Another quiet macro day was relatively catalyst-free - even with an armada of Fed Speakers - since all pretty much sang from the hymn-sheet - data-dependent, job not done, inflation still too high, rates high(er) for long(er), no cuts on the agenda:

Kashkari (uber hawkish): “I’m not see a lot of evidence that the economy is weakening,” reminding markets that there hasn’t been any discussions about interest-rate cuts at the FOMC.

Goolsbee (hawkish dreamer): The Fed can continue down what he calls the “golden path” to a soft landing. “We’ve got to get inflation down - that’s the No. 1 thing..."

Barr (hawkish, anti-crypto): “It is really critical that we continue to do the work necessary to make sure we get inflation down to 2%.” Fed has "strong interest" in regulating stablecoins, "still weighing the prospect" of CBDC.

Schmid (no comment on monetary policy): "The transition from fossil fuels to renewables is both reliant upon and an influencer of supply chains and capital allocation."

Waller (hawkish/neutral): Labor supply "clearly calming down", normalizing to pre-pandemic levels. "Everything was booming" in Q3. 10Y yield 'tightening' has been a monetary policy "earthquake." Prices probably won't go back to pre-pandemic levels, if rate-hikes "cause instability, Fed has other tools."

Logan (hawkish): "I have seen some important cooling in the labor market... inflation readings look like they are trending towards 3%, not 2%... " Critical that Fed "stay true to" 2% inflation target, "must stay focused on curbing inflation in a timely way."

Bowman (uber hawkish): “I continue to expect that we will need to increase the federal funds rate further to bring inflation down to our 2% target in a timely way.”

At around 1215ET, the FHFA said that FHLBs wil face new rules to curtail loans to struggling banks. Regional banks will be 'proper fucked' by this as, for now, this has been a workaround for them to manage the holes in their balance sheets.

The NYFed confirmed that the recent "strength" of the consumer was shown to be based on credit-card spending... and delinquencies are on the rise.

But none of that mattered to big-tech buyers as Nasdaq rallied from the cash open once again. The Dow and S&P managed modest gains while Small Caps ended red...

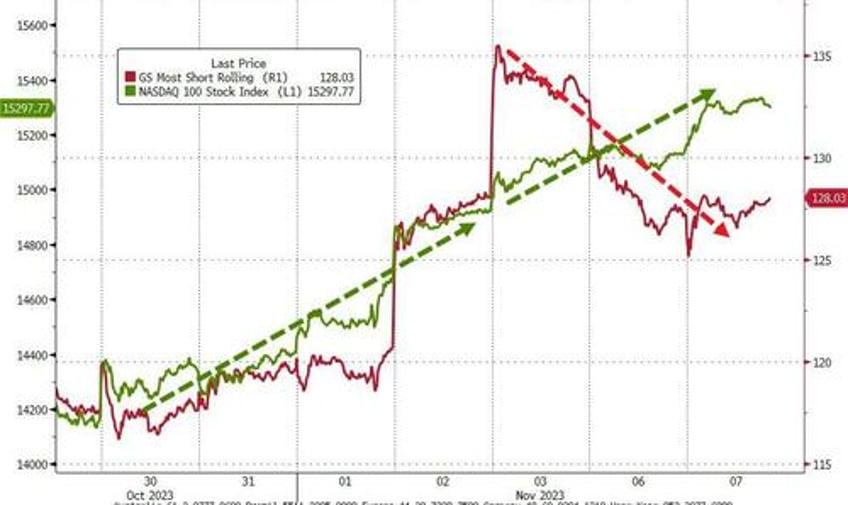

As UBS notes, US equities are squeezy below the surface in tech with profitless tech up 2.6% (some earnings driven) among the best performers on Tuesday, but not the broad squeeze/unwind seen across sectors last Thursday and Friday. The difference now vs last week is that mega caps are acting defensive and hence there is a much broader tech rally on Tuesday.

Source: Bloomberg

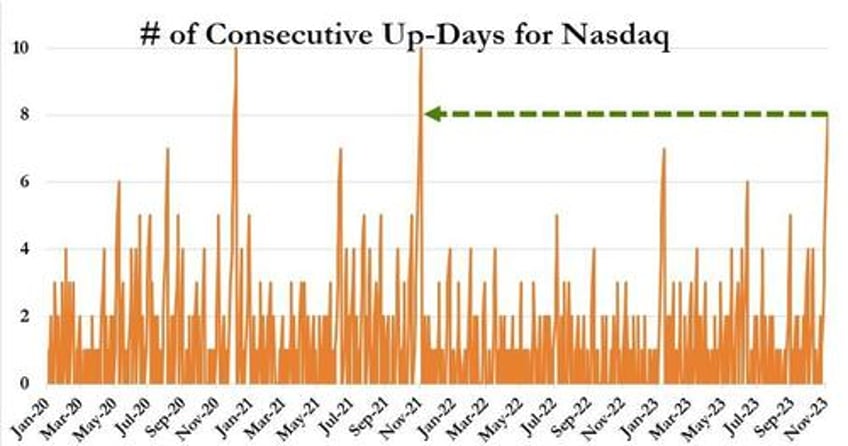

8 straight day higher for Nasdaq and 7 straight for S&P - the longest winning streaks since Nov 2021...

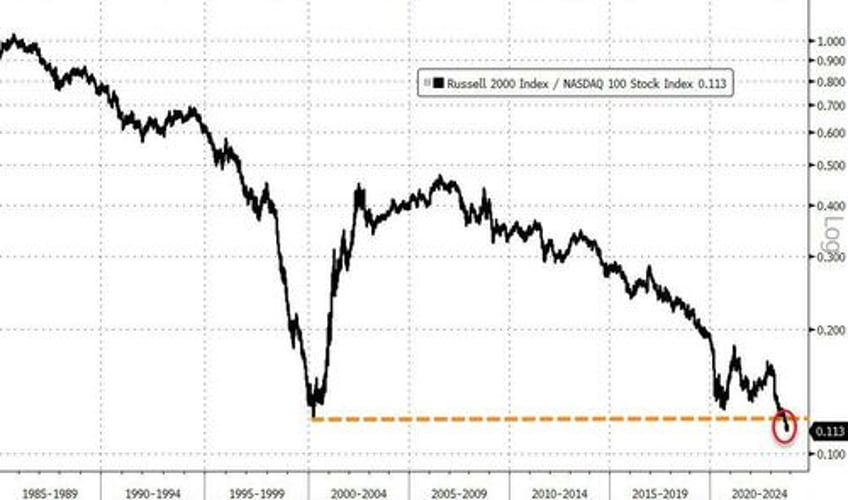

Small Caps are down for the second day, pushing the Russell 2000 to its widest gap to Nasdaq... ever

Source: Bloomberg

Small caps’ underperformance suggests some underlying jitters about an economic downturn, inflation and the impact of continued Fed hikes. These companies have more limited revenue streams than mega caps and are less able to pass through higher costs. They’re also more sensitive to slowing growth and changes in borrowing costs.

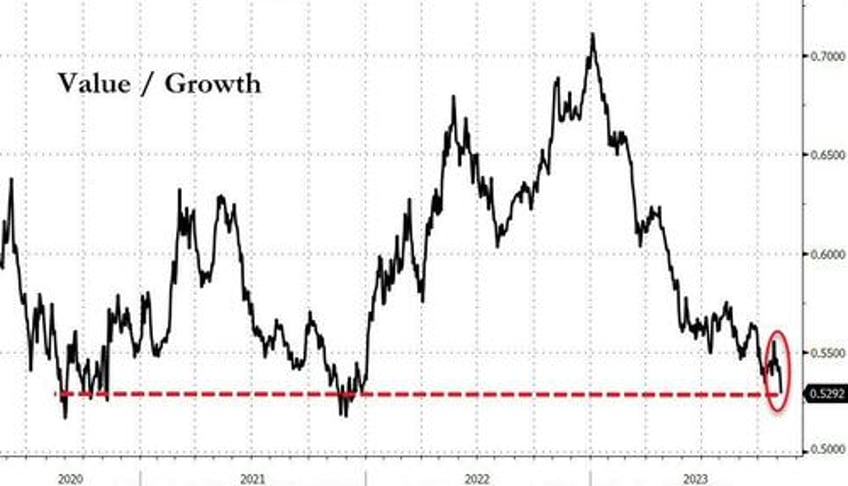

Value underperformed Growth once again, testing down to recent lows...

Source: Bloomberg

The Nasdaq Composite topped its 100DMA but the late day selloff tested back down to that level...

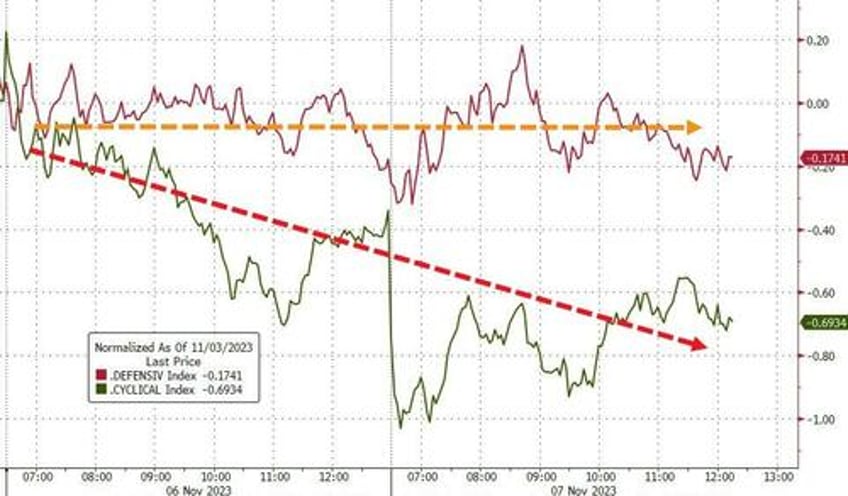

For the second day in a row, cyclical stocks failed to sustain a bid (defensives outperformed) as investors continue to envisage an eventual slowing in the economic growth momentum...

Source: Bloomberg

VIX was smashed to a 14 handle as gamma went increasingly positive...

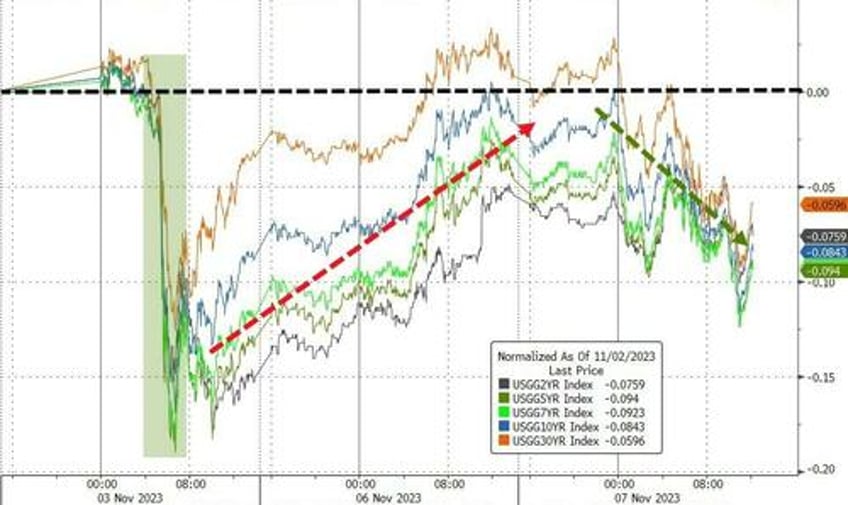

Treasuries were bid across the curve with the long-end outperforming (30Y -7bps, 2Y -2bps)...

Source: Bloomberg

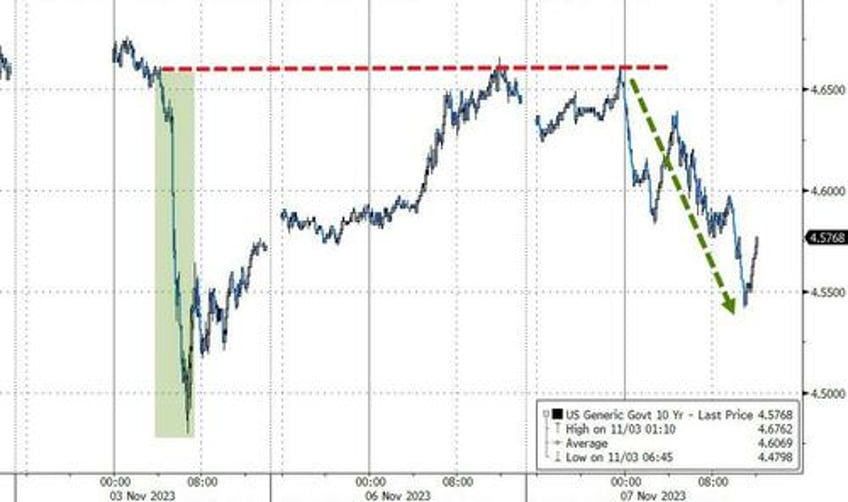

10Y yields ran up to pre-payrolls levels, hit all the stops, and have dropped since...

Source: Bloomberg

The dollar followed the same path - rallying up to pre-payrolls levels and reversing on the stops...

Source: Bloomberg

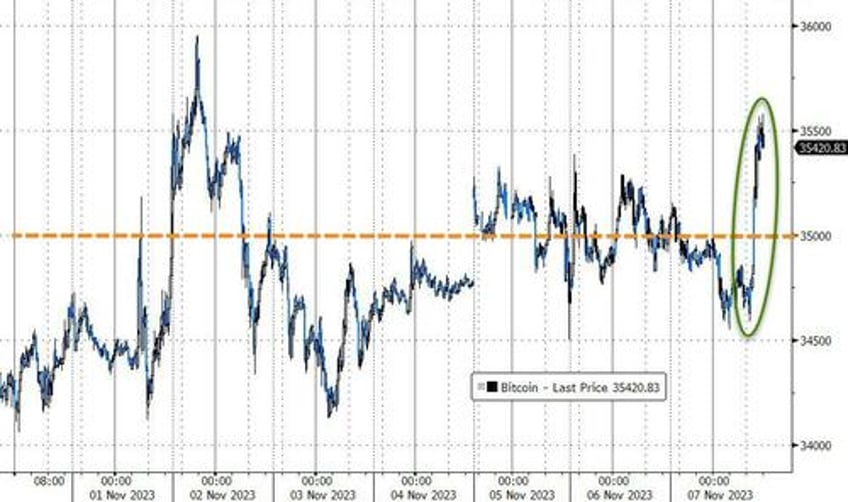

Bitcoin surged higher around 1215ET, back above $35,500...

Source: Bloomberg

Gold drifted lower again today...

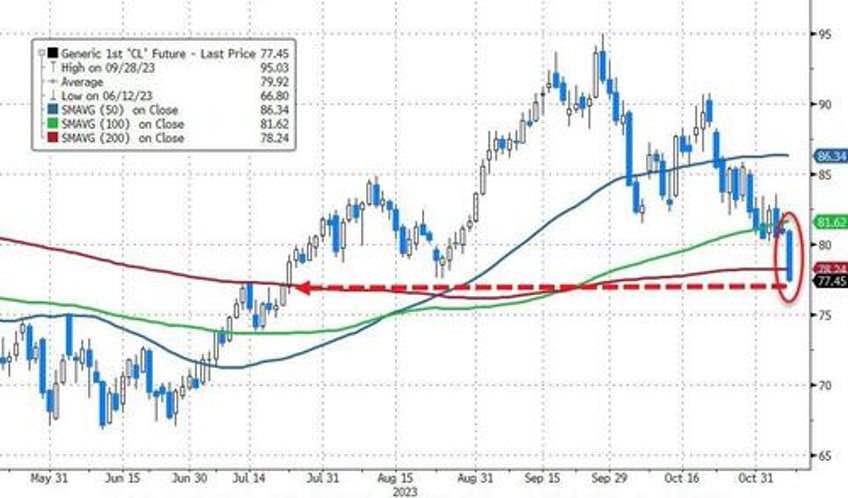

Oil was down hard today (ahead of tonight's API data), well below the pre-Israel levels...

...and breaking below the 200DMA to its lowest since July...

Source: Bloomberg

Finally, the world’s central banks keep draining the flood of pandemic-era liquidity from financial markets. “Central banks’ balance-sheet reduction will further deplete excess liquidity in the US, UK and Euro Area but the timing, speed and effects will vary,” strategists including Oliver Levingston wrote in a note to clients Tuesday.

Source: Bloomberg

Is the market betting on future balance-sheet expansion? Or do we need to see the convergence of stocks and liquidity before the world's central banks unleash their balance sheets once more?