Despite the slump in 'soft' survey data, analysts expected Empire Fed Manufacturing to bounce back from March's tumble to one year lows and they were right with the headline index rising from -20.0 to -8.1 (considerably better than the -13.5), but still negative. However, while current conditions jumped, expectations plunged to the lowest since 9/11/...

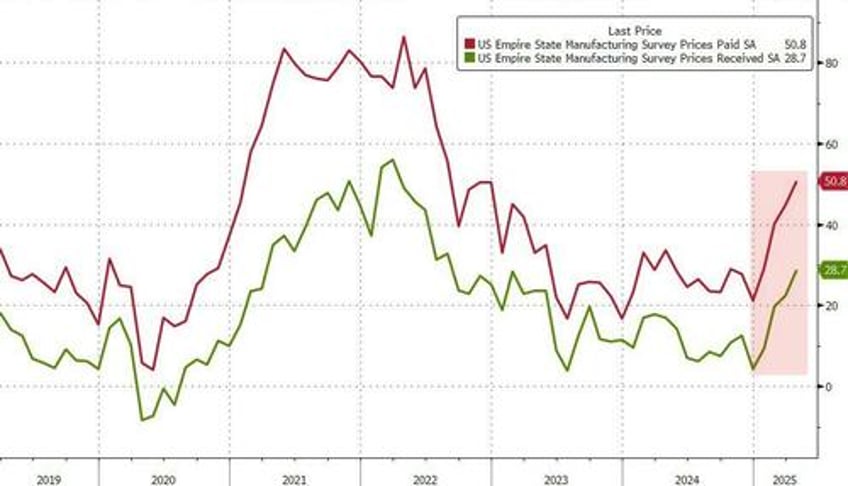

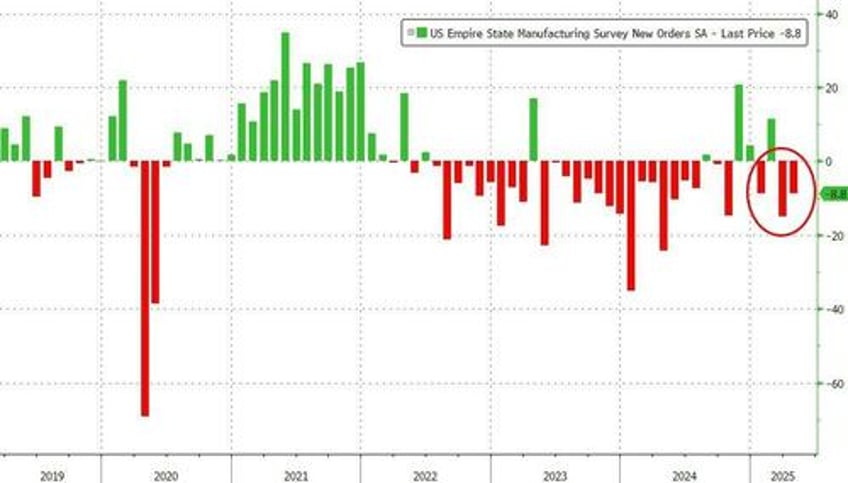

Source: Bloomberg

The gauges of future bookings and shipments dropped to the lowest in data back to 2001.

“After declining sharply last month, business activity continued to contract modestly in New York State in April. Input and selling price increases picked up to the fastest pace in more than two years. Firms turned pessimistic about the outlook for the first time since 2022.”

~Richard Deitz, Economic Research Advisor at the New York Fed

An index of current prices paid for materials increased nearly 6 points to 50.8, the highest since August 2022, while a gauge of prices received by manufacturers in the state also rose to a more than two-year high.

The figures, in addition to increases in price expectations, indicate higher tariffs are contributing to inflationary pressures.

The New York Fed’s gauge of current new orders and an index of shipments shrank at slower rates.

Are they interviewing the same people as the UMich surveyors?