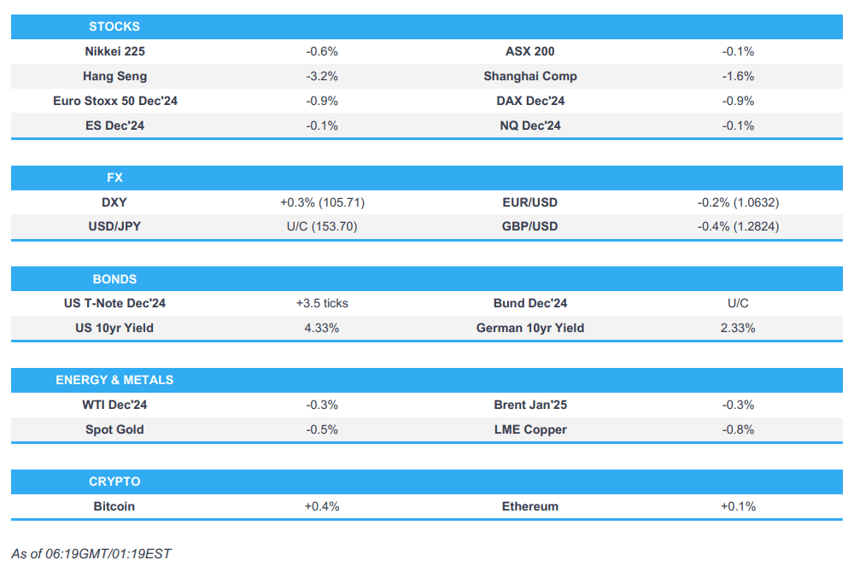

- APAC stocks were ultimately mixed and failed to sustain the momentum from Wall St.

- European equity futures are indicative of a negative cash open with the Euro Stoxx 50 future -0.9% after the cash market closed higher by 1.1% on Monday.

- DXY remains on the front foot, EUR/USD is stuck on a 1.06 handle, USD/JPY briefly moved above the 154 mark.

- Bitcoin was choppy overnight after the prior day's surge which lifted prices above the USD 89k level for the first time.

- Looking ahead, highlights include UK Jobs, EZ/German ZEW, NY Fed SCE, OPEC MOMR, Speakers including BoE’s Pill, ECB’s Rehn, Cipollone, Fed’s Waller, Barkin, Kashkari & Harker, Supply from Netherlands, UK & Germany.

- Earnings from Bayer, Brenntag, Infineon, Vodafone, AstraZeneca, Shopify, Home Depot, Tyson Foods, Spotify, Occidental Petroleum.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were mostly higher in a quiet session to start the week owing to Veterans Day and with trade largely a function of the Trump Trade with Republicans looking increasingly likely to take the House for a red sweep. This saw T-Note futures sell off to fall back beneath 110-00 and settle just beneath the aforementioned level, while the Dollar surged with DXY hitting its highest since July and Bitcoin rose to a fresh record above USD 88,000.

- SPX +0.10% at 6,001, NDX -0.05% at 21,107, DJIA +0.69% at 44,293, RUT +1.47% 2,43%.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President-elect Trump is expected to name Senator Marco Rubio as Secretary of State, according to NYT. It was also reported that President-elect Trump selected Florida Representative Waltz as National Security Adviser, according to WSJ

- Decision Desk HQ projects Republicans have won enough seats to remain in control of the House,

- Mexican Economy Minister Ebrard suggested that Mexico could retaliate with its own tariffs on US imports if the incoming US administration puts tariffs on Mexican exports, according to local radio.

APAC TRADE

EQUITIES

- APAC stocks were ultimately mixed and failed to sustain the momentum from Wall St where the major indices climbed to fresh record highs in a continuation of the Trump Trade and in quiet conditions due to Veterans Day.

- ASX 200 was restrained by weakness in mining and resources after underlying commodity prices were hit by dollar strength.

- Nikkei 225 gave up its early gains and more despite initial tailwinds from JPY weakness and chip-related support.

- Hang Seng and Shanghai Comp weakened with notable underperformance in the Hong Kong benchmark amid weakness in tech and auto names owing to the current tariff-related concerns, while the mainland was also pressured after recent new loans and financing data underwhelmed but with the downside cushioned after the PBoC recently pledged measures and with China reportedly planning to cut homebuying taxes to boost the property sector.

- US equity futures (ES -0.1%) mildly pulled back after hitting fresh record highs on Monday.

- European equity futures are indicative of a negative cash open with the Euro Stoxx 50 future -0.9% after the cash market closed higher by 1.1% on Monday.

FX

- DXY remained firmer after gaining at the start of the week in typical ‘Trump Trade’ behaviour amid very sparse newsflow on account of Veterans Day in the US and with no Fed speak or US data, while participants await the deluge of Fed commentary this week including from Powell, Williams and Waller, while the data highlight is the US CPI report on Wednesday.

- EUR/USD languished beneath the 1.0700 handle after giving up ground to the recent dollar strength.

- GBP/USD marginally extends on the prior day's losses heading into UK employment and average earnings data.

- USD/JPY initially edged higher owing to the firmer buck and recent clues of a lack of urgency at the BoJ for immediate rate hikes although the upside was capped and the pair gradually reversed course after hitting resistance around the 154.00 level.

- Antipodeans were mildly pressured amid the cautious risk appetite and after the PBoC set the weakest CNY reference rate since September last year, while an improvement in Australian consumer sentiment and business surveys did little to spur AUD/USD.

- PBoC set USD/CNY mid-point at 7.1927 vs exp. 7.1944 (prev. 7.1786).

FIXED INCOME

- 10yr UST futures nursed some losses as cash trade reopened following the Veterans Day closure.

- Bund futures remained indecisive after the recent whipsawing and ahead of German ZEW data.

- 10yr JGB futures lacked demand in the absence of any pertinent catalysts and tier-1 releases from Japan.

COMMODITIES

- Crude futures languished around yesterday's lows after having retreated on several bearish catalysts including negotiations to stop the war between Israel and Hezbollah, while there were also headwinds from a firmer dollar and amid a further return of production in the US Gulf of Mexico that had been shut in response to Rafael.

- BSEE said 25.69% of oil production in the US Gulf of Mexico is shut in response to Rafael (prev. 27.6%) and 13.06% of nat gas production is shut in (prev. 16.67%).

- Spot gold was contained after the precious metal recently slipped on the broad dollar strength.

- Copper futures were lacklustre with initial upside restricted amid the mixed risk appetite.

CRYPTO

- Bitcoin was choppy overnight after the prior day's surge owing to a continuation of the Trump Trade which briefly lifted prices to above the USD 89k level for the first time.

NOTABLE ASIA-PAC HEADLINES

- China plans to cut homebuying taxes to boost the property sector in which the home purchase deed tax could be reduced to 1% from 3%, according to Bloomberg.

- China is to strengthen monetary support for the economy and PBoC should provide liquidity through a RRR cut, while the PBoC should inject long-term liquidity in Q4 to offset a rise in government bond issuance, according to an article by PBoC-backed Financial News citing analysts.

DATA RECAP

- Australian Westpac Consumer Confidence Index (Nov) 94.6 (Prev. 89.8)

- Australian NAB Business Confidence (Oct) 5.0 (Prev. -2.0)

- Australian NAB Business Conditions (Oct) 7.0 (Prev. 7.0)

GEOPOLITICS

MIDDLE EAST

- A senior official in Israel said if Hezbollah does not accept the terms of the ceasefire agreement that are taking shape these days, "Israel is ready with powerful operational plans to continue the campaign in Lebanon", according to local press.

- Israel's message to the US is that it wants a settlement within weeks as fighting in the country is exhausted, according to Al Jazeera citing Israel's Channel 13. It was also reported that an agreement is expected to be reached soon on the "American document" that guarantees freedom of movement for Israel in the event of a violation of the agreement in the north which is said to be a positive development in settlement negotiations between Israel and Hezbollah, according to Sky News Arabia citing Israel Broadcasting Authority.

- Walla cited US officials stating Israeli PM Netanyahu made it clear to the Biden administration that he wants to end the war in Lebanon within weeks, according to Sky News Arabia. Axios also cited US and Israeli officials stating that the Israeli Minister of Strategic Affairs briefed US President-elect Trump on plans for Gaza and Lebanon over the next two months. It was also reported that Israeli PM Netanyahu's close aide Dermer met with US President-elect Trump on Sunday.

- Times of Israel reported that two officials in the previous Trump administration warned Israelis against assuming Trump would support Israel's annexation of the West Bank in his second term, according to Sky News Arabia.

- Israeli occupation forces raided the cities of Bethlehem and Hebron in the southern West Bank, according to Al Jazeera.

- Israeli Defence Minister said Iran is more vulnerable than ever to damage to its nuclear program and there is a possibility to thwart and eliminate the threat, according to Sky News Arabia.

- Iraqi armed factions attacked a "military target" in southern Israel with drones, according to Sky News. Arabia.

- Central Command of the US Army announced that it attacked nine targets in two locations linked to pro-Iranian militias in Syria as a response to the militias' activity against US forces in the past 24 hours, according to Kann News.

- Ansar Allah media outlets reported US-British raids on the Hodeidah governorate in Yemen, according to Al Jazeera.

OTHER

- Russian state agencies reported that a Russian navy carrier of hypersonic missiles conducted drills while passing through the English Channel, while RIA reported that the Russian ship capable of carrying hypersonic missiles carried out missions in the Atlantic after passing through the English Channel.

EU/UK

NOTABLE HEADLINES

- Brussels is to free up billions of euros for defence from the EU budget and policy shift will allow the bloc’s capitals to redirect ‘cohesion funds’ amid the Ukraine conflict and Trump victory, according to FT.