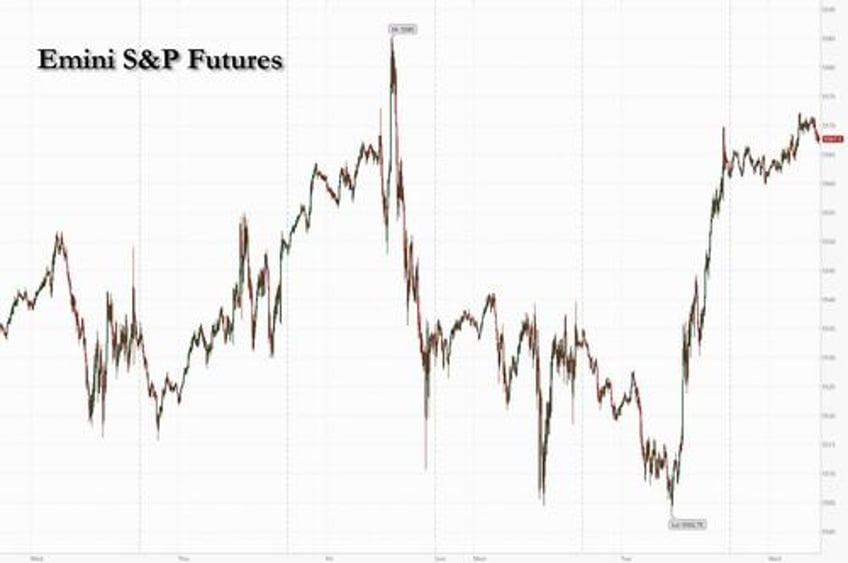

US futures traded at new record highs amid rising optimism a Fed rate cut is coming, perhaps as soon as the end of the month, and ignored sticky high yields which traded near the highest level in a month. As of 8:00am ET, and ahead of a data barrage later in the day which includes ADP, Trade and claims data, as well as the latest PMI, ISM, Factory orders and Durable goods reports, S&P and Nasdaq futures were flat, erasing a modest gain earlier in the session, and ahead of a shortened-session that will end at 1 p.m. because of the July 4 holiday. On Tuesday, the S&P 500 closed above 5,500 for the first time notching its 32nd record this year. Tech and small-caps are outperforming as the market received a bullish boost from Powell but now the question is whether the macro data (and earnings) can deliver with ISM Services today and NFP on Friday. European markets took heart from Wall Street’s latest all-time highs and efforts to block a right-wing majority in French elections. Bond yields are flat to +1bps as the curve is flattening; USD is lower and commodities are higher led by metals where silver is the standout. Today’s macro data focus is on ISM Services, ADP/Jobless Claims, Factory Orders, and Fed Minutes (released after the Equity close).

In premarket trading, TSLA led the Mag 7, +2.8% with NVDA weaker but broader Semis are up small. Paramount Global jumped 10% in US premarket trading after Bloomberg News reported that Skydance Media had reached a preliminary agreement to buy National Amusements Inc. and merge with Paramount. Here are some other notable premarket movers:

- Dell (DELL) advances 1.5% in premarket trading after BofA adds the personal computer maker to its US 1 list.

- Permian Resources (PR) shares advance 0.6% in premarket trading after the oil and natural gas company was upgraded to outperform from market perform at BMO Capital Markets.

With US stocks propelling higher by the day, the MSCI world index measuring both developed and emerging markets is also at a record high, evidence of the relentless euphoric sentiment toward stocks. The S&P 500 has added more than $16 trillion in value from a closing low in October 2022, thanks to solid earnings, the craze over artificial intelligence and expectations of lower borrowing costs.

After yesterday's dovish speech by Jerome Powell at the Sintra central bank conclave, today investors will parse US initial jobless claims and ADP employment data among other readings on the economy for more clues on the policy outlook. Powell acknowledged Tuesday that the central bank has made “quite a bit of progress” in reducing inflation but emphasized officials need more evidence before lowering rates. Markets are also gearing up for the all-important US payrolls reading due Friday. Economists expect the report to show employers added about 190,000 workers in June and the unemployment rate likely held at 4%.

“We are in a situation where momentum in the US equity market is still strong, we are seeing inflation tick lower and increasing odds of a Fed cut in September, all of which should be sufficient to keep the rally going,” said Guy Miller, chief market strategist at Zurich Insurance Co.

“There are clear signs the US economy and labor markets are slowing and that should be confirmed by Friday’s payrolls data, laying the path for the Fed to cut in September,” Zurich Insurance’s Miller said.

In Europe, much of the spotlight continues to be on politics, on the eve of elections in the UK. The Stoxx 600 is up 0.7%, led by gains in technology and mining shares, while in France, the benchmark CAC 40 index rallied 1.6% as anti-National Rally parties attempt to prevent Marine Le Pen’s far-right group from achieving an absolute majority in the final round of legislative voting on Sunday. Shares of BE Semiconductor Industries NV soared 9.1% in Amsterdam after analysts wrote that Apple Inc. could adopt the Dutch chip-equipment firm’s technology as soon as next year. Here are some other notable European movers:

- Diageo shares rises as much as 3.2%, the most about five months, after Citi upgraded the spirit maker to buy, saying it is nearing an inflection point and full-year results should be a clearing event for what continues to be an “attractive compounding growth story”

- BE Semiconductor shares advance as much as 7.9% after Morgan Stanley raised its price target on the Dutch semiconductor equipment maker to a Street-high, saying that Apple could adopt the company’s hybrid bonding technology in its chips as soon as 2H next year

- Galderma shares gain as much as 2.9%, the most since May, after Vontobel initiated coverage of the Swiss skincare firm with a buy recommendation and a Street-high price target, saying its future growth will be supported by two upcoming drug launches

- BPER Banca shares gain as much as 4% after main shareholder Unipol underwrites share swap with 4.77% of the bank’s capital as underlying. Equita analysts said that Unipol’s move confirms its commitment

- Drax shares jump as much as 5.8%, the most since February, after Barclays raised its price target to a new Street high, citing the UK power utility’s “forgotten upside potential” and predicting it will get a much-needed government subsidy contract

- Grenke shares rise as much as 13%, the most since October 2022, after the German leasing finance provider reported its strongest quarter ever in terms of new business

- Text shares soar as much as 12% after the Polish chatbot tools provider reported sales rising 12% y/y in the quarter through June, fueled by higher average revenue per user

- JD Sports shares fell as much as 4.4% after the stock received its only negative analyst rating. Barclays downgraded the sports apparel retailer to underweight from equal-weight, citing its high exposure to Nike

- PostNL shares drop as much as 7.2% to the lowest in more than four years after the delivery company was downgraded by UBS, which warned that downside risks to consensus look underestimated

- Bpost shares drop as much as 11% to an all-time low after the postal delivery company gave guidance that was below expectations, prompting analysts to cut their price targets

Europe suffered the biggest reduction in overweight positions among regions globally in June, reversing the buying trend seen in May, Goldman said. Funds cut the most exposure to financial stocks, particularly banks, with net selling for that sector the largest since November 2021.

Earlier, Asian equities advanced, driven by gains in Hong Kong and Taiwan, as the region’s technology stocks saw a rally tracking a similar move in the US. The MSCI Asia Pacific Index climbed as much as 0.8% in a fourth straight day of gains, its longest stretch since May. Federal Reserve Chief Jerome Powell’s remarks that a disinflationary trend is resuming in the US boosted risk appetite in the region. A MSCI gauge of technology stocks added 1.3%. Japanese stocks climbed for the fourth session, their longest run since March. Equities also gained in South Korea, Singapore and Australia. “A bearish move in the US dollar and a halt in US Treasury yields’ upside may keep the risk environment supportive in the Asia session,” said Jun Rong Yeap, market analyst at IG Asia. Yeap expects traders to limit risk-taking ahead of a holiday-shortened session in the US later Wednesday.

In FX, the Bloomberg Dollar Spot Index eased as much as 0.1%; the US currency stumbled versus the euro, which gained for the sixth-straight day, its best run since March, on growing confidence that France’s far-right may fail to win a majority at second-round general vote later in the week USD/JPY rose 0.3% to 161.94; the yen’s slide to its weakest since 1986 raises intervention concerns

In rates, treasuries are narrowly mixed with the curve flatter. On the day long-end yields are higher by ~2bp and 2-year yields are lower by ~2bp. German and UK curves are also flatter on the day following firm services PMI readings. French government bonds rise for a second day amid reports that political parties were maneuvering to block an absolute majority for the far-right after Sunday’s second-round vote. 2s10s and 5s30s spreads are tighter by ~2bp on the day. US 10-year yield around 4.43% is little changed vs Tuesday’s close with gilts outperforming by 1.5bp in the sector, leading gains across European bonds.

The Bloomberg Dollar Spot Index is little changed. The yen is the weakest of the G-10 currencies, falling 0.2% against the greenback to a multi-decade low near 162.

In commodities, oil prices pared an earlier gain to trade little changed, with WTI near $82.90 a barrel. Spot gold adds $13 to around $2,343/oz. Crypto is under pressure this morning, with Bitcoin briefly dipping below the $60k mark as prediction markets now see Kamala replacing Joe Biden.

Looking at today's barrage of data, the US economic data slate includes June Challenger job cuts (7:30am), June ADP employment change (8:15am), May trade balance, weekly jobless claims (8:30am), June final S&P Global services PMI (9:45am), May factory orders and June ISM services index (10am).

Market Snapshot

- S&P 500 futures little changed at 5,567.50

- Brent Futures up 0.3% to $86.49/bbl

- Gold spot up 0.7% to $2,345.59

- US Dollar Index down 0.10% to 105.62

- STOXX Europe 600 up 0.5% to 513.40

- MXAP up 0.7% to 182.08

- MXAPJ up 0.8% to 568.81

- Nikkei up 1.3% to 40,580.76

- Topix up 0.5% to 2,872.18

- Hang Seng Index up 1.2% to 17,978.57

- Shanghai Composite down 0.5% to 2,982.38

- Sensex up 0.6% to 79,914.27

- Australia S&P/ASX 200 up 0.3% to 7,739.88

- Kospi up 0.5% to 2,794.01

- German 10Y yield little changed at 2.63%

- Euro up 0.1% to $1.0761

- Brent Futures up 0.3% to $86.48/bbl

Top Overnight News

- European stocks rose, tracking a record S&P 500 close, on optimism about US interest-rate cuts after Federal Reserve Chair Jerome Powell said inflation is getting back on a downward path

- Marine Le Pen’s National Rally is scrambling to get an absolute majority in the final round of France’s legislative election Sunday as rival parties are maneuvering to keep the far-right party out of power

- SoftBank’s stock rose 1.5% to a new lifetime high on Wednesday, a vote of confidence in Masayoshi Son’s ambitions to ramp up investments in AI and semiconductors

- Venture dealmaking is coming back — at least, for artificial intelligence companies. Last quarter, US venture capitalists spent $55.6 billion backing startups, up by about half from a year earlier quarter and the spendiest quarter in two years, according to PitchBook data

- An activist short-seller, a New York hedge fund, a Mauritius-based investment vehicle and a broker tied to a big Indian bank: All played a role in one of the world’s most damaging short-seller attacks.

- Traders in the $27 trillion Treasury market are betting on higher long-term bond yields as Wall Street starts to adjust for Donald Trump’s potential return to the White House

- US judge postponed former President Trump's sentencing in the hush-money case to September 18th.

- Skydance has acquired around 50% of Paramount Global's (PARA) controlling shares at around USD 15.00/shr, CNBC reports citing sources.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly took impetus from the gains on Wall St where the S&P 500 and Nasdaq posted record closes amid softer yields and dovish-leaning comments from Fed Chair Powell, although gains were capped and China lagged on weak Caixin PMI data. ASX 200 kept afloat amid strength in the commodity-related sectors and with some encouragement from the better-than-expected Retail Sales and Building Approvals data from Australia. Nikkei 225 was underpinned and further extended above the 40,000 level on the back of recent currency weakness. Hang Seng and Shanghai Comp. were mixed in which the former attempted to reclaim the 18,000 status, while the mainland bucked the trend after Caixin Services PMI data disappointed and amid lingering global frictions as European officials alleged that China is building and testing lethal attack drones for Russia.

Top Asian News

- EU reportedly targets China's Temu and Shein with proposals for an import duty, according to FT.

- South Korean President Yoon said they have prepared KRW 25tln worth of support measures for small businesses and will provide tax benefits to companies actively raising dividend payouts, while they will address structural problems causing high local food prices.

- China's PCA says Chinese prelim retail car sales (Jun) -8% Y/Y, 2% M/M.

European bourses are higher across the board as the region catches up to the Wall St. handover and continues generally strong APAC performance, Stoxx 600 +0.8%. CAC 40, +1.1%, the European outperformer as the agreement between ENS & NFP has seemingly held regarding candidate withdrawals into Sunday's second round. No overarching bias or theme across the sectors; Tech gains after broker activity on ASM International & BE Semiconductor while Insurance once again lags amid the progression of Beryl. Stateside, futures flat and holding onto Tuesday's gains into a packed and frontloaded session on account of Independence Day on Thursday, ES +0.1%, NQ +0.1%.

Top European News

- Former UK PM Boris Johnson joined the Tory election campaign and said that current PM Sunak asked him to join the campaign, while he compared their differences as “trivial” to the threat of Labour leader Starmer, according to The Sun's Political Editor Harry Cole.

- Riksbank Minutes (Jun): Overall, the minutes chime with the tone of the last meeting which had two/three H2-2024 cuts as a possibility with the main potential headwinds being the SEK and inflation (in the context of May's hotter print). Notably, only Breman was explicit in saying the next cut and first H2 one is likely to occur in August.

FX

- DXY under pressure and holding near the 105.59 low with peers generally firmer as the USD continues to feel the weight of Powell's remarks and looks to the mentioned data deluge.

- Euro modestly firmer but EUR/USD yet to revisit Tuesday's 1.0776 peak. Limited reaction to the Final PMIs and nothing noteworthy from the Sintra conference thus far; heft OpEx in EUR/USD.

- GBP similarly a touch firmer against the USD but once again looses out slightly against the EUR, Cable at its 1.2701 peak. No reaction to PMIs as we count down to Thursday's UK election.

- USD/JPY hit another multi-decade peak of 161.97 overnight, action since limited with nothing of note from Japanese officials on the move.

- Antipodeans firmer given the risk tone, though NZD/USD us yet to re-test the 0.61 handle.

- PBoC set USD/CNY mid-point at 7.1312 vs exp. 7.2633 (prev. 7.1291).

Fixed Income

- OAT-Bund 10yr yield spread has narrowed to 67.8bps at best, though still circa. 20bps above pre-election levels; a narrowing which comes as the centre-left deal to prevent a RN majority appears to be holding with Ipsos remarking that an "absolute majority seems very unlikely" for RN.

- Bunds spent the first half of the session near the unchanged mark before fading on the PMIs and then slipping below Tusesady's130.28 base but with still someway to go before the figure itself.

- No real reaction to the new German 2034 Bund auction, with the results perhaps marginally softer than is usually the case but not necessarily surprising given the trick environment it entered.

- Gilts await Thursday's UK election, fleeting downticks on upwardly revised final PMIs but the benchmark is yet to meaningfully deviate from 97.00

- Stateside, Treasuries lower but above Tuesday's 109-07 base as we enter a packed and frontloaded session on account of Thursday's US Independence Day; data, FOMC Minutes and 3,10,30yr size announcements the highlights.

- Germany sells EUR 4.072bln vs exp. EUR 5bln 2.60% 2034 Bund: b/c 1.9 x, average yield 2.63%, retention 18.56%.

- Japanese gov't is targeting issuing a new floating-rate note from FY26, with two- & five-year maturities seen as options, via Reuters citing sources; to mitigate investors' risk from increasing yields.

Crude

- Crude benchmarks began the session firmer and were propped up by the much larger-than-expected draw in headline crude inventories, though this was offset somewhat by the gasoline build. Thereafter, benchmarks waned from best with specifics light into the US morning. WTI Aug and Brent Sep at lows of USD 62.77/bbl and USD 86.23/bbl respectively.

- Precious metals benefit from USD pressure and after the dovish commentary from Powell on Tuesday. XAU above the USD 2338/oz 50-DMA with the next point of significance being USD 2368/oz from 21st June.

- Base metals surged given APAC strength and the above while the likes of iron ore among the outperformers as participants cite supportive near-term demand and lingering expectations of Chinese stimulus.

- US Private Inventory Data (bbls): Crude -9.2mln (exp. -0.7mln), Distillate -0.7mln (exp. -1.2mln), Gasoline +2.5mln (exp. -1.3mln), Cushing +0.4mln.

- Lyondellbasell (LYB) Houston Refinery (268k BPD) reports flaring.

- NHC says Hurricane Beryl is expected to bring life-threatening winds and a storm surge to Jamaica later today, Cayman Islands tonight/Thursday.

Geopolitics

- Israeli army said it shelled Hezbollah positions last night in the areas of Blida, Yaron, Tair Harfa and Aitaroun in southern Lebanon, according to Al Jazeera.

- Palestinian Health Ministry said four were killed in an Israeli strike on West Bank's Nur Shams Refugee Camp, according to Reuters.

- US State Department said it has seen disturbing reports of the Israeli army's use of civilians as human shields and it called on Israel again to investigate quickly and ensure accountability for any abuses and violations, according to Al Jazeera.

- China is building and testing lethal attack drones for Russia with Chinese and Russian companies said to be developing an attack drone similar to an Iranian model deployed in Ukraine, according to European officials familiar with the matter cited by Bloomberg.

US Event Calendar

- 07:00: June MBA Mortgage Applications -2.6%, prior 0.8%

- 07:30: June Challenger Job Cuts YoY 19.8%, prior -20.3%

- 08:15: June ADP Employment Change, est. 165,000, prior 152,000

- 08:30: June Initial Jobless Claims, est. 235,000, prior 233,000

- June Continuing Claims, est. 1.84m, prior 1.84m

- 08:30: May Trade Balance, est. -$76.5b, prior -$74.6b

- 09:45: June S&P Global US Services PMI, est. 55.1, prior 55.1

- June S&P Global US Composite PMI, prior 54.6

- 10:00: May Factory Orders, est. 0.2%, prior 0.7%

- May Factory Orders Ex Trans, prior 0.7%

- 10:00: May Durable Goods Orders, est. 0.1%, prior 0.1%

- May Durables-Less Transportation, est. -0.1%, prior -0.1%

- May Cap Goods Orders Nondef Ex Air, est. -0.6%, prior -0.6%

- May Cap Goods Ship Nondef Ex Air, prior -0.5%

- 10:00: June ISM Services Index, est. 52.6, prior 53.8

- 14:00: June FOMC Meeting Minutes

DB's Jim Reid concludes the overnight wrap

Markets got Q3 off to a mixed start yesterday, with a pretty divergent performance across countries and asset classes. On the positive side, there was a noticeable recovery for French assets after the election results, with the Franco-German 10yr spread (-5.8bps) seeing its biggest decline since President Macron announced the election last month. However, that came alongside more weakness in US markets after investors became increasingly focused on the fiscal outlook, with the presidential election now just four months away. That saw the 10yr Treasury yield rise a further +6.5bps to 4.461%, building on its +11.0bps move on Friday and closing +20.3bp higher than the lows that came after Friday's soft core PCE. So had you got that data print right in advance you may have got bond markets totally wrong. I thought some of it was month-end shenanigans from Friday but a narrative has built up that due to the aftermath of the Trump/Biden debate, markets should be pricing in a higher probability of a Trump victory and larger fiscal deficits.

In terms of the French situation, the main news yesterday (as we discussed 24 hours ago) was that Marine Le Pen’s National Rally slightly underperformed the opinion polls from before the election. But DB’s economist thinks that their underperformance relative to polls likely reflected stronger participation in urban areas to some degree, in seats that the National Rally were unlikely to win anyway. He writes (link here) that the probability of a National Rally government (minority or majority) is actually now marginally higher than it was before round 1, and there is also the possibility that other MPs on the right or centre-right could implicitly support a minority government. So a slightly different view to the prevailing market narrative yesterday that a far-right majority was less likely. The house view is still a hung parliament though.

The second round will take place on Sunday, but the other parties are now attempting to keep the National Rally from gaining power, and there are negotiations on candidates standing down from districts where they wish to give another party a better chance of victory. For reference, candidates who receive more than 12.5% of registered voters can go forward to the second round, but there is a deadline tonight (6pm CET) for candidates to file papers to go forward, so it’s possible that those who did pass the threshold will withdraw, particularly if they came in third place. So once we know who’s actually standing where, we should get a better idea of the likely prospects going into Sunday’s vote.

In terms of the market reaction, there was an initial surge for equities at the open, with the CAC 40 up by +2.79% first thing. But those gains were then pared back, and the index “only” closed +1.09% higher. Other indices also advanced in Europe, but the gains were concentrated in the south, with Italy’s FTSE MIB (+1.70%) and Spain’s IBEX 35 (+1.04%) both outperforming. Meanwhile for sovereign bonds, the gap between French and German yields tightened back to 74bps, which is its tightest level in over two weeks, whilst Italian and Spanish spreads also fell. Nevertheless, yields still moved higher across the continent, and in absolute terms, the French 10yr yield (+5.1bps) was up to 3.349%, which is its highest closing level since November, whilst those on 10yr bunds were up by +10.7bps on the day. The US bond move from Friday afternoon was a big influence.

Well after the European close, ECB President Lagarde spoke at the annual retreat in Sintra, Portugal. She struck a slightly more hawkish tone, saying that Europe’s “still facing several uncertainties regarding future inflation, especially in terms of how the nexus of profits, wages and productivity will evolve and whether the economy will be hit by new supply-side shocks.” She added, “ It will take time for us to gather sufficient data to be certain that the risks of above-target inflation have passed.” There is now 38.2bps of cuts priced in by year-end, down -5.0bps from Friday’s close.

As discussed earlier, US Treasuries continued their significant last 36 hour decline from Friday as investors moved to focus on the upcoming election and the fiscal implications. That led to another fairly sharp curve steepening yesterday, with the 2s10s curve up +6.1bps to -29.9bps, having been at -49.6bps just one week earlier. For what it’s worth, this week is actually the second anniversary of the 2s10s inversion in July 2022, so we’re on track for yet more records in terms of this being the longest ever 2s10s inversion. And in terms of the specific moves, the 2yr yield was largely unchanged (+0.2bps) at 4.755%, but the 10yr yield saw a larger +6.5bps move to 4.461%. With the attention on the long end, fed futures were barely changed as the amount of cuts priced in by the December meeting was up just +1.0bps to 45bps. This morning in Asia, yields on the 10yr USTs have edged back down -2bps to around 4.44% as I type.

Risk appetite in the US was dampened by some weak data prints, with the ISM manufacturing for June falling to 48.5 (vs. 49.1 expected). Moreover, the subcomponents for new orders (49.3) and employment (49.3) were in contractionary territory as well so there was little respite in the report. The bright spot came on the inflation side, with the prices paid component down to a 6-month low of 52.1. That backdrop meant that US equities were mixed with tech once again saving the day with the Magnificent 7 surging +1.76%, even as the small-cap Russell 2000 was down -0.86%. The S&P 500 split the difference and was up +0.27%, even while 76% of the index members were lower on the day. S&P 500 (-0.23%) and NASDAQ 100 (-0.38%) futures are both trading notably lower this morning.

In Asia, the Nikkei (+0.38%) is trading higher with the Hang Seng (+0.57%) also gaining after returning from a public holiday. Elsewhere, Chinese stocks are struggling to gain traction with the CSI (-0.08%) and Shanghai Composite (+0.04%) relatively flat. Meanwhile, the KOSPI (-0.82%) is losing ground after a busy morning of inflation data. Indeed, South Korea’s inflation cooled more than expected, rising +2.4% y/y in June (v/s +2.6% expected), its slowest pace since July last year. It followed a +2.7% increase in the prior month. Meanwhile, core CPI came in +2.2% higher in June than a year before, in line with May’s reading.

In FX, the Japanese yen (-0.13%) is weakening to a fresh 38-year low of 161.68 against the dollar despite some verbal intervention from the authorities. Japanese Finance Minister Shunichi Suzuki stated that he is "closely watching FX moves with vigilance" while refraining from commenting on specific levels.

Finally, minutes from the RBA’s June monetary policy meeting indicated that board members discussed raising interest rates but eventually decided to hold rates steady at 4.35%. The board emphasized the need to remain vigilant to upside risks to inflation, noting that May’s inflation data hadn’t been enough to derail its inflation outlook of returning to target in 2026. However these minutes are slightly dated as a week after the meeting we had a strong CPI print. So our economists believe an August hike is likely.

To the day ahead now, and data releases include the Euro Area flash CPI print for June, along with the unemployment rate for May. Over in the US, there’s also the JOLTS report of job openings for May. From central banks, we’ll hear from Fed Chair Powell, ECB President Lagarde, ECB Vice President de Guindos, and the ECB’s Elderson and Schnabel