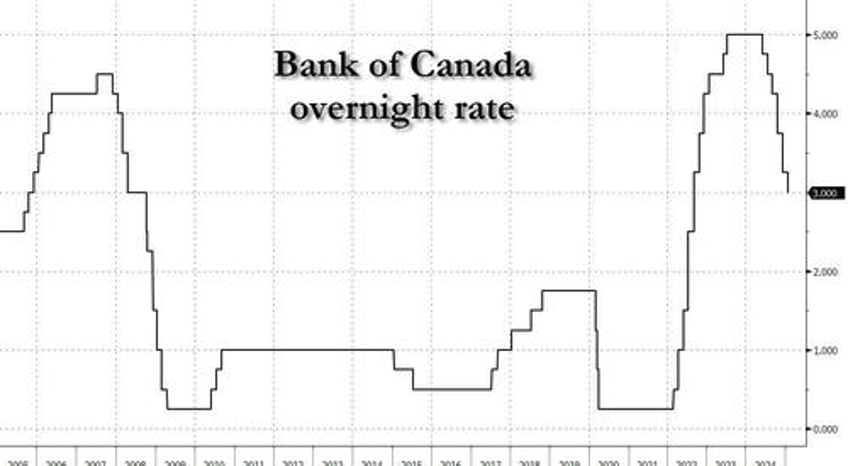

Just hours before the Fed's dovish pause, the Bank of Canada extended its easing experiment when moments ago it cut interest rates by a quarter percentage point as expected, ended the bank's Quantitative Tightening, and dropped guidance on any further adjustments to borrowing costs as President Trump’s tariff threat clouds the outlook.

The central bank headed by Governor Tiff Macklem lowered the benchmark overnight rate to 3% on Wednesday. The move was widely anticipated by both markets and economists in a Bloomberg survey.

The Bank is also announcing its plan to complete the normalization of its balance sheet, ending quantitative tightening. The Bank will restart asset purchases in early March, beginning gradually so that its balance sheet stabilizes and then grows modestly, in line with growth in the economy

"The economy is expected to strengthen gradually and inflation to stay close to target. However, if broad-based and significant tariffs were imposed, the resilience of Canada’s economy would be tested,” the bank said in its statement.

In prepared remarks, Macklem said while “monetary policy has worked to restore price stability,” a broad-based trade conflict would “badly hurt” economic activity, but that the higher cost of goods “will put direct upward pressure on inflation.”

“With a single instrument — our policy rate — we can’t lean against weaker output and higher inflation at the same time,” Macklem said, adding the central bank would need to “carefully assess” the downward pressure on inflation, and weigh that against the upward pressure on inflation from “higher input prices and supply chain disruptions.”

BoC officials called the 200 basis points of easing since June “substantial,” and removed any guidance about further rate cuts. The smaller reduction follows to back-to-back half percentage point cuts in October and December, and was the sixth consecutive monthly rate cut.

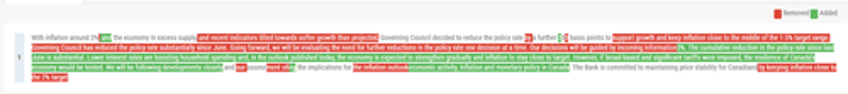

Below we present a redline comparison of the two latest BOC statements...

... and we excerpt the highlights from the latest one below:

Inflation

- "CPI inflation remains close to 2%, with some volatility due to the temporary suspension of the GST/HST on some consumer products."

- "Shelter price inflation is still elevated but it is easing gradually, as expected."

- "A broad range of indicators, including surveys of inflation expectations and the distribution of price changes among components of the CPI, suggests that underlying inflation is close to 2%."

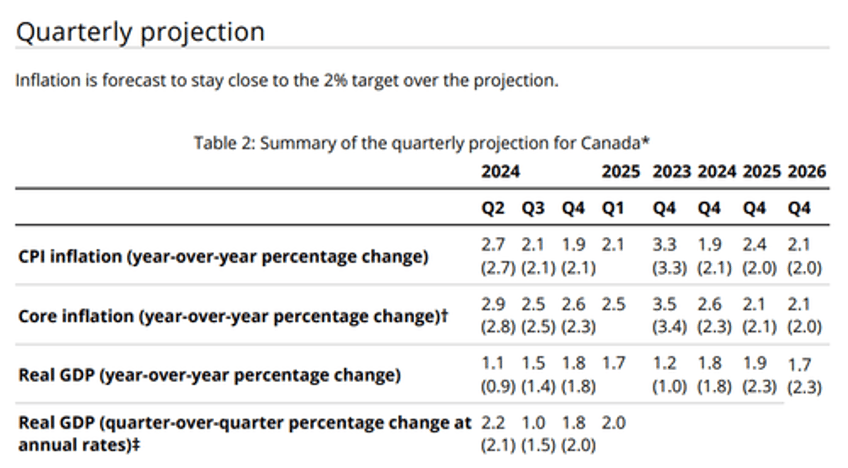

- "The Bank forecasts CPI inflation will be around the 2% target over the next two years."

Growth

- "The global economy is expected to continue growing by about 3% over the next two years."

- "Growth in the United States has been revised up, mainly due to stronger consumption."

- "Growth in the euro area is likely to be subdued as the region copes with competitiveness pressures."

- "In China, recent policy actions are boosting demand and supporting near-term growth, although structural challenges remain."

- "Canada’s labour market remains soft, with the unemployment rate at 6.7% in December."

- "Job growth has strengthened in recent months, after lagging growth in the labour force for more than a year."

- "The Bank forecasts GDP growth will strengthen in 2025."

- "Following growth of 1.3% in 2024, the Bank now projects GDP will grow by 1.8% in both 2025 and 2026, somewhat higher than potential growth."

- "As a result, excess supply in the economy is gradually absorbed over the projection horizon."

Future Policy

- "If broad-based and significant tariffs were imposed, the resilience of Canada’s economy would be tested."

- "We will be following developments closely and assessing the implications for economic activity, inflation and monetary policy in Canada."

- "The Bank is committed to maintaining price stability for Canadians."

- "The next scheduled date for announcing the overnight rate target is March 12, 2025."

- "The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the MPR on April 16. 2025."

- "The Bank will restart asset purchases in early March, beginning gradually so that its balance sheet stabilizes and then grows modestly, in line with growth in the economy."

- "Asset purchases will begin with the restart of the regular term repo program, followed by Government of Canada (GoC) treasury bill purchases."

- "The Bank will restart its term repo program effective March 5, 2025... Initially, term repo operations will range between $2bln and S5bln."

- "Treasury bill purchases will resume later this year and be conducted via GoC auctions."

- "Purchases of GoC bonds will likely not need to start until towards the end of 2026 at the earliest."

Other Changes

- "Effective January 30, the deposit rate will be set at a spread of 5bps below the Bank's policy interest rate."

- "This change... is being made to improve its effectiveness" and "support the functioning of short-term funding markets."

- "Adjusting the deposit rate should also help mitigate some of the upward pressure that has been seen on the overnight rate relative to the Bank's target rate."

- "Effective January 30, when they are required. ORR operations will be conducted through a uniform price auction with an aggregate cash value amount... of a minimum of S8 billion and individual dealer limits for each ORR of $3 billion."

- Reaction at 09:55

- USD/CAD moved from 1.4440 to 1.4420 before paring the entirety of the move; initial CAD strength potentially driven by the lack of explicit signal for further easing, increasing inflation forecasts and the accompanying statement from Macklem which highlights inflation is close to target and economic activity is increasing. Points which, alongside the uncertainty around future US tariffs, indicates the BoC may be done for now with a wait-and-see approach to tariffs and any economic fallout from them.

For now, the central bank sees inflation holding close to the 2% target well into 2026 and said the upside and downside risks to price pressures were “reasonably balanced.” Policymakers said they see evidence that rate cuts are helping to boost the economy through consumption and housing activity, and that existing excess supply would be “gradually absorbed” over the next few years. Still, the threat of a tariff war looms large, and is “clouding the economic outlook,” the bank said. Trump has repeatedly pledged to levy 25% tariffs as soon as this Saturday, and Canada’s government has vowed to retaliate.

Combined, the communications suggest the central bank isn’t likely to make further adjustments to monetary policy until the specifics of Trump’s trade policy become clearer. Absent that threat, Canada’s economy looks increasingly headed for a soft landing.

The Bank of Canada also cut its growth forecasts for both 2025 and 2026, citing the dampening effect of government policies designed to curb population growth.

In the accompanying monetary policy report, the central bank lowered its forecast for economic growth in 2025 due to the federal government’s lower immigration targets. The bank now expects the economy to expand 1.8% in 2025 and 2026, down from 2.1 and 2.3% in previous projections. The central bank trimmed estimates for business investment and exports, but boosted its consumption forecast. Annual inflation in 2025 will average 2.3%, up from 2.2% in October, due to less excess supply, stronger oil prices and higher import prices resulting from the lower Canadian dollar. Inflation in 2026 is seen averaging 2.1%, up from 2.0% the bank forecast in October.

In an accompanying monetary policy report, officials also produced forecasts independent of the tariffs, but also modelled a scenario examining how a prolonged trade dispute — in which the US and Canada impose 25% tariffs on each other — could disrupt the northern nation.

Overall, the impact of a trade battle would be higher prices in Canada, even as the economy was substantially weakened. In that scenario, the effect of price increases from higher import costs and a weaker loonie would more than offset the drag from falling exports, business investment and demand.

Officials also announced that the central bank would end quantitative tightening on March 5, when it says it will restart asset purchases “as part of normal balance sheet management.” Earlier this month, Deputy Governor Toni Gravelle had signaled the program would soon end.

Policymakers also made changes to deposit rate, which will now be set 5 basis points below the overnight rate as of Thursday, a move that’s likely meant to incentivize a better flow of settlement balances or reserves across financial market participants.

The bank estimated that interest rate divergence with the Federal Reserve was responsible for about 1% of the depreciation in the Canadian dollar since October.

Macklem and Senior Deputy Governor Carolyn Rogers will speak to reporters at 10:30 a.m. Ottawa time. The governor will also do an interview with Bloomberg Wednesday afternoon.