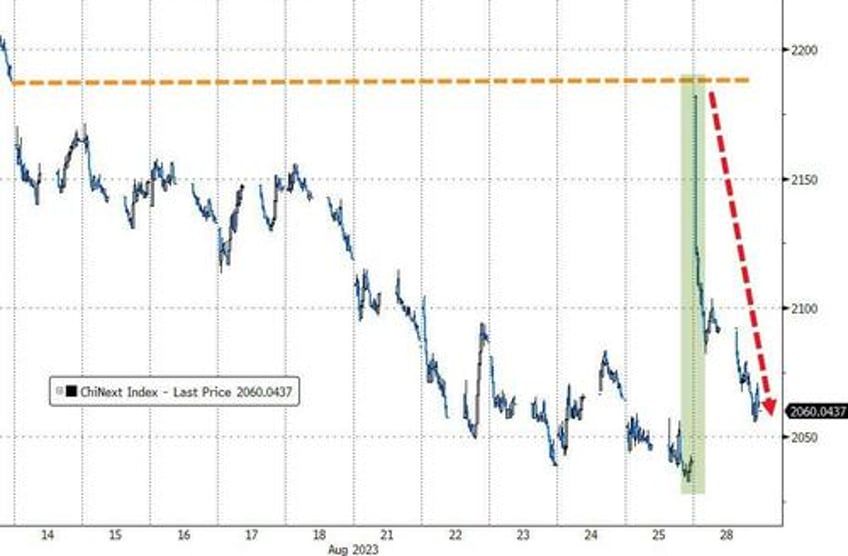

A quiet day for macro - ahead of a week chock full of 'event risk' signals from PCE to ISM to NFP - was dominated early on by China's 5th try-and-fail to ignite some momentum in its stock market...

Source Bloomberg

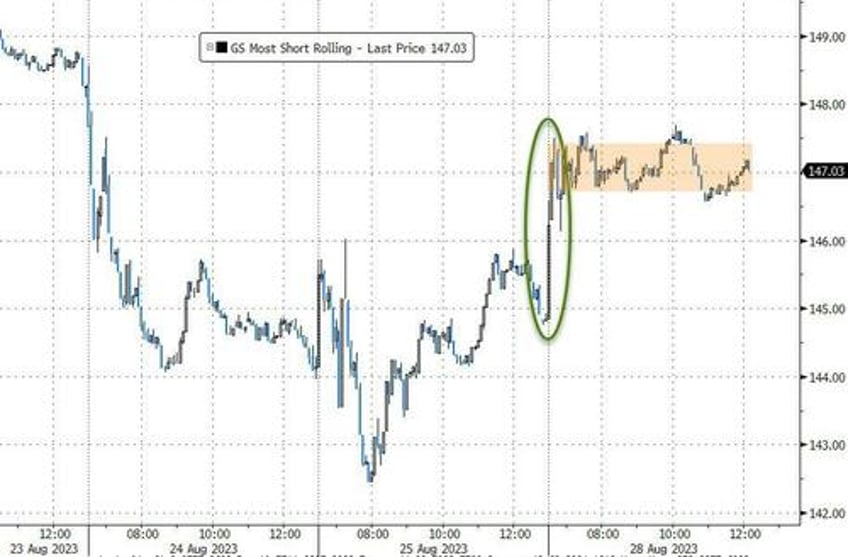

That, as well as the new negative gamma regime (see below) prompted a giant short-squeeze at the cash open (but note no follow-through)...

Source Bloomberg

And despite the opening mess, all the majors ended the day higher with Small Caps leading the charge...

The S&P stalled 4 times at a critical CTA level (4447)...

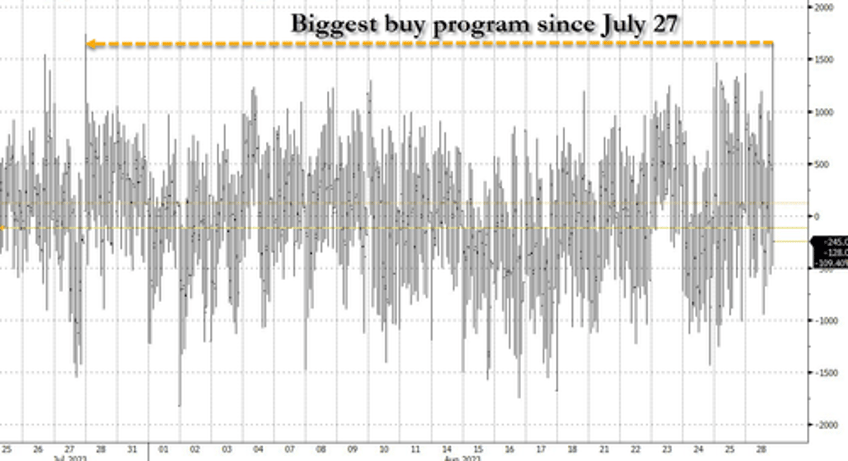

That late-day surge was the biggest buy-program since July 27th...

Source Bloomberg

NVDA was ugly early on but we suspect the buybacks stepped in and lifted the AI angel back to pre-earnings spike resistance...

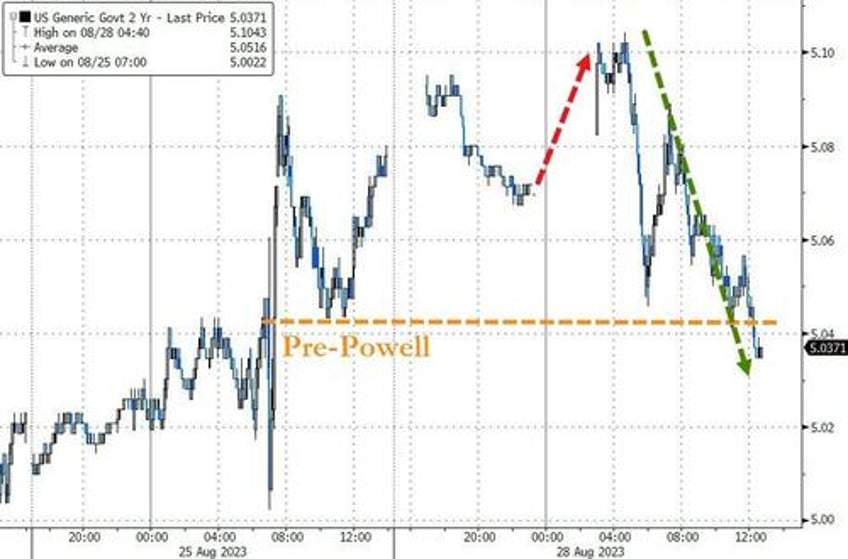

Treasuries were mixed with the long-end underperforming. All but the 30Y yield (unch) were down today. NOTE, Treasuries were bid during the Asia session and then bid again during the early US session...

Source Bloomberg

The 2Y yield fell back to pre-Powell levels today, but remains above 5.00%...

Source Bloomberg

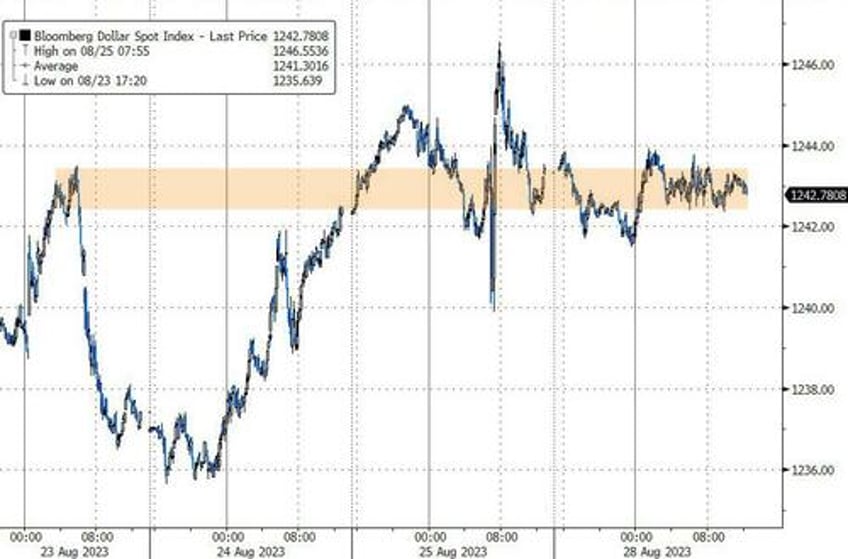

The dollar traded in a very narrow range all day ending unch...

Source Bloomberg

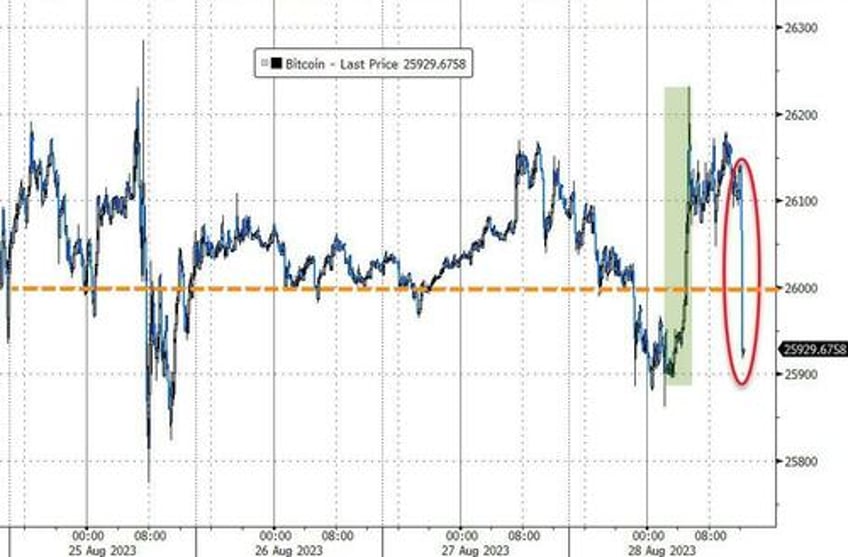

Bitcoin rallied back above $26k early but then puked back below as the equity market closed...

Source Bloomberg

Gold (spot) rallied back above $1925 today - 3 week highs...

Oil prices were also higher on the day with WTI managing to get back above $80...

Finally, as SpotGamma notes, we entered into a negative gamma regime earlier this month and remain there. The expected result of this is a relatively wider range of price action, but also daily trends that tend to continue more often in one direction without retracing.

The market can be more difficult to read when market gamma is negative. This is partly because the occasional faceripping rally tends to bring it right back up to its resistance points, and testing into neutral territory. However, with key levels dropping, a structural path keeps reopening itself for the market to sneak down over time.