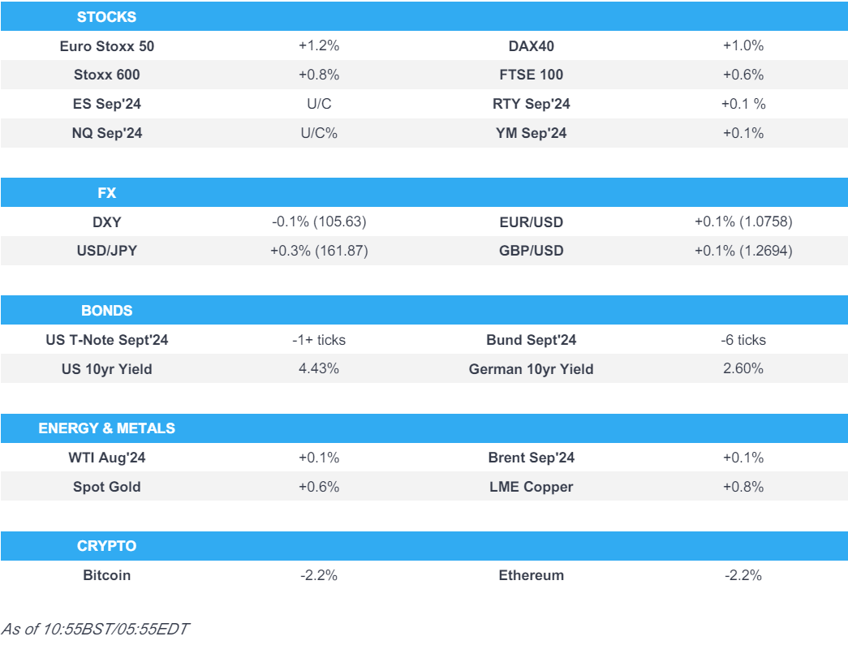

- European bourses are higher across the board as the region catches up to the Wall St. handover and continues generally strong APAC performance

- DXY under pressure and holding near the 105.59 low with peers generally firmer as the USD continues to feel the weight of Powell's remarks and looks to the mentioned data deluge

- OAT-Bund 10yr yield spread has narrowed to below 68bps at best, though is still circa. 20bps above pre-election levels; largely unreactive to PMIs

- Crude benchmarks began the session firmer after the private data on Tuesday, though they have since waned; metals generally supported

- Looking ahead, highlights include US Final PMIs, US ADP, IJC, Challenger, Factory Goods, ISM Services, FOMC Minutes, NBP Policy Announcement, US Refunding (3,10,30yr), Comments from Fed's Williams, ECB's Lane, Lagarde, de Guindos & Knot, Earnings from Constellation Brands.

- Click for the Newsquawk Week Ahead

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses are higher across the board as the region catches up to the Wall St. handover and continues generally strong APAC performance, Stoxx 600 +0.8%.

- CAC 40, +1.1%, the European outperformer as the agreement between ENS & NFP has seemingly held regarding candidate withdrawals into Sunday's second round.

- No overarching bias or theme across the sectors; Tech gains after broker activity on ASM International & BE Semiconductor while Insurance once again lags amid the progression of Beryl.

- Stateside, futures flat and holding onto Tuesday's gains into a packed and frontloaded session on account of Independence Day on Thursday, ES +0.1%, NQ +0.1%.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY under pressure and holding near the 105.59 low with peers generally firmer as the USD continues to feel the weight of Powell's remarks and looks to the mentioned data deluge.

- Euro modestly firmer but EUR/USD yet to revisit Tuesday's 1.0776 peak. Limited reaction to the Final PMIs and nothing noteworthy from the Sintra conference thus far; heft OpEx in EUR/USD.

- GBP similarly a touch firmer against the USD but once again looses out slightly against the EUR, Cable at its 1.2701 peak. No reaction to PMIs as we count down to Thursday's UK election.

- USD/JPY hit another multi-decade peak of 161.97 overnight, action since limited with nothing of note from Japanese officials on the move.

- Antipodeans firmer given the risk tone, though NZD/USD us yet to re-test the 0.61 handle.

- PBoC set USD/CNY mid-point at 7.1312 vs exp. 7.2633 (prev. 7.1291).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- OAT-Bund 10yr yield spread has narrowed to 67.8bps at best, though still circa. 20bps above pre-election levels; a narrowing which comes as the centre-left deal to prevent a RN majority appears to be holding with Ipsos remarking that an "absolute majority seems very unlikely" for RN.

- Bunds spent the first half of the session near the unchanged mark before fading on the PMIs and then slipping below Tusesady's130.28 base but with still someway to go before the figure itself.

- No real reaction to the new German 2034 Bund auction, with the results perhaps marginally softer than is usually the case but not necessarily surprising given the trick environment it entered.

- Gilts await Thursday's UK election, fleeting downticks on upwardly revised final PMIs but the benchmark is yet to meaningfully deviate from 97.00

- Stateside, Treasuries lower but above Tuesday's 109-07 base as we enter a packed and frontloaded session on account of Thursday's US Independence Day; data, FOMC Minutes and 3,10,30yr size announcements the highlights.

- Germany sells EUR 4.072bln vs exp. EUR 5bln 2.60% 2034 Bund: b/c 1.9 x, average yield 2.63%, retention 18.56%.

- Japanese gov't is targeting issuing a new floating-rate note from FY26, with two- & five-year maturities seen as options, via Reuters citing sources; to mitigate investors' risk from increasing yields.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks began the session firmer and were propped up by the much larger-than-expected draw in headline crude inventories, though this was offset somewhat by the gasoline build. Thereafter, benchmarks waned from best with specifics light into the US morning. WTI Aug and Brent Sep at lows of USD 62.77/bbl and USD 86.23/bbl respectively.

- Precious metals benefit from USD pressure and after the dovish commentary from Powell on Tuesday. XAU above the USD 2338/oz 50-DMA with the next point of significance being USD 2368/oz from 21st June.

- Base metals surged given APAC strength and the above while the likes of iron ore among the outperformers as participants cite supportive near-term demand and lingering expectations of Chinese stimulus.

- US Private Inventory Data (bbls): Crude -9.2mln (exp. -0.7mln), Distillate -0.7mln (exp. -1.2mln), Gasoline +2.5mln (exp. -1.3mln), Cushing +0.4mln.

- Lyondellbasell (LYB) Houston Refinery (268k BPD) reports flaring.

- NHC says Hurricane Beryl is expected to bring life-threatening winds and a storm surge to Jamaica later today, Cayman Islands tonight/Thursday.

- Click for a detailed summary

NOTABLE DATA RECAP

- French HCOB Composite PMI (Jun) 48.8 vs. Exp. 48.2 (Prev. 48.2); Services 49.6 vs. Exp. 48.8 (Prev. 48.8)

- German HCOB Composite Final PMI (Jun) 50.4 vs. Exp. 50.6 (Prev. 50.6); Services 53.1 vs. Exp. 53.5 (Prev. 53.5)

- EU HCOB Composite Final PMI (Jun) 50.9 vs. Exp. 50.8 (Prev. 50.8); Services 52.8 vs. Exp. 52.6 (Prev. 52.6)

- UK S&P Final PMI Composite (Jun) 52.3 vs. Exp. 51.7 (Prev. 51.7); Services 52.1 vs. Exp. 51.2 (Prev. 51.2)

- EU Producer Prices MM (May) -0.2% vs. Exp. -0.1% (Prev. -1.0%); YY -4.2% vs. Exp. -4.1% (Prev. -5.7%)

NOTABLE EUROPEAN HEADLINES

- Former UK PM Boris Johnson joined the Tory election campaign and said that current PM Sunak asked him to join the campaign, while he compared their differences as “trivial” to the threat of Labour leader Starmer, according to The Sun's Political Editor Harry Cole.

- Riksbank Minutes (Jun): Overall, the minutes chime with the tone of the last meeting which had two/three H2-2024 cuts as a possibility with the main potential headwinds being the SEK and inflation (in the context of May's hotter print). Notably, only Breman was explicit in saying the next cut and first H2 one is likely to occur in August.

NOTABLE US HEADLINES

- US judge postponed former President Trump's sentencing in the hush-money case to September 18th.

- Skydance has acquired around 50% of Paramount Global's (PARA) controlling shares at around USD 15.00/shr, CNBC reports citing sources.

GEOPOLITICS

MIDDLE EAST

- Israeli army said it shelled Hezbollah positions last night in the areas of Blida, Yaron, Tair Harfa and Aitaroun in southern Lebanon, according to Al Jazeera.

- Palestinian Health Ministry said four were killed in an Israeli strike on West Bank's Nur Shams Refugee Camp, according to Reuters.

- US State Department said it has seen disturbing reports of the Israeli army's use of civilians as human shields and it called on Israel again to investigate quickly and ensure accountability for any abuses and violations, according to Al Jazeera.

OTHER

- China is building and testing lethal attack drones for Russia with Chinese and Russian companies said to be developing an attack drone similar to an Iranian model deployed in Ukraine, according to European officials familiar with the matter cited by Bloomberg.

CRYPTO

- Crypto is under modest pressure thus far, with Bitcoin edging towards but still holding above the USD 60k mark ahead of numerous Tier 1 US data points.

APAC TRADE

- APAC stocks mostly took impetus from the gains on Wall St where the S&P 500 and Nasdaq posted record closes amid softer yields and dovish-leaning comments from Fed Chair Powell, although gains were capped and China lagged on weak Caixin PMI data.

- ASX 200 kept afloat amid strength in the commodity-related sectors and with some encouragement from the better-than-expected Retail Sales and Building Approvals data from Australia.

- Nikkei 225 was underpinned and further extended above the 40,000 level on the back of recent currency weakness.

- Hang Seng and Shanghai Comp. were mixed in which the former attempted to reclaim the 18,000 status, while the mainland bucked the trend after Caixin Services PMI data disappointed and amid lingering global frictions as European officials alleged that China is building and testing lethal attack drones for Russia.

NOTABLE ASIA-PAC HEADLINES

- EU reportedly targets China's Temu and Shein with proposals for an import duty, according to FT.

- South Korean President Yoon said they have prepared KRW 25tln worth of support measures for small businesses and will provide tax benefits to companies actively raising dividend payouts, while they will address structural problems causing high local food prices.

- China's PCA says Chinese prelim retail car sales (Jun) -8% Y/Y, 2% M/M.

DATA RECAP

- Chinese Caixin Services PMI (Jun) 51.2 vs. Exp. 53.4 (Prev. 54.0); Composite PMI (Jun) 52.8 (Prev. 54.1)

- Australian Building Approvals (May) 5.5% vs. Exp. 1.6% (Prev. -0.3%, Rev. 1.9%)

- Australian Retail Sales MM Final (May) 0.6% vs. Exp. 0.2% (Prev. 0.1%)