Mate 60 series last fall. Meanwhile, Apple iPhone sales tumbled 19% in the quarter.

Here are the highlights of the report:

- China's smartphone sales grew 1.5% YoY and 4.6% QoQ in Q1 2024, marking the second consecutive quarter of positive YoY growth.

- Huawei stood out as the best performer among all OEMs during the quarter, enjoying 69.7% YoY growth; HONOR also saw double-digit growth.

- vivo took the top spot, followed by HONOR and Apple.

- Apple's sales dropped 19.1% YoY in Q1 as Huawei's comeback directly impacted the premium segment.

- The market is expected to see low single-digit YoY growth in 2024.

"Momentum seems to be building on a recovery as China's smartphone sales continued their growth trajectory and grew 4.6% QoQ in Q1 2024. The sales promotions during the Chinese New Year festivities were the biggest growth driver. The average weekly sales during the four weeks leading up to the Chinese New Year saw a robust growth of 20% when compared to a normal week, according to Counterpoint's China Smartphone Weekly Model Sales Tracker," Counterpoint's Associate Director Ethan Qi wrote in a statement.

Counterpoint's Senior Research Analyst Ivan Lam said on the iPhone recovery story, "We are seeing slow but steady improvement from week to week, so momentum could be shifting. For the second quarter, the possibility of new color options combined with aggressive sales initiatives could bring the brand back into positive territory; and of course, we are waiting to see what its AI features will offer come WWDC in June. That has the potential to move the needle significantly longer term."

Counterpoint's data was published one week after International Data Corporation reported that iPhone shipments plunged by 10% in the quarter.

Since early January, institutional desks, Barclays, Piper Sandler, and Jefferies have warned about a downturn in iPhone sales, mainly because of a slowdown in the world's largest handset market.

While Goldman removed Apple from its "Conviction List" and Evercore ISI dropped Apple from its "Tactical Outperform" list earlier this year, Bank of America analyst Wamsi Mohan named Apple the top pick for 2024, citing a "rich catalyst path with defensive cash flows."

Apple shares have been widely underperforming the S&P500 index on numerous reports this year on weaker iPhone demand in China.

Just 56% of the analysts tracked by Bloomberg have buy ratings on Apple, while the percentage of bulls for Microsoft, Nvidia, Alphabet, Amazon, and Meta Platforms is around 85%.

Besides waning iPhone sales in China, investors have been given the impression that the company lags in the artificial intelligence race. Just weeks ago, there were reports that the company nuked its car project. Plus, the $4,000 Apple Vision Pro goggles do not appear to be taking off as expected.