By Michael Every of Rabobank

Two kinds of Stag Do/No-Bucks Night

We are all invited to two different kinds of ‘Stag Do’ (for those in the US, Bachelor Party), which (for those in Australia) are also a ‘No-Bucks Night’.

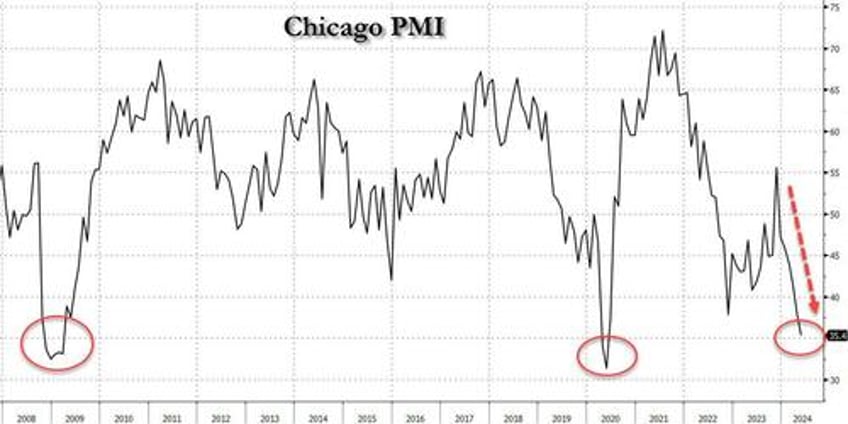

April US personal consumption income and spending data on Friday saw the former up 0.3% m-o-m as expected, but spending 0.2%, a tick lower, and real personal spending -0.1% vs. 0.1%, meaning inflation was biting. The core measure was 0.2% m-o-m, in line, as were the Fed’s-favoured PCE y-o-y deflator at 2.7% and the core at 2.8%, but they remain above the 2% target. However, the Chicago PMI that followed was a disaster at 35.4 vs. 41.6 expected, its lowest reading since Covid lockdowns of May 2020. New orders and order backlogs both fell to May 2020 levels, plunging 9.2 and 8 points, respectively.

The reaction saw US Treasury yields dropping and stocks rising despite inflation not falling. Recall our Fed-watcher Philip Marey has been warning the US is heading for stagflation – and the four rate cuts he expects to see over 2024 and 2025 will only be due to the ‘stag’ not the ‘flation’ part. Backing his view, the Daily Mail reports ‘A 'perfect storm' is wiping out America's restaurants’, with dining out declining as lifestyles are forced to shift by higher prices. Fortune adds, ‘The housing market is finally seeing more inventory, but buyers aren’t showing up as a ‘cold reality is settling down’. That offers the potential prospect of lower activity and lower prices – if owners sell, and lose their current low mortgage rate, rather than the housing market just freezing, not clearing.

The RBA’s Hunter says the “first and predominant challenge” is bringing inflation down; yet he cited the Reserve Bank’s dual full-employment mandate to explain why they aren’t (yet) raising rates again in order to do it. Meanwhile, as house prices continue to soar further even before rates do anything in either direction, the ABC stresses a ‘hidden home loans crisis’ as 2 in 5 Australians with mortgage debt, some 5.8m people, say they will have real difficulty making payments over the next 12 months. In short, parts of the economy say rates need to come down: but inflation says the opposite.

The same is true in weaker form in Europe. The ECB meeting on Thursday is almost certain to see rates cut by 25bp. However, our team notes, “one cut is no cut” in practical terms, and “lingering inflation risks tilt the odds towards a slower or shorter cycle than expected.”

Central banks will be glad to see that while OPEC+ extended its voluntary production cuts of around 2m barrels a day through to Q3, oil is declining in response. However, Saudi Aramaco selling $12bn in shares in brisk trade does not suggest a truly bearish climate for oil, regardless of the global climate. Meanwhile, plenty of other commodities are going sharply higher – and we know what would happen to them and oil were rates to come down before inflation does.

So, that’s one kind of ‘Stag Do’. The other kind is the clashing of antlers.

Domestically, that means elections, with potential market impact. India’s PM Modi will retain his parliamentary majority, building the China > India market mojo switch; South Africa’s ANC lost its majority for the first time since the end of Apartheid, with the outlook now unclear; Mexico’s Claudia Sheinbaum, successor to outgoing President Obrador, is expected to win, meaning policy continuity; and former US president Trump claims to have raised $52.8m from small donors in one day post-conviction, and $200m over three days including larger donations - he also joined TikTok and gained 1m followers in an hour.

A Bloomberg survey says a Trump win is a risk to Fed independence, which would “likely rock financial markets”. 44% of respondents say they expect him to politicize the Fed or limit its power vs. just 6% who say he will leave it alone, and 35% who think he will use social media to lean on it. 24% say a Trump win would immediately cause 10-year Treasury yields to rise more than 25bps, 23% say a smaller rise would occur, and 24% that yields would fall. By contrast, 54% think Biden will leave the Fed alone --a low number reflecting the structural shifts towards a political-economy I flagged would emerge to roil markets-- 41% think he would lean on the Fed to urge lower rates to some degree, and 5% think he’d do more than that, while not specifying.

This week also sees the EU elections, which our team recently published a report on in regards to Europe’s attempts to respond to economic and geopolitical challenges by building ‘strategic autonomy’, with market-moving implications.

Internationally, the tail risks are also market moving. In the Middle East, President Biden floated a new peace proposal that could either see de-escalation or, if it fails, re-escalation. Ukraine used western HIMARS to attack Russia proper, after TASS warned ‘Full-scale war between Russia, West can’t be ruled out, expert says’. President Zelenskyy accused China of helping Russia sabotage his plans for a peace summit and prosecute its war, economically. The Philippines warned a clash with China in the South China Sea could spiral into war, as China’s defence minister countered of the “limits” to its restraint. China also warned about the formation of an “Asian NATO”, as Zelenskyy visits Manila.

EU foreign policy chief Borrell said he has seen no evidence of Chinese military support for Russia, and its help to Russia is not comparable to Iran and North Korea – true in drones and munitions, but not for overall aid to a war economy. He then added the EU doesn’t have the ability to sanction third countries that circumvent Russian sanctions: unwilling, maybe, but it is surely able. By contrast, a Financial Times op-ed from Deputy US Treasury Secretary Adeyemo (‘We need to put sand in the gears of the Russian war machine’) argues, “the private sector must play its part in Putin’s military-industrial complex”, specifically mentioning Russia’s imports of dual-use inputs. That suggests EU firms, and banks, will need to do more, and more broadly, not less on this front.

Unavoidable military rearmament will require a lot of bucks; and greater use of third country sanctions may mean many have even fewer in hand.

Meanwhile, against this backdrop, Bloomberg also reports: “War in the Middle East and Europe, US-China tensions, climate change, threats from new technologies - geopolitical risk is everywhere. A coterie of fund managers are pitching a class of ETFs that claim to offer a hedge for all that uncertainty. These funds, ranging in size from $8m to $800m in assets, strip out companies the managers say threaten national security or are vulnerable to state takeover or US sanctions… Champions of these ETFs view them as a corrective to what they see as Wall Street’s agnostic view of geopolitical developments… [using] publicly available information to screen companies on a range of criteria, including whether they’re under sanctions, work in cybersecurity, have been accused of human-rights violations, or have operated in disputed waters near China.”

The idea is a good one – but how do these ETFs account for information that isn’t publicly available, or project the second, third, fourth, nth order impact of on apparently safe firms from the spectrum of potential, conflating political and geopolitical tail risks now emerging? Surely a broader variety of hedging tools are required which look at scenario analysis and ‘then what(s)?’, including of the market kind mentioned in the Bloomberg survey above?

Another good idea is a safe, cheap pill that would ensure you can go for a wild weekend Stag Do/Bachelor Party/Buck’s Night and still emerge without The Hangover on Monday morning. But in the real world, that doesn’t exist yet either.