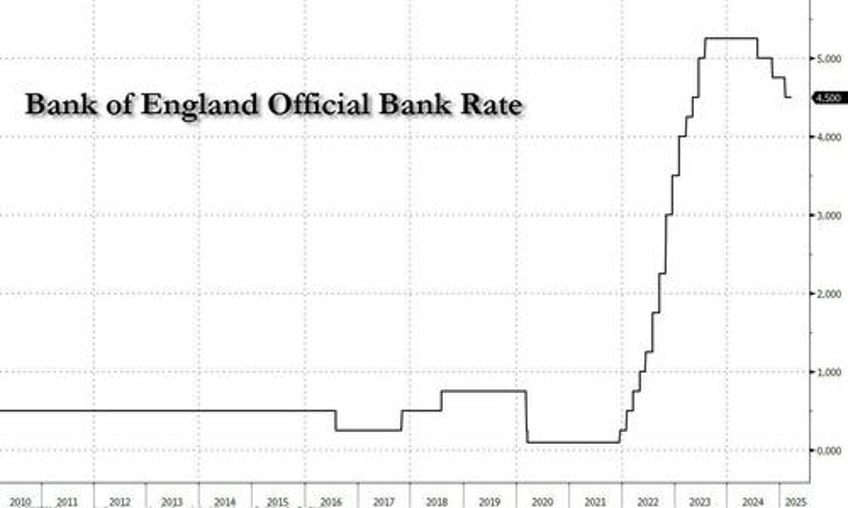

The Bank of England held interest rates at 4.5% as expected, and says it will stick to a “gradual and careful” approach to easing as some of its more outspoken doves turned cautious. The vote split was 8-1 (expectations were for a 7-2 split), with external member Swati Dhingra voting for a 25bp cut and Mann moving into the unchanged group. The BoE said that interest rates are still on a gradually declining path. As with all the other central banks this week, the BoE highlighted elevated uncertainty. It said domestic price and wage pressures were moderating, but remained elevated. Today's decision followed macro data which showed unemployment held at 4.4% and wage growth slowed as expected.

The BoE statement maintained the view that "a gradual and careful approach to policy restraint remains appropriate" and reiterated that monetary policy is not on a preset course over the next few meetings; the statement indicates that while the MPC does think that disinflationary progress has continued, there hasn't been enough news since the last MPC meeting to conclude a further rate cut was justified at this stage. It stated:

“There remained two-sided risks around the balance of supply and demand, and the persistence of domestic price and wage pressures. The underlying disinflationary process was expected to continue, but an accumulation of evidence would be used to assess progress. There was no presumption that monetary policy was on a pre-set path over the next few meetings.”

Some more highlights from the statement:

TRADE POLICY/GEOPOLITICS:

- Notes that gloval trade policy has intensified, other geopolitical uncertainties have also increase

- MPC will pay close attention to any signs of more lasting inflation pressure

ECONOMY:

- Domestic wage pressures are moderating, but are still somewhat elevated

- Energy prices are higher than last year

- It is possible that labour costs have been a driver of the recent pickup in nonenergy goods prices

- Notes that GDP has been slightly stronger than expected in February; surveys still suggest weak growth, and employment plans

GOVERNOR COMMENTS:

- BoE Governor Bailey says there is a lot of economic uncertainty

- Bailey still thinks that interest rates are on a gradually declining path

Overall, the decision was largely as expected with policy settings maintained and language around “gradual and careful" reiterated. The main update was the vote split, 8-1 with Dhingra the lone dissenter as activist Mann switched to an unchanged vote after calling for 50bps in February (Feb. decision was a 25bps cut); a switch which is likely one of the drivers behind the modest hawkish move.

In terms of guidance, language is much the same as last time, with the eight members who voted for unchanged, emphasising that “there had been relatively little news since the previous meeting...", one point of note is the continuing emphasis that the BoE is not on a pre-set path, though Bailey reiterated the view that interest rates are on a gradually declining path. Elsewhere, the release acknowledged upside in energy prices and moderating but elevated inflationary pressures.

According to UBS, the commentary from the BoE was "in line with market views. The notable change comes from MPC external member Mann. Having been hawkish for so long, she suddenly called for a 50bp cut in February, alongside Dhingra. Dhinghra voted for a 25bp cut this week. Mann, however, has returned to an unchanged view. Her suggestion for an activist approach has gone. While inconsequential for markets, it does draw attention to her odd vote at the last meeting."

There is no formal press conference as this is not an MPR meeting. However, Governor Bailey will likely do the press rounds later in the day, typically the lock-in period for this ends at around 16:00GMT though timing is for guidance only.

In kneejerk response, the pound trimmed declines and lifted from 1.2955 to 1.2979. While Gilts were also choppy but ultimately fell from 92.96 to 92.87 before extending to 92.75 over an eight minute period. UK 10-year yield is 6bps lower at 4.57%; two-year peer is 4bps lower at 4.17%. Money markets maintain BOE rate-cut wagers, price 53bps more cuts by the end of next year.