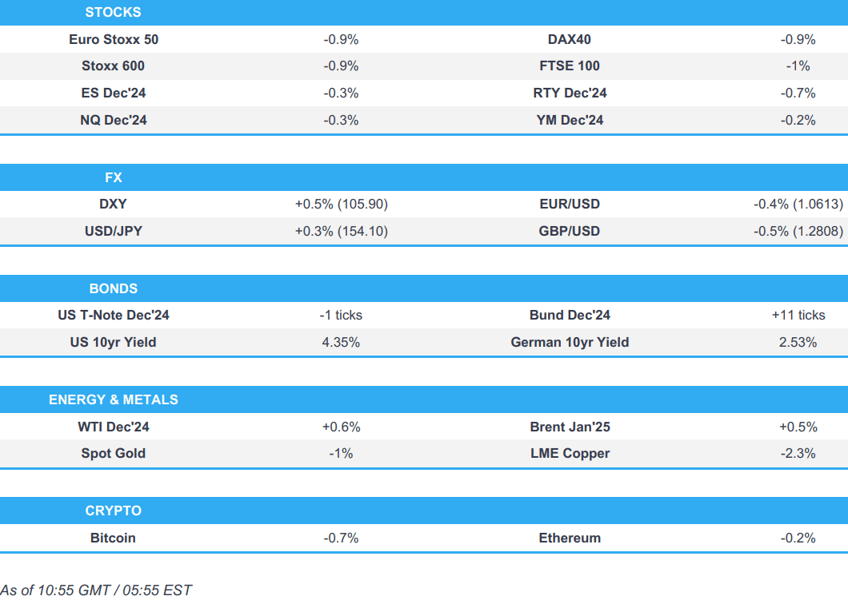

- Equities are on the backfoot; the RTY underperforms, paring some of the Trump-induced strength in the prior session.

- Dollar continues to advance higher, GBP on the backfoot following mixed jobs data which saw an uptick in unemployment but wages remain sticky.

- Bonds are mixed, USTs are flat ahead of several Fed speakers whilst Bunds are bid after poor German ZEW figures.

- Crude holds an upward bias, XAU/base metals are pressured by the stronger Dollar; BTC pulls back from a USD 89k handle.

- Looking ahead, NY Fed SCE, OPEC MOMR, Speakers including ECB’s Cipollone, Fed’s Waller, Barkin, Kashkari & Harker.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-1%) opened on very weak footing and continued to trundle lower as the morning progressed. In recent trade, sentiment has picked up a touch, with indices now sitting just above worst levels.

- European sectors hold a strong negative bias. Tech takes the top spot, lifted by post-earning strength in Infineon +4.5%, despite reporting weak results and cutting guidance. China-exposed sectors such as Basic Resources and Consumer Products are found at the foot of the pile, weighed on by the glum mood in China overnight.

- US Equity Futures (ES -0.1%, NQ -0.1%, RTY -0.4%) are entirely in the red, with very modest underperformance in the RTY, in a slight paring to the hefty Trump-induced gains seen in the prior session.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is firmer vs. all peers as the post-election rally continues and focuses markets on the prospect of looser fiscal policy vs. a subsequently potentially tighter approach from the Fed. DXY has been as high as 105.87 with all eyes on a test of the 106 mark.

- EUR is softer vs. the broadly stronger USD with the pair's bruising post-election sell-off continuing to pick-up pace. From a macro perspective in the Eurozone, today has seen commentary from ECB's Rehn and Holzmann with the former flagging downside risks to growth and the latter cautioning over the impact of Trump tariffs on inflation. German ZEW fell short of expectations. EUR/USD has delved as low as 1.0618.

- USD/JPY has made its way onto a 154 handle, topping out at 154.16 vs. yesterday's opening levels of 152.61. Fresh macro drivers for Japan have been on the quiet side today.

- GBP is near the foot of the leaderboard in the wake of UK jobs metrics. The usual data quality caveats apply, however, the main takeaway was a larger-than-expected jump in the unemployment rate to 4.3% from 4.0% and a slowdown in the rate of employment. Comments from BoE's Pill this morning adopted a cautious stance towards further policy loosening.

- Antipodeans are both softer vs. the USD with risk sentiment in Europe very much on the backfoot and a poor showing for China overnight.

- PBoC set USD/CNY mid-point at 7.1927 vs exp. 7.1944 (prev. 7.1786).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are softer but only modestly so, with US-specific newsflow somewhat light as we count down to a handful of Fed speakers today before CPI and Powell later in the week. Currently, at the mid-point of a 109-24+ to 110-04 bound, yields firmer across the curve which is a touch flatter as it stands.

- Bunds were under modest pressure, but lifted incrementally from a 132.24 base, amid geopolitical reports, which suggested that Israel is planning an imminent ground operation in Lebanon, reported via Sky News Arabia (since deleted). Thereafter, soft ZEW metrics helped lift Bunds futher to a 132.62 peak.

- Gilts underperform vs peers after today's mixed jobs report, where the unemployment rate lifting markedly, whilst the wages metrics remained sticky. Gilts lifted off lows in tandem with the bid in Bunds, and were largelly unreactive to its own robust auction.

- Netherlands sells EUR 2.105bln vs exp. EUR 2.0-2.5bln 0.25% 2029 DSL Auction: average yield +2.295% (prev. -0.427%).

- UK sells GBP 2.25bln 4.75% 2043 Gilt Auction: b/c 3.28x (prev. 3.27x), average yield 4.4836% (prev. 4.421%) & tail 0.1bps (prev. 0.1bps)

- Germany sells EUR 4.019bln vs exp. EUR 5bln 2.0% 2026 Schatz Auction; b/c 2.20x (prev. 2.61x), average yield 2.11% (prev. 2.16%) & retention 19.62% (prev. 16.76%)

- Click for a detailed summary

COMMODITIES

- Crude holds a mild upward bias after Israel's Defence Minister Katz poured cold water on hopes of a Hezbollah-Israel ceasefire, suggesting there will be no ceasefire and Israel will continue to hit Hezbollah with full force. Brent towards the top of a USD 71.55-72.36/bbl parameter.

- Precious metals are softer across the board amid the continued gains in the USD on the back of the ongoing Trump trade. Spot gold fell under USD 2,600/oz resides towards the bottom of a USD 2,590.89-2,627.23/oz parameter.

- Base metals are lower across the board amid the firmer Dollar and a continuation of the disappointment from the NPC Standing Committee meeting last week. 3M LME copper fell to levels under USD 9,200/t.

- OPEC Monthly Oil Market Report due to be released at 11:40GMT/06:40EST.

- Biden’s administration is setting out plans for the US to triple nuclear power capacity by 2050, according to Bloomberg.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK ILO Unemployment Rate (Sep) 4.3% vs. Exp. 4.1% (Prev. 4.0%)

- UK HMRC Payrolls Change (Oct) -5k (Prev. -15k, Rev. -9k); Claimant Count Unemployment Change (Oct) 26.7k (Prev. 27.9k, Rev. 10.1k)

- UK Avg Earnings (Ex-Bonus) (Sep) 4.8% vs. Exp. 4.7% (Prev. 4.9%); Avg Wk Earnings 3M YY (Sep) 4.3% vs. Exp. 3.9% (Prev. 3.8%, Rev. 3.9%)

- German ZEW Economic Sentiment (Nov) 7.4 vs. Exp. 13.0 (Prev. 13.1); "economic expectations for Germany have been overshadowed by Trump's victory and the collapse of the German coalition"; ZEW Current Conditions (Nov) -91.4 vs. Exp. -85.9 (Prev. -86.9)

- EU ZEW Survey Expectations (Nov) 12.5 (Prev. 20.1)

NOTABLE EUROPEAN HEADLINES

- BoE's Pill says still some work to be done on underlying domestic inflation pressure in the UK. Policy has anchored expectations close to target. It was not obvious two years ago that CPI would now be at target. Today's labour data shows that pay growth it still at high levels. Additional rate cuts are to be a gradual process. Shocks the the global economy could know the UK off its lower inflation path. Underlying Q/Q UK economic growth of 0.3% is not far off the trend growth rate. Overall picture on fiscal policy is one of consolidation despite the short-term boost from the budget. UK is perhaps further along with its adjustment process towards neutral rates. Higher neutral rate in the UK is not a base case but is something the MPC must consider. Not surprising that markets are considering possibility of a higher neutral rate.

- ECB's Rehn says the ECB is data dependent, not data point dependent; the direction of the ECB is clear, the speed depends on data; will could be leaving restrictive territory in Spring 2025. Disinflation is well on track in EZ. Says the speed of rate cuts will depend on the assessment at each meeting. sees downside risks to growth; waiting for December macro projection for a better view, most of the data is quite weak, particularly in manufacturing.

- ECB's Holzman says Trump's tariffs will put pressure on EZ inflation; will mean higher US rates with an affect on FX

- Brussels is to free up billions of euros for defence from the EU budget and policy shift will allow the bloc’s capitals to redirect ‘cohesion funds’ amid the Ukraine conflict and Trump victory, according to FT.

- German union and employers' association says an agreement was reached in wage talks for metal and electrical engineering industries

- German lawmakers reportedly near deal for early election in February, according to Bloomberg. Chancellor will first submit to a confidence vote in the lower house of parliament to trigger national ballot, likely H1 of December.

- Germany's political parties propose Feb 23rd as the date for the new election, according to Rheinische post. According to the report, there is also talk that the Chancellor could ask for a vote of confidence on December 18. However, this is still open because time could then be running out to pass laws, according to party circles. German Parliment to hold a confidence vote on Dec 16th, according to Reuters sources. mixed reporting

- UK reportedly nearing a free-trade agreement with oil-rich Gulf nations including Saudi Arabia, according to Bloomberg sources

NOTABLE US HEADLINES

- US President-elect Trump is expected to name Senator Marco Rubio as Secretary of State, according to NYT. It was also reported that President-elect Trump selected Florida Representative Waltz as National Security Adviser, according to WSJ

- Decision Desk HQ projects Republicans have won enough seats to remain in control of the House

- Mexican Economy Minister Ebrard suggested that Mexico could retaliate with its own tariffs on US imports if the incoming US administration puts tariffs on Mexican exports, according to local radio.

GEOPOLITICS

MIDDLE EAST - EUROPEAN SESSION

- "Washington Post quoting US official: Israel tells Washington that it is planning an imminent ground operation in Lebanon", via Sky News Arabia - NOTE: Sky News Arabia has since deleted this tweet

- Israel's Defence Minister Katz says in Lebanon there will be no ceasefire, and will continue to hit Hezbollah with full force.

- "Palestinian source to Sky News Arabia: No agreement between Fatah and Hamas and the gaps between the two sides are still wide", according to Sky News Arabia.

- "Israeli PM Netanyahu in conversations in recent days: When Trump goes back to the White House - we should put the annexation issue back on the table", according to sources via Kann news.

MIDDLE EAST

- Walla cited US officials stating Israeli PM Netanyahu made it clear to the Biden administration that he wants to end the war in Lebanon within weeks, according to Sky News Arabia. Axios also cited US and Israeli officials stating that the Israeli Minister of Strategic Affairs briefed US President-elect Trump on plans for Gaza and Lebanon over the next two months. It was also reported that Israeli PM Netanyahu's close aide Dermer met with US President-elect Trump on Sunday.

- Times of Israel reported that two officials in the previous Trump administration warned Israelis against assuming Trump would support Israel's annexation of the West Bank in his second term, according to Sky News Arabia.

- Israeli occupation forces raided the cities of Bethlehem and Hebron in the southern West Bank, according to Al Jazeera.

- Iraqi armed factions attacked a "military target" in southern Israel with drones, according to Sky News. Arabia.

- Central Command of the US Army announced that it attacked nine targets in two locations linked to pro-Iranian militias in Syria as a response to the militias' activity against US forces in the past 24 hours, according to Kann News.

- Ansar Allah media outlets reported US-British raids on the Hodeidah governorate in Yemen, according to Al Jazeera.

OTHER

- Russian state agencies reported that a Russian navy carrier of hypersonic missiles conducted drills while passing through the English Channel, while RIA reported that the Russian ship capable of carrying hypersonic missiles carried out missions in the Atlantic after passing through the English Channel.

CRYPTO

- Bitcoin has been whipsawing between gains and losses, and currently sits around USD 85k which marks a fresh session low; having pulled back from an overnight peak of USD 89.9k.

APAC TRADE

- APAC stocks were ultimately mixed and failed to sustain the momentum from Wall St where the major indices climbed to fresh record highs in a continuation of the Trump Trade and in quiet conditions due to Veterans Day.

- ASX 200 was restrained by weakness in mining and resources after underlying commodity prices were hit by dollar strength.

- Nikkei 225 gave up its early gains and more despite initial tailwinds from JPY weakness and chip-related support.

- Hang Seng and Shanghai Comp weakened with notable underperformance in the Hong Kong benchmark amid weakness in tech and auto names owing to the current tariff-related concerns, while the mainland was also pressured after recent new loans and financing data underwhelmed but with the downside cushioned after the PBoC recently pledged measures and with China reportedly planning to cut homebuying taxes to boost the property sector.

- Softbank Group (9984 JT) 6-month (JPY): Revenue 3.47tln (exp. 3.42tln). Net +1.01tln (prev. -1.41tln). Co. reaffirms guidance.

NOTABLE ASIA-PAC HEADLINES

- Fitch says China's new fiscal proposals are unlikely to immediately bolster growth

- China plans to cut homebuying taxes to boost the property sector in which the home purchase deed tax could be reduced to 1% from 3%, according to Bloomberg.

- China is to strengthen monetary support for the economy and PBoC should provide liquidity through a RRR cut, while the PBoC should inject long-term liquidity in Q4 to offset a rise in government bond issuance, according to an article by PBoC-backed Financial News citing analysts.

DATA RECAP

- Australian Westpac Consumer Confidence Index (Nov) 94.6 (Prev. 89.8)

- Australian NAB Business Confidence (Oct) 5.0 (Prev. -2.0); Business Conditions 7.0 (Prev. 7.0)