Consumer products company Helen of Troy crashed in premarket trading in New York after missing earnings expectations and slashing its full-year outlook. This is yet another warning of lingering inflation and high interest rates impacting consumer spending.

"We are disappointed with the start to our fiscal year. We battled an unusual number of internal and external challenges in the quarter, which resulted in net sales and adjusted EPS below our outlook," CEO Noel Geoffroy wrote in a statement.

Geoffroy said, "Many of these challenges became more pronounced toward the end of the first quarter and some continue to evolve."

Helen of Troy designs, develops, and markets branded housewares, health and home products, and beauty products worldwide. Some of those brands include kitchen supplies manufacturer OXO, water bottle maker Hydro Flask, and electric shaver maker Braun.

The company reported a big fiscal first-quarter earnings miss, coming in at 99 cents a share a share on revenue of $416.8 million. Analysts tracked by Bloomberg expected earnings of $1.59 a share on revenue of $445.8 million.

Here's a snapshot of the first quarter results (courtesy of Bloomberg):

Adjusted EPS 99c vs. $1.94 y/y, estimate $1.59

Net sales $416.8 million, -12% y/y, estimate $445.8 million

Home & Outdoor net sales revenue $198.5 million, -8.6% y/y, estimate $221.8 million

Beauty & Wellness net sales rev $218.4 million, -15% y/y, estimate $224.8 million

Adjusted Ebitda $52.4 million, -28% y/y, estimate $64.8 million

Adjusted operating margin 10.3% vs. 13.9% y/y, estimate 13.1%

Gross margin 48.7% vs. 45.4% y/y, estimate 46.6%

Inventory $444.7 million, +2.5% y/y

Notice above how quarterly sales in beauty and wellness plunged. The company blamed "softer consumer demand" and "shifts in consumer spending" and "shipping disruption at the Company's Tennessee distribution facility due to automation startup issues" for its woes.

For fiscal 2025, the company slashed its outlook:

Sees adjusted EPS $7.00 to $7.50, saw $8.70 to $9.20, estimate $8.93 (Bloomberg Consensus)

Sees net sales $1.89 billion to $1.94 billion, saw $1.97 billion to $2.03 billion, estimate $1.99 billion

"We now see this fiscal year as a time to take action to reset and revitalize our business. As a result, we are lowering our annual outlook, which delays the delivery of the long-term financial algorithm in our strategic plan," CEO Geoffroy said.

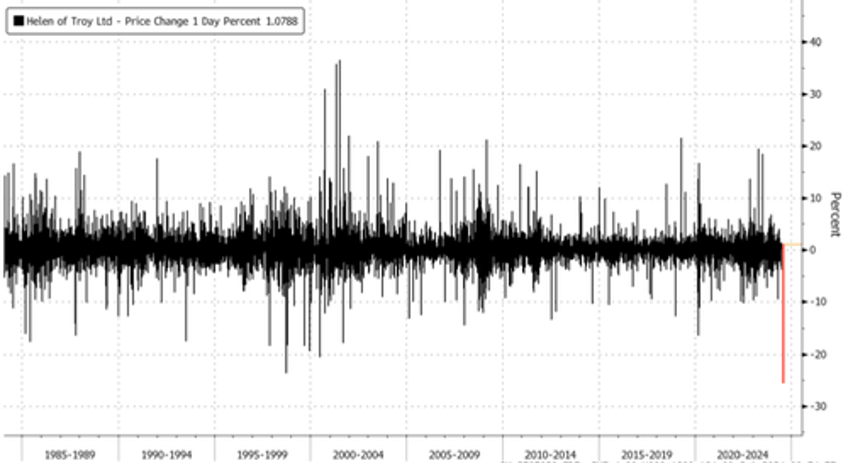

As a result of this dismal outlook for the company and major warning signs of a consumer slowdown will persist, shares in premarket trading in New York crashed as much as 25.5%.

If premarket losses hold into the cash session, Helen of Troy will be set for its biggest daily decline on record and lowest level since early 2015.

Helen of Troy is the latest example of consumer companies crushed in the consumer slowdown. Bloomberg noted:

Consumer companies, including Nike Inc. and Walgreens Boots Alliance Inc., saw shares tumble to multi-year lows after disappointing earnings and guidance.

With the S&P500 index hitting new highs by the day, let's not forget about apparel stocks negatively diverging on weak consumer trends.

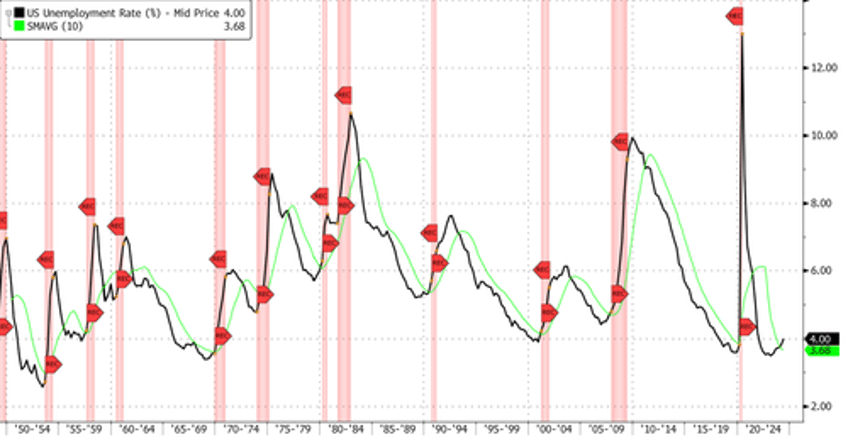

Bloomberg pointed out in a report Monday, "A labor market indicator signaled it has passed a tipping point for recession ahead, and options skew favors calls on Fed funds futures."

We have been vocal about the ongoing consumer slowdown:

- Goldman Tells Top Clients To Start "Shorting The Middle-Income Consumer"

- Goldman's Commentary On Consumer Health Is An Ominous One

- "Did Something Change?": Goldman Trading Desk Warns Hedge Funds Are Suddenly Dumping Consumer Stocks

It's clear that cracks in the middle class are widening as folks reduce their spending. Is a recession ahead?