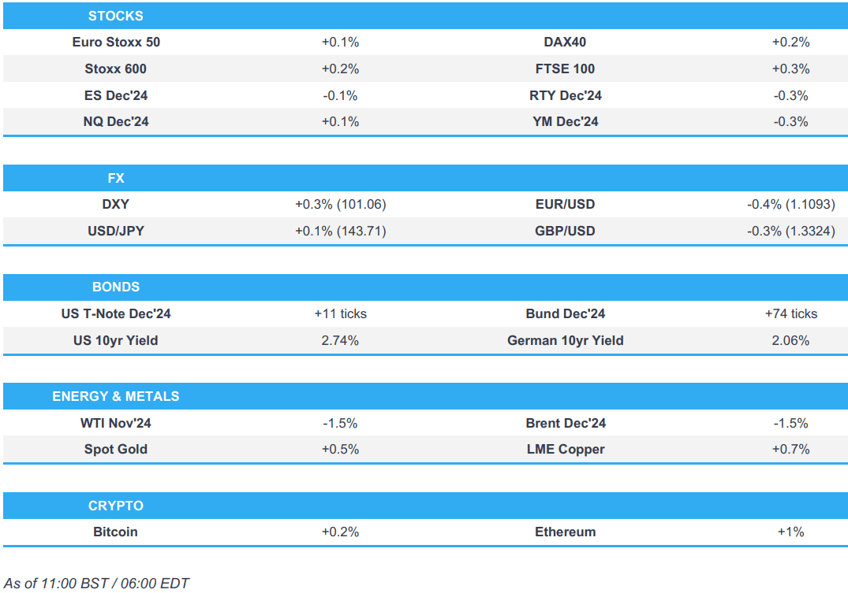

- Equities are mixed ahead of US ISM Manufacturing and JOLTS data; RTY marginally underperforms

- Dollar is firmer continuing the gains seen post-Powell on Monday, EUR was fairly unreactive to EZ Manufacturing PMIs/HICP

- USTs are firmer and back to pre-Powell levels, Bunds also gain but were unmoved by the EZ PMIs which were revised modestly higher but the overall growth narrative remains weak

- Crude continues to slip, XAU gains and base metals are mixed

- Looking ahead, US, Canadian Manufacturing PMIs, US ISM Manufacturing PMI, JOLTS Job Openings, Speakers including ECB’s Schnabel, BoE’s Pill, Fed’s Bostic, Cook & Barkin, Earnings from Paychex, Nike, Lamb Weston

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.2%) began the session around flat, but quickly dipped lower as sentiment took a hit early in the morning; a move which has since stabilised. As it stands, indices in Europe are mixed and trade very modestly on either side of the unchanged mark. EZ Manufacturing PMI/HICP figures passed through with little impact on price action.

- European sectors hold a slight positive bias, but with the breadth of the market fairly narrow. Tech takes the top spot alongside strength in Travel & Leisure. Energy is found at the foot of the pile, given the continued weakness in oil prices.

- US Equity Futures (ES -0.1%, NQ U/C RTY -0.3%) are mixed, with slight underperformance in the economy-linked RTY as traders continue to digest remarks from Fed Chair Powell who pushed back against another oversized cut in 2024.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is building on the gains seen yesterday that were driven by comments from Fed Chair Powell. DXY has briefly made its way onto a 101 handle, topping out at 101.04.

- EUR/USD is on the backfoot vs. the USD as the post-Powell USD buying has dragged the pair lower. Today's in-line EZ HICP metrics provided little follow-through into the EUR given soft regional prints ahead of the release.

- GBP is softer vs. the broadly firmer USD as Cable extends its move further south of the 1.34 mark, taking out its 10DMA at 1.3338 in the process.

- After a soft start to the session, which looked to be a continued fall out from the post-Powell USD buying, JPY has been able to regain some poise vs. the USD after the pair topped out at 144.53.

- AUD/USD is currently straddling the 0.69 mark after yesterday's Powell-induced selling pressure dragged the pair away from its 0.6942 YTD peak. For now, the pair is holding above yesterday's low at 0.6894 with Retail Sales overnight offering some support. NZD/USD is holding just above the 0.63 mark

- BNZ forecasts a 50bps at the October RBNZ policy announcement.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are firmer and back to pre-Powell levels after the marked bear-flattening the Chair induced on Monday evening. USTs to a 114-21 peak, approaching Monday’s best which itself is a tick below Friday’s 114-25 peak. Docket ahead is headlined by Final Manufacturing and then, more pertinently, the ISM Manufacturing PMI before remarks from Barkin, Bostic & Cook.

- EGBs are firmer, lifted by the Final PMIs as while there were modest upward revisions the overall growth-narrative remains weak and factors in favour of the doves who are considering an October cut; EZ CPI printed largely in-line, and had no impact. Bunds to a 135.72 peak, which has eclipsed the August 135.66 best for a new contract high.

- Gilts are at a 99.15 peak with supply strong but spurring no move ahead of remarks from Chief Economist Pill this afternoon. BoE's Greene spoke overnight and noted that she is attentive to any sign that firms could begin passing on higher costs if consumption rebounds strongly. Today’s Manufacturing PMI data for the UK was unrevised.

- UK sells GBP 2.25bln 4.75% 2043 Gilt: b/c 3.27x (prev. 3.37x), average yield 4.421% (prev. 4.372%) & tail 0.1bps (prev. 0.2bps)

- Germany sells EUR 3.301bln vs exp. EUR 4bln 2.50% 2029 Bobl: b/c 1.9x (prev. 2.2x), average yield 1.9% (prev. 2.17%) & retention 17.48% (prev. 16.25%)

- Click for a detailed summary

COMMODITIES

- Subdued trade in the crude complex as the China optimism loses steam (against the backdrop of a cautious risk tone) and with the complex largely ignoring recent geopolitical developments. Do note, Libyan supply is slated to resume today after the dispute between eastern and western factions was settled. Brent'Dec sits just off today's trough, with the range for today is USD 69.91-71.97/bbl parameter.

- Precious metals are modestly firmer despite the stronger Dollar but amidst the backdrop of escalating geopolitics. XAU sits in a current USD 2,633.31-2,647.51/oz parameter.

- Base metals are somewhat muted/mixed as the complex takes a breather from the recent China-induced gains and in the run-up to risk events including ISM Manufacturing today and NFP on Friday. As a reminder, Chinese markets will be away for the rest of the week amid Golden Week Holiday.

- US buys 6mln bbls of oil for SPR with 1.5mln bbls of oil per month for delivery from February to May 2025, according to the Energy Department.

- Chevron (CVX) reports unplanned flaring at its 290k BPD El Segundo California refinery, according to a community alert.

- BofA retain their bullish call on gold and see yellow metal hitting USD 3000/oz next year. Copper at USD 12,000/t or USD 5.44/lb in 2026

- Click for a detailed summary

NOTABLE DATA RECAP

- EU HICP-X F&E Flash YY (Sep) 2.7% vs. Exp. 2.7% (Prev. 2.8%); HICP-X F,E,A&T Flash YY (Sep) 2.70% vs. Exp. 2.80% (Prev. 2.80%); HICP Flash YY (Sep) 1.8% vs. Exp. 1.8% (Prev. 2.2%); Services Y/Y 4.0% vs. prev. 4.1%

- UK BRC Retail Shop Price Index YY (Sep) -0.6% vs Exp. -0.3% (Prev. -0.3%)

- Spanish HCOB Manufacturing PMI (Sep) 53.0 vs. Exp. 50.2 (Prev. 50.5)

- Swiss Manufacturing PMI (Sep) 49.9 vs. Exp. 47.8 (Prev. 49).

- Italian HCOB Manufacturing PMI (Sep) 48.3 vs. Exp. 49 (Prev. 49.4)

- French HCOB Manufacturing PMI (Sep) 44.6 vs. Exp. 44 (Prev. 44)

- German HCOB Manufacturing PMI (Sep) 40.6 vs. Exp. 40.3 (Prev. 40.3)

- EU HCOB Manufacturing Final PMI (Sep) 45.0 vs. Exp. 44.8 (Prev. 44.8)

- UK S&P Global Manufacturing PMI (Sep) 51.5 vs. Exp. 51.5 (Prev. 51.5)

NOTABLE EUROPEAN HEADLINES

- Deutsche Bank now expects an ECB cut in October and believes a 50bps move in December could be a close call if recent weaker growth and inflation trends continue.

- ECB's de Guindos says expectations surveys are an important part of the toolkit available to central banks for their policy analysis.

- ECB's Rehn sees EZ inflation stabilising at 2% during 2025; direction of monetary policy is clear - rate cuts have begun; stance is becoming less restrictive; pace and scale of cuts decided meeting-by-meeting. Draghi report is a necessary wake-up call about Europe's low growth and will provide good bases for next commission work programme. EZ growth could be weaker than forecast. In his view, there are now more reasons to justify a rate cut in October; recent weakening of EZ growth outlook also tips the scale in direction of an October cut

- ECB's Nagel says that future purchases of government bonds by the European Central Bank should be reserved for special cases, according to Bloomberg.

- French PM Barnier is planning to announce additional tax increases of EUR 15-18bln in an attempt to gain back control of the nation's finances, according to Le Parisien. To speak at 14:00BST/09:00ET

- Riksbank minutes (September meeting): Thedeen said; "The fact that we explicitly state in the draft report that we may make cuts in larger steps is a clear indication that, given the favourable inflation outlook, this is now part of our gradual monetary policy strategy". "Krona remains undervalued and our inflation forecast is based on the assumption of a gradual appreciation of the exchange rate". Click for full details.

NOTABLE US HEADLINES

- Port of Houston Authority said in the event of a work stoppage, Port Houston container terminal gates will be closed beginning October 1st. It was reported shortly after that the United States Maritime Alliance said USMX and ILA exchanged counter offers around wages, while it is hopeful to fully resume collective bargaining around other outstanding issues in an effort to reach an agreement. However, the union later rejected the latest USMX Ports contract offer which it called unacceptable, according to a Reuters source.

GEOPOLITICS

MIDDLE EAST - EUROPEAN MORNING

- "Al-Arabiya correspondent: Lebanese army deployed in the Bekaa", according to Al Arabiya.

- "Israel Broadcasting Corporation quoting an Israeli official: The scale of ground operations in Lebanon could change", according to Sky News Arabia.

- Israel Security Official says Israeli ground operation is limited, and a wider operation targeting Beirut is "not on the table"; no clashes with Hezbollah reported yet on the ground.

- "Al-Arabiya sources: The Israeli army plans to incursion into Lebanon from 1 to 2 km in the first phase", according to Al Arabiya

MIDDLE EAST

- Israeli military said it began limited, localised and targeted raids against Hezbollah targets in the border area of southern Lebanon, while it said the targets are located in villages near the border and pose an immediate threat to northern Israeli communities. Furthermore, Axios reported that officials also confirmed that the Israeli ground operation in southern Lebanon has started.

- An Israeli strike was reported on a building in Ain Al-Hilweh Palestinian Camp near Lebanon's Sidon and Lebanese sources noted an Israeli raid targeted the house of Major General Munir Al-Maqdah inside the Ain al-Hilweh camp, according to Sky News Arabia.

- Israel informed Washington it is planning a limited ground operation in Lebanon that could start imminently, according to the Washington Post. Furthermore, a senior US official told Fox that Israel will launch a "limited" ground incursion into South Lebanon, while the official added that an incursion is imminent and will be smaller in scale than in 2006 and last a shorter period of time.

- Israeli Security Cabinet approved the war’s next phase and ministers slammed US leaks about ground operations, according to Times of Israel.

- Hezbollah said it is countering Israeli ground military movements and it targeted Israeli troop movements across from Lebanese border towns.

- Israel's Channel 12 reported that about 10 rockets were fired from Lebanon and landed in open areas in Miskaf in northern Israel, according to Sky News Arabia. It was separately reported that the IDF said it monitored the launch of 3 rockets from Lebanon towards Safed and it intercepted two rockets while the other landed in an open area, according to Al Jazeera.

- Syrian state media reported that explosions were heard over Syria's capital Damascus with Syrian air defences intercepting hostile targets.

- Yemen's Houthis said they will escalate military operations in response to Israeli attacks.

- Media outlets close to the Houthis noted talk about the Houthis launching a ballistic missile towards Tel Aviv, according to Sky News Arabia. Israel's Channel 12 reported shortly after that residents in central Israel heard an explosion in the Tel Aviv area.

- A military base hosting US forces near Iraq's Baghdad International Airport was targeted by a rocket attack.

- Yemeni Houthi spokesperson says group targeted Israeli military posts in Tel Aviv and Eilat with drones.

OTHER

- Russia's Deputy Foreign Minister says Russia are ready for a long confrontation with the US; They send all necessary warnings.

- North Korea criticised the US deployment of nuclear assets in South Korea with a US B-1B bomber potentially to participate in a planned military parade on Tuesday.

CRYPTO

- Bitcoin is essentially flat and holds just beneath USD 64k.

APAC TRADE

- APAC stocks began the new quarter mixed amid a slew of data releases and several key market closures with markets in Mainland China, Hong Kong and South Korea closed, while participants also reflected on Fed chair Powell's recent comments and Israel's ground offensive in Lebanon.

- ASX 200 was pressured as underperformance in the mining, materials and financial sectors overshadowed the resilience in tech and defensives, while data releases were mixed as Retail Sales topped forecasts but Building Approvals showed a sharper-than-feared contraction.

- Nikkei 225 rallied after the recent heavy selling with the recovery facilitated by a weaker currency amid mixed Tankan data and varied BoJ opinions.

NOTABLE ASIA-PAC HEADLINES

- BoJ Summary of Opinions from the September meeting stated that a member said there is no change to the stance of adjusting the degree of monetary support if the economy and prices move in line with forecast although they must be vigilant to factors behind still unstable markets, while there was an opinion from a member that there is no need to raise rates when markets are unstable because they are not behind the curve on inflation and a member also said that given economic and market uncertainties, it is undesirable to make further changes to policy rate in a way that give markets impression they are moving to full-fledged policy tightening. Furthermore, a member said there is no change to the view that the BoJ must raise rates without waiting too long, but the rate hike must not be purpose in itself, while a member also thought that the rate path should move policy rate to 1.0% in the latter half of fiscal 2025 at earliest.

- Japan's newly appointed Finance Minister Kato says he has been instructed to promote a growth-orientated economy driven by wage increases and investment, via Jiji.

- Japan's newly appointed Economy Minister Akazawa says he wants the BoJ to decide on future rate hikes carefully; Taking Japan completely out of deflation is the top priority.

DATA RECAP

- Japanese Tankan Large Manufacturing Index (Q3) 13.0 vs. Exp. 13.0 (Prev. 13.0); Outlook (Q3) 14.0 vs. Exp. 12.0 (Prev. 14.0)

- Japanese Tankan Large Non-Manufacturing Index (Q3) 34.0 vs. Exp. 32.0 (Prev. 33.0); Outlook (Q3) 28.0 vs. Exp. 30.0 (Prev. 27.0)

- Japanese Tankan Large All Industry Capex Estimate (Q3) 10.6% vs. Exp. 11.9% (Prev. 11.1%)

- Japanese Unemployment Rate (Aug) 2.5% vs. Exp. 2.6% (Prev. 2.7%)

- Australian Building Approvals (Aug) -6.1% vs. Exp. -4.3% (Prev. 10.4%, Rev. 11.0%)

- Australian Retail Sales MM (Aug F) 0.7% vs. Exp. 0.4% (Prev. 0.0%)

- New Zealand Building Consents (Aug) -5.3% (Prev. 26.2%, Rev. 26.4%)